As fintechs have expanded their offerings of “buy now, pay later” (BNPL) products, consumers and merchants in the United States have increasingly adopted them. In a previous Payments System Research Briefing, we examined the benefits and risks of this payment option for consumers and merchants; this Briefing explores how banks, payment networks, and regulators are responding to the proliferation of BNPL products.

The Effects of BNPL on Credit Cards

The rise of BNPL products may alter consumers’ use of payment methods such as credit cards, which share some key characteristics with BNPL. Both BNPL and credit cards offer short-term, interest-free loans, enabling consumers to take immediate possession of goods and delay payments. For some consumers and merchants, BNPL products may be more appealing than credit cards. Unlike credit cards, BNPL products can be approved without a full credit check and offer consumers flexible financing options, transparent terms, predetermined repayment schedules, and lower or no interest fees (Alcazar and Bradford 2021). While credit card loans can be interest free for up to one month and limited to cardholders who pay the previous billed amount in full, BNPL loans are typically interest free for up to three months. Millennials and Generation Z consumers already tend to shy away from credit cards given their general dislike of high-interest debt; for these groups, BNPL may be a more palatable option (Rossman 2021). For merchants, BNPL products offer the ability to settle sales quickly, and BNPL providers assume the risks of chargebacks and fraud (Eckler 2020).

Given these benefits, BNPL products have the potential to replace credit card payments, cutting into profits for providers of credit card services. Issuing credit cards is highly profitable for banks—especially large banks—compared with other bank activities (Board of Governors of the Federal Reserve System 2021). BNPL is already making a dent in banks’ profits: according to McKinsey’s Consumer Lending Pools data, over the past couple of years banks lost $8 billion to $10 billion in revenue per year to fintechs offering BNPL products (Dikshit and others 2021). BNPL may also reduce profits for payment card networks: credit cards generate more revenue for these networks than debit or prepaid cards, and a recent survey by C+R Research found that 38 percent of BNPL users said BNPL would eventually replace their credit cards (Palmer 2021).

Banks’ and Payment Networks’ Reactions to BNPL

Incumbent players in the U.S. payment industry have started to respond to the risk of losing credit card profits to BNPL products. These reactions take various forms, from partnering with BNPL providers to acquiring them to competing with them.

Some banks partner with BNPL providers to underwrite loans. Cross River Bank, for example, has originated the majority of loans facilitated through Affirm’s BNPL platform (Affirm 2021). Partnership may be advantageous for banks that have difficulty originating unsecured loans themselves due to costly customer acquisition and cumbersome loan applications. Partnering with BNPL firms streamlines this process. Moreover, BNPL firms often purchase loans after origination, providing banks liquidity and revenue._

Some banks and merchant payment processors also partner with BNPL firms to enable merchants to offer BNPL payment options. For example, First National Bank of Omaha recently rolled out a BNPL offering to merchants by partnering with Skeps, a provider of a BNPL lending product, and EXL, an operations management and analytics firm (PYMNTS 2021). In addition, in October 2021, merchant payment processor Stripe announced a partnership with fintech Klarna. Any merchant currently using Stripe as its payment processor can now offer its customers Klarna’s installment loan options (Stripe 2021).

Other incumbents have reacted to BNPL products by attempting to acquire them. In August 2021, Square, a mobile wallet provider and merchant payment processor, announced its intention to acquire Afterpay (Square 2021). Square offers Cash App, a payment wallet app, for its consumer customers, as well as apps and payment processing services for merchants. The acquisition would enable even the smallest of Square’s merchant customers to offer BNPL at checkout and enable Cash App customers to discover merchants that offer BNPL directly within the app. Furthermore, Afterpay’s consumer customers would be able to manage their installment payments directly in Cash App (Square 2021).

Still other incumbent players have reacted to BNPL products by competing with them, offering BNPL options or installment loans within their existing infrastructure. For example, PayPal, a mobile/digital wallet provider and merchant payment processor, has reinvigorated its deferred interest product and introduced an installment loan product called “Pay in 4” (PayPal 2021). Pay in 4 has the same features as a typical BNPL product: four equal, interest-free installments, with the first repayment at the time of purchase and the remaining three repayments every two weeks following.

Card networks such as Mastercard and Visa are also competing by developing BNPL options that keep transactions on their networks. Mastercard’s BNPL option is available to banks, lenders, fintech firms, and digital wallet providers that accept Mastercard payments (Zacks Equity Research 2021). Consumers access Mastercard’s BNPL options through their lender’s mobile banking or digital wallet app, or apply and receive BNPL loan approval during checkout; thus, consumers can use BNPL at any merchant that accepts Mastercard. Similar to other BNPL products, the merchant is typically charged a fee while the customer has access to interest-free installments. Visa also offers BNPL through an application programming interface that enables card issuers to create installment plans and merchants to display eligible installment plans and costs that cardholders can choose from during checkout (Visa 2021). With Visa’s solution, the card issuer maintains cardholder loyalty and collects cardholder fees, and the merchant payment processor enhances its offerings to the merchant.

Some credit card issuing banks are also competing by creating their own BNPL products._ For example, Citi and J.P. Morgan Chase have launched new products Citi Flex Pay and My Chase Plan, respectively, which let their credit card customers pay off purchases through fixed payments._ With these products, the card-issuing bank identifies purchases of at least $100 that their cardholder has already made and makes them eligible for repayment in equal installments ranging from three to 48 months. Cardholders who accept these offers pay either a monthly fee based on the annual percentage rate or an interest rate based on the purchase amount and repayment duration. Whether these “post-purchase” installment loans will attract consumers remains to be seen. Because these products are associated with credit cards, even short-term loans (such as a three-month loan) are not interest free, lacking the attractive feature of short-term BNPL products.

International and Domestic Regulators’ Reactions to BNPL

As BNPL offerings expand, they face greater scrutiny. In the United Kingdom and Australia, for example, regulators have already begun taking steps to regulate the BNPL industry (Dikshit and others 2021). The UK Treasury recently published a consultation exploring policy options for regulating the BNPL industry (HM Treasury 2021). The consultation broadly focuses on consumer outcomes, access to dispute resolution, and the fees BNPL providers charge merchants. The Reserve Bank of Australia recently concluded that it would be in the public’s interest to remove no-surcharge rules in BNPL arrangements, thereby enabling merchants to pass their cost of accepting BNPL transactions onto customers that use BNPL (Reserve Bank of Australia 2021). Although regulators in Australia have taken no direct action regarding consumer concerns, the industry association including the largest BNPL firms has issued a code of practices to self-regulate the BNPL industry (AFIA 2021).

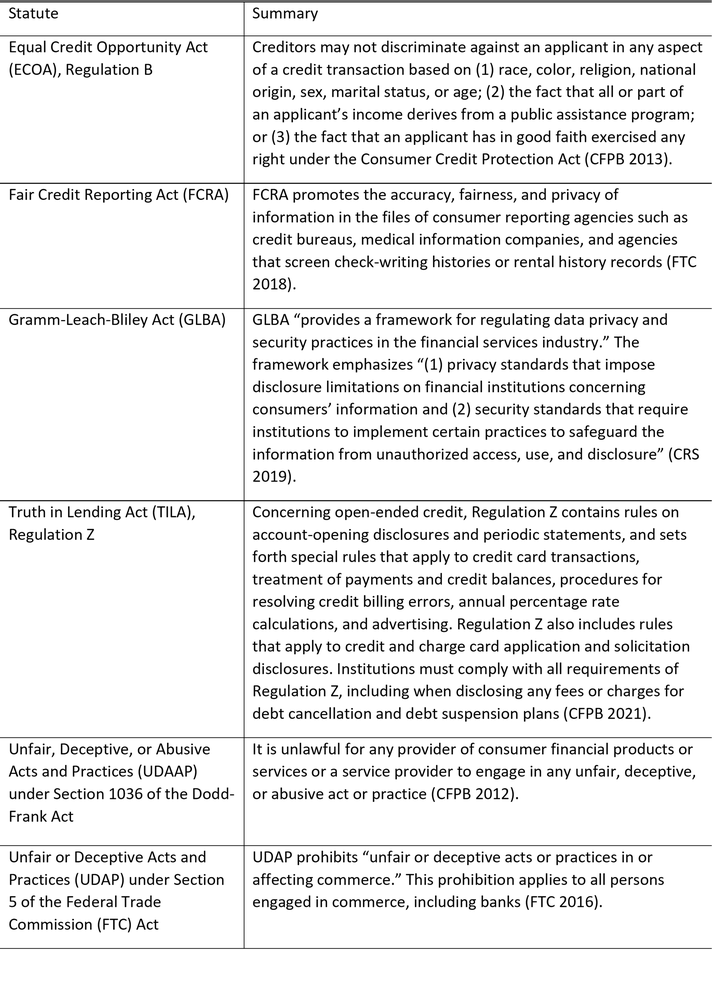

In the United States, the potential consumer risks of BNPL have led to calls for regulatory attention at the state and federal levels. For example, the California Department of Financial Protection and Innovation settled lawsuits with ViaBill, Sezzle, QuadPay (now Zip), Klarna, and Afterpay, which resulted in nearly $1.9 million in refunds to California consumers (California Department of Business Oversight 2020)._ At the federal level, regulators are assessing the extent to which BNPL products may be covered by existing consumer protection laws (U.S. House of Representatives 2021). (See the appendix for existing statutes that may be relevant to BNPL products.) In addition, the Consumer Financial Protection Bureau (CFPB) is encouraging BNPL users to be informed about risks and their consumer protection rights (Akeredolu and others 2021). Congress has also taken notice. In November 2021, the House Financial Services Committee Financial Technology Task Force held a hearing that explored the growth, risks, and potential benefits associated with fintech cash flow products such as BNPL (U.S. House of Representatives 2021).

Although most of the domestic focus on BNPL is on emerging consumer issues, existing regulation may apply to the provision of these services as well. Incumbents must consider risk mitigation and responsible lending, for example, as they get involved in BNPL arrangements (Board of Governors of the Federal Reserve System and others 2020).

Conclusion

The number of BNPL providers is increasing, and consumers and merchants appear to be readily adopting the products they offer. Banks and payment networks have reacted by engaging with, acquiring, and competing with BNPL providers. Internationally, regulators have reacted by beginning to implement guardrails. Domestically, as BNPL adoption grows, the calls for regulation of BNPL products may persist. We will continue to monitor the growth of the BNPL market and any regulatory developments.

Appendix

Table A-1: Existing Statutes That May Be Relevant to BNPL Products

Endnotes

-

1

The repurchase of loans will cap the potential gains banks can earn, as the fee is often a small percentage of the total origination.

-

2

Banks generally leverage payment card networks’ BNPL application programming interfaces when offering BNPL products to their own card customers.

-

3

Citi Flex Pay also enables qualifying cardholders to choose a Flex Pay plan at Amazon.com right at checkout for a minimum $75 purchase.

-

4

The $1.9 million settlement reflects refunds of all fees collected by these BNPL firms: External LinkSezzle ($282,000), External LinkQuadPay (now Zip) ($685,561), External LinkKlarna ($6,929.82), and External LinkAfterpay ($905,362.78). External LinkViaBill settled its lawsuit with no required refunds.

References

Affirm. 2021. “External LinkAnnual Report on Form 10-K.” September 17.

AFIA (Australian Finance Industry Association). 2021. “External LinkBuy Now Pay Later Code of Practice: Version 1.” March 1.

Akeredolu, Nelson, Andrew Braden, Joshua Friedman, and Laura Udis. 2021. “External LinkShould You Buy Now and Pay Later?” Consumer Financial Protection Bureau, July 6.

Alcazar, Julian, and Terri Bradford. 2021. “External LinkThe Appeal and Proliferation of Buy Now, Pay Later: Consumer and Merchant Perspectives.” Federal Reserve Bank of Kansas City, Payments System Research Briefing, November 10.

Board of Governors of the Federal Reserve System. 2021. “External LinkReport to the Congress on the Profitability of Credit Card Operations of Depository Institutions.” July 15.

Board of Governors of the Federal Reserve System, Federal Deposit Insurance Corporation, National Credit Union Administration, and Office of the Comptroller of the Currency. 2020. “External LinkInteragency Lending Principles for Offering Responsible Small-Dollar Loans.” Press release, May.

California Department of Business Oversight. 2020. “External LinkPoint-of-Sale Lender QuadPay Agrees to Cease Illegal Loans, Pay Refunds in Settlement with the California Department of Business Oversight.” Press release, April 22.

CFPB (Consumer Financial Protection Bureau). 2021. “External LinkInteragency Consumer Laws and Regulations: Truth in Lending Act, Regulation Z.” October.

———. 2013. “External LinkConsumer Laws and Regulations: Equal Credit Opportunity Act.” June.

———. 2012. “External LinkConsumer Laws and Regulations: Unfair, Deceptive, or Abusive Acts or Practices.” October.

CRS (Congressional Research Service). 2019. “External LinkBig Data in Financial Services: Privacy and Security Regulation.” November 15.

Dikshit, Puneet, Diana Goldshtein, Blazej Karwowski, Udai Kaura, and Felicia Tan. 2021. “External LinkBuy Now, Pay Later: Five Business Models to Compete.” McKinsey & Company, July 29.

Eckler, Mike. 2020. “External LinkWhat Merchants Should Know about ‘Buy Now, Pay Later’.” Practical Ecommerce, August 24.

FTC (Federal Trade Commission). 2018. “External LinkFair Credit Reporting Act.” September.

———. 2016. “External LinkFederal Trade Commission Act, Section 5: Unfair or Deceptive Acts or Practices.” December.

HM Treasury. 2021. “External LinkRegulation of Buy-Now Pay-Later Consultation.” October.

Palmer, Kimberly. 2021. “External LinkBuy Now, Pay Later vs. Credit Cards: Which Is Right for You?.” Nerdwallet, October 19.

PayPal. 2021. “External LinkWhat Is Pay in 4?”

PYMNTS. 2021. “External LinkFirst National Bank of Omaha Rolls out BNPL Offering.” September 21.

Reserve Bank of Australia. 2021. “External LinkReview of Retail Payments Regulation: Conclusions Paper.” October.

Rossman, Ted. 2021. “External LinkDo Young Adults Want Credit Cards?” Bankrate, February 1.

Square. 2021. “External LinkSquare, Inc. Announces Plans to Acquire Afterpay, Strengthening and Enabling Further Integration Between its Seller and Cash App Ecosystems.” August 1.

Stripe. 2021. “External LinkKlarna Partners with Stripe to Help Online Businesses Grow Their Revenue.” October 26.

U.S. House of Representatives, Committee on Financial Services. 2021. “External LinkMemorandum, October 28.”

Visa. 2021. “External LinkInstallments: Consumers Can Buy Now and Pay Later.” July 28.

Zacks Equity Research. 2021. “External LinkMastercard (MA) Enters BNPL Market With Mastercard Installment.” Nasdaq, September 28.

Julian Alcazar is a payments specialist and Terri Bradford is a senior payments specialist at the Federal Reserve Bank of Kansas City. The views expressed are those of the authors and do not necessarily reflect those of the Federal Reserve Bank of Kansas City or the Federal Reserve System.