In the last decade, buy now, pay later (BNPL) has become an increasingly popular payment option in the United States. This Payments System Research Briefing explores how BNPL compares with other “purchase/pay-over-time” options, and the benefits and risks BNPL presents to the consumers and merchants who adopt them. A forthcoming Briefing will consider BNPL from the perspective of financial institutions, payment networks, and regulators.

What Is BNPL?

BNPL is a type of short-term loan that allows consumers to make purchases and pay for them at a future date over a series of installments. BNPL divides a consumer’s purchase into multiple equal payments, with the first due at checkout. Shorter-term BNPL products are usually interest free, while longer-term BNPL products may charge interest. Although BNPL was initially used mainly for online purchases, it has expanded to purchases in stores and has become an increasingly popular payment option to purchase electronics, clothing and fashion items, furniture, and appliances. Today, BNPL is beginning to be available for services such as travel and even health care.

BNPL products can be grouped into two main types, depending on how they are offered to consumers. One type of BNPL product is offered directly to consumers by fintechs before a purchase is made; the other is offered during a purchase through a merchant who partners with a fintech or financial institution._ Although five BNPL fintech providers—Affirm, AfterPay, Klarna, Sezzle, and Zip (formerly known as QuadPay)—are the most prominent, there are approximately two dozen domestic providers.

The first type of BNPL products generally targets millennials, Generation Z (Gen Z) consumers, and financially underserved consumers such as those with no credit or bad credit. The credit limits associated with these services tend to be lower, ranging from hundreds of dollars up to thousands, with only a soft credit check that verifies credit history, age, and salary but does not rely on a consumer’s credit score. However, credit limits may increase as a consumer demonstrates creditworthiness. BNPL services include a virtual or physical payment card to make purchases, which typically can only be used at participating merchants. Repayment of a purchase with these services usually involves four equal, interest-free installments, with 25 percent paid at the time of purchase and the remaining balance paid in three two-week cycles._ These services allow multiple BNPL purchases up to the predetermined credit limit.

Compared with the first type of BNPL products, the type offered through merchants targets broader consumer segments and offers longer-term installments. In addition to millennials and Gen Z consumers, baby boomers and affluent customers may also be targeted. BNPL products offered through merchants tend to have higher credit limits that may reach up to tens of thousands of dollars and repayment terms that range from six weeks to 60 months (depending on the type of merchant). Unlike shorter-term loans, longer-term loans (3 months or more) typically require no upfront payment at the time of purchase. Interest rates vary according to the length and value of the loan and can range from 0 percent to nearly 30 percent.

Revenue for the fintechs or financial institutions that provide both types of these loans is primarily derived from fees charged to the merchants that accept the loans as a customer payment option. However, revenue may also be generated from late fees or penalties charged to consumers who fail to comply with the terms of repayment._

BNPL Compared with Other Installment Options

BNPL products may look and feel new, but they share similarities with existing installment payments, such as layaway and credit cards. Layaway is a pay-over-time service offered by a merchant that allows a consumer to reserve an item by making interest-free, predetermined installment payments until the item is paid for in full. Consumers who use layaway may have bad or no credit or limited income. Like BNPL, layaway enables consumers to acquire a good they may not otherwise be able to afford, but without taking on debt. Layaway is relatively low risk for both the consumer and merchant. Consumers may be charged a nonrefundable service fee and may incur a cancellation fee if they do not complete the purchase. For merchants, layaway enables sales that might not occur otherwise; however, if the consumer fails to pay in full, the value of the good may decrease over the loan term._ Although still available—especially during the holiday season—layaway programs began declining during the 1980s as the ubiquity of credit cards decreased their utility. Now, with BNPL products increasing, even more merchants are eliminating layaway services (Kenton 2020; Bruce 2021).

BNPL products also share similarities with credit cards, which enable consumers to take immediate possession of goods and delay payment. Consumers use credit cards for their rewards, cash-free convenience, and as a cushion for emergencies, among other reasons. Some consumers carry a balance from month to month, while others may pay each month’s balance in full. However, a consumer’s ability to obtain a credit card hinges on their creditworthiness (Weliver 2021). Even among those deemed creditworthy, younger generations are less likely to use credit cards than previous generations; only about one-third of Gen Z and about one-half of millennials has a credit card (Rossman 2021).

Although credit cards are a viable form of installment payment for many, products like layaway and BNPL offer a means for a broader range of consumers—especially those with bad or no credit—to access goods and services. Generally, interest-free BNPL loans and layaway are comparable in their terms and costs, but BNPL enables consumers to take immediate possession of a product at the point-of-purchase while layaway requires consumers to wait until the product has been paid for in full. When using layaway requires a service fee, BNPL can be the least expensive method of payment. Interest-bearing BNPL loans may be less expensive than credit cards, as the average interest charge of BNPL is typically lower. (See the appendix to compare a purchase made with BNPL, credit card, and layaway installment options.)

Consumer Adoption, Benefits, and Risks

Many U.S. consumers have already adopted BNPL, and the number of adopters is growing rapidly. According to a September 2021 report by Accenture, the number of BNPL users in the United States has grown by more than 300 percent per year since 2018, reaching 45 million active users in 2021 (Accenture 2021). Spending with BNPL has also increased and now represents about 2 percent of U.S. online retail sales (Tighe 2021). Information provided by the Financial Technology Association indicates that BNPL users are predominantly female and younger, with the vast majority being millennials and Gen Z consumers (Financial Technology Association 2021). The user base also includes lower-income consumers who may lack access to traditional forms of credit or banking services.

For consumers, BNPL offers various benefits. Credit may be the most important BNPL benefit, especially for consumers with limited means. In a poll by Ascent in March 2021, 45 percent of U.S. adults who were BNPL users said they used these services to make purchases that otherwise would not fit their budget (Backman 2021). Predetermined repayment schedules may be another important benefit. Unlike credit card debt, for which consumers need to make their own repayment plan, consumers simply follow the repayment schedule set by the BNPL product. The broad availability of BNPL may be another benefit relative to the limited availability of layaways; moreover, unlike layaway, BNPL enables consumers to immediately take possession of a product as they are still paying for it. Among other reasons for adopting BNPL, consumers cite convenience, transparency of terms, interest avoidance, cash conservation, and less impact to their credit score. For users with little or no credit, or bad credit history, some BNPL providers have begun offering programs for users to submit their repayment behavior to a credit bureau to help build their credit file and improve their credit score (Sezzle 2021).

However, BNPL products also carry risks. Unlike credit card issuers, BNPL lenders are not required to consider a consumer’s ability to repay loans._ Most BNPL providers only run a soft credit check for interest-free installment loans. As a result, consumers may use multiple BNPL products—in addition to other credit products—and risk financial overextension. New research from consumer research firm Piplsay found that though 74 percent of BNPL users were able to make their BNPL payments on time, 14 percent missed a payment once, and 12 percent missed a payment more than once (Piplsay 2021)._ As some BNPL providers do report to credit bureaus, late payments may affect an individual’s credit scores (Paul 2021; Lapera 2021).

Another potential risk for consumers is that the availability of BNPL credit during the checkout process could encourage impulse buying. The March 2021 Ascent survey found that 16 percent of BNPL users reported making five or more purchases with BNPL in an average month. BNPL purchases can be difficult for consumers to track in aggregate when multiple purchases are made from multiple providers. This could result in late and missed payment fees and interest may accrue with some providers if a BNPL balance is not paid in accordance with the terms and conditions.

BNPL products also have longer-term risks. Users of BNPL products tend to skew younger, so any financial trouble could hinder their ability to access credit in the future or even obtain certain types of employment. Identity fraud is also possible. In instances where BNPL loans are not reported to credit bureaus, an individual may be unaware that BNPL credit has been fraudulently established and used in their name, and alert and monitoring services would have no insight. Because some merchants have eliminated layaway services in favor of BNPL options, some consumers may feel nudged into using a credit product they cannot effectively manage.

Merchant Adoption, Benefits, and Risks

Merchants receive several benefits by adopting BNPL products as payment options for their customers. A study by BNPL firms shows that merchants experience a decrease in cart abandonment and an increase in repeat business (Todorov 2021). The predefined, fixed-dollar installments—with or without interest—can make goods more attainable for new customers, increase existing customers’ propensity to purchase, and increase transaction value. BNPL products also provide merchants the ability to settle sales quickly and may eliminate a merchant’s chargeback and fraud risks because BNPL firms assume those risks (Eckler 2020). Furthermore, BNPL products decrease a risk associated with layaway—that the value of a good may decrease. Additionally, at least for now, BNPL may provide merchants an opportunity to gain or maintain a competitive advantage because consumers may choose merchants that offer BNPL over those that do not.

BNPL firms can also assist the merchant by directly marketing the merchant’s offers to consumers. In addition, BNPL products with direct API integration capabilities (which allow different apps to exchange data) enable merchants to offer consumers a seamless checkout experience: the consumer can apply for a loan, receive the loan approval, and pay for the first installment easily and quickly during checkout (CB Insights 2021). As a result, an increasing number of merchants—including big-box merchants such as Amazon, Target, and Walmart—are offering BNPL options for e-commerce as well as for in-store purchases. According to a Zip.co survey of more than 1,000 U.S. merchants, 25 percent accept BNPL; of those that do not, 46 percent say they are either likely or extremely likely to accept BNPL within the next year (Willson 2021).

Although BNPL provides benefits to many merchants, not all merchants may find it optimal. Offering BNPL as a payment option comes at a premium. The cost of a BNPL transaction for merchants ranges from 1.5 to 7 percent of the purchase value (including tax), while the cost of a typical debit or credit-card transaction ranges from 1 to 3 percent. As a result, merchants should consider whether BNPL products fit what they sell and whether a minimum transaction value is needed to justify offering BNPL as a payment option. Although BNPL products may earn a merchant a new customer, BNPL providers may cap the number of concurrent loans a consumer can have, which can limit a merchant’s ability to maintain a recurring relationship._

Offering BNPL also comes with the risk that the interest-free BNPL payments will attract existing customers away from payment options that cost merchants less to accept, such as debit and prepaid cards (Southall 2021). Long-term effects could include lasting shifts in payments that result in the cost of accepting BNPL outweighing the value. Once consumers have widely adopted BNPL, merchants may not be able to discontinue accepting it even if the cost has become greater than the benefit—and the cost may not decline without regulatory intervention.

Additionally, the use of BNPL can complicate a merchant’s returns process and damage customer satisfaction. Although merchants experience lower return rates with BNPL purchases, returns that do occur can be cumbersome due to the extra steps involved. Some BNPL firms may even hold a consumer responsible for the total cost of a purchase after an item has been returned (Akeredolu and others 2021).

Conclusion

The number of BNPL providers is increasing and consumers and merchants appear to be readily adopting the products they offer. Although BNPL has benefits for both consumers and merchants, the offerings are new enough that potential risks may not yet be well understood. The risks to consumers have resulted in calls for regulatory attention domestically and internationally. As a result, the Consumer Financial Protection Bureau has encouraged BNPL providers in the United States to take steps to ensure users are adequately informed of the risks BNPL presents. For merchants, BNPL cost of acceptance may warrant careful consideration as regulatory intervention is uncommon in the United States. In our forthcoming Payments System Research Briefing, we will examine the regulatory considerations of offering BNPL products in addition to the perspectives of financial institutions and payment networks.

Appendix: Comparison of Consumer Payments across BNPL, Credit Card, and Layaway

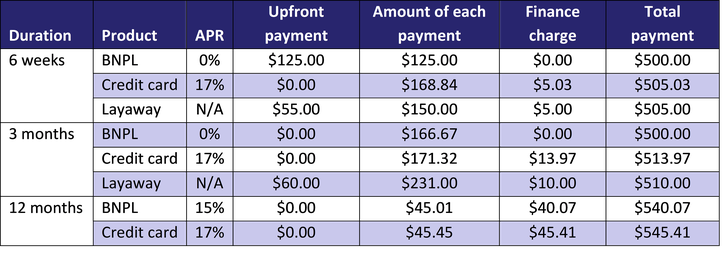

Table 1 below compares a consumer’s payment for the purchase of a $500 TV (including tax) using BNPL, a credit card, or layaway for three different durations of loans: six weeks with three biweekly payments (in addition to the upfront payment at the time of purchase for BNPL and layaway); three months with three monthly payments (in addition to the upfront payment for layaway); and 12 months with 12 monthly payments. For BNPL and credit cards, all three durations are possible, while for layaway only the first two durations (six weeks and three months) are possible.

In the table, we assume “typical” fees or interest charges. For BNPL, we assume interest-free or 0 percent annual percentage rate (APR) for the six-week and three-month durations and 15 percent APR for the 12-month duration._ For credit cards, we assume 17 percent APR for all three durations._ For layaway, we assume a service fee of $5 for the six-week duration and $10 for the three-month duration. We make additional assumptions for a credit card. We assume that the consumer has an unpaid balance at the time of the TV purchase, and therefore no grace period applies for the purchase. We also assume that the consumer pays almost equal amounts for each biweekly or monthly payment.

Table 1 shows that BNPL is generally the least expensive among the three products, because BNPL typically assesses no service fee and no interest charge for short-term loans. However, if BNPL has an interest charge for longer-term loans that is the same as the credit card interest charge, the total payment the consumer makes is similar between the two products.

Table 1: BNPL Is Generally the Least Expensive among the Three Loan/Installment Products

Endnotes

-

1

Recently, a third type of BNPL product has emerged, which credit card issuers can offer to their cardholders after purchases have been made. We discuss this type more thoroughly in the next BNPL Briefing.

-

2

Some providers offer longer-term loans up to 60 months, which may carry an interest rate as high as 30 percent.

-

3

Financial institutions may also derive revenue from interest charges on longer-term BNPL loans.

-

4

Merchants may offset this depreciation with service or cancellation fees.

-

5

BNPL providers also may not offer the same disclosures or the same billing error resolution procedures.

-

6

The research is based on the online survey conducted September 28–30, 2021, which gathered 30,880 responses. It found that 43 percent of Gen Z users missed a BNPL payment at least once this year, compared with 31 percent of millennials and 26 percent of Gen X users.

-

7

However, BNPL firms could nudge the consumer back to the merchant when they are done paying off a loan.

-

8

Typically, interest-free BNPL is available for the six-week and three-month durations (Affirm 2021). For the 12-month duration, the average interest charge is not available. We assume the midpoint of the typical range of APR between 0 percent and 30 percent.

-

9

As of August 2021, the average APR of credit cards is 17.01 percent, according to the Federal Reserve Bank of St. Louis, FRED, External LinkCommercial Bank Interest Rate on Credit Card Plans, Accounts Assessed Interest.

References

Accenture. 2021. “External LinkThe Economic Impact of Buy Now, Pay Later In the US.” September.

Affirm. 2021. “External LinkWelcome to the Affirm Investor Forum.” September 28.

Akeredolu, Nelson, Andrew Braden, Joshua Friedman, and Laura Udis. 2021. “External LinkShould You Buy Now and Pay Later?” Consumer Financial Protection Bureau, July 6.

Backman, Maurie. 2021. “External LinkStudy: Buy Now, Pay Later Services Continue Explosive Growth.” The Ascent, March 22.

Bruce, Beverly. 2021. “External LinkMajor Retailers Are Starting to Ged Rid of This Popular Perk.” BestLife, September 27.

CB Insights. 2021. “External LinkDisrupting the $8T Payment Card Business: The Outlook On ‘Buy Now, Pay Later’.” Research Report, March 2.

Eckler, Mike. 2020. “External LinkWhat Merchants Should Know about ‘Buy Now, Pay Later’.” Practical Ecommerce, August 24.

Financial Technology Association. 2021. “External LinkJust the Facts: Buy Now Pay Later (BNPL).” July 8.

Kenton, Will. 2020. “External LinkWhat Is Layaway?” Investopedia, December 30.

Lapera, Gaby. 2021. “External Link72% of Americans Saw Their Credit Scores Drop After Missing a ‘Buy Now, Pay Later’ Payment, Survey Finds.” Credit Karma, February 8.

Paul, Trina. 2021. “External Link‘Buy Now, Pay Later’ Loans Can Decrease Your Credit Score Even If You Pay on Time—Here’s What You Need to Know.” CNBC.com, September 3.

Piplsay. 2021. “External Link‘Buy Now, Pay Later’ Programs: How Interested Are U.S. Shoppers?” October 4.

Rossman, Ted. 2021. “External LinkDo Young Adults Want Credit Cards?” Bankrate, February 1.

Tighe, D. 2021. “External LinkMost Popular Online Payment Methods in the U.S. 2020.” Statista, July 19.

Sezzle. 2021. “External LinkSezzle Expands Partnership with TransUnion.” October 14.

Southall, Martha. 2021. “External LinkBuy Now, Pay Later—Three Key Lessons from Australia.” The Paypers, October 1.

Todorov, Svetlio. 2021. “External LinkEntering the Mainstream: The Growth of BNPL.” Payments Journal, October 21.

Weliver, David. 2021. “External LinkWhat Credit Score Do You Need to Get Approved For a Credit Card?” Money Under 30, November 1.

Willson, Amelia. 2021. “External LinkIs 2021 the Year of BNPL? 6 Facts You Need to Know about This Payment Method.” Zip, July 10.

Julian Alcazar is a payments specialist and Terri Bradford is a senior payments specialist at the Federal Reserve Bank of Kansas City. The views expressed are those of the authors and do not necessarily reflect those of the Federal Reserve Bank of Kansas City or the Federal Reserve System.