Agricultural debt at commercial banks continued to decline in the first quarter of 2021 and farm loan performance improved. Both real estate and production loans decreased, reducing farm debt by more than 5% from a year ago and contributing to a decline in the number of banks classified as agricultural banks. The reduction in agricultural loan balances was less pronounced among banks most concentrated in agriculture, driven by modest growth in real estate debt among those lenders. Delinquency rates on farm debt dropped notably from a year ago and, alongside strong earnings, profitability at agricultural banks improved from the end of last year.

The outlook for agriculture remained strong heading into the summer months. Robust demand for key farm commodities continued to support strong prices and optimism across the sector. Increases in production costs and persistent drought in many regions lingered as concerns, however; and profitability for cattle producers remained narrow. Overall, strength in aggregate conditions and lasting support of government aid and lending programs have continued to limit increases in farm debt and ease agricultural credit stress.

First Quarter Commercial Bank Call Report Data

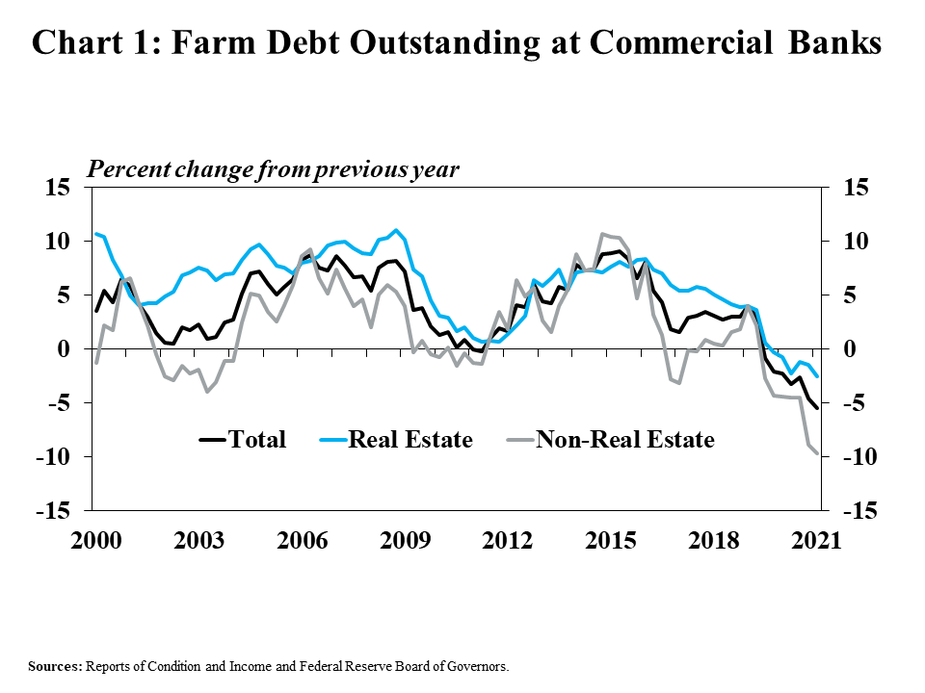

Farm debt at commercial banks continued to shrink in the first quarter. Non-real estate farm debt decreased by 10% from a year ago as strong profits in large segments of the agricultural sector limited producers’ needs for operating loans (Chart 1). Similarly, farm real estate debt declined by 3% from a year ago despite ongoing increases in the valuations of farm real estate.

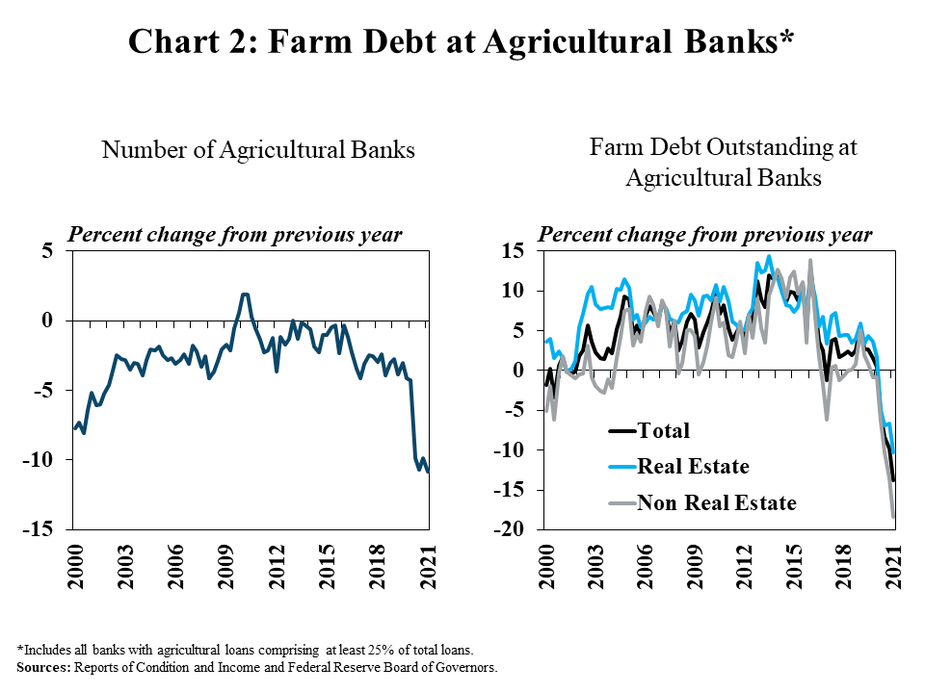

Alongside the consistent declines in farm lending over the past year, the number of banks with concentrations in farm lending has decreased notably. From 2010 to 2019, the number of banks classified as agricultural banks decreased at an annual pace of about 2%. Since early 2020, however, the number of commercial banks meeting the criteria to be considered an agricultural bank has dropped by an average of more than 10% (Chart 2, left). With a smaller number of banks highly concentrated in agriculture, the amount of farm debt held at agricultural banks has dropped considerably when compared with a year ago (Chart 2, right).

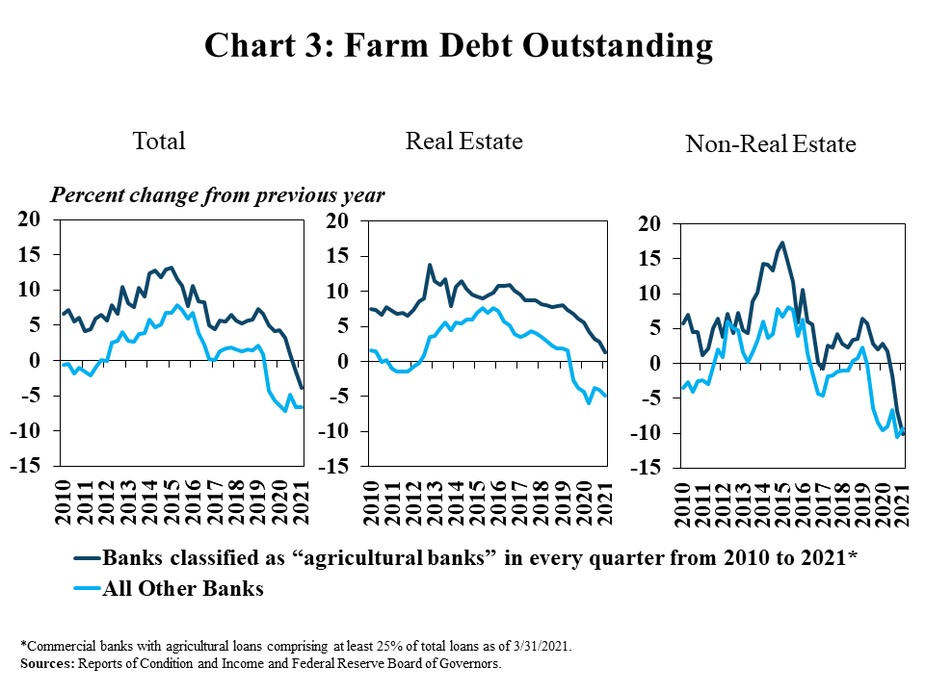

Among lenders that have remained highly concentrated in agriculture, the pullback in farm debt in recent quarters has been less pronounced. For banks that retained their classification as an agricultural bank through the first quarter of 2021, farm debt was about 3% less than a year ago. In contrast, farm debt decreased by nearly 7% at other banks not classified as an agricultural bank in the first quarter (Chart 3, left). Moreover, farm real estate debt increased slightly at banks retaining their agricultural classification while real estate lending at other banks declined by 5% (Chart 3, middle). Non-real estate farm loan balances dropped by about 10% at all commercial banks, regardless of their classification as agricultural or non-agricultural (Chart 3, right).

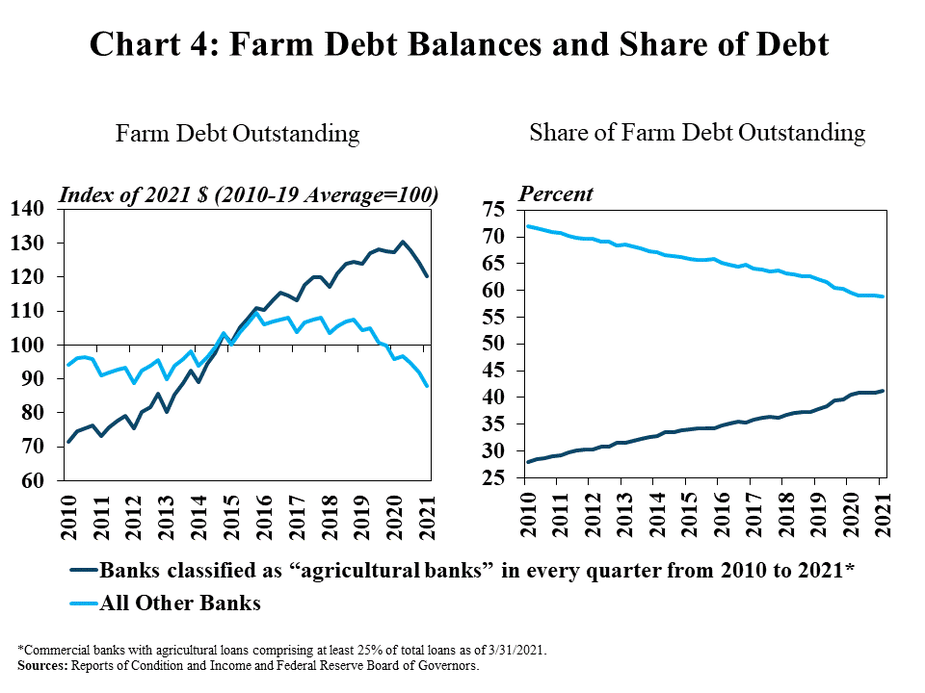

The level of farm debt also remained elevated among the most concentrated farm lenders but reached a ten year low among other banks. Farm loan balances remained about 20% above the ten-year average for banks classified as agricultural banks in every quarter since 2010 but were more than 10% below that average among all other banks (Chart 4). With substantial growth in farm debt at banks consistently meeting the criteria to be considered an agricultural bank, the share of farm loan balances held by those lenders has increased steadily.

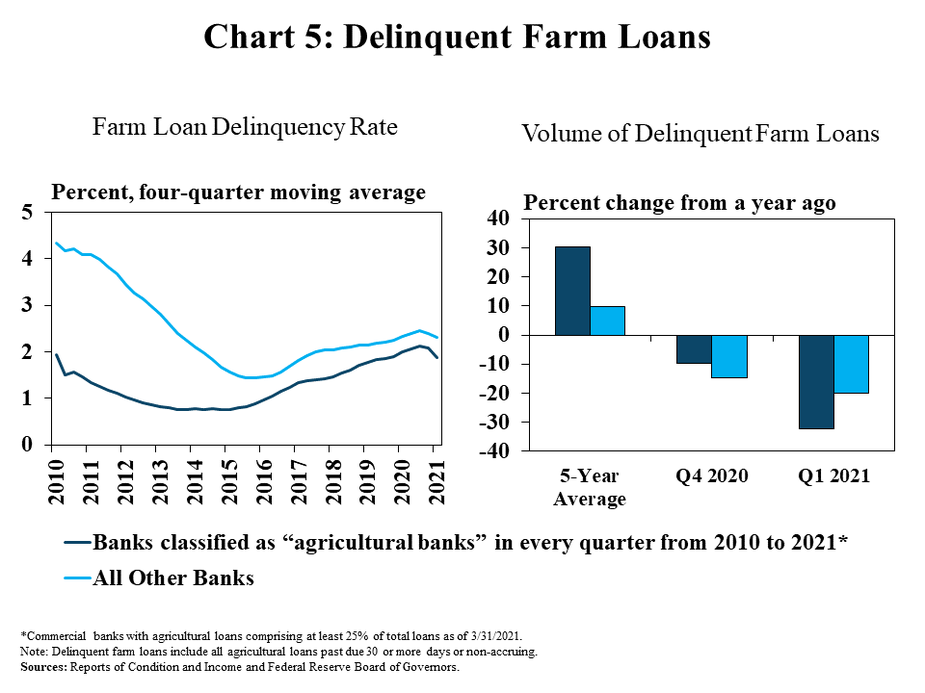

Alongside reduced levels of farm debt in aggregate, the volume of delinquent loans declined substantially in the first quarter. The volume of delinquent farm loans was about 25% less than a year ago at commercial banks and the rate of delinquencies also edged lower. Delinquent loan volumes decreased more substantially at banks most concentrated in agriculture and the rate of delinquency among those lenders also remained slightly less than at other banks (Chart 5).

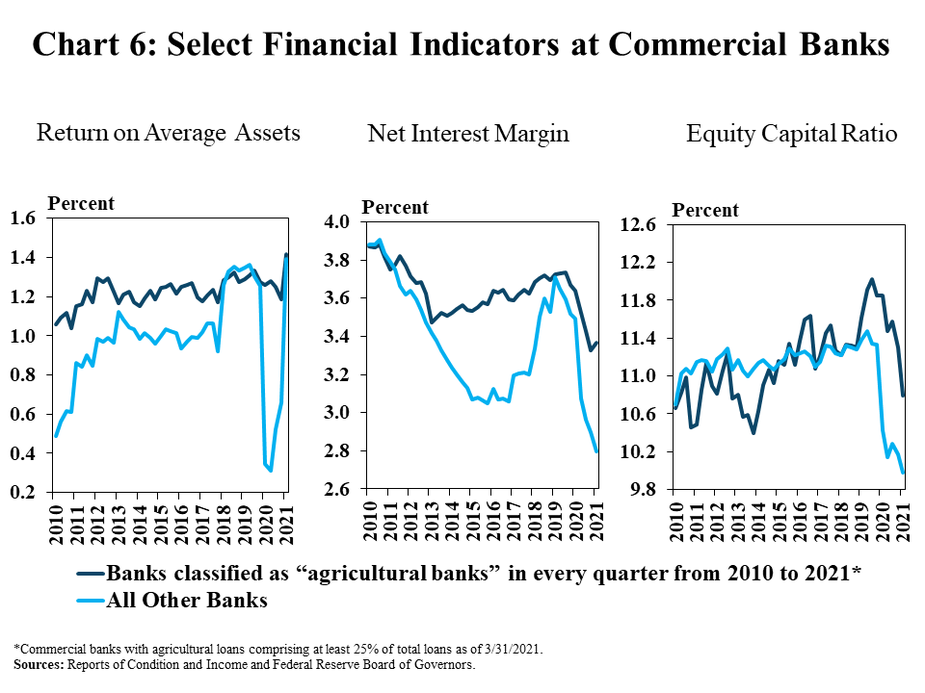

In addition to improvement in the performance of farm loans, profitability at agricultural banks strengthened considerably. After declining at the end of 2020, and despite net interest margins remaining narrow, the return on assets at agricultural banks rebounded alongside strong growth in non-interest income and lower expenses (Chart 6). Consistent with broader trends, the amount of capital at agricultural banks grew alongside strong earnings, but growth in total assets resulting from large deposit balances put downward pressure on capital ratios.

Data and Information

Commercial Bank Call Report Historical Data