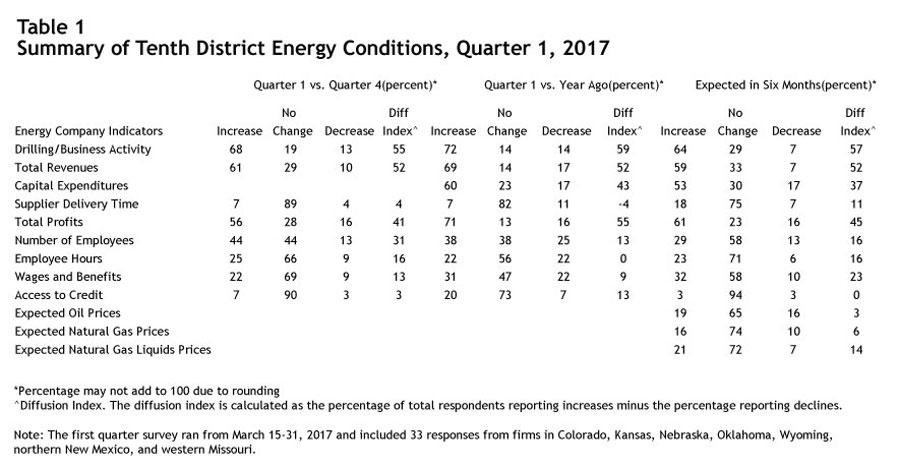

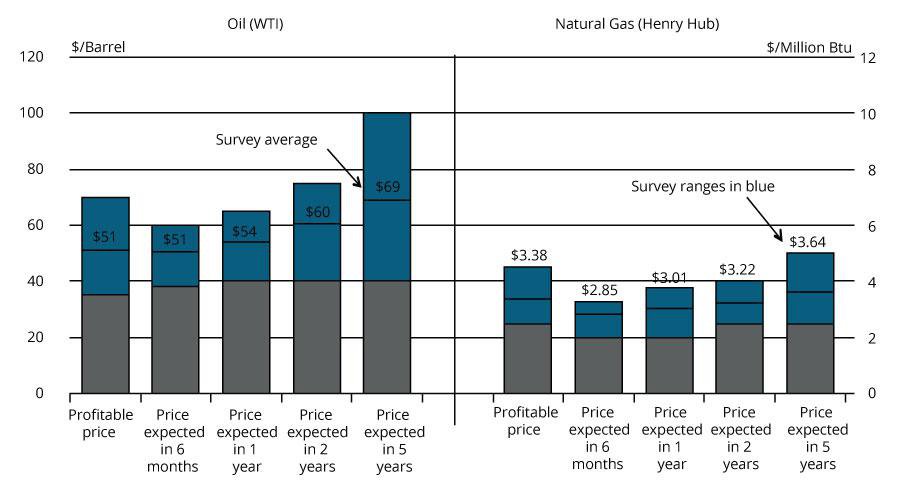

Summary of Quarterly Indicators

District energy activity continued to expand solidly in the first quarter of 2017, as reported by firms contacted between March 15 and 31 (Tables 1 & 2). Most indexes remained near their high readings of the fourth quarter of 2016. The drilling and business activity index eased from 64 to 55 but was still the second highest reading since the survey began three years ago (Chart 1). The total revenues index fell to 52, and the indexes for employee hours and wages and benefits also moderated slightly. The access to credit and employment indexes edged higher, and the supplier delivery index turned positive for the first time since the third quarter of 2015.

Chart 1: Drilling/Business Activity Index vs. a Quarter Ago

Skip to data visualization table| Date | Drilling/Business Activity |

|---|---|

| 2014Q1 | 39 |

| 2014Q2 | 38 |

| 2014Q3 | 50 |

| 2014Q4 | -24 |

| 2015Q1 | -68 |

| 2015Q2 | -37 |

| 2015Q3 | -37 |

| 2015Q4 | -56 |

| 2016Q1 | -72 |

| 2016Q2 | 0 |

| 2016Q3 | 26 |

| 2016Q4 | 64 |

| 2017Q1 | 55 |

Most year-over-year indexes continued to improve. The revenues, profits, and capital spending indexes increased considerably, while the drilling and business activity and employment indexes rose modestly. The supplier delivery time index also increased but remained negative. The access to credit index jumped into positive territory for the first time since the third quarter of 2014. In contrast, the employee hours and wages and benefits indexes fell somewhat.

Most future expectations indexes declined but remained solid. The future drilling and business activity index decreased from 73 to 57, and the future revenues and total profits indexes were also moderately lower. The future capital spending index declined from 79 to 37, and the access to credit index fell to 0

Price expectations for oil and gas rose only slightly. The expected oil prices index fell from 72 to three, meaning most respondents expected oil prices to remain near current levels in the coming months. The NGL price and natural gas prices indexes also fell considerably but remained above 0.

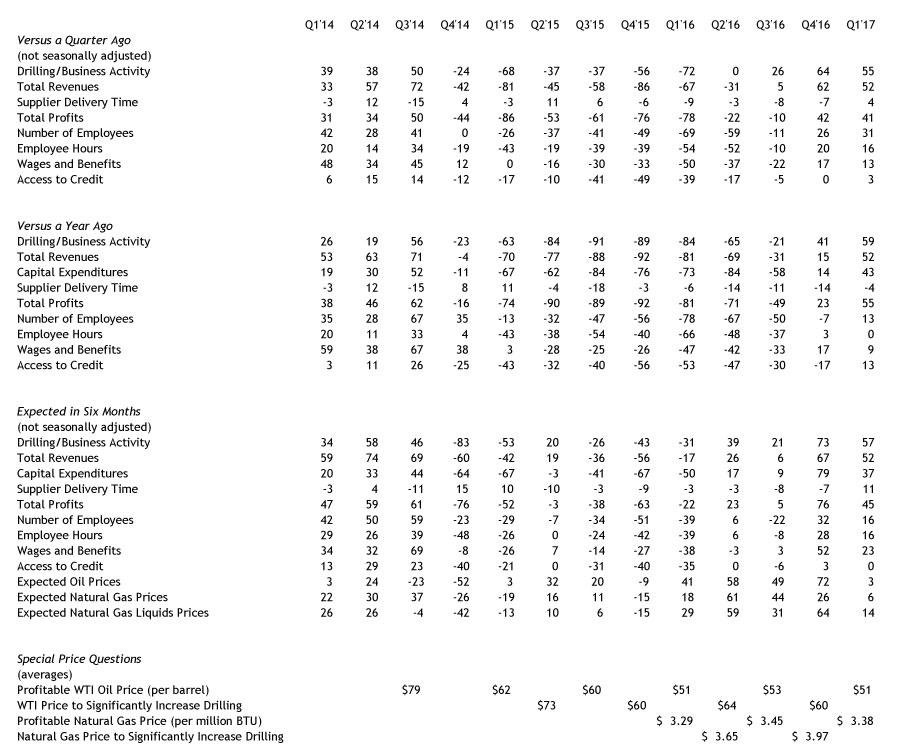

Summary of Special Questions

Firms were asked what oil and natural gas prices were needed to be profitable in the areas in which they were active. The average oil price needed was $51 per barrel, with a range from $35 to $70 (Chart 2). This was slightly lower than the $53 average in the third quarter of 2016, and the same as the average in the first quarter of 2016. The average natural gas price needed was $3.38 per million Btu, with responses ranging from $2.50 to $4.50.

Chart 2: Special Question - What price is currently needed for drilling to be profitable for oil and natural gas, and what do you expect the WTI and Henry Hub prices to be in six months, one year, two years, and five years?

Firms were also asked what they expected oil and natural gas prices to be in six months, one year, two years, and five years. The average expected WTI prices for these periods were $51, $54, $60, and $69 per barrel, respectively. Firms overall expected global oil demand to keep increasing and eventually overtake global supply, although price expectations varied considerably. The average expected Henry Hub natural gas prices for these periods were $2.85, $3.01, $3.22, and $3.64 per million Btu. Large supply availability, particularly from the Marcellus play, was cited as the main factor driving natural gas prices.

Firms were asked how oilfield service costs have changed since the first quarter of 2016. The majority of firms reported slight increases in costs since last year (Chart 3). Some firms expected costs to keep rising through the summer, particularly for well completion services.

Chart 3. Special Question - With the rise in oil prices and activity, how have oilfield service costs changed since Q1 2016?

Skip to data visualization table| Change | Votes |

|---|---|

| Increased significantly | 8 |

| Increased slightly | 64 |

| No change | 24 |

| Decreased slightly | 4 |

| Decreased significantly | 0 |

Firms were also asked if they were concerned about labor or physical capital shortages limiting near-term growth in activity. More than 40 percent of respondents reported having no concerns (Chart 4). However, over a third of firms reported concerns about labor shortages. Several respondents said many laid off experienced workers were not returning, so they will have to train new employees.

Chart 4. Special Question - Are you concerned about labor or physical capital shortages limiting near-term growth in activity?

Skip to data visualization table| Concern | shortages |

|---|---|

| Yes for labor | 37 |

| Yes for capital | 10 |

| Yes for labor and capital | 10 |

| No concerns | 43 |

Firms were questioned about their hedging activity as well. Slightly more firms had increased hedging since 2014 than had decreased it. Hedging firms had on average hedged 66 percent of oil production for 2017 and 41 percent for 2018, and had hedged 59 percent of natural gas production for 2017 and 25 percent for 2018.

Selected Comments

“Increasing world demand for fossil fuels will eventually help bring supply and demand back in balance, along with production cuts in OPEC countries.”

“Worldwide demand keeps rising. Supply is also rising but so are drilling and completion costs. These rising costs will continue which should push up the need for a higher commodity price.”

“Near-term field based employees, especially those with technical and leadership skills, are expected to become tight as soon as the next 4-6 weeks and extend well into the rest of the year.”

“Total well costs on a per unit basis have increased +/- 5%. We are expecting a 10% total increase by the third or fourth quarter of 2017.”

“Many employees have left the industry for other jobs so it will take time to train and get an experienced workforce to do the job.”

“Increased oilfield service costs reflect reactivating idled equipment and also retraining personnel.”

“The glut of gas from the Marcellus Shale as well as large surplus of natural gas should keep prices low for some time.”

“Storage is at all-time high; it is going to take some years for demand to catch up, but when it does it will be a big swing up in the price.”

“Wage levels are still attractive enough to attract labor, and capital availability seems sufficient.”