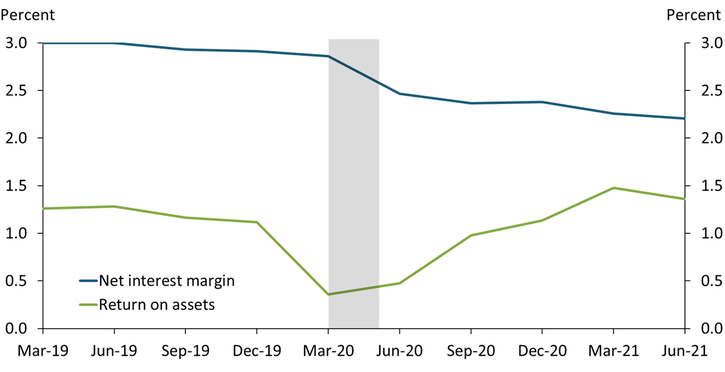

Despite a global pandemic and historically low interest rates, bank profitability in 2021 has been at its highest level in recent history. Return on assets (ROA), the most common indicator of overall bank profitability, reached a record high in the first quarter of 2021. At the same time, however, traditional sources of bank revenue trended down. Chart 1 shows that while banks’ ROA has risen since the first quarter of 2020, net interest margins (NIMs) have declined, reaching their lowest level in recent years by June 2021. NIMs capture the difference between the interest banks receive on loans, securities, and other assets and the interest they pay on interest-bearing non-deposit and deposit liabilities. Accordingly, NIMs are widely accepted as an indicator of profitability from banks’ core activities.

Chart 1: Bank Net Interest Margins (NIMs) Declined while Returns on Assets (ROA) Increased

Note: Gray shaded area represents a National Bureau of Economic Research (NBER)-defined recession.

Sources: Board of Governors of the Federal Reserve System and NBER.

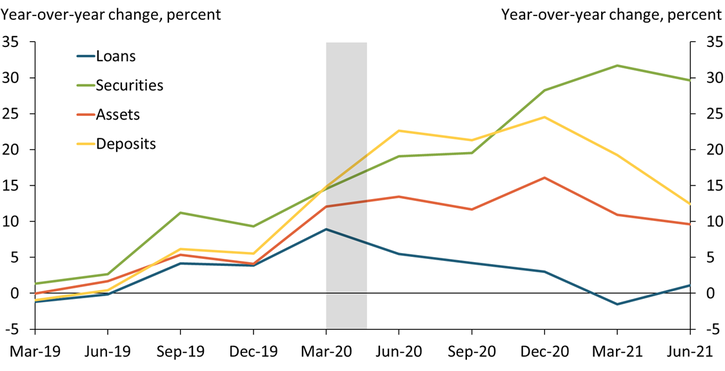

That banks continued to receive such high ROA while margins from their core business activities faltered is remarkable. Even more remarkable is that this growth in bank ROA has come during a period of high asset growth. Bank balance sheets expanded dramatically in the early days of the pandemic, attributed largely to increases in credit line withdrawals and deposit inflows (Glancy, Gross, and Ionescu 2020). The yellow line in Chart 2 shows that deposits continued to grow throughout 2020, fueled by the extraordinary measures undertaken by the U.S. Treasury and the Federal Reserve during the pandemic to stabilize financial markets and provide economic relief to households and businesses._ However, this surge in deposits has not materially increased banks’ interest expenses. On the contrary, banks have seen lower expenses on deposits than before the pandemic, which has supported NIMs despite their overall decline (Sengupta and Xue, forthcoming)._

Chart 2: Bank Balance Sheets Continued to Grow through the Pandemic

Note: Gray shaded area represents a National Bureau of Economic Research (NBER)-defined recession.

Sources: Board of Governors of the Federal Reserve System and NBER.

At the same time, declining loan yields and a slowdown in loan growth have reduced NIMs overall. The initial surge in loan growth from credit line withdrawals was somewhat sustained by banks’ participation in the Paycheck Protection Program (PPP). In fact, PPP loans have contributed to much of the increase in bank lending during the pandemic (Marsh and Sharma 2020). However, lower loan yields from declining rates and low loan rates on PPP loans contributed to the decline in bank NIMs. As businesses repaid their credit line withdrawals and received forgiveness for PPP loans, the decline in loan demand from cash-rich businesses and households led non-PPP lending to contract (Ennis and Jarque 2021). In addition to declining yields, the decline in loans as a share of bank portfolios over the previous two years has also contributed to the reduction in bank NIMs (Sengupta and Xue, forthcoming). Meanwhile, the windfall in bank deposits has financed increased cash holdings and low-yielding liquid securities without significantly increasing interest revenues. In sum, although deposits and liquid asset balances expanded during the pandemic, they have had a limited effect on banks’ bottom lines.

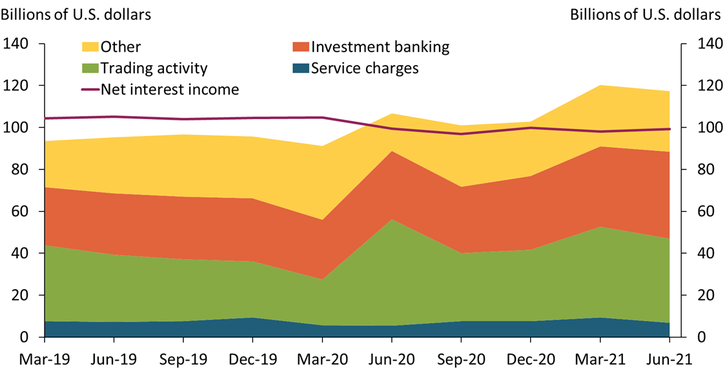

Instead, the divergence between banks’ ROA and NIMs shown in Chart 1 can be attributed to growth in noninterest income, especially at large banks. Over the years, banks have developed new business strategies to supplement their traditional business of taking loans and making deposits, including fees and service charges, trading activity, and investment banking services. Chart 3 shows that increased income from trading activities (orange region) and investment banking services (green region) has contributed to the overall increase in noninterest income during the pandemic. Although net interest income declined during the pandemic (maroon line), noninterest income increased. Such noninterest income has traditionally been the preserve of large banks: recent trends indicate that noninterest income comprises over half of large banks’ operating revenue compared with only 30 to 40 percent for small banks.

Chart 3: Noninterest Income Increased while Net Interest Income Declined

Note: From 2019:Q1 to 2021:Q2, net interest income declined by over $5 billion while noninterest income grew by over $13 billion.

Source: Board of Governors of the Federal Reserve System.

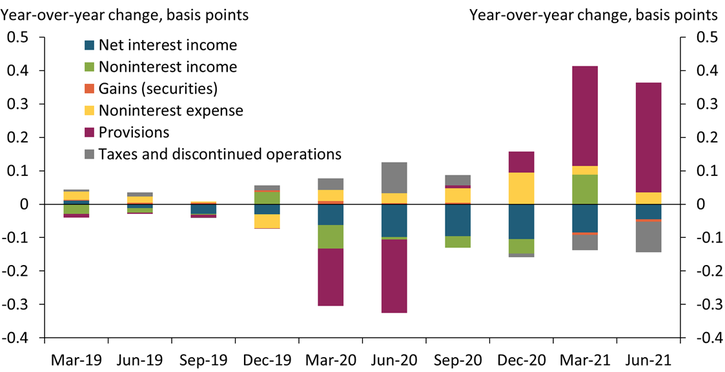

However, the increase in noninterest income cannot fully explain the divergence between ROA and NIMs. Although bank noninterest income increased in 2020, Chart 4 shows that on a year-over-year basis, noninterest income as a share of assets (green bars) declined in 2020. Put differently, bank assets grew at a faster rate than noninterest income during the pandemic. Therefore, while the increase in noninterest income partly offset the decline in interest income during the pandemic, it cannot account for increases in ROA after 2020:Q1.

Chart 4: Provisions Have Contributed the Most to the Increase in Bank Profitability

Source: Board of Governors of the Federal Reserve System.

Chart 4 shows that a declining share of noninterest expenses (yellow bars) and loss provisions (maroon bars) have supported bank ROA during the pandemic._ Noninterest expenses comprise those unrelated to banks’ obligatory interest payments, such as staff salaries and building and maintenance costs. Although these expenses increased during the pandemic, with especially strong growth in salary expenses, their share in bank portfolios declined, thereby generating a positive contribution to ROA. Loss provisions—reserves banks build in anticipation of future losses—also increased early in the pandemic, as job losses and the shutdown of businesses prompted banks to increase their loss provisions in anticipation of loan defaults. Ennis and Jarque (2021) find that the allowance for loan and lease losses (ALLL)—the cumulative balance of all current and prior loss provisions—nearly doubled between 2019:Q4 and 2020:Q2. However, pandemic relief measures undertaken by the Federal Reserve and the U.S. Treasury—including loan forbearance under the Coronavirus Aid, Relief, and Economic Security (CARES) Act—helped maintain low rates of loan default. As financial conditions rapidly improved, the high rates of default anticipated by banks at the start of the pandemic became increasingly unlikely to materialize (Feldman and Schmidt 2021). As a result, banks have substantially reduced their ALLL balances from the mid-2020 peak, leading to a significant positive contribution from provisions to ROA in 2021.

In sum, the recent rebound in bank profitability has been driven by a revaluation of loan losses from the pandemic rather than significant increases in bank incomes. To a large extent, banks have benefited from the extraordinary policy measures undertaken by the Federal Reserve and U.S. Treasury during the pandemic. These measures not only helped in arresting the panic of March 2020, but also engineered a rapid rebound in financial market conditions that underlies the recovery in bank profitability. As a result, it is not surprising that the rebound in profitability has been driven by a decline in provisions for loan losses. However, such positive contributions are likely to be transitory, and the future of bank profitability in a low-rate environment is much less certain. Moreover, the recent lack of loan growth, low yields on earning assets, and the pressure to increase income from other (fee-based) sources may create incentives for more risk-taking.

Endnotes

-

1

These measures include over $2 trillion in support for households, businesses, and local governments as part of the Coronavirus Aid, Relief, and Economic Security (CARES) Act. Meanwhile, the Federal Reserve also lowered the target federal funds rate to near zero and substantially increased purchases as part of its accommodative monetary policy. In addition, the Federal Reserve and Treasury also enacted a series of unprecedented liquidity and credit measures to support corporate bonds, bank loans, longer-term municipal debt, and asset-backed securities. McAndrews, Morgan, and Vickery (2012) show how quantitative easing by the Federal Reserve drives deposit growth in banks. Additionally, increased savings at households and nonfinancial corporations have also contributed to the surge in deposits during the pandemic.

-

2

Being an expense item, a decline in deposit rates yields a positive contribution to NIMs. The bulk of the surge in bank deposits has been of the noninterest-bearing variety, whereas banks currently have low interest expenses on interest-bearing balances.

-

3

Being expense items, a decline in their share registers as a positive contribution to ROA.

References

Ennis, Huberto M., and Arantxa Jarque. 2021. “External LinkBank Lending in the Time of COVID.” Federal Reserve Bank of Richmond, Economic Brief, no. 21-05, February.

Feldman, Ron J., and Jason Schmidt. 2021. “External LinkGovernment Fiscal Support Protected Banks from Huge Losses during the COVID-19 Crisis.” Federal Reserve Bank of Minneapolis, May 26.

Glancy, David, Max Gross, and Anamaria Felicia Ionescu. 2020. “External LinkHow Did Banks Fund C&I Drawdowns at the Onset of the COVID-19 Crisis?” Board of Governors of the Federal Reserve System, FEDS Notes, July 31.

Marsh, W. Blake, and Padma Sharma. 2020. “External LinkPPP Raised Community Bank Revenue but Lowered Profitability.” Federal Reserve Bank of Kansas City, Economic Bulletin, December.

McAndrews, James J., Donald P. Morgan, and James Vickery. 2012. “External LinkWhat’s Driving Up Money Growth?” Federal Reserve Bank of New York, Liberty Street Economics (blog), May 23.

Sengupta, Rajdeep, and Fei Xue. Forthcoming. “Do Small and Large Bank Net Interest Margins Vary Differently with Interest Rates?” Federal Reserve Bank of Kansas City, Economic Review.

Rajdeep Sengupta is a senior economist at the Federal Reserve Bank of Kansas City. Adam Byrdak is a research associate at the bank. The views expressed are those of the authors and do not necessarily reflect the positions of the Federal Reserve Bank of Kansas City or the Federal Reserve System.