Demand for agricultural credit remained high and loan volumes continued to increase in the first quarter of 2019. To meet growing demand for financing, lenders, especially small, agricultural banks, increasingly have used loan participations and Farm Service Agency loan guarantees. Despite ongoing demand for farm loans and adjustments to lending portfolios, delinquency rates on farm loans have remained low. Interest rates on farm loans continued to rise, but farm real estate values remained relatively steady through the end of 2018.

Section A: First Quarter Survey of Terms of Lending to Farmers

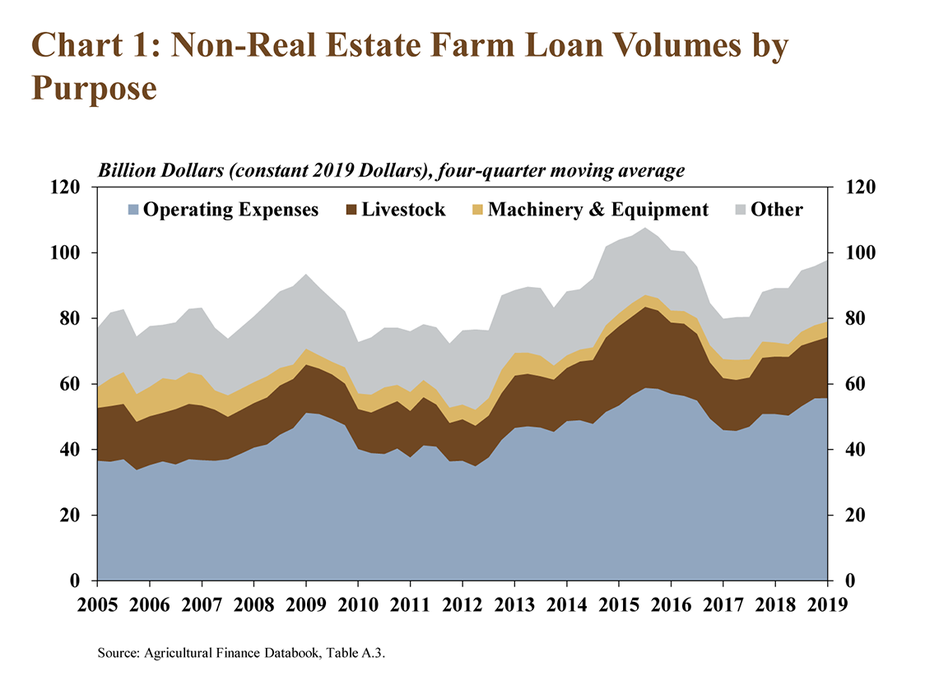

According to the National Survey of Terms of Lending to Farmers, non-real estate lending continued to increase at a moderate pace in the first quarter. The volume of non-real estate loans increased 9 percent from a year ago (Chart 1). Although the volume of loans to finance operating expenses remained relatively steady, volumes for livestock loans and loans to finance machinery and equipment increased. The increase in livestock lending likely was due, in part, to slightly higher prices for livestock. In addition, volumes for other loans increased notably due to an uptick in both the size and number of loans.

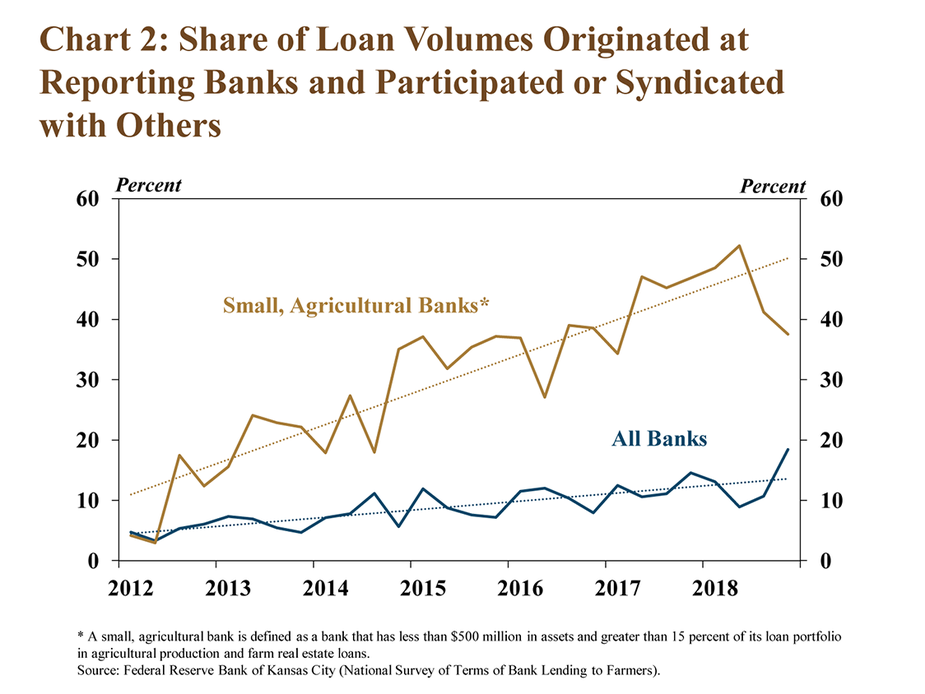

Alongside ongoing growth in demand for farm loans, a larger share of new loans has been originated with participation or syndication status. Although participations have been on a slight upward trend at all banks, they have risen significantly in recent years at small, agricultural banks (Chart 2). For example, in 2012, less than 10 percent of loans that were originated at small, agricultural banks were participated or syndicated to other institutions, compared with 40 percent of farm loan volumes that were participated or syndicated in the first quarter of 2019.

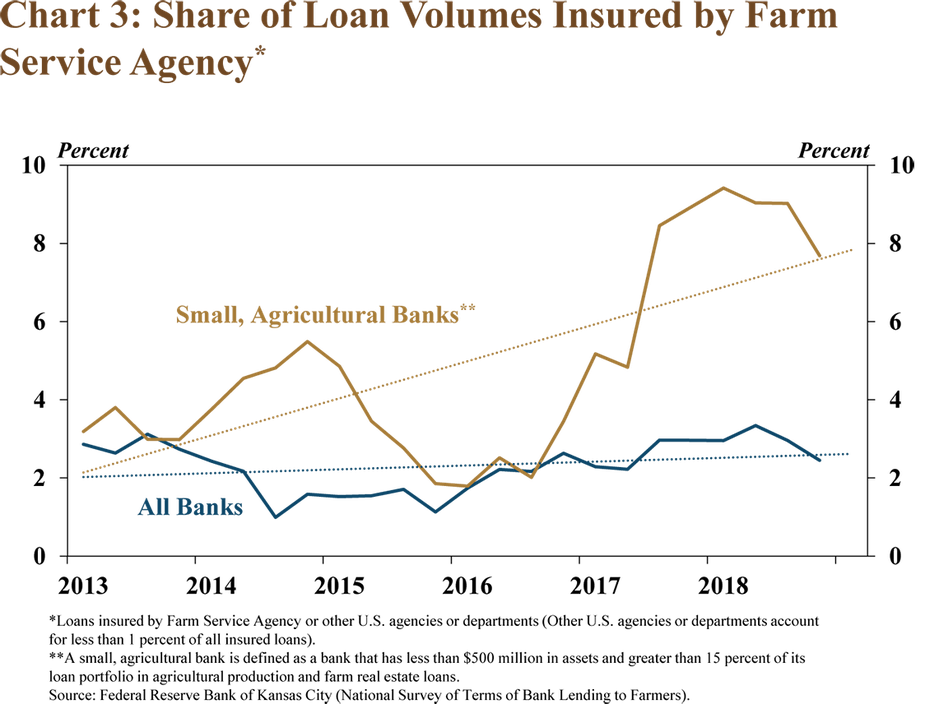

In addition, more loans at small, agricultural banks have been insured by the Farm Service Agency (FSA) or other government agencies. Although a relatively small share of new loan volumes was insured by FSA, small, agricultural banks in recent years have utilized loan insurance and guarantees more than other banks (Chart 3). Increased levels of loan guarantees and participations at small, agricultural banks relative to all banks could be an indication of elevated financial stress in the farm sector.

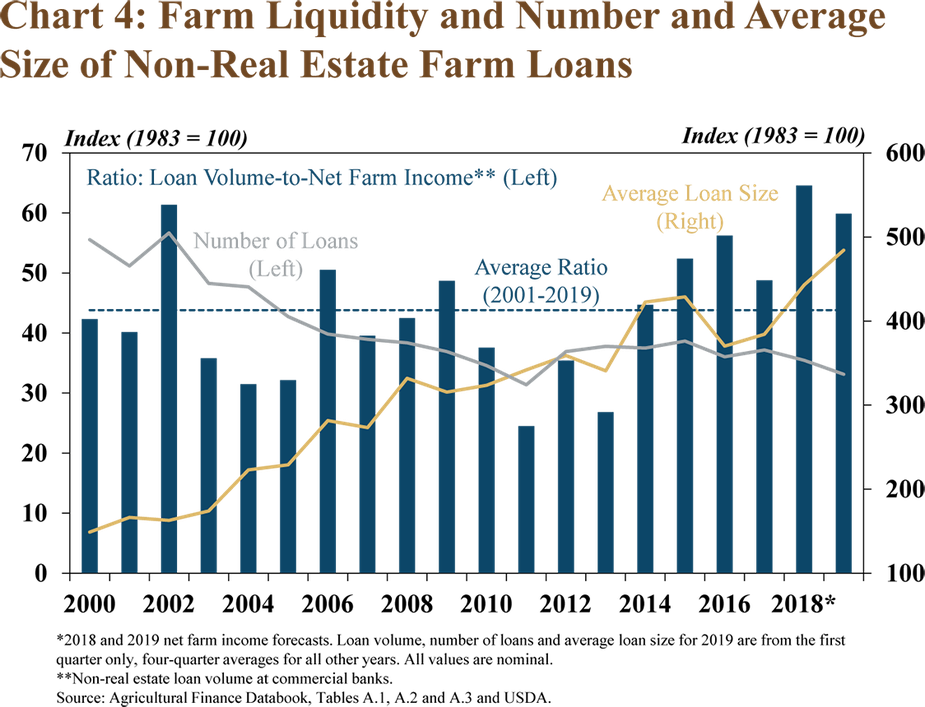

Adjustments at small, agricultural banks have occurred alongside reduced liquidity in the farm sector. In fact, the ratio between total loan volume and net farm income reached a 16-year high in 2018 and remained elevated in the first quarter (Chart 4). Most of the increases in loan volumes have been driven by increased loan sizes, as the number of loans originated has declined slightly over time. Although the ratio of loan volumes to net farm income in 2018 and the first quarter of 2019 was high compared with recent years, the ratio remained less than in the 1980s.

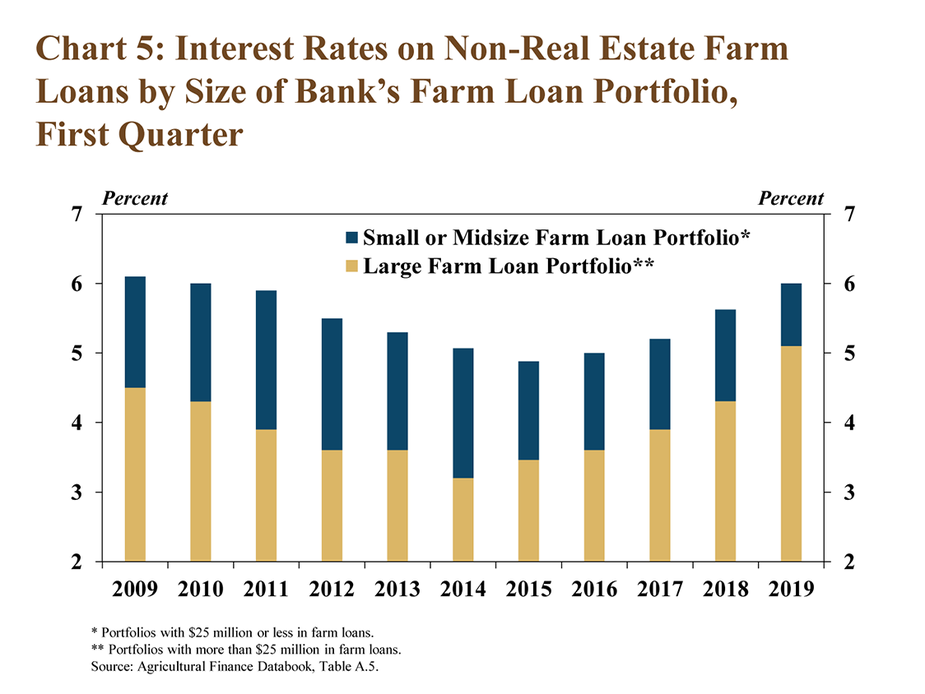

As agricultural lending activity continued to increase, interest rates on non-real estate farm loans also edged higher. Furthermore, interest rates on non-real estate farm loans at banks with large farm loan portfolios increased at a faster pace in the first quarter than interest rates at banks with small or midsized farm loan portfolios (Chart 5). On average, interest rates remained lower at banks with large farm loan portfolios. However, interest rates increased 80 basis points at banks with large farm-loan portfolios, while interest rates increased just 37 basis points at banks with smaller farm loan portfolios.

Section B: Fourth Quarter Call Report Data

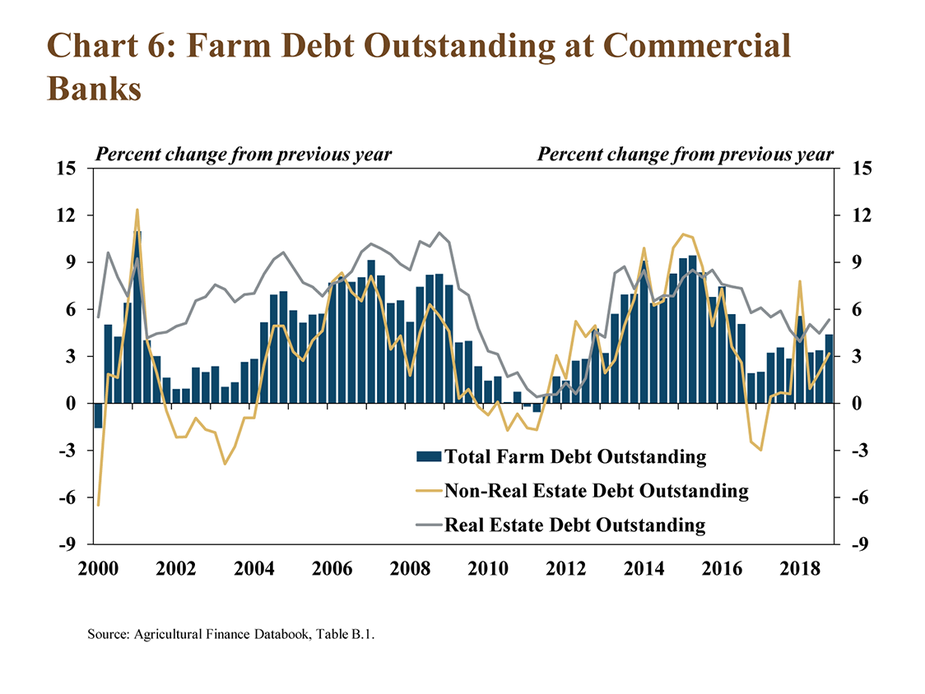

Total farm debt outstanding at commercial banks also continued to increase, according to Call Report data. The pace of growth increased slightly in the fourth quarter for both real estate and non-real estate lending (Chart 6). Over the past 20 years, total farm debt at commercial banks has increased almost 70 percent, or more than $70 billion, on an inflation-adjusted basis. That growth primarily has been driven by farm real estate loans, which increased nearly 150 percent and accounted for $60 billion of that increase.

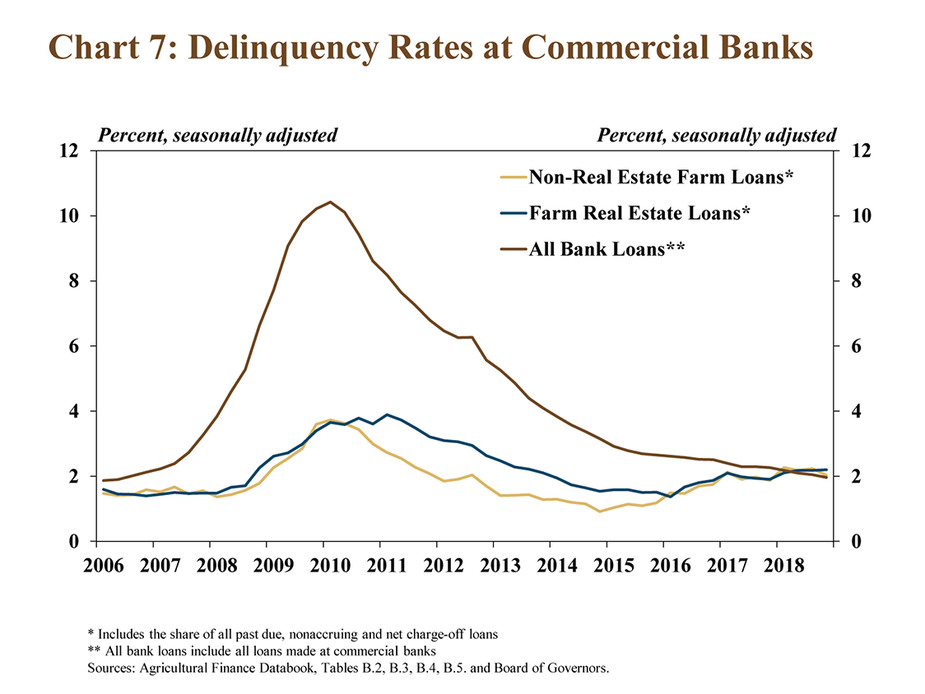

Delinquency rates on all types of agricultural loans at commercial banks increased slightly from a year ago, but remained low from a historical perspective. In early 2018, delinquency rates on farm loans edged higher than rates of delinquency on all commercial bank loans and that trend continued through the end of the year (Chart 7). Over the past four quarters, the annual increase in the volume of delinquent farm real estate loans averaged 14 percent and that rate of increase was slightly lower for non-real estate farm loans at about 10 percent. Together with an average annual increase of about 4 percent in total farm debt over that period, delinquency rates have increased only modestly.

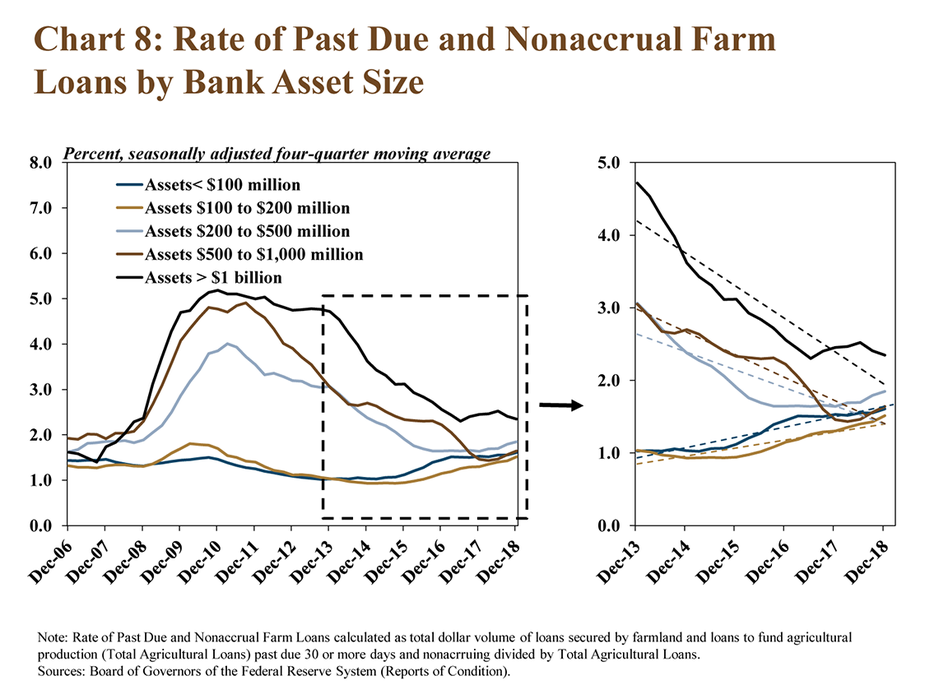

While remaining low overall, the trends of nonperformance rates on agricultural loans in recent years have varied across banks of different asset sizes. The rate of past due and nonaccrual farm loans has remained highest among the largest commercial banks since 2008, while the smallest banks have maintained comparably lower rates of nonperformance (Chart 8). The rate of nonperformance at the smallest banks trended upward beginning in 2015 and appeared more stable in 2018, while nonperforming rates at the largest banks trended lower in 2017 and also appeared to stabilize in 2018.

Despite ongoing challenges in the U.S. farm economy, financial performance at agricultural banks has remained sound. In fact, the rate of return on equity at agricultural banks reached its highest levels since 2006, in addition to the share of banks with a return on equity above 10 percent (Chart 9). Higher farm loan volumes, higher interest rates on farm loans and low farm loan delinquency rates likely have supported the uptick in earnings at agricultural banks.

Section C: Fourth Quarter Regional Agricultural Data

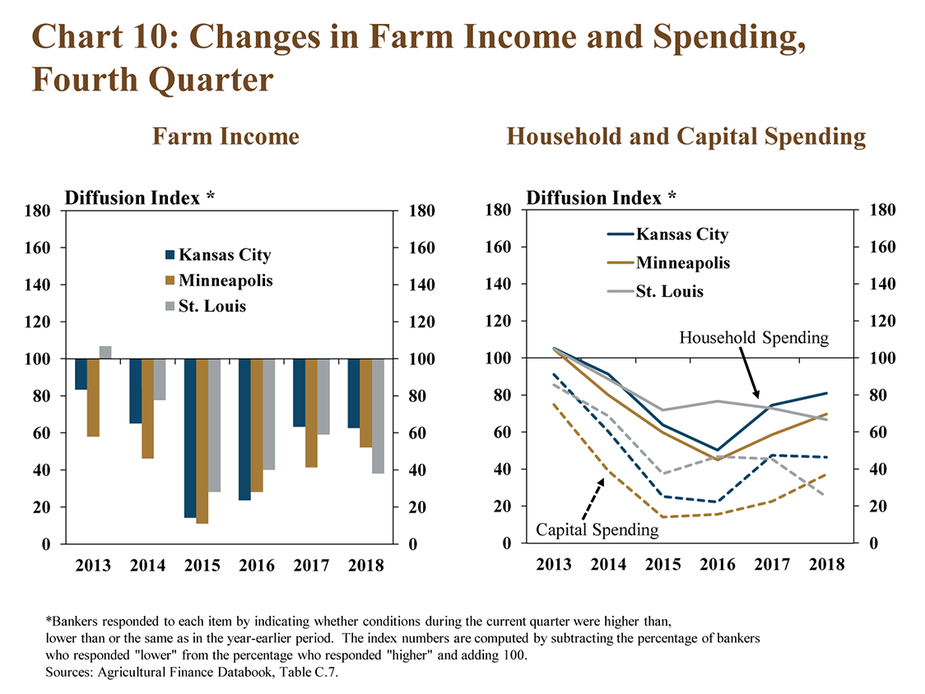

As weaknesses in the broad U.S. farm economy persisted, bankers responding to regional Federal Reserve surveys of agricultural credit conditions indicated that farm income in the fourth quarter was lower than a year ago across all participating Districts. This marked six consecutive years that bankers reported lower farm income in the fourth quarter for the Kansas City and Minneapolis Districts (Chart 10, left panel). With strain on farm income, farm household and capital spending also remained low (Chart 10, right panel). A notably faster pace of decline in spending was reported by respondents in the St. Louis District, which also reported the largest drop in farm income.

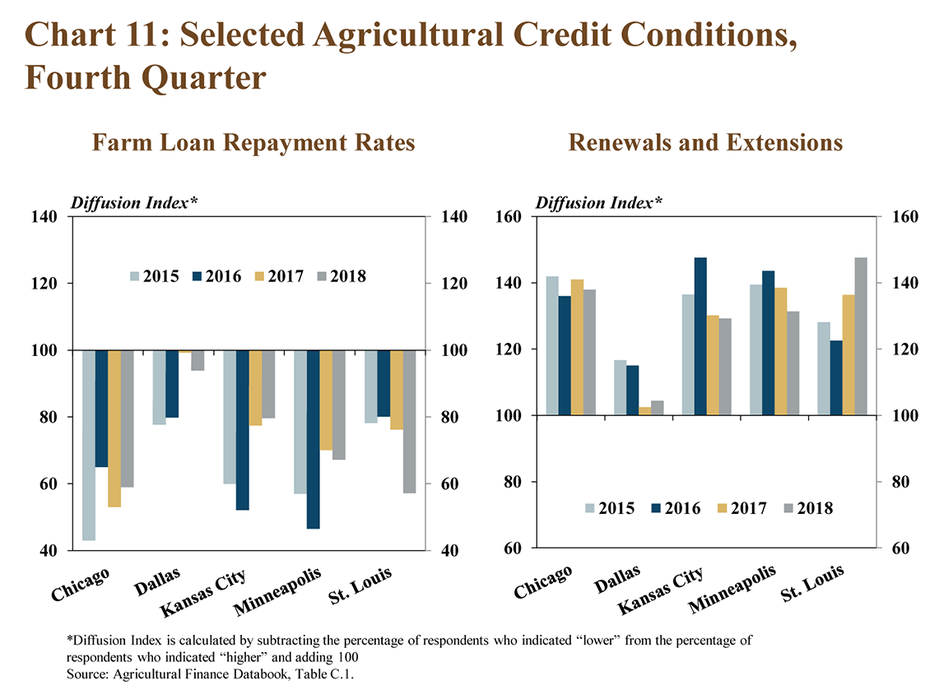

Alongside weak farm income, bankers across all Districts indicated farm loan repayment rates remained low and the number of renewals and extensions was higher. Similar to farm income, bankers in the St. Louis District also reported a sharper decline in repayment rates and increase in renewals and extensions compared with a year ago (Chart 11). The pace of decline in repayment rates slowed in the Chicago and Kansas City Districts while increasing slightly in the Dallas and Minneapolis Districts. Despite increasing at a slower pace, renewals and extensions remained high across most regions.

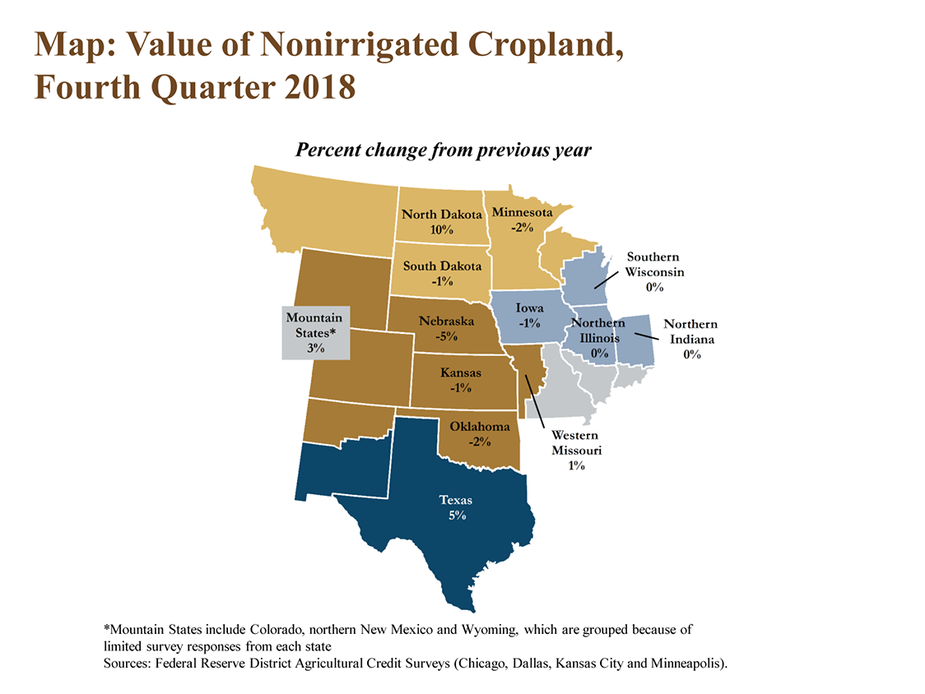

Despite lower farm income, weak credit conditions and higher interest rates, farm real estate values generally remained stable. For states exhibiting declines in the value of nonirrigated farmland, the changes remained modest through the end of 2018, providing ongoing support to the farm sector (Map). As weaknesses in the overall farm economy have persisted, risks to the outlook for farmland include slightly higher interest rates and underlying supply and demand fundamentals of farm real estate markets.

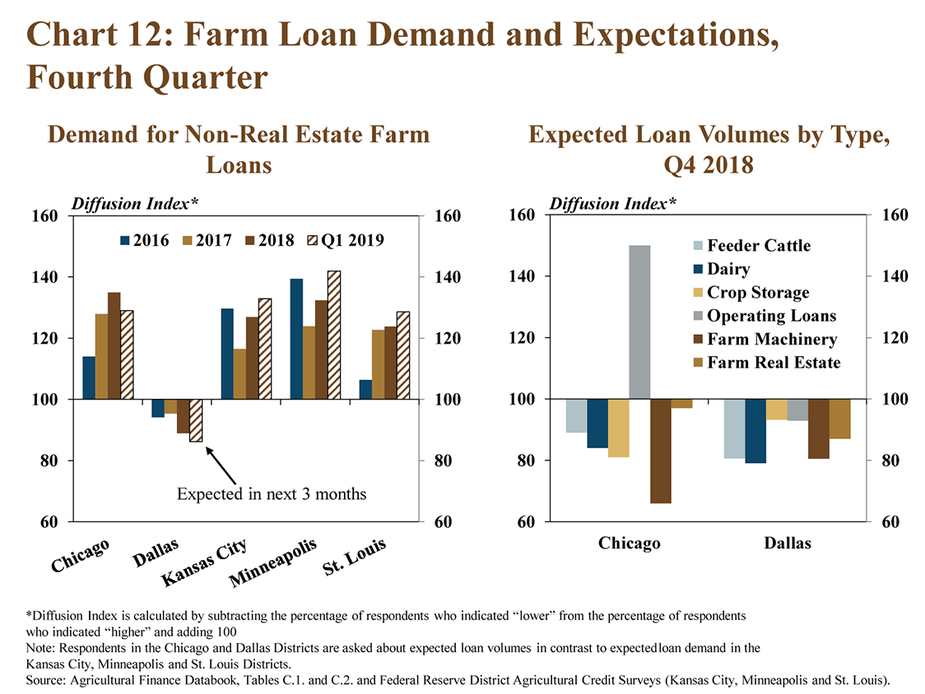

Similar to national data, bankers across almost all Federal Reserve Districts reported that demand for non-real estate farm loans remained high. The pace of increase in loan demand reported by respondents was slightly faster than this time last year across all Districts except Dallas (Chart 12). In addition, respondents across those Districts also indicated they expected demand to remain high through the first quarter of 2019. For Districts reporting loan volume expectations by type of loan, it appears that strong demand for farm loans in the Chicago District during the coming months was expected to be driven by operating loans.

Conclusion

Despite a slight decline in the total number of loans reported by agricultural bankers, farm lending continued to increase in the first quarter of 2019. The growth in loan volumes was due primarily to additional increases in the average size of loans to farmers. Alongside larger loans and higher loan volumes, small, agricultural banks have made adjustments to continue to meet strong demand from farm borrowers and mitigate risks associated with lending in a low income environment. Despite continued weakness in agricultural credit conditions, earnings at agricultural banks have remained strong, delinquency rates low and farmland values stable.