The volume of non-real estate farm debt continued to increase in the fourth quarter of 2018. The increase was driven by growth in operating loans, which reached a historically large average size. Rounding out a year characterized by lower farm incomes, uncertainties about agricultural trade and the growth of lending volumes, interest rates on agricultural loans trended higher.

Data & Information

Historical Data | Tables | About

Section A: Fourth Quarter Survey of Terms of Lending to Farmers

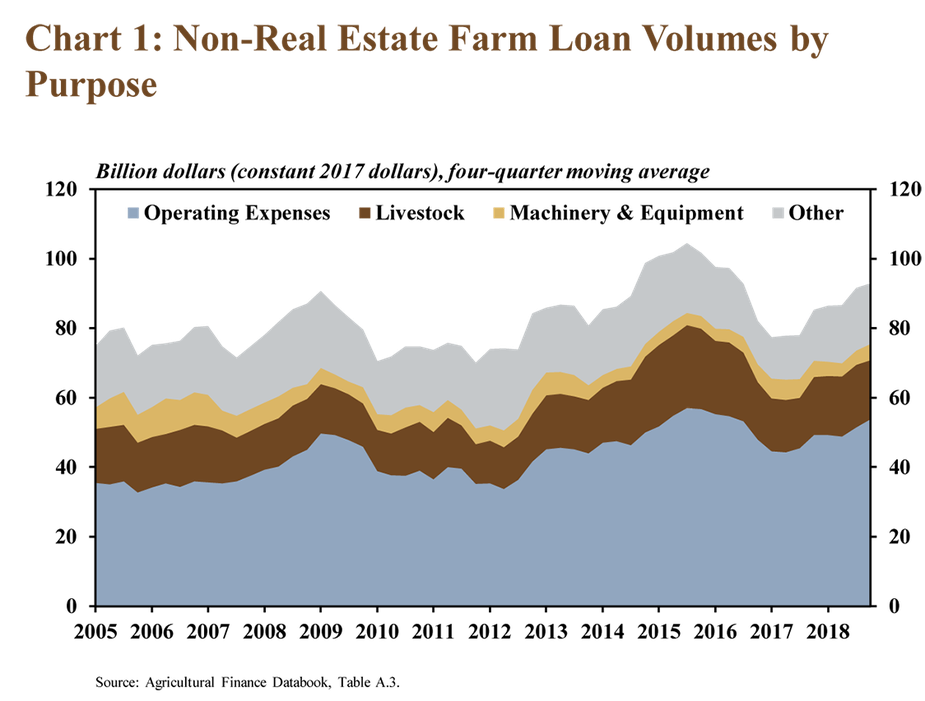

Non-real estate lending continued to increase in the fourth quarter, according to the National Survey of Terms of Lending to Farmers. Total non-real estate farm loans were up nearly 8 percent from a year ago (Chart 1). This was the seventh consecutive quarter of annual growth in loan volumes, with an average growth rate in 2018 of about 12 percent. As lending needs increase, the size of farm loan portfolios at commercial banks also grow, and both have contributed to a shift in loan volumes based on the size of the farm loan portfolio. Non-real estate loan volumes at the largest agricultural banks, or those with farm loan portfolios larger than $25 million, were up about 16 percent from the fourth quarter of 2017. In contrast, the volume of lending at banks with farm loan portfolios less than $25 million was down 15 percent.

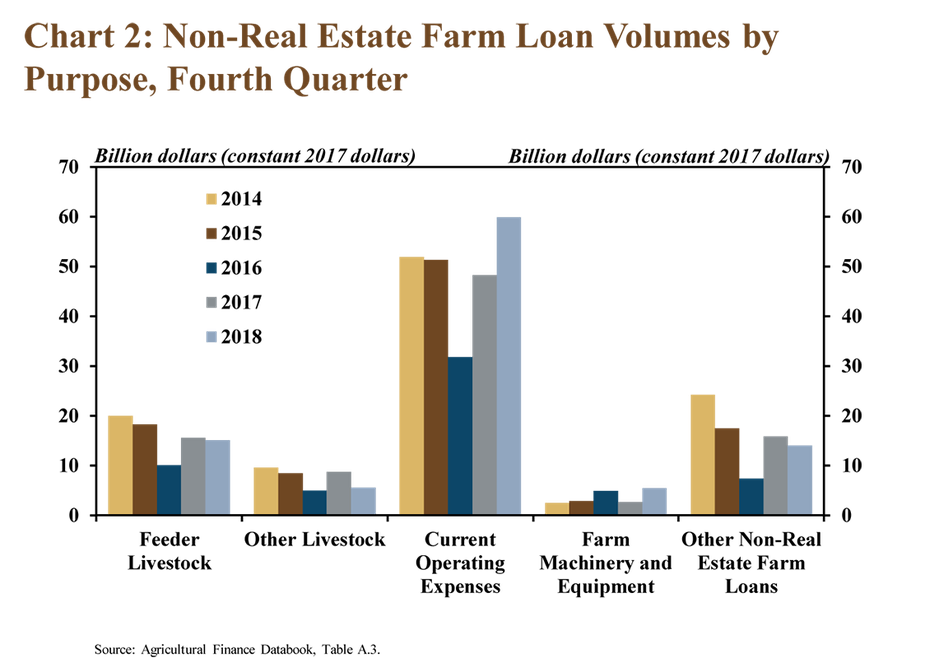

The increase in farm financing also continued to be driven by lending to fund current operating expenses. The volume of operating loans reached a historical high for the fourth quarter, increasing more than $10 billion, or 22 percent year over year (Chart 2). Loans in this category account for the largest share of non-real estate farm loans and have increased in the last eight quarters by an average of 12 percent. While representing a much smaller portion of total lending, loans to finance farm machinery and equipment nearly doubled from the fourth quarter of 2017. The volume of loans for all other purposes declined over that same period.

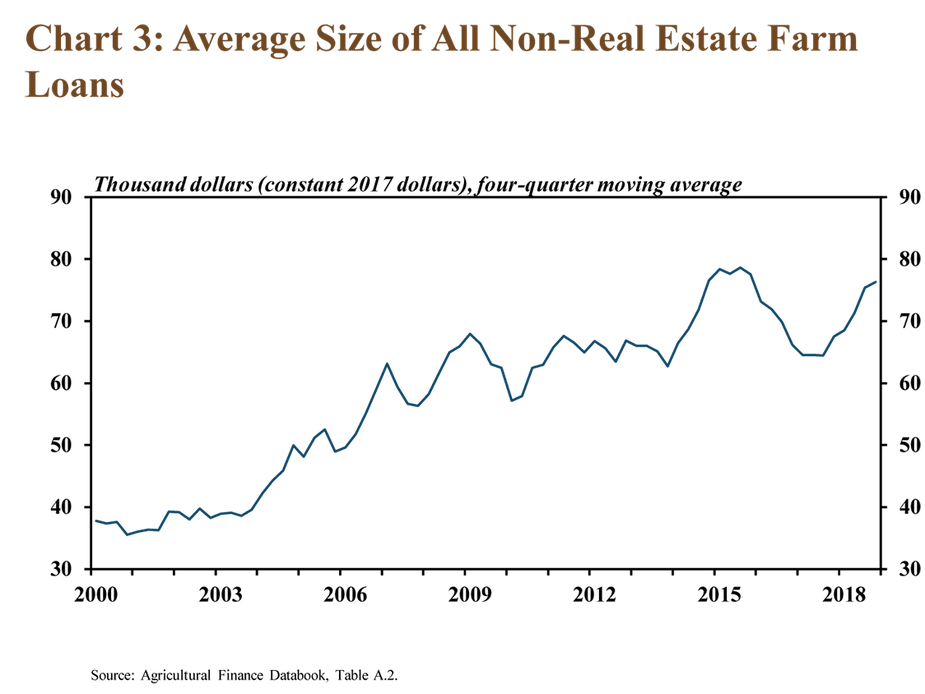

Alongside an expansion in the overall volume of non-real estate farm lending, the size of individual loans also continued to grow. Since declining modestly in late 2016, the average size of all non-real estate loans has increased year over year for almost two years and at an average pace of 10 percent (Chart 3). Adjusting for inflation, the average size of all non-real estate loans reached the highest fourth quarter level since 2014, and the average size of loans to fund current operating expenses grew to the largest on record for the fourth quarter.

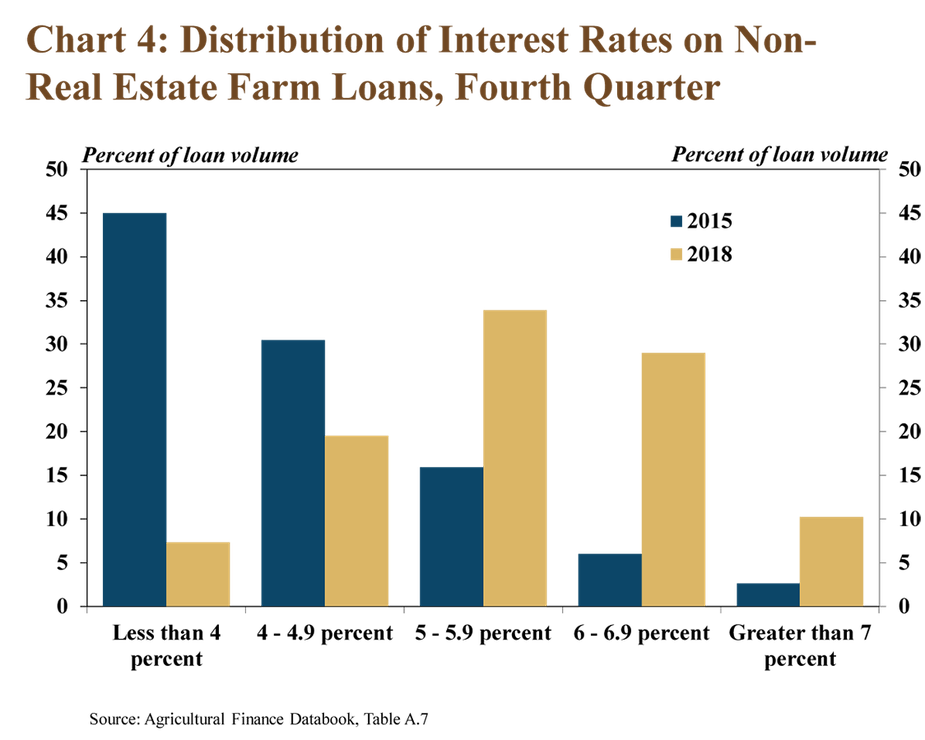

As the volume of farm loans continued to increase in the fourth quarter, interest rates also increased. The distribution of rates has shifted significantly in recent years, and in the fourth quarter 40 percent of all non-real estate farm loans were charged a rate more than 6 percent (Chart 4). At this time in 2017, a quarter of all loans were charged an interest rate less than 4 percent. Moreover, in the fourth quarter of 2015, nearly half of all loans carried a rate less than 4 percent while only a fraction had a rate more than 6 percent.

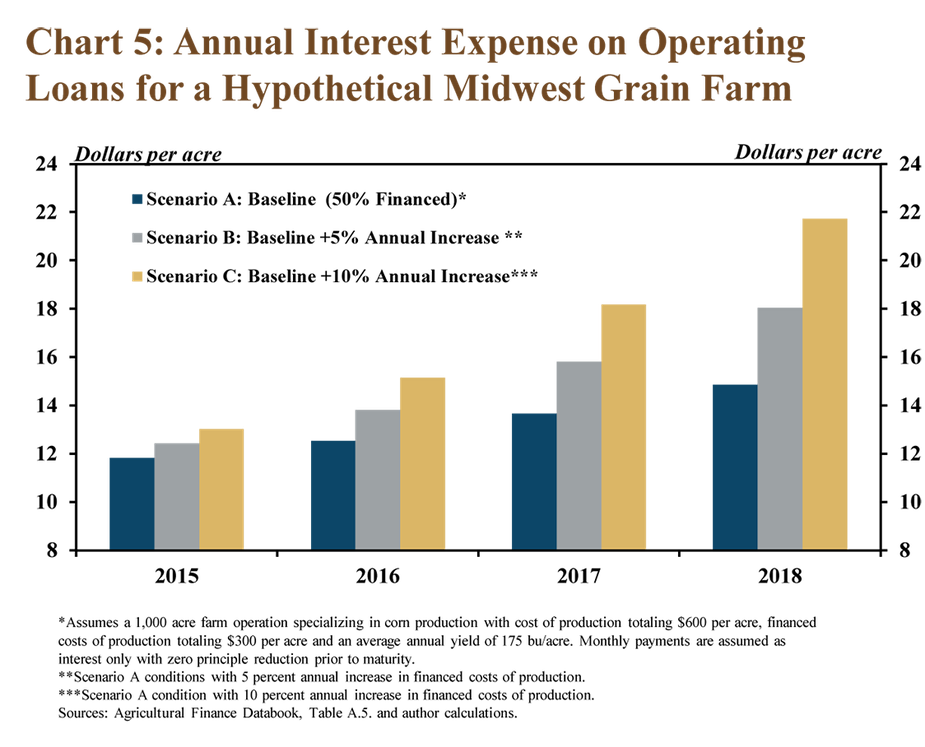

The combination of increased lending needs and higher interest rates has continued to raise the cost of financing at a modest pace. For a mid-sized Midwest farm operation that has not increased its financing needs in recent years, annual interest expenses have increased just about $3 an acre (Chart 5). However, for operations that have required a moderate amount (10 percent per year) of additional financing, annual interest expenses have increased about $10 an acre. In the current price environment, this increase in annual interest expense would equate to about three bushels of corn an acre, a modest but nontrivial amount of production.

Section B: Third Quarter Call Report Data

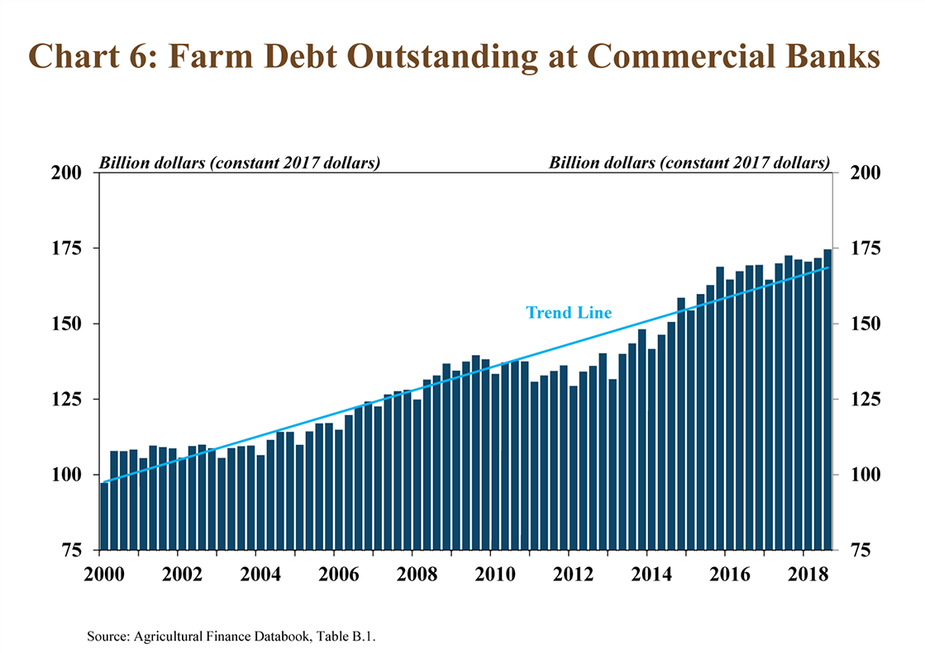

Third quarter Call Report data also showed that total farm debt at commercial banks continued to increase. Loans extended to farmers from commercial banks have increased at an above-trend rate for nearly four consecutive years and have not declined year over year in any quarter since 2011 (Chart 6). Driven by modest increases in lending for both real estate and non-real estate, total farm debt increased more than 3 percent, with real estate loans up more than 4 percent and non-real estate loans up about 2 percent.

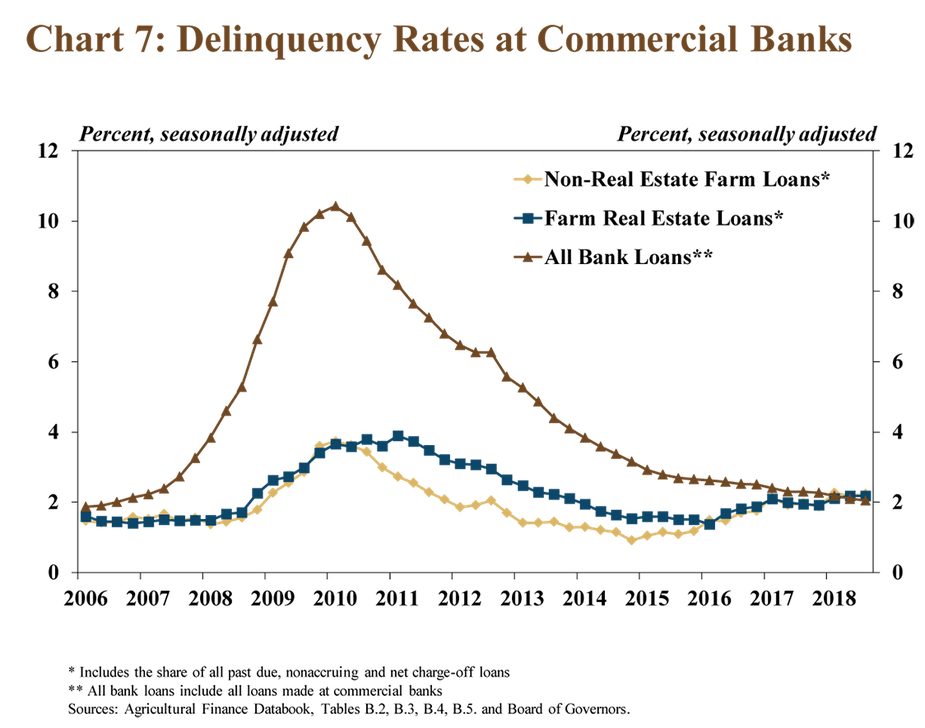

As farm debt has increased, delinquency rates on loans for both production and farm real estate have continued to edge higher. Despite remaining near historical lows, the share of delinquent loans in the third quarter for both categories increased roughly 25 basis points from a year ago (Chart 7). While the increase in delinquency rates on non-real estate loans primarily was driven by loans past due less than 90 days, the increase in delinquency rates on real estate loans was driven by nonaccruing loans.

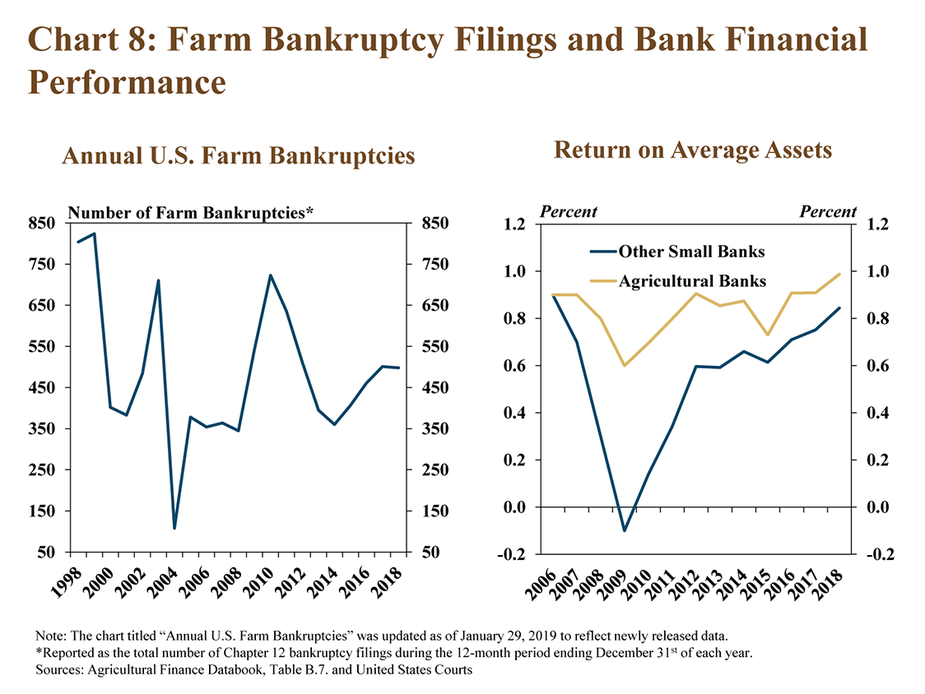

In addition to higher rates of delinquency on farm loans, financial pressures in the agricultural sector also have led to an upward trend in farm bankruptcy filings, despite a slight decline in the 12-month period ending in September. Since reaching a 10-year low in 2014, the number of filings has steadily increased; filings, however, remained well below highs reached in 2010 (Chart 8, left panel). Despite the increases in borrowers’ financial stress, however, returns at agricultural banks remained relatively strong (Chart 8, right panel).

In contrast to the strength of earnings performance, liquidity at agricultural banks continued to tighten. With the weight of increasing loan volumes, the average loan-to-deposit ratio at all agricultural banks trended higher in the third quarter (Chart 9). The level of liquidity was lowest at banks with headquarters in the San Francisco and Minneapolis Federal Reserve Districts and noticeably higher among banks in the Dallas District. Dallas also was the only District that exhibited an increase in liquidity compared with a year ago.

Section C: Third-Quarter Regional Agricultural Data

An important factor for liquidity at agricultural banks, demand for non-real estate farm loans remained strong in the third quarter. According to regional Federal Reserve surveys of agricultural credit conditions, bankers in all participating districts reported a modest increase in loan demand with the exception of Dallas (Chart 10, left panel). Growth in the need for farm financing continued to place downward pressure on the availability of funding at agricultural banks (Chart 10, right panel). Respondents in the Chicago District reported a more significant decline in available funding while bankers in all other districts except Dallas reported modest declines.

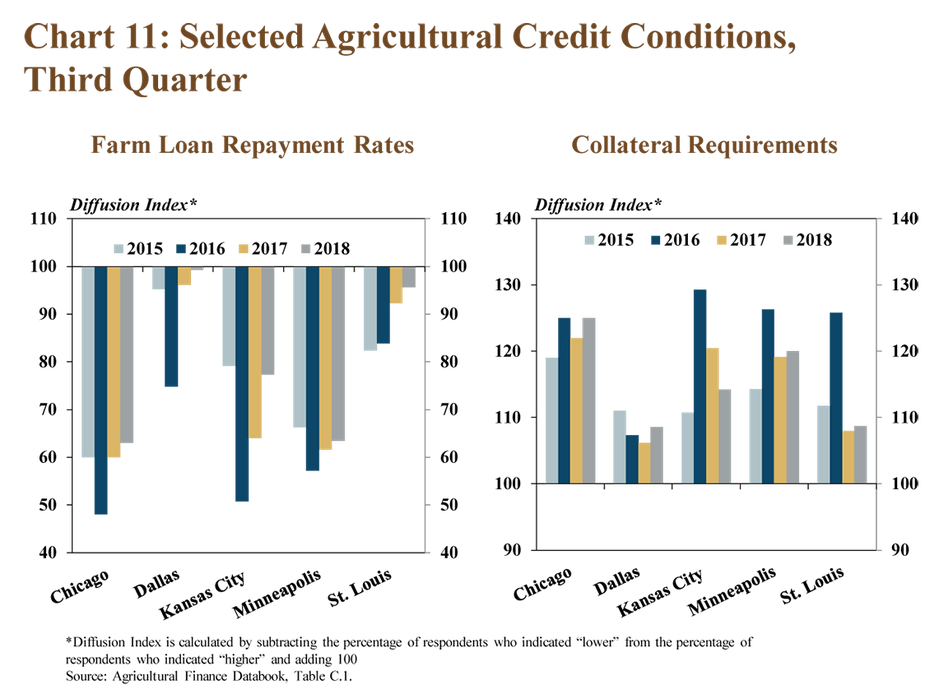

Alongside growing demand for farm lending, loan repayment rates continued to trend lower. Responses from bankers in all participating Federal Reserve Districts indicated a decline in the rate of loan repayment compared with a year ago; the fastest pace of decline was reported in the Chicago and Minneapolis Districts (Chart 11, left panel). Similarly, the increase in collateral requirements was most significant in those two districts (Chart 11, right panel). Stricter lending requirements are a likely response by agricultural bankers to the combination of rising finance needs and a slower pace of repayment.

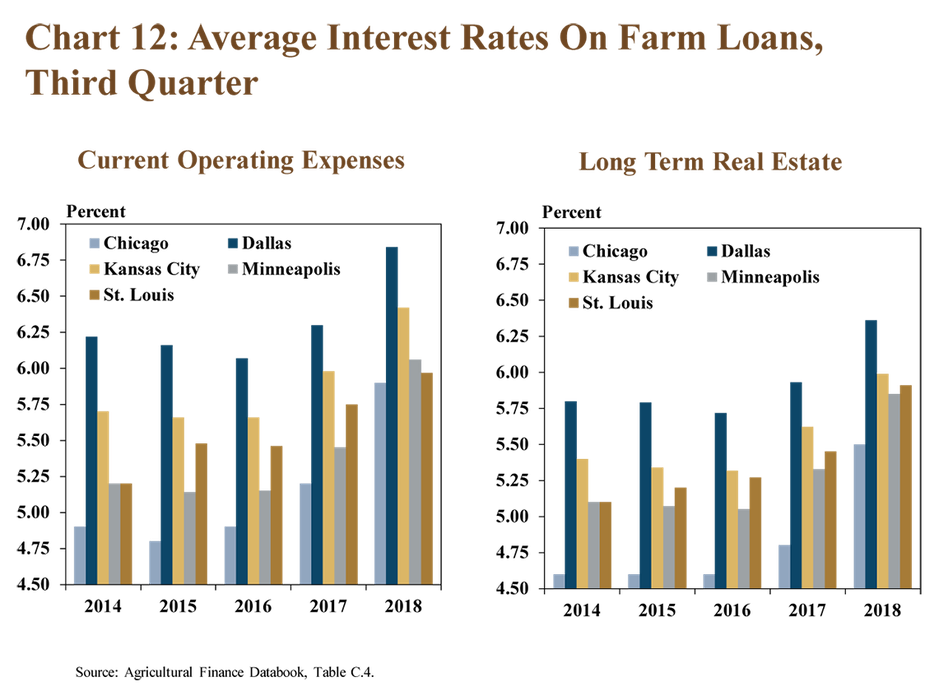

Consistent with national data, interest rates also continued to rise across each Federal Reserve District. In the third quarter, rates charged on operating loans remained slightly higher in the Dallas District while respondents in the Chicago and Minneapolis Districts reported the largest increases from a year ago (Chart 12, left panel). The comparison of rates on longer-term real estate loans across regions was similar, with bankers in the Dallas District continuing to report slightly higher rates and those in the Chicago and Minneapolis Districts indicating a slightly faster pace of increase (Chart 12, right panel).

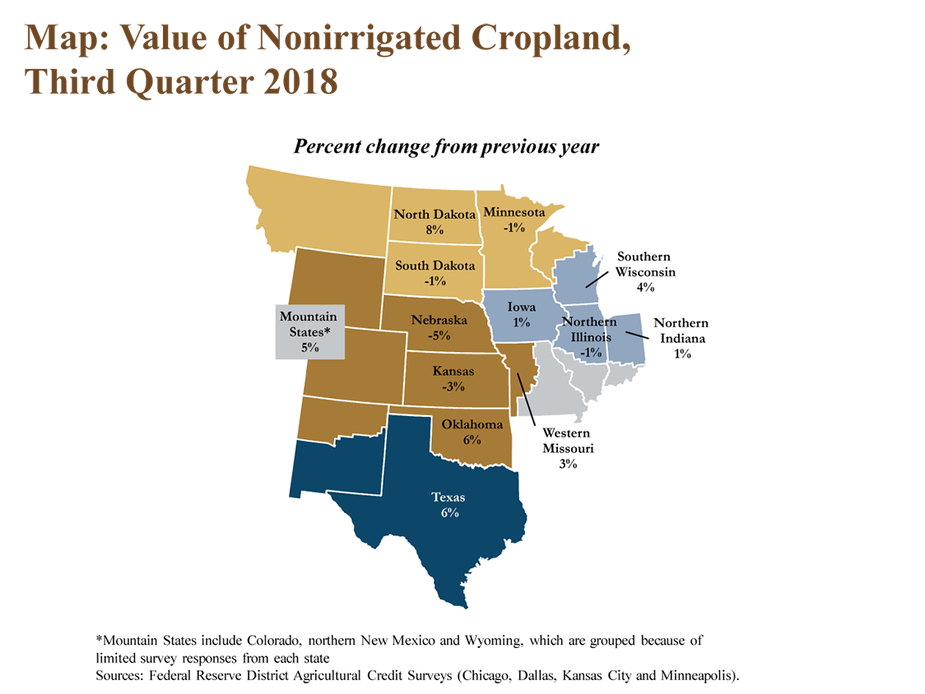

Despite tightening credit conditions and higher interest rates, farm real estate values generally remained stable. In fact, the value of nonirrigated farmland increased in many states in the third quarter (Map). The increase averaged 5 percent for states with positive changes from a year ago. North Dakota, Texas and Oklahoma exhibited the largest gains while declines were modest in Nebraska and Kansas; there were only slight changes across most other states.

Conclusion

Lending in the farm sector continued to grow in the fourth quarter of 2018 alongside a similar increase in interest rates on agricultural loans. As a result of strong demand for farm loans, liquidity at agricultural banks trended lower and collateral requirements continued to tighten in the third quarter. Delinquency rates on farm loans inched up, but remained low from a historical perspective, and financial performance at agricultural banks remained relatively strong. Despite mounting pressure on the farm sector and limited profit opportunities, the value of farm real estate has continued to provide ongoing support and remains a key area to monitor in the coming months if leverage continues to increase.