Summary of Quarterly Indicators

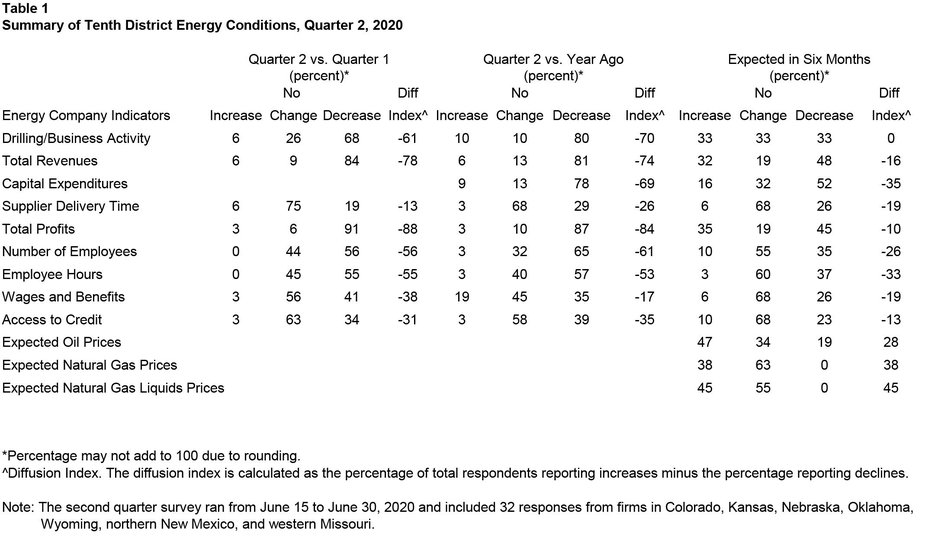

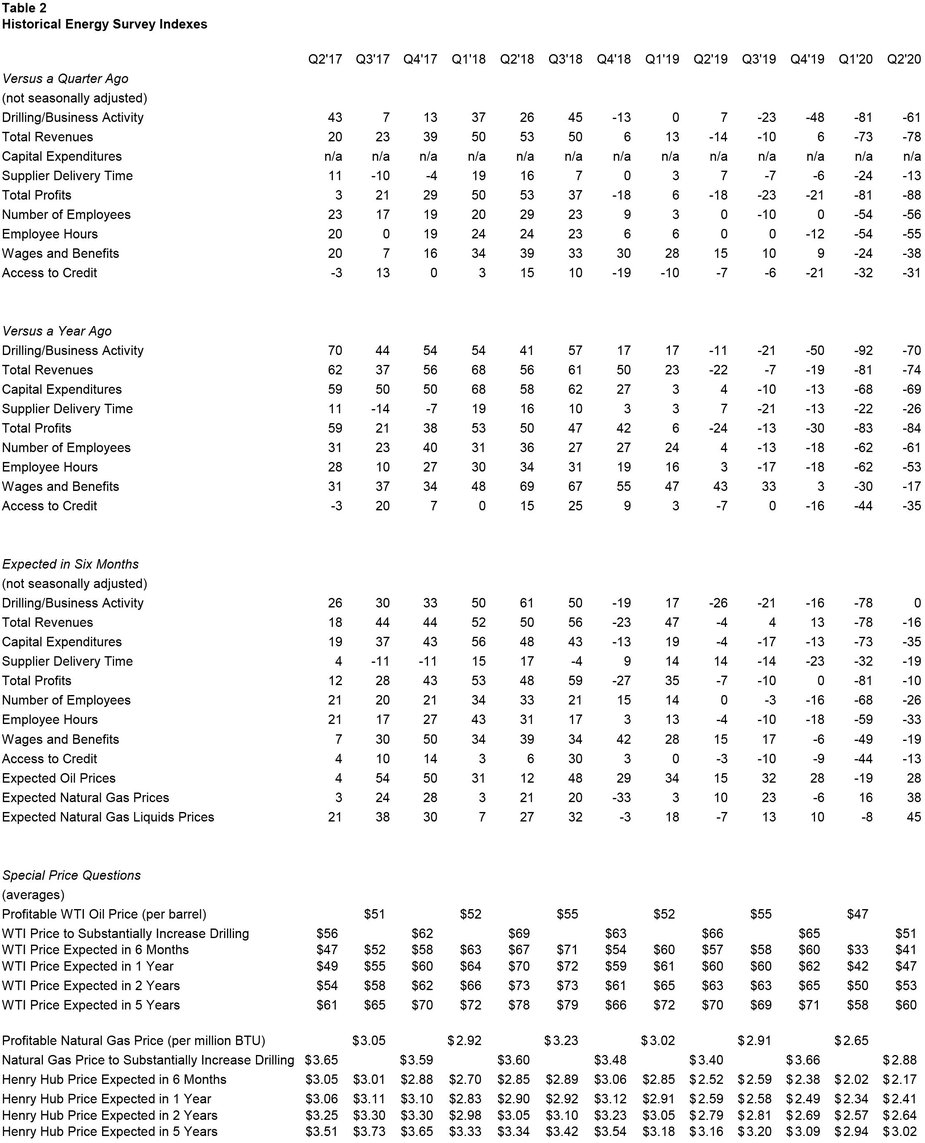

Tenth District energy activity declined nearly as much in the second quarter of 2020 as in the first quarter, as indicated by firms contacted between June 15th and June 30th, 2020 (Tables 1 & 2). The drilling and business activity index rose somewhat, from -81 to -61, but indicated continued substantial decreases in activity (Chart 1). The drop in the revenues and profits indexes accelerated, and the employment and wages and benefits indexes fell further. However, the access to credit index declined at a similar pace as Q1 2020, and the supplier delivery time index decreased less sharply in Q2 2020.

Chart 1.

Drilling/Business Activity Index vs. a Quarter Ago

Skip to data visualization table| Date | Drilling/Business Activity |

|---|---|

| 2017Q1 | 55 |

| 2017Q2 | 43 |

| 2017Q3 | 7 |

| 2017Q4 | 13 |

| 2018Q1 | 37 |

| 2018Q2 | 26 |

| 2018Q3 | 45 |

| 2018Q4 | -13 |

| 2019Q1 | 0 |

| 2019Q2 | 7 |

| 2019Q3 | -23 |

| 2019Q4 | -48 |

| 2020Q1 | -81 |

| 2020Q2 | -61 |

Year-over-year indexes also decreased significantly. The year-over-year drilling and business activity index remained highly negative at -70, but was up from a record survey low of -92. Indexes for total revenues, capital expenditures, delivery time, profits, employment, employee hours, wages and benefits, and access to credit continued to decrease.

Expectations indexes rose considerably from very negative levels in Q1 2020, and future energy activity was expected to remain largely unchanged. The future drilling and business activity index expanded from -78 to 0. The future revenues capital expenditures, delivery time, profits, employment, employee hours, wages and benefits, and access to credit indexes remained negative in Q2 2020, but decreased less sharply compared to the previous quarter. Price expectations for oil, natural gas, and natural gas liquids increased, rebounding somewhat from earlier in 2020.

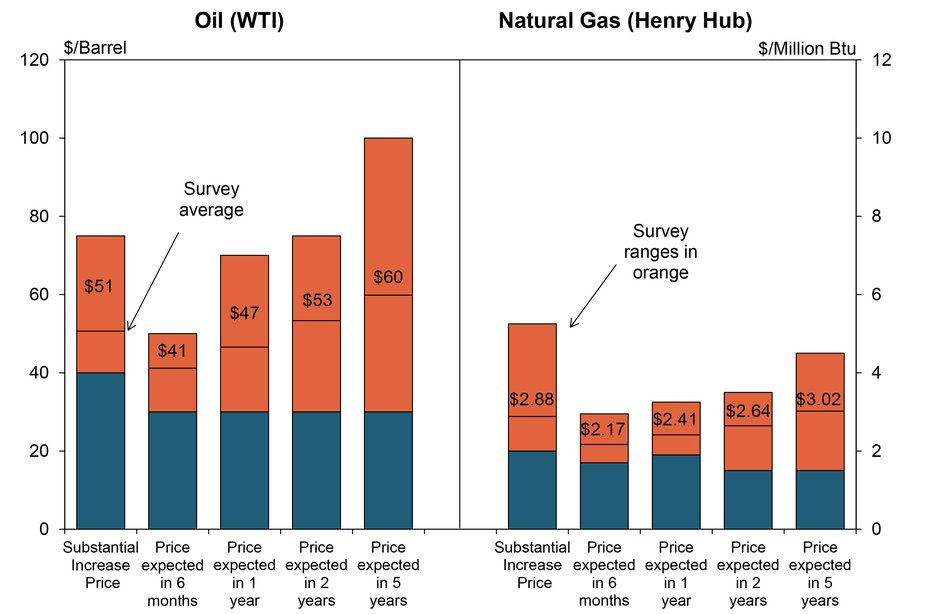

Summary of Special Questions

This quarter firms were asked what oil and natural gas prices were needed to substantially increase drilling on average across the fields in which they are active (in alternate quarters they are asked what prices are needed to be profitable). The average oil price needed was $51 per barrel, with a range of $40 to $75 (Chart 2). This average was below the prices reported in 2019, and the lowest recorded price to substantially increase drilling. The average natural gas price needed was $2.88 per million Btu, with responses ranging from $2.00 to $5.25.

Chart 2. Special Question - What price is currently needed to substantially increase drilling for oil and natural gas, and what do you expect the WTI and Henry Hub prices to be in six months, one year, two years, and five years?

Source: Federal Reserve Bank of Kansas City

Firms were again asked what they expected oil and natural gas prices to be in six months, one year, two years, and five years. Expected oil prices were moderately higher than price expectations from Q1 2020, but lower than a year ago. The average expected WTI prices were $41, $47, $53, and $60 per barrel, respectively. Expectations for natural gas prices grew modestly from last quarter. The average expected Henry Hub natural gas prices were $2.17, $2.41, $2.64, and $3.02 per million Btu, respectively.

Firms were also asked about shut-in wells (Chart 3). Over 62% of firms shut-in wells or curtailed production in Q2 2020, primarily driven by low wellhead prices. Regarding prices moving forward, 37% of firms indicated they expect the majority of producers in the U.S. to restart horizontal drilling at prices of $41 to $45 per barrel. Another 37% of firms expect oil prices would need to be higher than $45 per barrel for drilling to restart.

Additionally, firms were again asked about solvency. A majority of firms in our survey applied for and received SBA PPP loans, but low energy prices have hurt profitability. Over two-thirds of firms reported they could survive more than a year if current revenues were to continue, while around 32% would not survive a year if current revenue levels persist (Chart 4).

Chart 3.

Special Question - At what price do you expect the majority of producers in the U.S. to restart horizontal shut-in wells?

Skip to data visualization table| Price | Percent |

|---|---|

| <$30 | 6.666667 |

| $31-$35 | 10 |

| $36-$40 | 10 |

| $41-$45 | 36.66667 |

| $46-$50 | 23.33333 |

| >$51 | 13.33333 |

Chart 4.

Special Question - If current revenues were to continue, how long could your firm survive?

Skip to data visualization table| Length of TIme | Percent |

|---|---|

| 0-3 months | 3.225806 |

| 3-6 months | 9.677419 |

| 6-12 months | 19.35484 |

| More than 1 year | 67.74194 |

Table 1 - Summary of Tenth District Energy Conditions, Quarter 2, 2020

Source: Federal Reserve Bank of Kansas City

Table 2 - Historical Energy Survey Indexes

Source: Federal Reserve Bank of Kansas City

Selected Comments

“We have low debt and believe rig counts are beginning to bottom.”

“We’re starting our 4th month without any revenue. Currently we have nothing scheduled to drill.”

“The U.S. orphaned well inventory will explode to new highs if the current price continues. In addition, I don't see a market for stripper wells in the future so many small producers will be surrendering their wells...”

“The PPP was a life saver, we're now planning to apply for the SBA Economic Disaster.”

“The market is currently oversupplied and needs to be brought back into balance. Reduced production rates are required.”

“Summer and fall waves of COVID-19 driving down demand.”

“The demand destruction from Covid-19 impact on the economy is the biggest unknown until an effective vaccine is developed. Underinvestment will drive higher prices in future years.”

“Over supply will continue to be a problem with short term moves up, but will fall back down”

“Decreased oil drilling equates to less gas production, less flaring, electricity demand going up this summer.”

“Tightening supply due to rig drop while demand gradually rebuilds.”

“Natural gas is a derivative of crude, and is not as sensitive to people sheltering in place. With less crude there will be less natural gas and without the decline in demand.”

“This has been a historically challenging down cycle. Many firms will not survive and there will be longer term damage than in comparable down cycles.”

“Continued improvement in oil prices will drive our business (i.e. whether to begin drilling or not) in the next 6 months.”