Summary of Quarterly Indicators

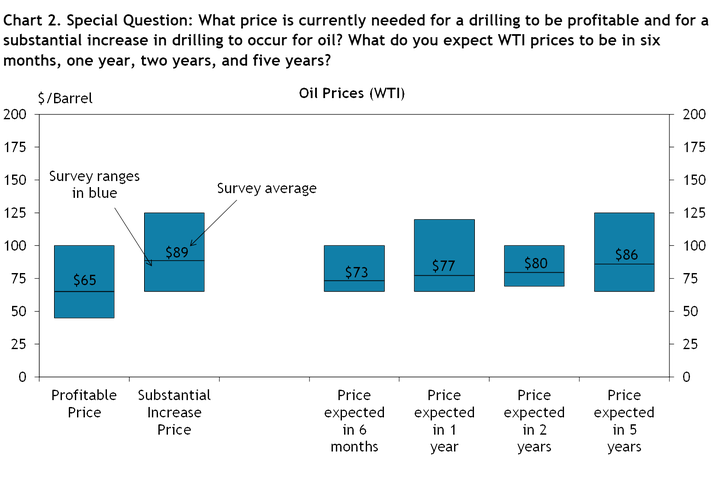

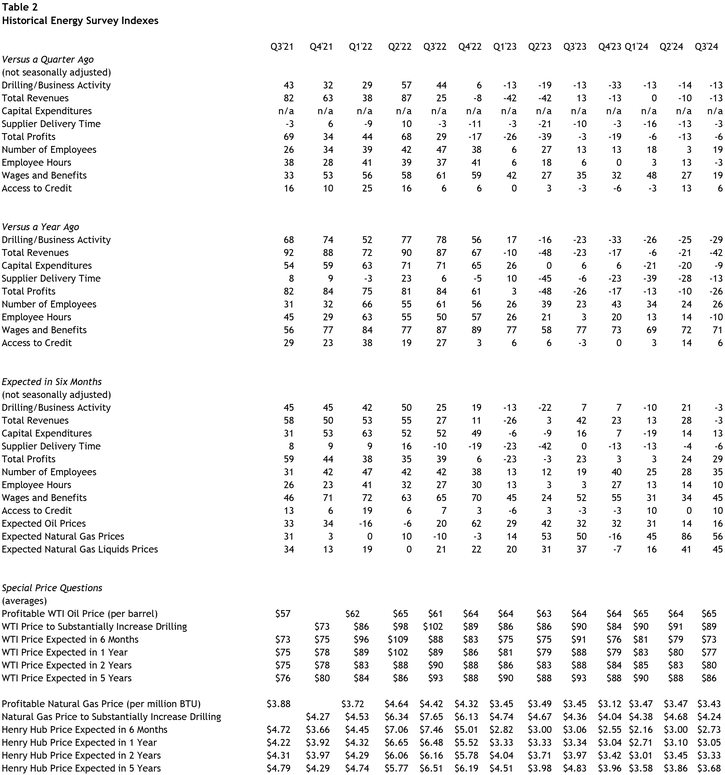

Tenth District energy activity declined further in the third quarter of 2024, as indicated by firms contacted between September 16th, 2024, and September 30th, 2024 (Tables 1 & 2). The quarter-over-quarter drilling and business activity index was largely unchanged, at -14, compared to -13 in the previous quarter (Chart 1). Employment levels grew moderately with a reading of 19, even as revenues and profits declined further.

Chart 1. Drilling/Business Activity Indexes

Skip to data visualization table| Quarter | Vs. a Quarter Ago | Vs. a Year Ago |

|---|---|---|

| Q3 20 | 4 | -71 |

| Q4 20 | 40 | -60 |

| Q1 21 | 35 | 12 |

| Q2 21 | 33 | 59 |

| Q3 21 | 43 | 68 |

| Q4 21 | 32 | 74 |

| Q1 22 | 29 | 52 |

| Q2 22 | 57 | 77 |

| Q3 22 | 44 | 78 |

| Q4 22 | 6 | 56 |

| Q1 23 | -13 | 17 |

| Q2 23 | -19 | -16 |

| Q3 23 | -13 | -23 |

| Q4 23 | -33 | -33 |

| Q1 24 | -13 | -26 |

| Q2 24 | -14 | -25 |

| Q3 24 | -13 | -29 |

Drilling activity also remained down from this time last year, with the year-over-year drilling and business activity index ticking down from -25 to -29. Annual revenues decreased substantially at a reading of -42. Employment levels continued increasing from year-ago levels, but employee hours fell. Capital expenditures continued to decrease moderately, but access to credit stayed positive.

Activity is expected to be slightly negative in the next six months, with the six-month drilling expectations index falling from 21 in Q2 to -3 in Q3. Expected revenues are also at -3, but profits are expected to increase with a reading of 29. All other expectations indexes are positive except for supplier delivery time.

Summary of Special Questions

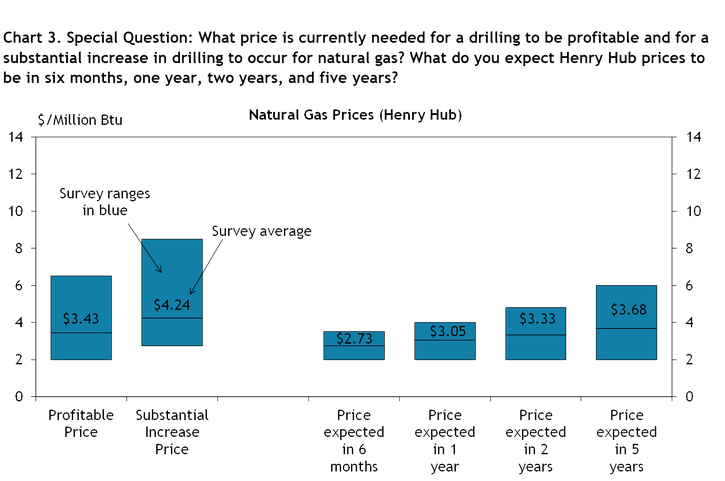

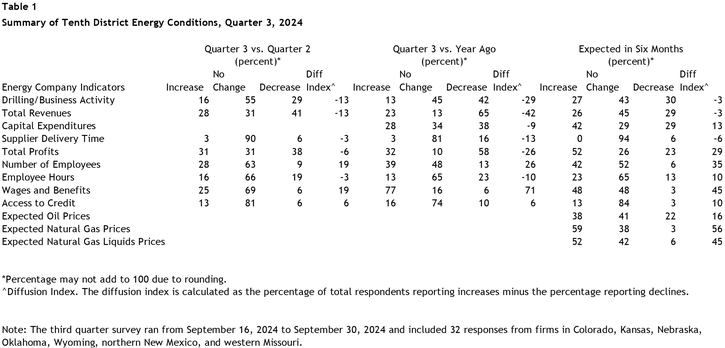

Firms were asked what oil and natural gas prices were needed on average for drilling to be profitable across the fields in which they are active. The average oil price needed was $65 per barrel (Chart 2), while the average natural gas price needed was $3.43 per million Btu (Chart 3). Firms were also asked what prices were needed for a substantial increase in drilling to occur across the fields in which they are active. The average oil price needed was $89 per barrel (Chart 2), and the average natural gas price needed was $4.24 per million Btu (Chart 3).

Firms reported what they expected oil and natural gas prices to be in six months, one year, two years, and five years. The average expected WTI prices were $73, $77, $80, and $86 per barrel, respectively. The average expected Henry Hub natural gas prices were $2.73, $3.05, $3.33, and $3.68 per million Btu, respectively.

Firms were asked how their hiring and capital expenditures plans have changed since the beginning of the year (Chart 4). Most firms’ (87%) hiring plans are unchanged, while 6.5% now expect more hiring in 2024 than they did at the beginning of the year and another 6.5% expect less. Responses for capital expenditures were mixed, with 42% of firms reporting unchanged plans for capital expenditures, 35% expecting less, and 23% expecting more.

Chart 4. Special Question: Compared to the beginning of the year, have your hiring/capital expenditures plans changed for the remainder of 2024?

Skip to data visualization table| Category | Hiring Plans | Capital Expenditures |

|---|---|---|

| Expect more | 6.5 | 23 |

| Plans have not changed | 87 | 42 |

| Expect less | 6.5 | 35 |

Contacts were also asked how uncertainty about economic conditions has changed since the beginning of the year (Chart 5). Over two-thirds (68%) of firms report more uncertainty about economic conditions now than the beginning of the year, while 23% report no change in their uncertainty. Another 3% each reported much more uncertainty, less uncertainty, and much less uncertainty.

Chart 5. Special Question: How has your uncertainty about economic conditions for your business changed since the beginning of the year?

Skip to data visualization table| Category | Percent |

|---|---|

| Much more uncertainty | 3 |

| More uncertainty | 68 |

| No change | 23 |

| Less uncertainty | 3 |

| Much less uncertainty | 3 |

Selected Energy Comments

“The natural gas side of our business has become very cyclical and it feels like one year of great pricing and then if we have warm winters, two years of lousy pricing. The industry has become too good at finding natural gas and with the Permian takeaway increasing, a lot of Permian operators don't care about gas as a revenue stream with the strong oil component.”

“Geopolitical risk remains and potential economic slowdown continues to be a possibility.”

“The easiest barrels have been produced. A needed return on capital expenditures will provide a long-term floor for oil price. Natural gas needs to be close to $4.00 for profitable development other than associated gas in the Permian.”

“Improved demand for increased LNG capacity will strengthen prices.” “Continued overabundance of gas supply dampens price increases.” “Contract labor force is still not good.”

“The market price of our product is not high enough to warrant drilling at this time.”

“We think natural gas prices have to create an incentive for more drilling unless we have another warm winter. Then it will require decline in supply or enough demand growth.”

“We will concentrate on oilier plays.”

“Prices remain volatile. Watching for any demand softening.”

“The key factors driving us in the next six months are finding assets to acquire that fit our criteria by expanding out of the MidCon due to increased competition in Oklahoma.”