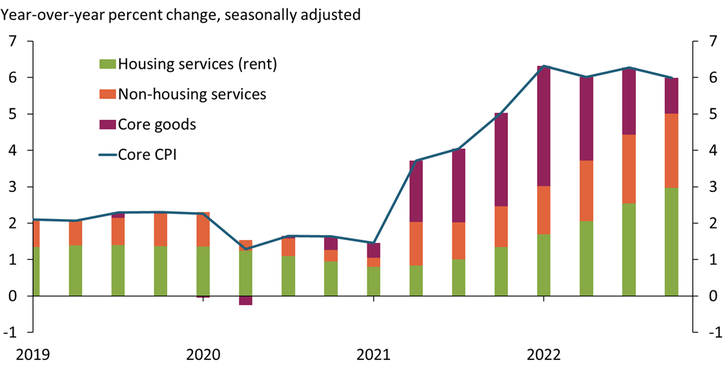

Inflationary pressures in the U.S. economy have increasingly shifted from goods to services. The purple bars in Chart 1 illustrate that increasing goods prices were responsible for much of the initial rise in core Consumer Price Index (CPI) inflation in 2021 and early 2022. More recently, goods inflation has moderated. However, the decline in goods inflation has largely been offset by increasing price pressures in the services sector, leaving core inflation elevated. In particular, rent inflation (green bars)—formally known as housing services inflation—contributed about 3 percent to core CPI inflation in 2022:Q4._ Prior to the pandemic, when inflation was running near 2 percent, rent inflation was contributing only about 1.5 percent to core CPI inflation. Even if goods inflation continues to normalize, rent inflation would also need to meaningfully decline to return inflation to 2 percent.

Chart 1: Rent inflation is the largest contributor to elevated core inflation

Note: This chart shows the contributions to year-over-year core CPI inflation.

Sources: Bureau of Labor Statistics (Haver Analytics) and authors’ calculations.

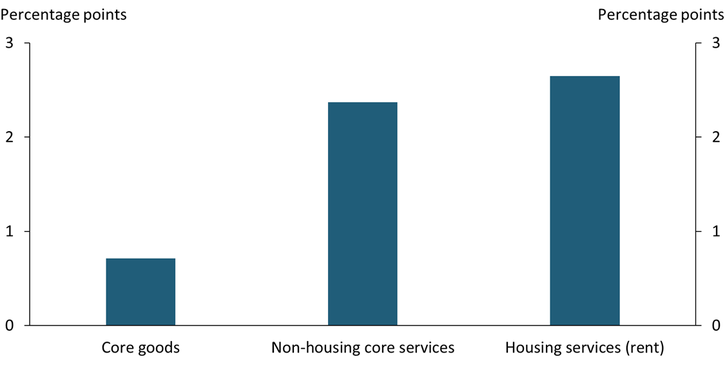

The outlook for rent inflation depends importantly on labor market tightness. We measure labor market tightness using the ratio of job vacancies to the number of unemployed workers (often denoted the “V/U” ratio). Chart 2 shows how a one-unit increase in the V/U ratio (a similar magnitude to the increase in labor market tightness since the start of the pandemic) can influence three components of core CPI inflation: core goods, non-housing core services, and housing services (rent)._ Labor market tightness has the smallest pass-through to core goods inflation, likely because the sector is less labor-intensive than many services. Consistent with this explanation, the pass-through to non-housing core services inflation—a category that includes labor-intensive industries such as accommodation, education, and healthcare—is three times as large. However, the pass-through from labor market tightness to housing services (rent) inflation is estimated to be just as large as the pass-through to these labor-intensive industries.

Chart 2: Rent inflation responds more to a tighter labor market compared with other inflation components

Note: Chart shows the long-run component level CPI inflation responses to a tighter labor market, as measured by a one-unit increase in the ratio of vacancies to unemployed persons.

Sources: Bureau of Labor Statistics (BLS), Bureau of Economic Analysis (BEA), Federal Reserve Bank of New York, and authors’ estimates. All data sources accessed through Haver Analytics.

On the surface, the large pass-through from labor market tightness to rent inflation may be somewhat puzzling since the flow of housing services emanating from the stock of existing housing units is not especially labor intensive. One explanation for the observed influence of labor market conditions on rent inflation is through demand rather than supply, since changes in rental supply tend to materialize very slowly. According to the U.S. Census Bureau, it takes about 18 months to build an apartment complex after a permit has been acquired, and obtaining the permit can take even longer. Therefore, changes in demand for shelter largely shape rent inflation over economic cycles._

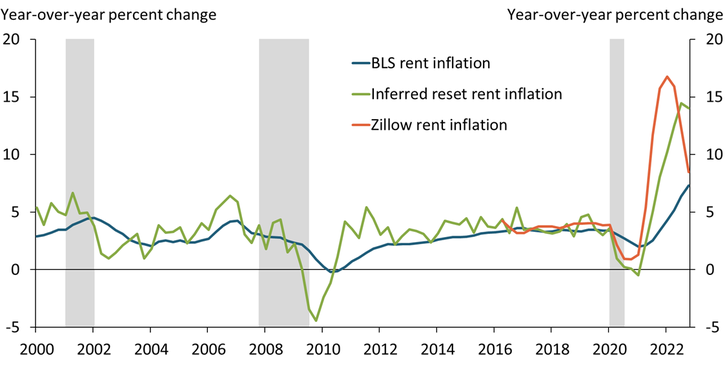

Growth in employment and wages, which vary with broader economic conditions, are key determinants of demand for shelter and hence rent inflation. The blue line in Chart 3 shows that rent inflation slows in economic recessions (gray shaded regions) and rises in economic expansions, albeit with a lag._ This lagged response is largely due to the way that rents are measured. The Bureau of Labor Statistics (BLS) measures rents across the universe of occupied housing each month, including both housing units that have a new lease and units whose rents are fixed under an existing lease. To remedy this measurement issue, the green series in Chart 3 infers from the BLS rent measure the rate of inflation for leases that have expired and had their rents reset._ Compared with the official BLS measure, this inferred reset rent measure exhibits larger and more timely changes in response to swings in the economy. Other measures of rent inflation on new leases, including Zillow’s measure of what landlords are asking on new leases (orange line), also appear more sensitive to changes in economic conditions than the BLS measure.

Chart 3: Rent inflation rises during economic expansions and has surged to historic highs of late

Note: Gray bars denote National Bureau of Economic Research (NBER)-defined recessions.

Sources: BLS, Zillow, NBER, and authors’ calculations. All data sources accessed through Haver Analytics.

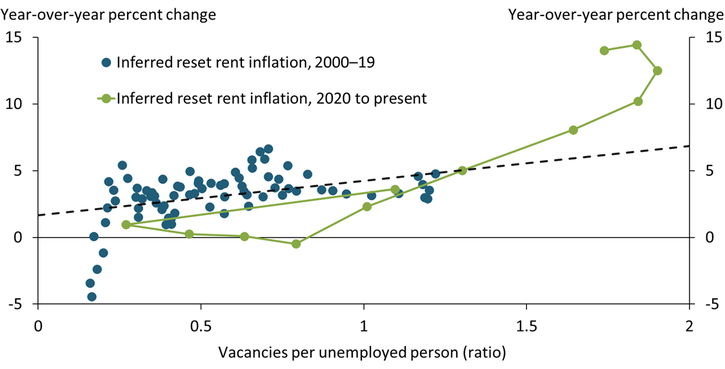

All measures of rent inflation have surged in the wake of the pandemic, coinciding with a historically large increase in labor market tightness. The V/U ratio stood near 1 prior to the pandemic but has hovered near 2 of late, indicating two available jobs per unemployed person._ Although the historically tight labor market has contributed to elevated rent inflation, other pandemic-related factors are also responsible for the increase. Chart 4 shows that rent inflation is running above levels predicted by pre-pandemic patterns (dashed line), even when measured by our inferred reset rent measure, which tends to be more cyclical. Some factors that help explain the pandemic-era surge in rents are an increase in remote work and higher input costs for building and maintaining rental units, both of which led to a boost in home prices that has further contributed to rent inflation (Kmetz, Mondragon, and Wieland, 2022).

Chart 4: A tight labor market is not the only factor behind the recent surge in rent inflation

Sources: BLS (Haver Analytics) and authors’ calculations and estimates.

Some of these pandemic factors that contributed to the surge in rents appear to be unwinding, as evident in Zillow’s measure of rent inflation. After running well above the official BLS measure of rent inflation, the Zillow rent inflation metric has since turned down sharply. Some policymakers have interpreted the decline in the Zillow measure as an indication that BLS rent inflation measures will soon peak as well. However, a return to pre-pandemic rates of rent inflation could remain elusive. With labor markets still tight, historical patterns predict that rent inflation is likely to remain elevated even after the dust settles on pandemic-driven swings in rents.

Endnotes

-

1

Housing services comprise rent of primary residence and owners’ equivalent rent (OER). Since OER is constructed from source data on the rent of primary residence, we use “rent inflation” to refer to all housing services inflation. This version corrects an error in Chart 1 in the original Bulletin. The error resulted in an overstatement of the contribution of rent inflation in recent quarters.

-

2

Estimates are based on univariate regressions of inflation components on their own lags, the V/U ratio, and, for goods, relative import prices and the New York Fed’s measure of global supply chain pressures (GSCPI). The sample period is 2000 through 2022. These three components are constructed so that they jointly comprise the entirety of core CPI.

-

3

Lansing, Oliveira, and Shapiro (2022) make a similar argument for demand-driven fluctuations in rent inflation.

-

4

The lagging response of rent inflation to changes in economic conditions helps to explain why monetary policy appears to influence rent inflation with a lag, as recently documented by Liu and Pepper (2023).

-

5

We construct our measure from the BLS measure of “rent of primary residence” by assuming that leases, on average, reset every 18 months. Adams and others (2022) employ source data from the BLS to produce a measure of new-tenant rent inflation that shares a high correlation (0.83) with our inferred measure of reset rent inflation.

-

6

The job openings series we use is collected by the U.S. Census Bureau and released in the Job Openings and Labor Turnover Survey (JOLTS), which began in 2000. However, Barnichon (2010) puts forth a historical measure of job openings that suggests the recent levels of the V/U ratio are above historical precedent dating back to the early 1950s.

References

Adams, Brian, Lara Loewenstein, Hugh Montag, and Randal Verbrugge, 2022. “External LinkDisentangling Rent Index Differences: Data, Methods, and Scope.” Federal Reserve Bank of Cleveland Working Paper No. 22-38.

Barnichon, Regis. 2010. “External LinkBuilding a Composite Help-Wanted Index.” Economics Letters, vol. 109, no. 3, pp. 175–178.

Kmetz, Augustus, John Mondragon, and Johannes F. Wieland. 2022. “External LinkRemote Work and Housing Demand.” Federal Reserve Bank of San Francisco, Economic Letter, September 26.

Lansing, Kevin J., Luiz E. Oliveira, and Adam Hale Shapiro. 2022. “External LinkWill Rising Rents Push Up Future Inflation?” Federal Reserve Bank of San Francisco, Economic Letter, February 14.

Liu, Zheng, and Mollie Pepper. 2023. “External LinkCan Monetary Policy Tame Rent Inflation?” Federal Reserve Bank of San Francisco, Economic Letter, February 13.

Brent Bundick is a senior research and policy advisor at the Federal Reserve Bank of Kansas City. A. Lee Smith is a senior vice president and economist at the bank. Luca Van der Meer is a research associate at the bank. The views expressed are those of the authors and do not necessarily reflect the positions of the Federal Reserve Bank of Kansas City or the Federal Reserve System.