Sources: U.S. Securities and Exchange Commission (via U.S. Office of Financial Research) and author’s calculations.

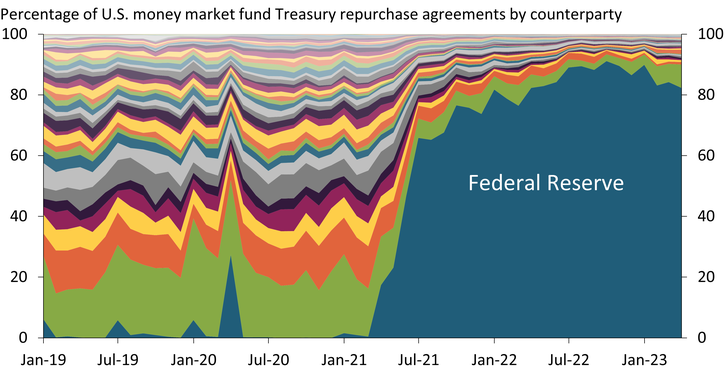

The Federal Reserve’s Overnight Reverse Repurchase Facility provides money market funds with a short-term, risk-free investment paying competitive returns. Through this program, the Fed’s role as a counterparty for money market funds’ Treasury security repurchases has grown significantly. The chart above shows counterparties to U.S. money market funds in Treasury security repurchase agreements as a percentage of the total market. From 2019 to 2021, activity was spread among a diverse set of counterparties. However, since 2021, the Fed has been the dominant counterparty for U.S. money market funds’ Treasury repurchases.

See more research from Charting the Economy.