Nebraska’s economy maintained momentum in 2016 as statewide indicators generally continued to show improvement. Despite ongoing headwinds in rural parts of the state stemming from a downturn in the agricultural economy, further increases in employment, strengthening wages and strong economies in Omaha and Lincoln have underscored a sense of general optimism in the state economy.

Economic Conditions

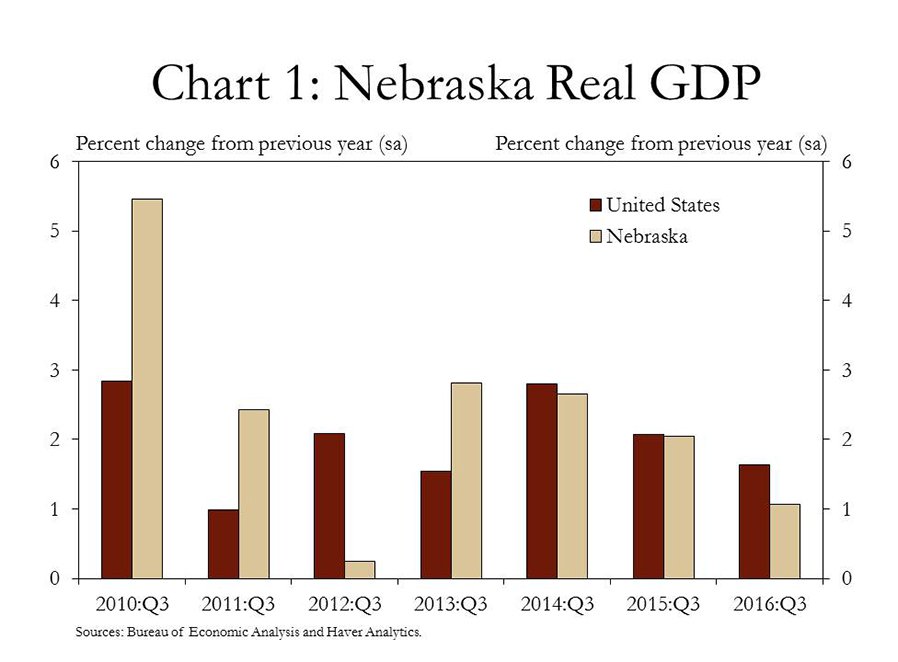

Nebraska’s economy continued to grow over the past year, as did the nation as a whole. The state’s economy, as measured by GDP, expanded at an annualized rate of 1.1 percent in the third quarter of 2016 (Chart 1). Although growth was slightly slower than in recent years and slightly less than the nation, 2016 was the sixth year of continuous expansion with only two quarters in which GDP growth dipped below zero.

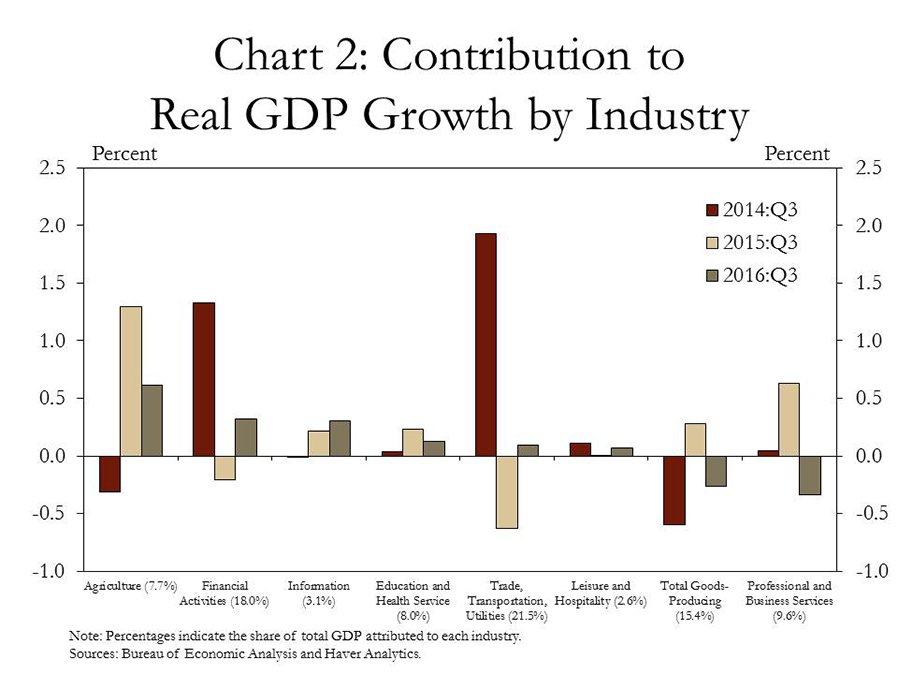

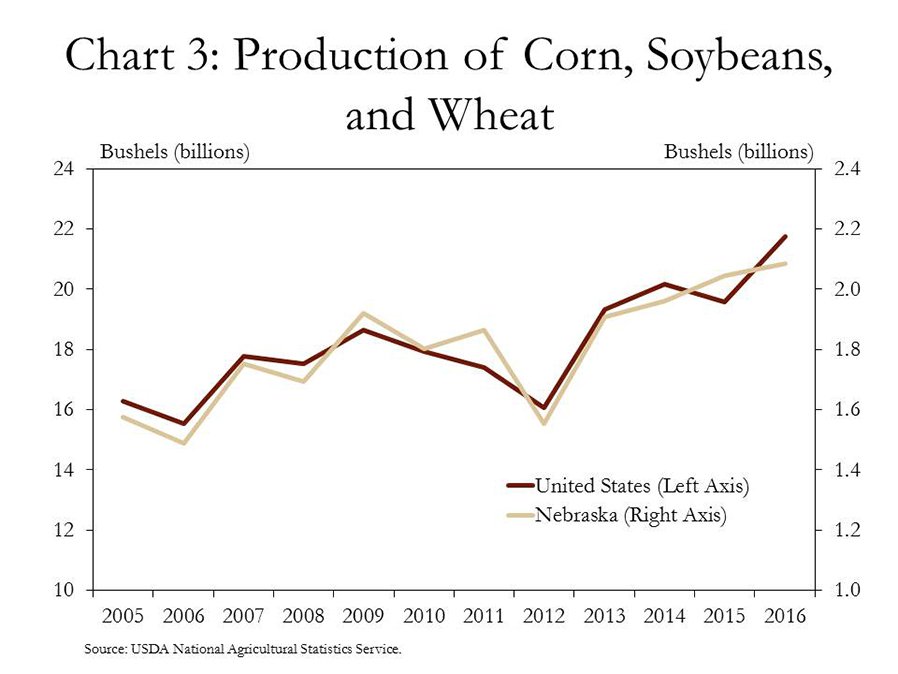

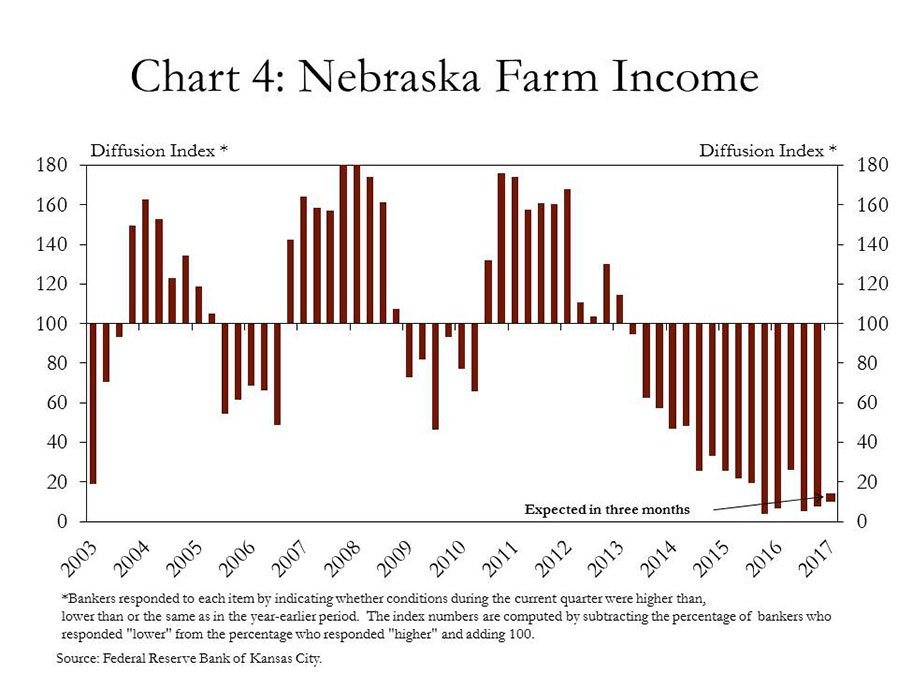

Similar to 2015, Nebraska’s agricultural sector contributed significantly to GDP growth in the state, despite reduced farm income and tight profit margins. Increases in agricultural production in 2016 continued to boost real GDP growth in Nebraska, even as agricultural commodity prices remained low (Chart 2). Similar to the nation, production of major row crops was poised to set records again in 2016 (Chart 3). Increased agricultural production, however, continued to weigh on farm income, which declined throughout 2016 and was expected to remain weak in early 2017 (Chart 4).

In addition to agriculture, the financial sector provided a notable boost to economic growth through the third quarter. The financial sector, which includes insurance and real estate, is the second-largest industry in the state as a share of GDP (18 percent) and contributed 0.32 percent to third-quarter GDP growth. Several other smaller service-oriented industries also added to GDP, while the contribution from goods-producing industries and professional and business services weakened from a year earlier.

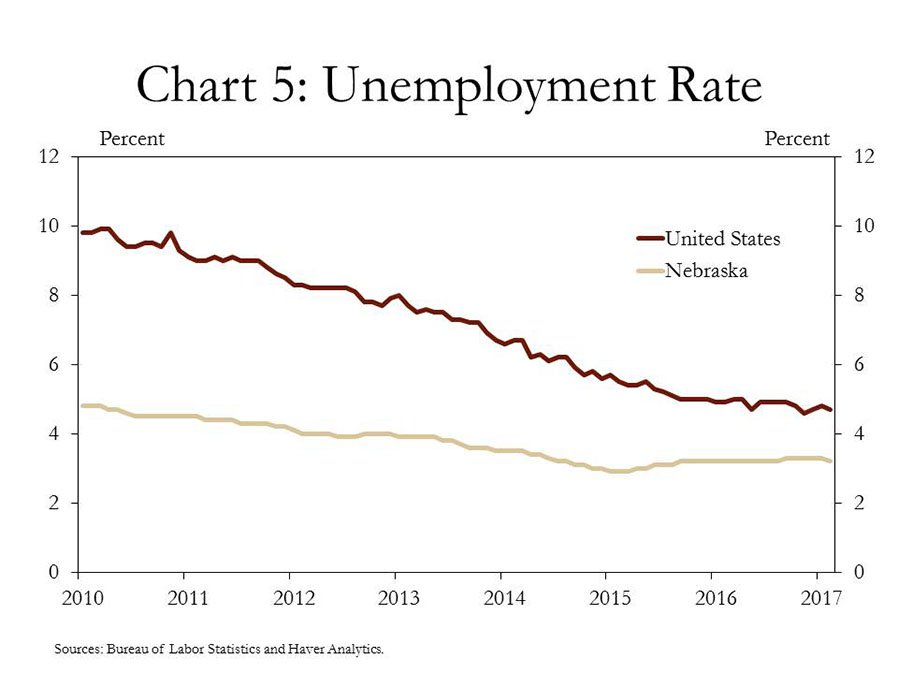

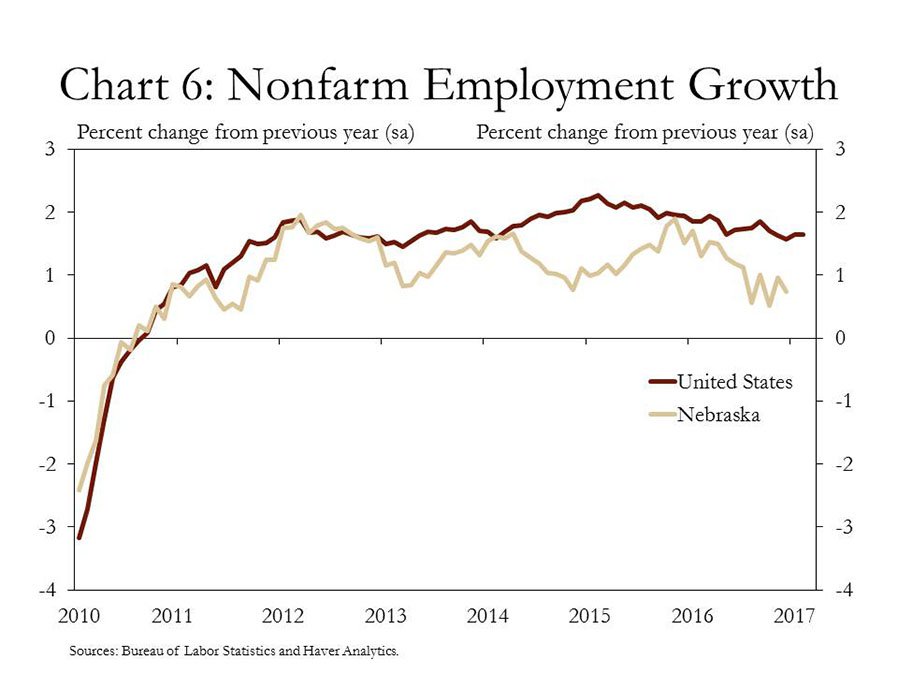

Nebraska’s labor market remained relatively stable through 2016, despite a modest softening from 2015. Nebraska’s year-end unemployment rate of 3.3 percent remained significantly lower than the country as a whole (Chart 5). Employment in the state also continued to expand through 2016 but, similar to GDP growth, slowed somewhat from 2015, and the rate of growth was slightly less than in the United States overall (Chart 6).

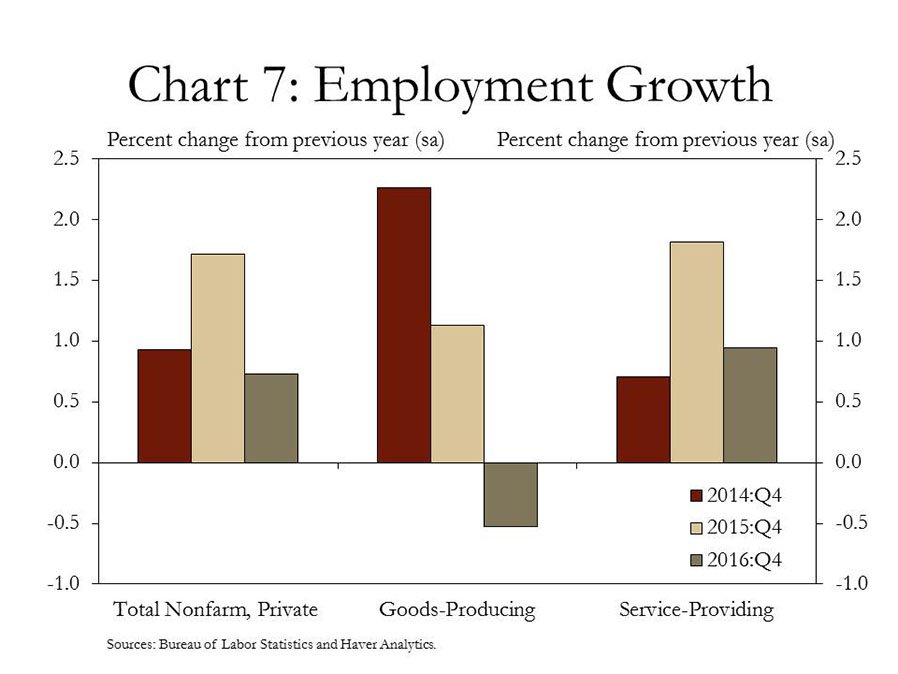

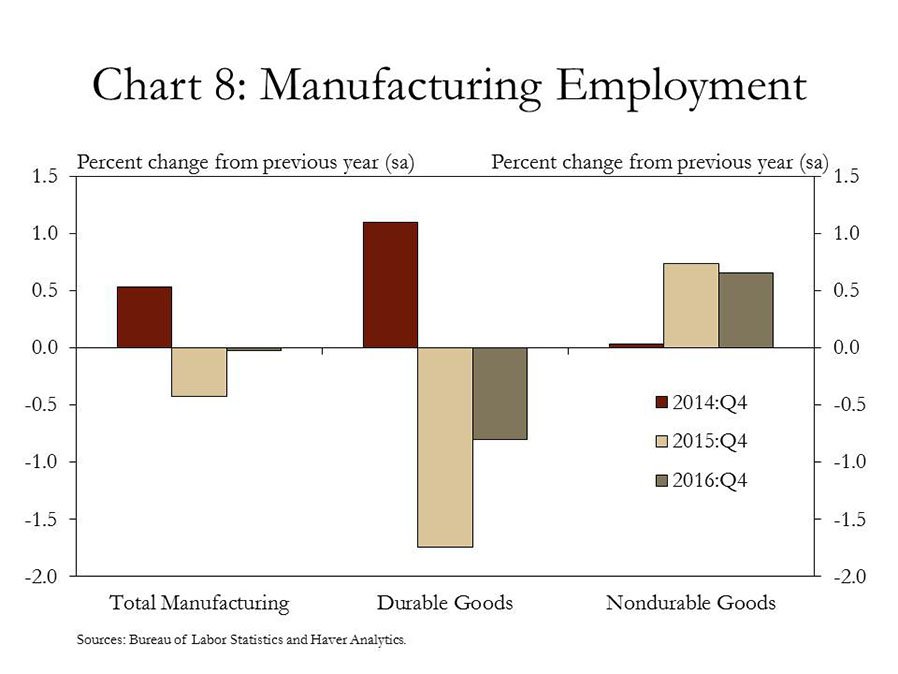

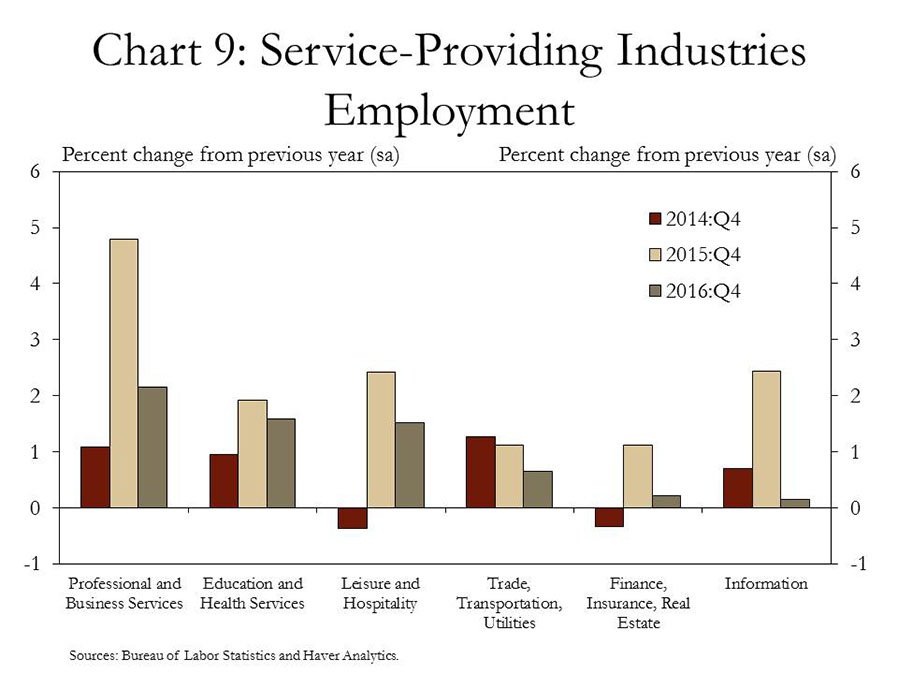

Service-providing industries in Nebraska continued to account for the majority of job gains in 2016. Whereas employment declined modestly among goods-producing industries, service-providing industries continued to add jobs in 2016 at a rate of about 1.0 percent in the fourth quarter (Chart 7). In the goods-producing sector, durable goods manufacturers continued to shed jobs while producers of nondurable goods added jobs at a rate of about 0.7 percent (Chart 8). In the services sector, professional and business services continued to lead job growth in the state while similar gains were seen in education and health services and leisure and hospitality (Chart 9).

Industry Employment and Wages

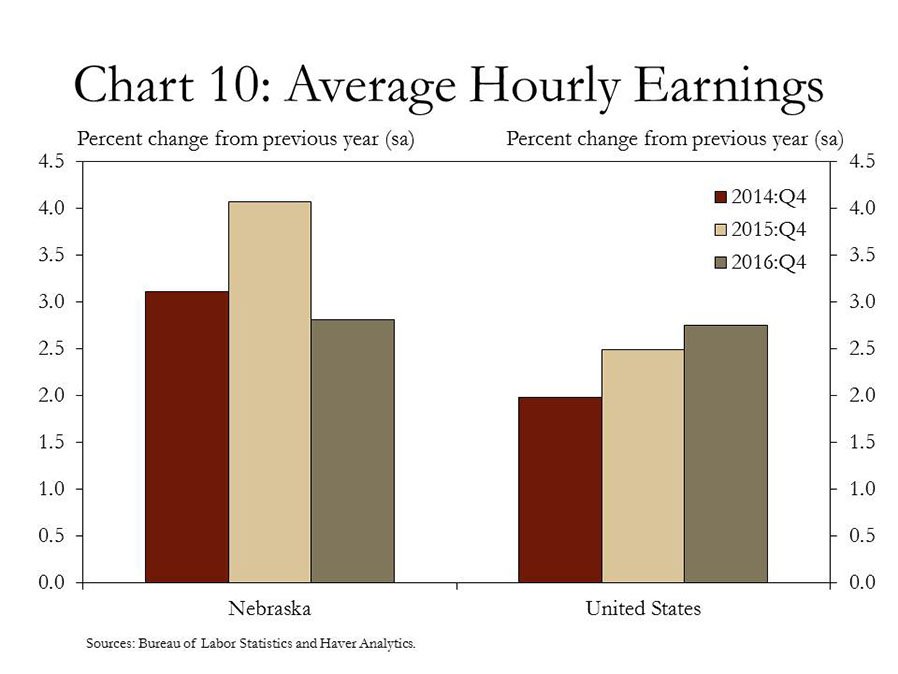

Reflecting further optimism in the state’s economy, wage growth in Nebraska remained strong in 2016. In the fourth quarter, average hourly earnings increased 2.8 percent from 2015 (Chart 10). This increase marked the third consecutive year in which fourth-quarter wage growth outpaced the nation as a whole. The consistent increase in wages, and at a rate stronger than the nation, suggests that labor markets have tightened in Nebraska, which may also be dampening the rate of job growth in the state.

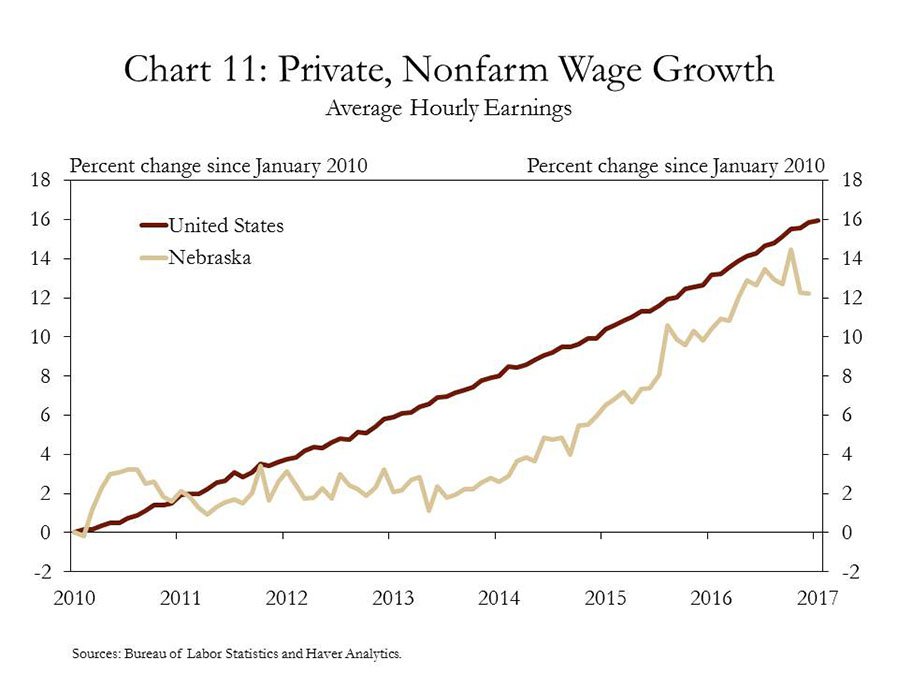

Strengthening wage growth in Nebraska has been a relatively recent development, however, following a period of stagnation after the 2008-09 recession. Compared with 2010, wage growth in Nebraska has reached a rate relatively similar to the nation only recently, though a modest gap remains (Chart 11). Over the past several years, though, the pace of wage growth in Nebraska has been much faster than in the early years of the economic recovery. As of December 2016, earnings in the nonfarm private sector were about 12 percent higher than at the beginning of 2010. Just three years ago, earnings had increased only about 2.5 percent since the beginning of 2010.

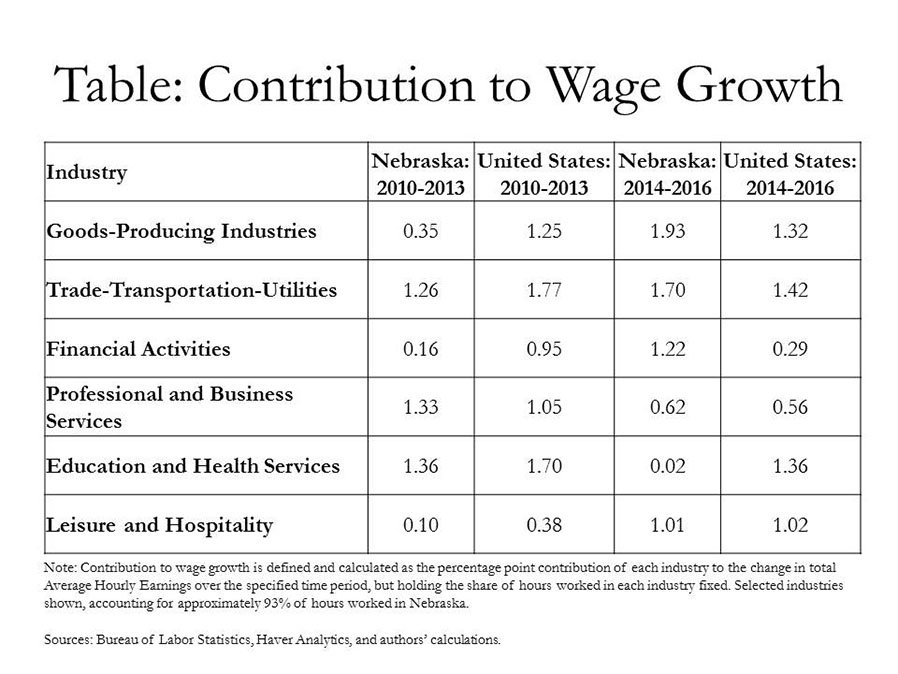

Recent job growth in Nebraska’s goods-producing sector and the trade, transportation and utilities sectors has been among the slowest, but those industries have been important drivers of wage growth in the state. From 2010 through 2013, these two sectors accounted for a significant portion of wage growth in Nebraska (Table). These industries have driven wage growth since 2014, even as employment growth has slowed. Consistent wage increases in these industries amid slower growth in employment, suggests that labor markets may be particularly tight in construction, manufacturing, transportation, wholesale and retail trade and utilities.

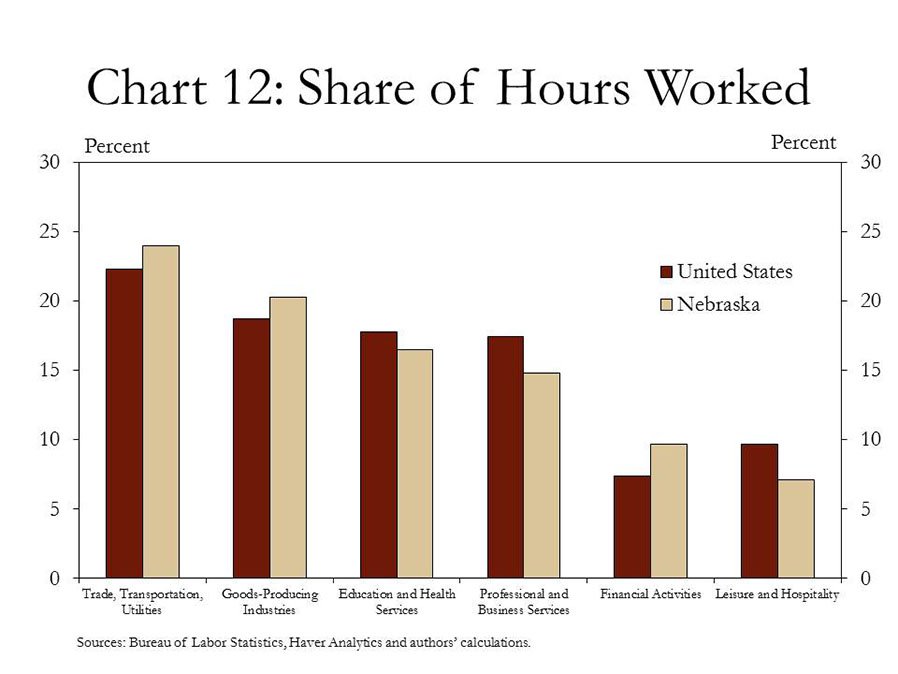

Other industries also have contributed to the state’s recent strengthening in wages. Collectively, trade, transportation and utilities and goods-producing industries account for about 44 percent of an average workweek in Nebraska, which is slightly larger than that of the nation (Chart 12). Nebraska’s financial activities sector also has expanded in recent years and, at nearly 10 percent, accounts for a larger share of total hours than in the nation (7.4 percent). Since 2014, financial activities have provided a 1.2 percentage point boost to overall wage growth, about double the contribution at the national level. Other prominent service-based industries, such as leisure and hospitality also have boosted wages more notably in recent years.

Business and Household Optimism

In addition to ongoing strength in wage growth and employment, other indicators also underscore a relatively strong state economy. As noted in a previous issue of the Nebraska Economist, much of this business and household optimism has been concentrated in the state’s metro regions while economic conditions in rural Nebraska have softened alongside a weaker agricultural economy. Nevertheless, the steady growth in Omaha and Lincoln has continued to drive economic growth and optimism at the state level.

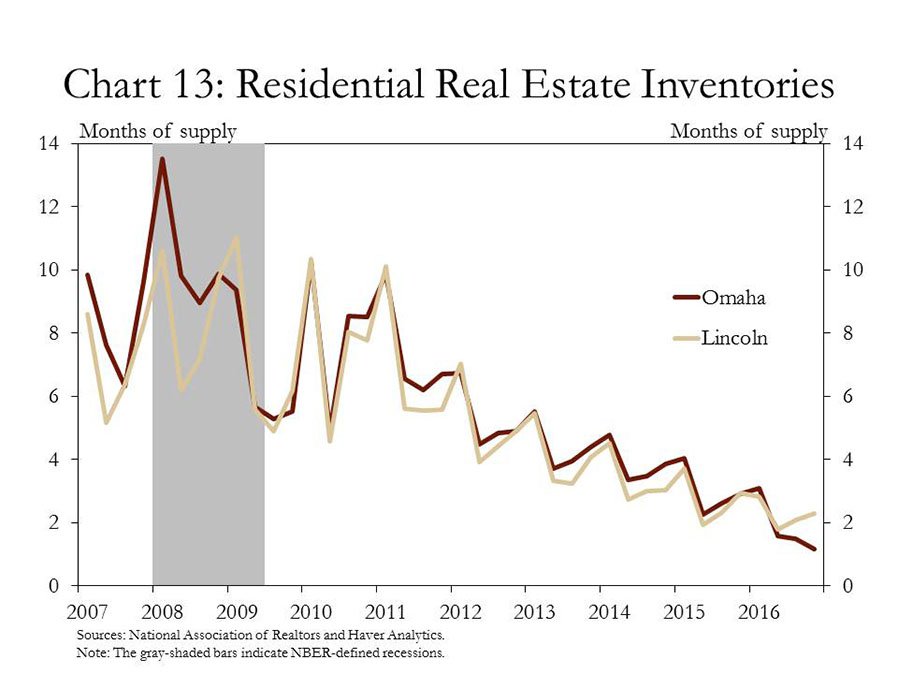

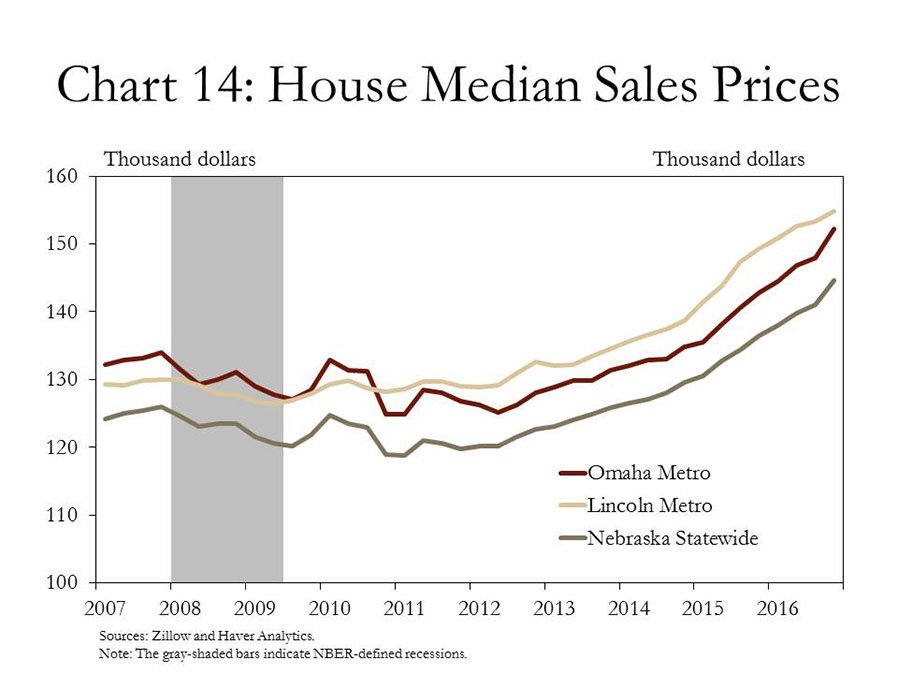

Real estate markets, a significant driver of household optimism throughout the state, have continued to strengthen. Indicative of persistent demand for residential real estate, the supply of homes available in Omaha and Lincoln has continued to tighten significantly, and is well below the level prior to the last recession (Chart 13). Real estate agents sometimes note that a supply of five to seven months typically is necessary for a balanced market; in Omaha and Lincoln the supply is considerably less. Due in part to tightening supplies, house prices also have continued to rise and are well above pre-recession levels in both of the state’s major metro areas (Chart 14). According to Zillow, a real estate database company, the median sales price of homes in Omaha and Lincoln both surpassed $150,000 in the fourth quarter; prices in general have continued to rise in Nebraska.

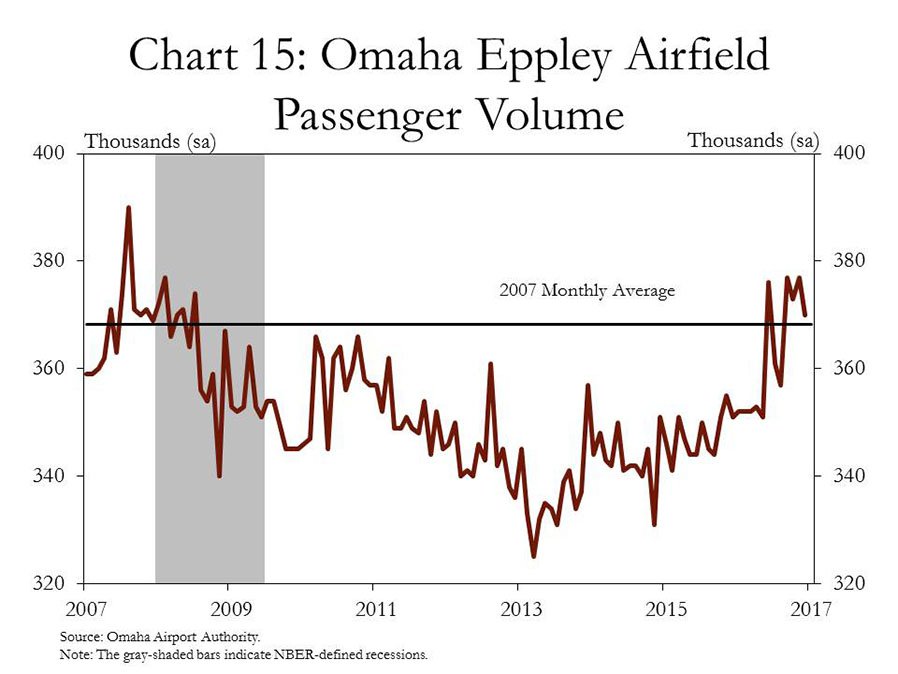

Also reflecting ongoing business and consumer optimism in the state’s economy, passenger traffic at Omaha’s Eppley Airfield increased sharply toward the end of 2016. In fact, passenger volume statistics for late 2016 were consistently above the pre-recession average of about 370,000 passengers per month (Chart 15). Moreover, since the beginning of 2016, airlines with service from Eppley have added, or announced plans to add, a significant number of new nonstop flights. New non-stop destinations include San Diego, Miami, San Francisco, Los Angeles, and Portland with additional non-stop service to Dallas, Houston and Washington D.C.

Following a dip in 2014 and 2015, retail sales in Nebraska also appeared to rebound in 2016. In 2015, taxable retail sales in Nebraska increased only 0.9 percent. In 2016, however, sales increased more than 4.3 percent, similar to some of the strongest gains in Nebraska over the past decade (Chart 16).

Conclusion

Although some indicators suggest economic growth in Nebraska has slowed recently, others point to steady gains as the housing and labor markets appear to have tightened. Gains in employment, strengthening wage growth and improvements in business activity underscore a sense of optimism for the state economy, even as rural areas continue to face challenges alongside a softer agricultural economy. As in the nation, there appears to be some momentum behind economic gains in the state, with Omaha and Lincoln continuing to drive much of Nebraska’s economic activity.

The views expressed in this article are those of the authors and do not necessarily reflect the views of the Federal Reserve Bank of Kansas City or the Federal Reserve System.