Oklahoma’s job growth in 2019 has slowed to well below the national rate. Except for a few months in early 2018, Oklahoma’s year-over-year rate of employment growth now has been lower than the nation in every month since April 2013. This recent sluggishness followed a decade in which state job growth outpaced the nation nearly 90 percent of the time. This edition of the Oklahoma Economist looks at the industries that have driven the state’s weaker overall job growth since 2013. However, it also identifies Oklahoma industries that have thrived in that time—adding thousands of jobs—and how wages in those industries compare with wages in industries that have downsized. It shows that several high-paying industries are growing rapidly in the state, but the average pay of growing industries lags that of declining industries.

Overview of Oklahoma’s lagging job growth

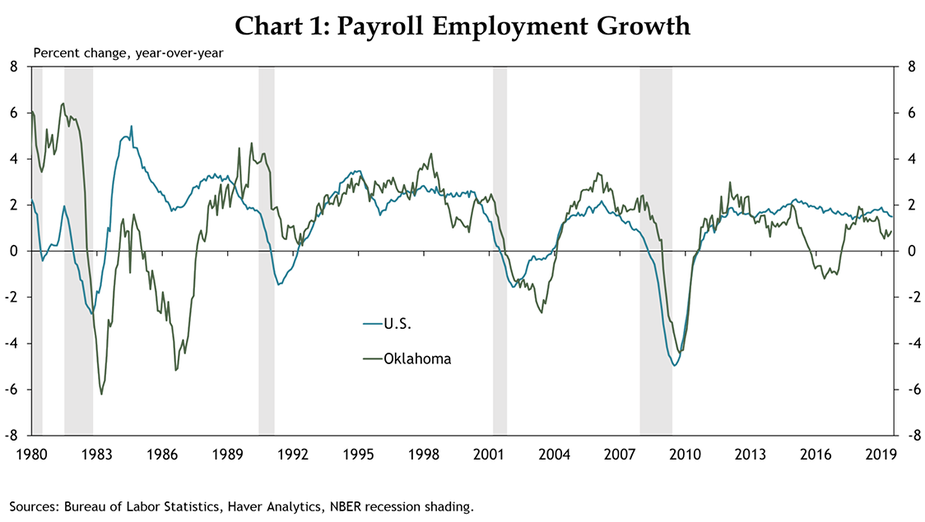

The recent extended period of slower job growth in Oklahoma is not unprecedented. Oklahoma job growth also lagged the nation from 1982 to 1989, but by a much wider margin than in recent years (Chart 1). However, the effects of weaker overall job growth the past six years have begun to add up. From mid-2013 through mid-2019, Oklahoma employment has grown only 4 percent, even as national employment grew 11 percent. Moreover, as highlighted in recent editions of the Oklahoma Economist, Oklahoma has had more residents move to other states in recent years than have moved in—especially those with college degrees.

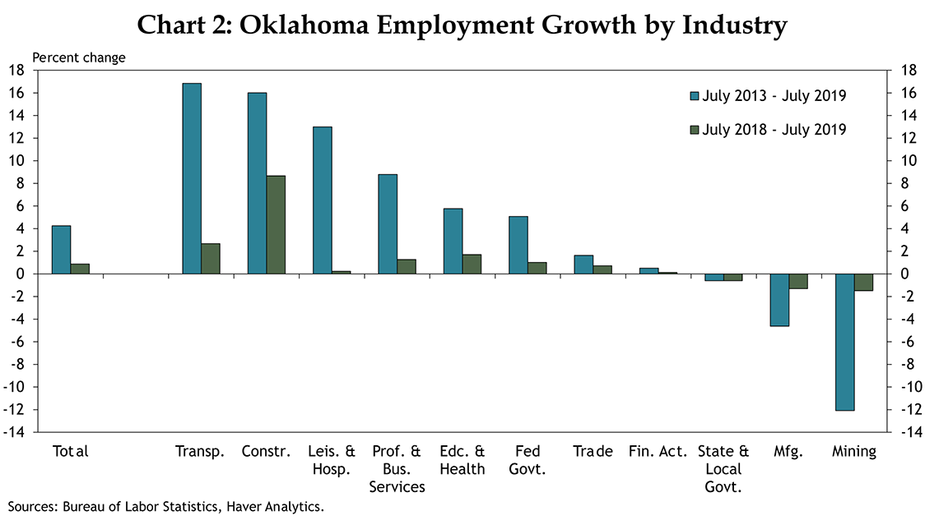

Looking across broad categories of industries, for which timely monthly data are available, the largest drops in Oklahoma jobs over both the past year and the past six years have been in the mining sector (Chart 2). This decline has been driven by both the sharp downturn in oil prices in 2014-15 as well as by subsequent and historic efficiency gains in the sector, as detailed in the second quarter 2018 Oklahoma Economist. In addition to mining, the state’s manufacturing sector also has lost jobs over the past year and past six years, even as the sector expanded nationally. Employment in Oklahoma’s state and local government sector also is down slightly.

Meanwhile, several broad sectors of the Oklahoma economy have continued to add jobs over both the past year and the past six years, with the fastest growth in transportation and construction. However, for both expanding and declining industries in the state, looking at more detailed breakdowns of industries provides more insight into what kinds of jobs are being gained and lost, whether they are becoming more or less concentrated in Oklahoma than in the nation, and their relative pay.

Which specific Oklahoma industries have shrunk most?

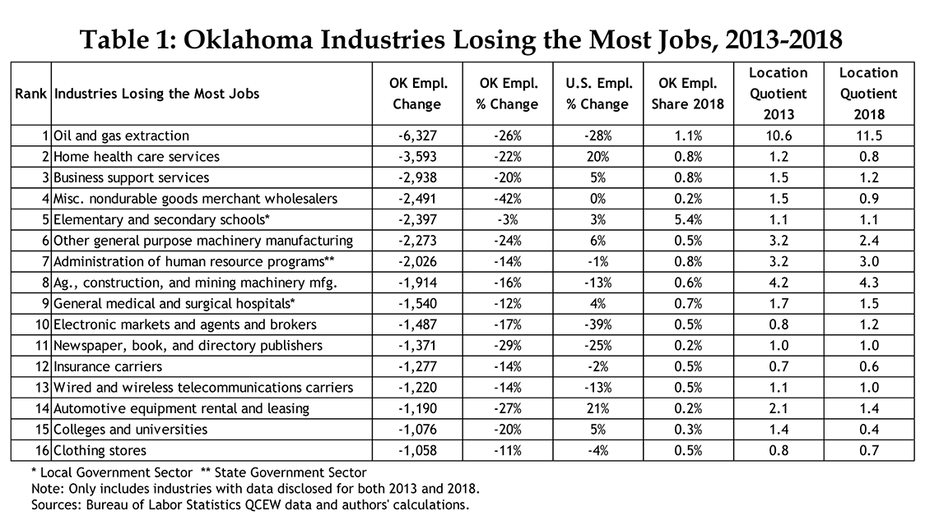

Annual data on state employment are available through 2018 for about 300 detailed industries (defined as four-digit NAICS, or North American Industry Classification System, industries). These data show that 16 Oklahoma industries each shed more than 1,000 jobs between 2013 and 2018 (Table 1). Several of these industries are within the broader mining, manufacturing, and state and local government categories, but most are segments of other broad sectors.

The biggest employment decline in Oklahoma since 2013 has been in oil and gas extraction, which lost over 6,000 jobs—more than a quarter of its total employment._ Even with this large shrinkage, the extraction industry remains over 11 times as concentrated in the state as in the nation, based on location quotient._ As such, the industry will continue to play a sizable, even if slightly diminished, role in the state’s economy.

Two oil and gas-related manufacturing industries in the state also shed about 2,000 jobs each from 2013 to 2018. The largest subcomponent of “other general purpose machinery manufacturing” in Oklahoma is pumps and compressors, including oil field pumps. And over 70 percent of the Oklahoma jobs in “agriculture, construction, and mining machinery” are in oil field equipment and machinery. Difficult agricultural conditions in recent years also have hurt these two industries. Despite their recent sizable reductions in staffing, these industries remain much more concentrated in Oklahoma than in other states.

Several services sectors in Oklahoma had sizable percentage declines in jobs. The sharpest drop was at “miscellaneous nondurable goods merchant wholesalers,” which includes subsectors such as farm supplies merchants and book, periodical and newspaper merchants. Also shedding more than a quarter of their Oklahoma jobs since 2013 were newspaper, book and directory publishers themselves, as well as automotive equipment rental and leasing firms. Employment in business support services, which consists primarily of telemarketing, also fell drastically.

Two health-care industries in the state likewise reduced employment significantly—home health care services and local government-owned general hospitals. These reductions occurred even as several other health-care industries added considerably to their employment in recent years, as will be noted in the following section.

Two other state and local government industries also shed over 1,000 jobs, as revenues at the state and local level have been hurt by the state’s relative economic sluggishness. Public elementary and secondary schools have lost nearly 2,400 jobs, or 3 percent of their 2013 workforce, while over 2,000 jobs were lost in the administration of human resource programs at the state level.

Which industries have thrived in recent years?

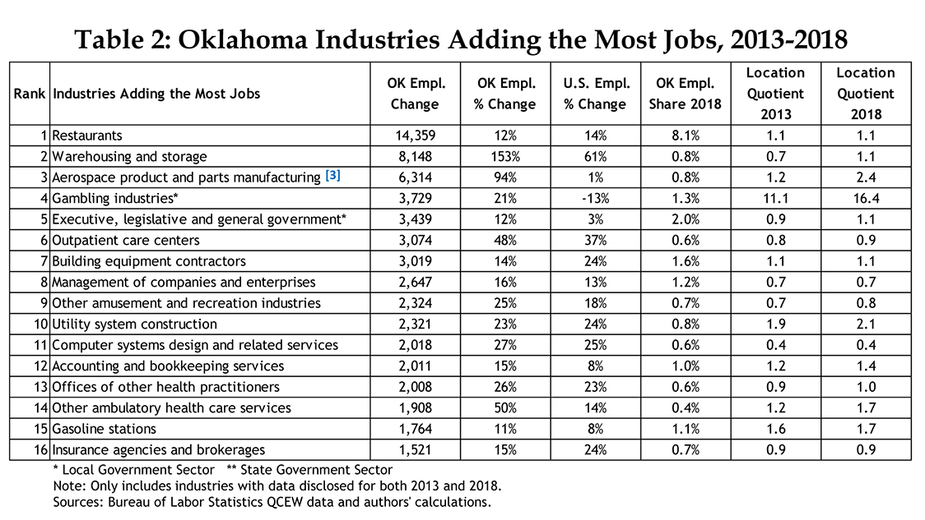

Although Oklahoma job growth has lagged the nation by a sizable margin the past six years and a number of industries substantially shed jobs, some industries in the state have grown considerably. Table 2 lists the 16 Oklahoma industries that each added more than 1,500 jobs from 2013 to 2018. This group was led, by far, by restaurants, which added over 14,000 jobs, with sizable growth among both full-service and limited-services restaurants. However, a variety of other services and goods-producing industries also have thrived.

The industries with the second- and third-most jobs added in the state also are the two with the fastest percentage growth in jobs the past five years—warehousing and storage; and aerospace product and parts manufacturing._ Warehousing also has grown nationally, as shoppers shift to online buying and thus more product is held at distribution centers. But Oklahoma’s growth in the sector has been over twice as fast, and warehousing and storage now is more concentrated in the state than the nation. Oklahoma’s rapid growth in aerospace jobs has occurred even as that industry has had virtually flat employment nationally. Based on location quotient, aerospace now is more than twice as concentrated in the state as in the nation, after being only slightly more concentrated in 2013.

Two local government industries are next on the list—gambling industries; and executive, legislative and general government. Each has added over 3,000 jobs and grown much faster than in the nation. The faster growth in executive, legislative and general government jobs is attributable to the inclusion of tribal governments within this category—over 90 percent of the Oklahoma jobs added were in tribal governments. As casinos have continued to grow in the state, Native American tribe revenues have grown as well, and some tribes have ventured into other industries and expanded their employment accordingly.

Three health-care industries in the state have seen their employment grow by more than 25 percent the past five years, even as a couple of health-care industries have shrunk as noted in the previous section. Indeed, outpatient care centers have seen 48 percent job growth since 2013, accounting for over 3,000 new jobs, and other ambulatory health care services (including various kinds of health screenings) grew 50 percent. Offices of other health-care practitioners—especially those with specialty therapy or mental health patients—also have expanded their presence greatly in the state.

Several high-paying professional and high-tech services industries also have grown rapidly. The computer systems design and related services industry, including software and systems engineers, grew 27 percent from 2013 to 2018, or over 2,000 jobs. Jobs in the management of companies and enterprises (i.e., headquarters) rose 16 percent, while the accounting and bookkeeping services industry as well as insurance agencies and brokerages rose by similar percentages.

Two high-skilled “blue collar” industries also increased their employment sizably from 2013 to 2018. The building equipment contractors industry—including electrical, plumbing and HVAC contractors—added over 3,000 jobs. Utility system construction, including pipelines, added over 2,000 more. Even though upstream oil- and gas-related employment has declined in the state since 2013, continued increases in oil and gas productivity have created the need for more pipelines to move the growing amount of product to markets.

The category “other amusement and recreation industries” also has boomed in Oklahoma in recent years, increasing its employment by 25 percent, faster growth than in the nation. This industry consists primarily of fitness and recreational sports centers. Gasoline stations also grew slightly faster in Oklahoma than in the country as a whole.

Wage comparison for growing vs. declining industries

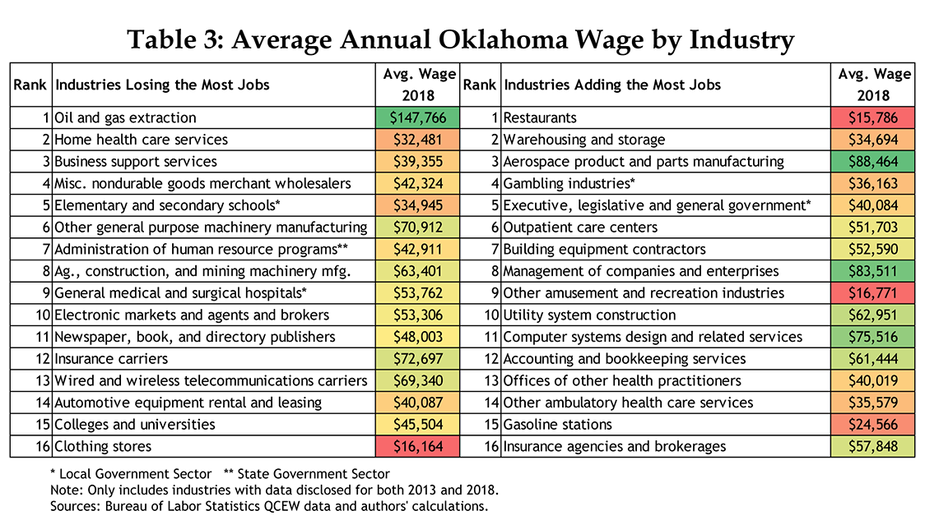

While a variety of industries have seen large declines in employment in Oklahoma since 2013, a likewise diverse set of industries has thrived and added thousands of jobs. The pay of both growing and declining industries in the state also varies widely. Depending on how the industries are compared, the typical wage across all declining industries either greatly exceeds or only slightly exceeds that of industries that have grown rapidly.

Overall, the average annual Oklahoma wage of the 16 industries losing the most jobs from 2013 to 2018—weighted by the number of jobs lost—was more than $65,000. However, the median pay for these industries was under $47,000. The highest-paying industry in Oklahoma, by far, is oil and gas extraction—the industry that has shed the most jobs since 2013 (Table 3). Among other declining industries, though, half of them paid below the average pay across all Oklahoma jobs in 2018: $46,724. Only four of the other declining industries paid an average wage above $60,000.

The weighted average pay of the 16 fastest-growing industries in Oklahoma, by contrast, is just over $43,000, due largely to the sizable number of lower-paying restaurant jobs included. But the median pay of these industries is nearly $46,000, only slightly lower than the median for the fastest-growing industries in the state. Beyond restaurants, a couple of other industries also have lower pay—other amusement and recreation industries; and gasoline stations. But three fast-growing industries in the state pay over $75,000 on average—aerospace product and parts manufacturing; management of companies and enterprises; and computer systems design and related services. And two others—utility system construction and accounting and bookkeeping—have average pay of over $60,000.

Summary

Oklahoma employment has grown much slower than in the nation since 2013. This largely has been driven by difficulties in the oil and gas sector, but technological changes in other sectors also have taken a toll on jobs—such as in the newspaper, telemarketing and auto rental industries. At the same time, however, some Oklahoma industries have thrived during this overall sluggish period in the state. The pay in many of these industries is similar to the pay of jobs in industries that have been declining, although the overall average pay is lower, the warehousing and storage industry has more than doubled its number of jobs in the state since 2013, and the high-paying aerospace industry has nearly done so. Several health-care industries also have grown rapidly, as have well-paying blue-collar industries such as building equipment contractors and pipeline construction. In the hospitality realm, restaurants, casinos and recreation centers likewise have added thousands of jobs. And while the state’s computer systems design industry remains smaller than in the country as a whole, its rate of employment growth has outpaced the nation since 2013.

Endnotes

-

1

The other main upstream oil and gas industry, support activities for mining, shed 454 jobs during the period, bringing its total employment down to 32,698 in 2018. For more information on NAICS definitions, visit: External Linkhttps://www.census.gov/cgi-bin/sssd/naics/naicsrch.

-

2

A location quotient is simply an industry’s share of a state’s (or local area’s) employment divided by that industry’s share of national employment. Thus numbers above 1 mean the industry is more concentrated in the state, while numbers below 1 mean the industry has less presence in the state.

-

3

A sizeable portion of the growth in aerospace product and parts manufacturing (NAICS 3364) jobs in Oklahoma in recent years appears to be due to the reclassification of several thousand jobs in air transportation (NAICS 481) to that sector.