In November, the Federal Reserve Bank of Kansas City conducted its biannual LMI Survey across the Tenth District. The results were as expected. The effects of COVID-19 continued to impede improvements in the economic conditions of low- and moderate-income (LMI) populations. Housing topped the list of concerns from respondents, especially related to the looming evictions crisis. Job growth through the summer was short-lived. By November, job growth either slowed considerably or began showing losses again. Shortly after the survey was conducted, many jurisdictions across the Tenth District imposed stricter regulations to stem the rising number of COVID-19 cases, leading to concerns about further job losses.

Affordable Housing Index (relative to previous quarter)

The looming evictions crisis contributed to a sharp drop in the affordable housing index. Based on calculations from the U.S. Census Bureau’s Household Pulse survey, about 250,000 renters across the Tenth District could have faced eviction if the eviction moratorium had been lifted in December, when the original CDC order was scheduled to end.

The COVID-19 relief bill Congress passed in December set aside rent assistance of $25 billion. That amount, however, is a fraction of what many estimates suggest is needed. The bill also extended the CDC eviction moratorium to the end of January. President Joe Biden signed an executive order that extended the eviction and foreclosure moratorium to March 31, 2021.

It is important to note that while the CDC has invoked this moratorium, local judges have discretion in how to implement it. In many cases that has meant eviction cases have continued, and people are still being evicted from their homes. Landlords also have tightened their screening criteria or chosen to leave units vacant to limit their risk of housing a tenant who cannot pay.

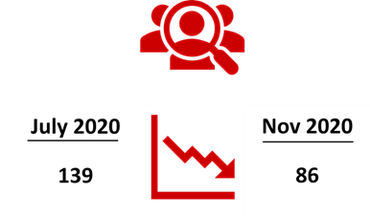

Job Availability Index (expectations for next quarter)

When the Kansas City Fed conducted the survey in July, respondents were optimistic about job growth. At the time, substantial job growth followed the abrupt business closures in April and May. Since then, however, job growth slowed considerably. Survey respondents in November were negative about job growth in the first quarter of 2021. Their expectations were realized in December, at least, when the economy lost 140,000 jobs, mostly in industries with large concentrations of low-wage workers.

See the full report for additional information and reporting on all the indexes we track.