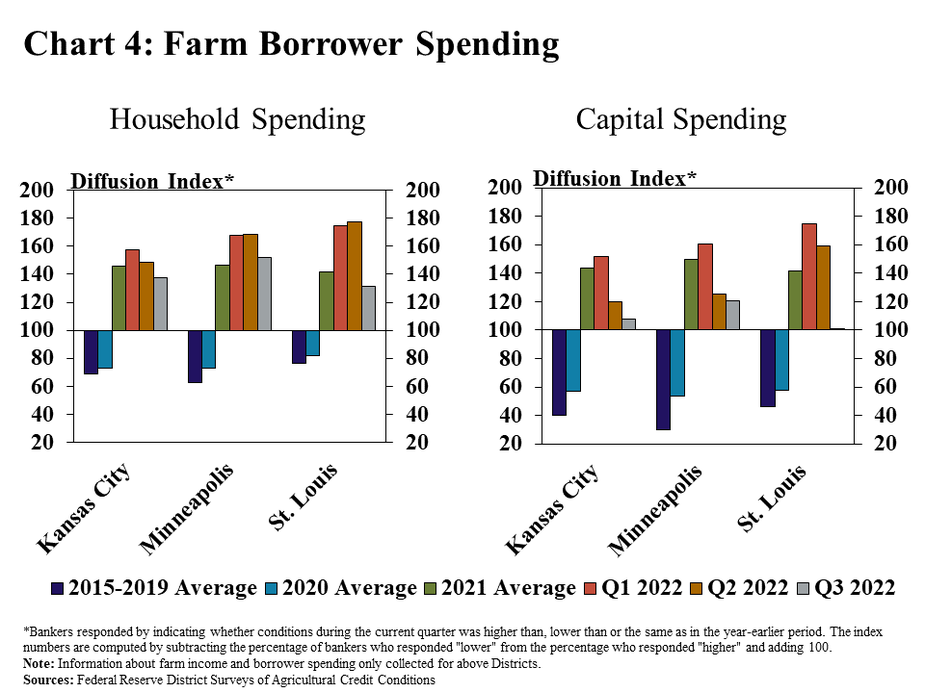

Interest rates on farm loans increased sharply in the third quarter. Despite the higher borrowing costs, farm real estate values continued to increase, but the acceleration eased somewhat. Following consistently higher increases earlier in 2022, the value of farmland in most Districts grew at a slightly slower pace in the third quarter. Farm income and credit conditions also remained strong, but improvement was more limited. With higher production expenses, broad inflation and an uptick in financing costs, growth in household spending by farm borrowers began to outpace capital spending more noticeably.

Strength in farm finances continued to support a generally positive outlook for agricultural credit conditions through the remainder of 2022, but some pressures have continued to intensify. Volatility in crop markets, higher expenses and drought are key risks, but profit opportunities remained favorable alongside strong commodity prices. Despite more measured improvement in recent quarters, farm finances remained solid following especially strong incomes across the sector the past two years.

Third Quarter Federal Reserve District Ag Credit Surveys

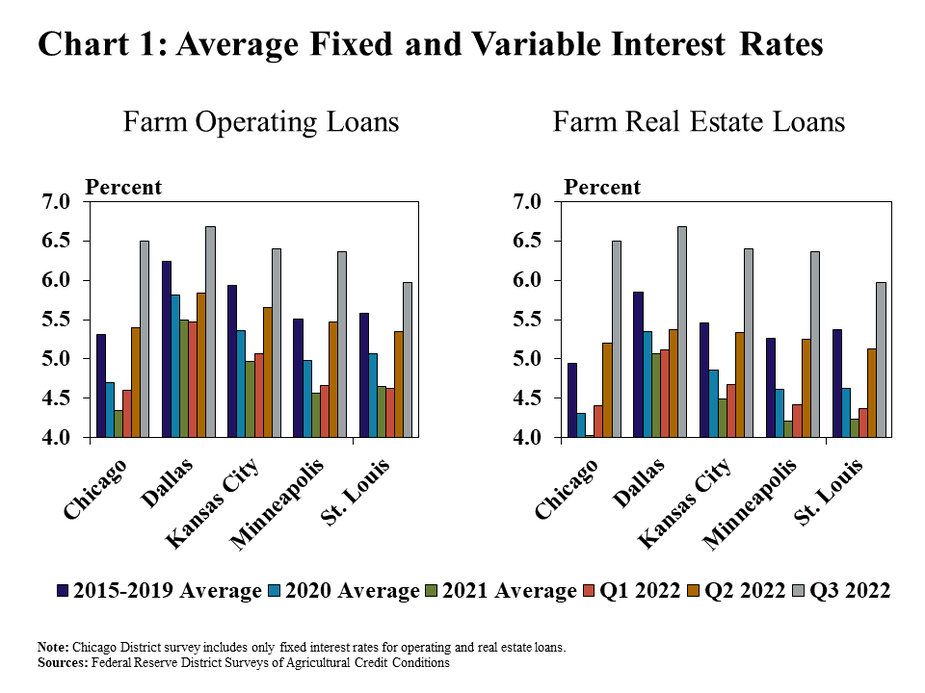

Farm loan interest rates rose rapidly in the third quarter alongside increases in benchmark interest rates. The typical rate charged on farm operating and real estate loans across all Districts administering a survey of ag credit conditions increased by an average of 85 and 110 basis points from last quarter, respectively (Chart 1). The quick rise pushed financing rates above the average from 2015-2019 in all regions.

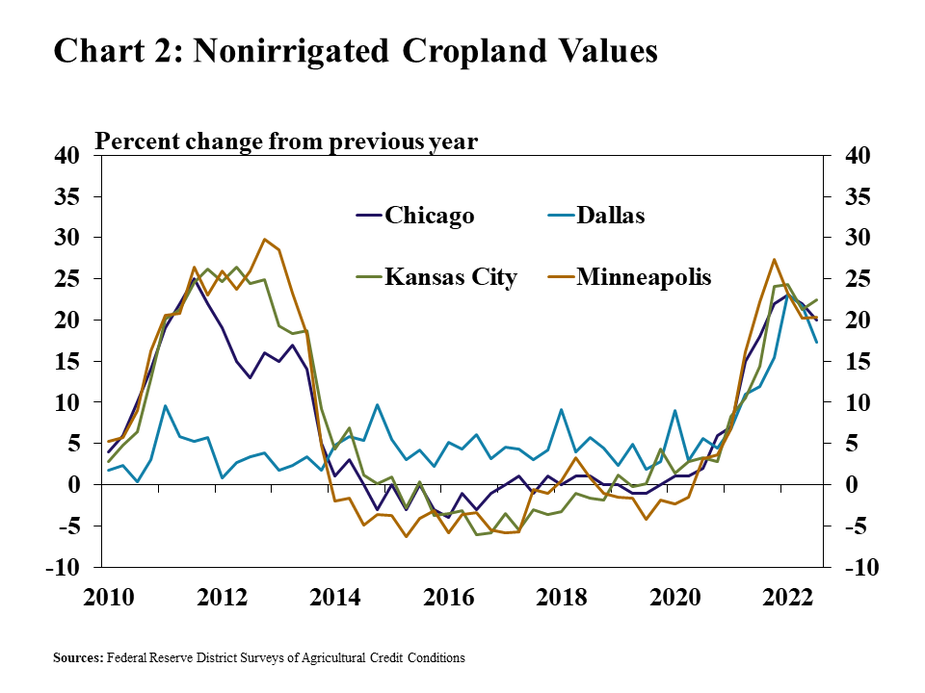

Farmland values increased further in the third quarter despite the recent increases in interest rates, but at a slower pace than the rapid gains a year ago. The value of nonirrigated cropland was an average of 20% higher than the same time a year ago across all Districts, which was the slowest pace of growth since early 2021 (Chart 2). Demand for farmland has remained strong alongside broad strength in the farm economy, but the acceleration in values over the past year has shown signs of easing in recent quarters.

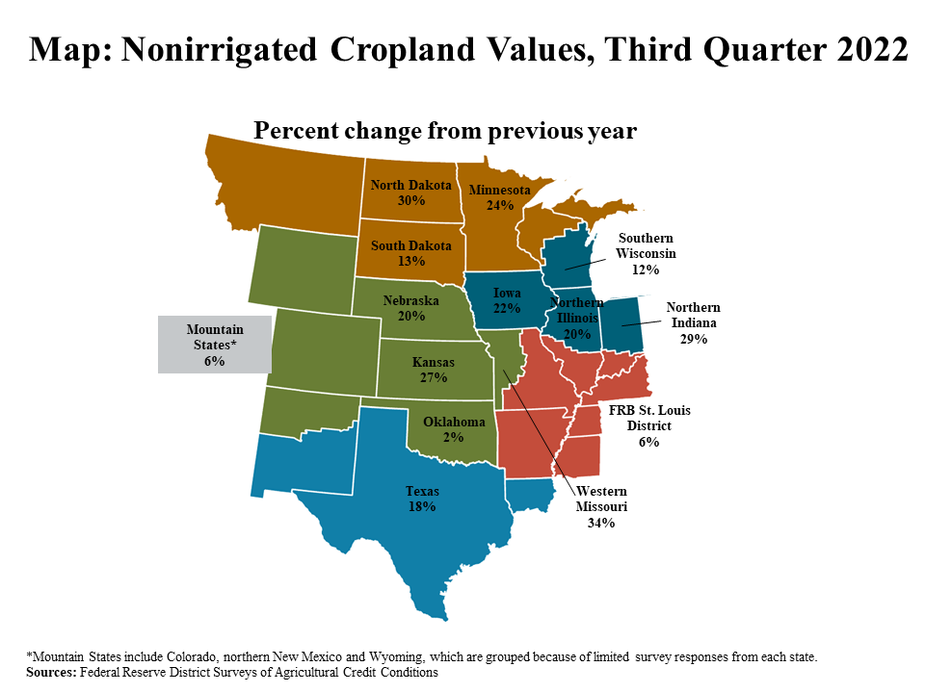

The rise in farmland values over the past year has been notable across nearly all states. The value of nonirrigated cropland grew by at least 20% in the majority of states, but increased at a comparatively slower rate in some areas (Map). Gains were generally highest in areas with the highest quality farmland, while values in Oklahoma increased only slightly as conditions in the state have diverged from most others.

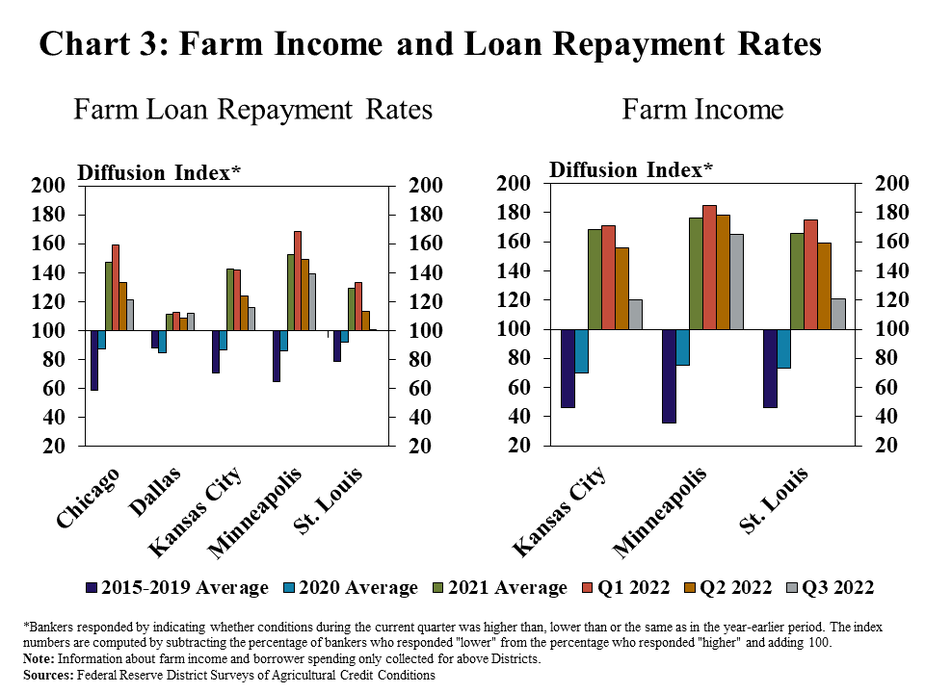

Credit conditions remained strong, but the pace of improvement has slowed alongside sharp increases in interest rates and a rise in production expenses. Farm loan repayment rates increased at the slowest pace since early 2020 in all Districts except Dallas (Chart 3). Similarly, the pace of increase in farm income also was the slowest in two years in all reporting Districts.

Household spending rose more steadily than capital spending alongside broad inflationary pressures and higher financing costs. The pace of increase in household spending across participating Districts was only modestly slower than the average over the past year (Chart 4, left panel). In contrast, the pace of increase in capital spending slowed notably from recent quarters (Chart 4, right panel).

Data and Information

Federal Reserve Ag Credit Surveys Historical Data

Federal Reserve Ag Credit Surveys Tables

About the Federal Reserve Ag Credit Surveys

The views expressed are those of the authors and do not necessarily reflect the positions of the Federal Reserve Bank of Kansas City or the Federal Reserve System.