Credit conditions in the Federal Reserve’s Tenth District weakened as farm income declined further in the first quarter of 2015. Persistently low crop prices and high input costs reduced profit margins and increased concerns about future loan repayment capacity. Funds were available to meet historically high loan demand, but loan repayment rates dropped considerably. Although profit margins in the livestock industry have remained stable, most bankers do not expect farm income or credit conditions to improve in the next three months. Reduced incomes in the crop sector trimmed the value of nonirrigated and irrigated cropland, but steady profitability in the cattle sector supported higher prices for ranchland.

Farm Income

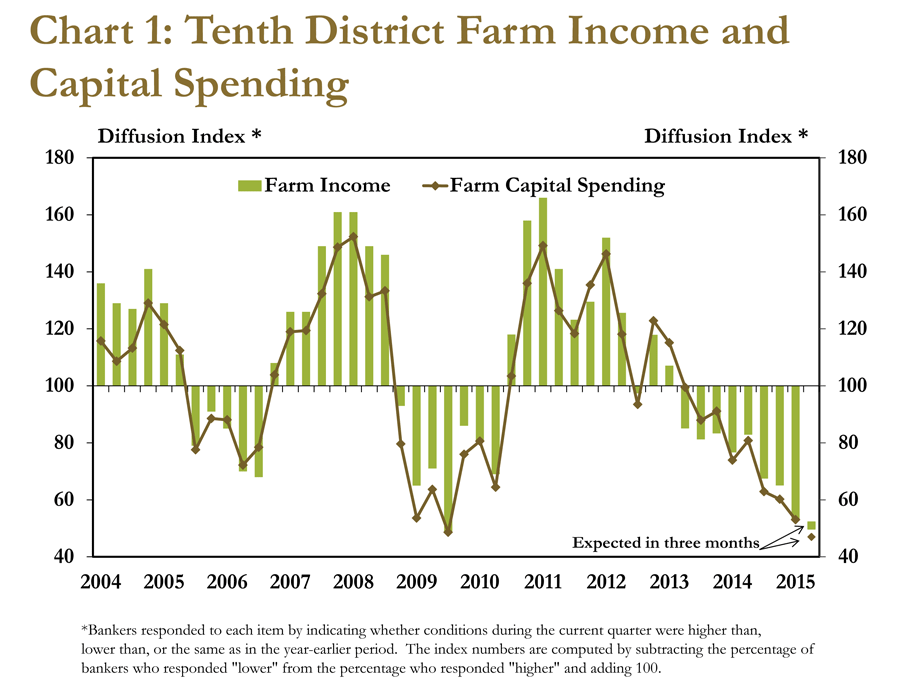

Farm income continued to decline in the first quarter of 2015 (Chart 1). Reduced supplies from winter wheat kill and persistently low crop prices have tightened revenues for crop producers. Despite poor winter wheat conditions in parts of the Tenth District that may limit production, wheat prices have remained around 30 percent less than a year ago. Similarly, as of the end of April, corn prices were about 27 percent less than the previous year. Moreover, since July 2014, the monthly average price of corn has been less than $4.00 per bushel, generally below what some bankers noted is the breakeven cost of production for corn producers. Although many livestock operators have profited from lower feed grain costs, crop production costs have remained relatively high.

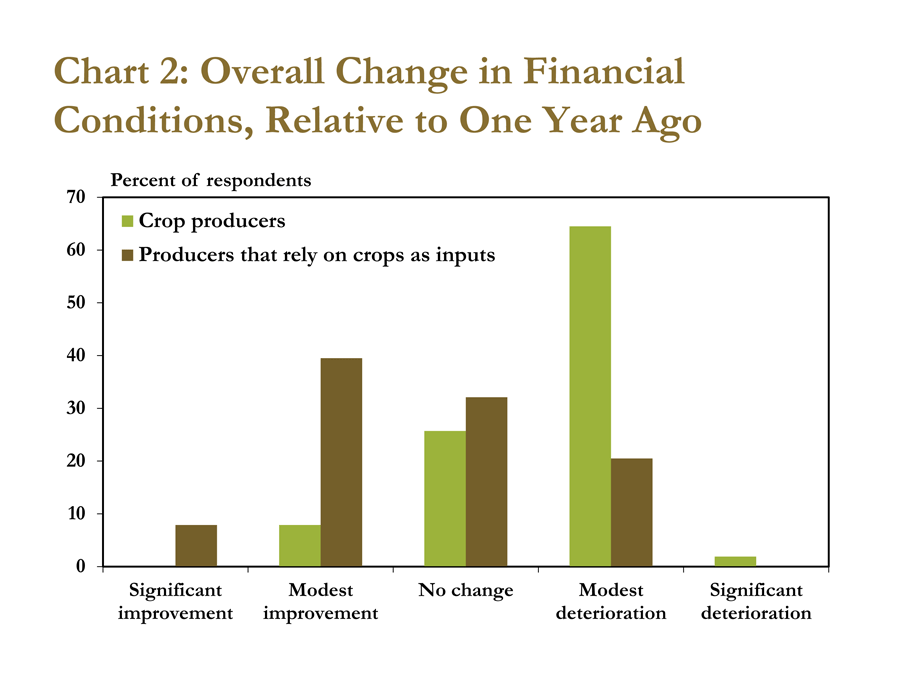

Weaker profit margins and reduced cash flows caused financial conditions to weaken for many crop producers in the District. In fact, more than 60 percent of survey respondents reported a modest deterioration from a year ago in the financial conditions of crop producers (Chart 2). In contrast, nearly half of respondents indicated that financial conditions have improved over the past year for borrowers that rely on crops as inputs, such as cattle, hog, poultry and dairy producers.

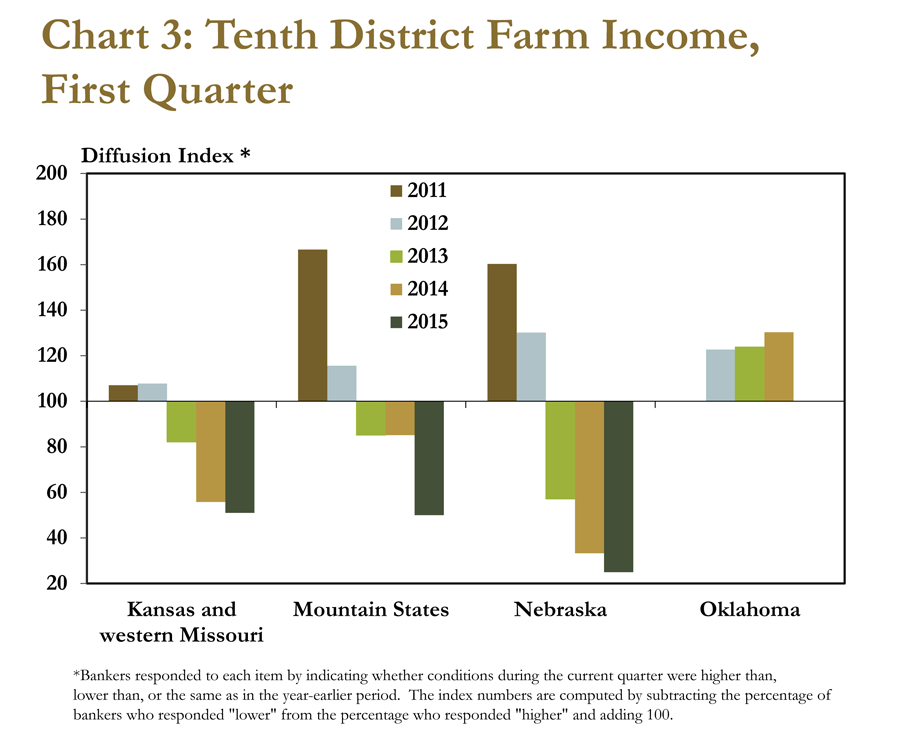

On a more regional level, farm income declined in all District states except Oklahoma. In Oklahoma, farm income has steadily improved over the last three years due to revenue from mineral rights and cattle production but remained unchanged in the first quarter of 2015 (Chart 3). Although farm income held steady in Oklahoma, a greater portion of agricultural lenders reported farm income was lower than a year ago in Kansas, western Missouri, Nebraska and the Mountain States (Colorado, northern New Mexico and Wyoming).

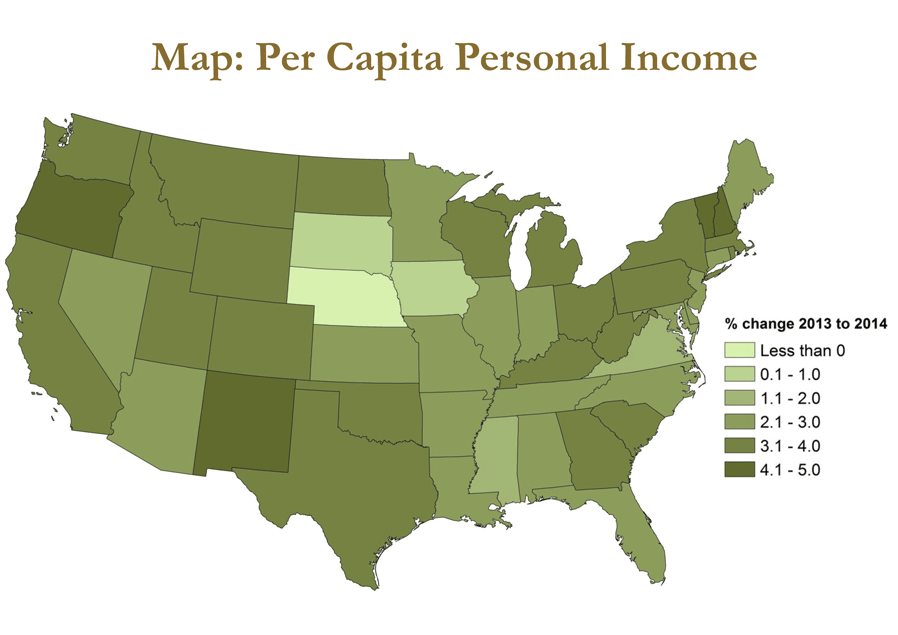

Strains on the farm economy have begun to affect the overall economic outlook in some states. Through 2014, growth in per capita personal income was notably smaller in states most heavily concentrated in crop production (Map). For example, per capita personal income expanded less than 1.0 percent in Iowa and South Dakota and declined slightly in Nebraska. These growth rates were significantly weaker than the national average of 3.9 percent from 2013 to 2014. Ninety-four percent of survey respondents expect farm income to remain the same or decline further in the next three months. Additional declines in farm income could continue to create economic challenges in states heavily dependent on crops.

Farm Loan Demand and Credit Conditions

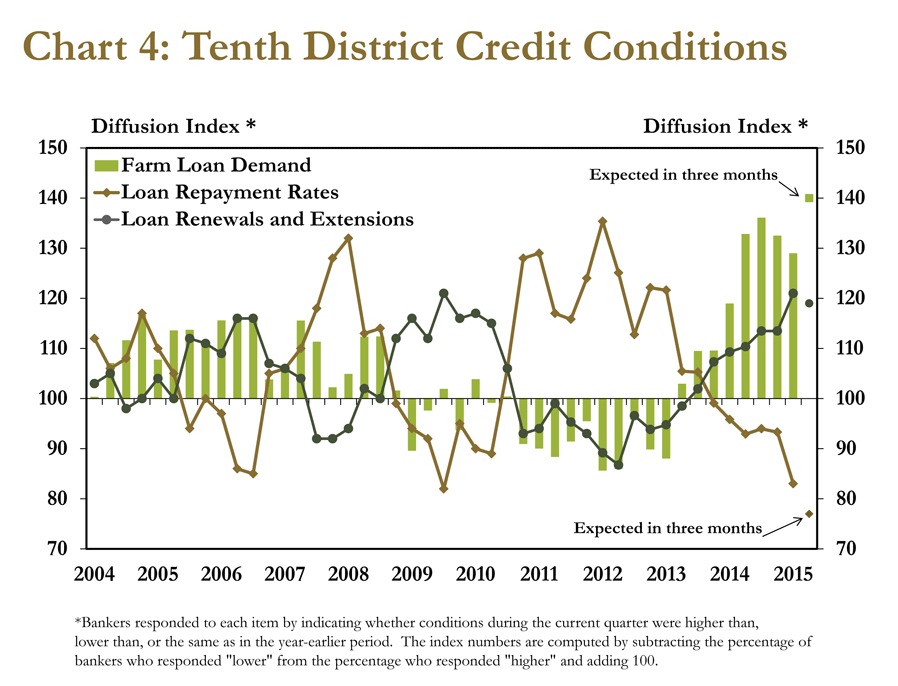

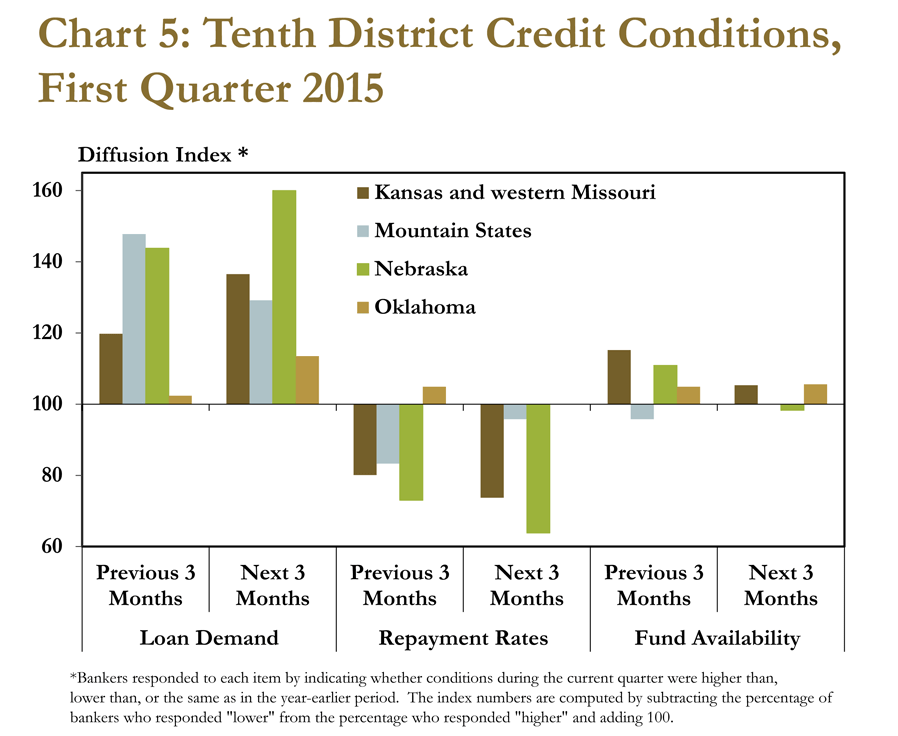

The continued decline in farm income boosted demand for new loans as well as renewals and extensions on existing loans (Chart 4). During years of historically high farm income, some farmers were able to self-finance. However, as working capital has declined due to high production costs and lower crop revenues, more producers have needed external financing to pay for operating expenses and capital purchases. Loan demand was also supported by livestock loans on feeder cattle, which still command historically high prices. In fact, demand for non-real estate farm loans increased across all District states in the first quarter and is expected to remain elevated over the next three months (Chart 5). If expectations are met, the survey measure of loan demand would be the highest since the survey began in 1980.

Alongside reduced farm income and higher loan demand, loan repayment rates have declined significantly. More than 26 percent of survey respondents reported that loan repayment rates declined in the first quarter of 2015, compared to 17 percent in the previous quarter. Moreover, the expectation for loan repayment rates in the next three months was the lowest since 2003, and, if expectations hold, could be the first time in several years that repayment rates decline in all District states.

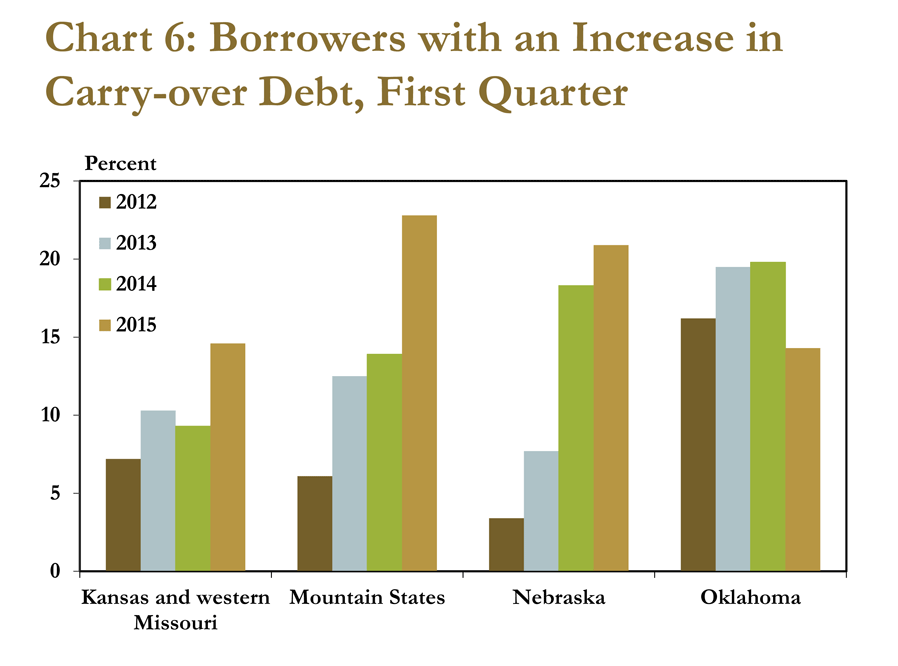

The deterioration in loan repayment rates has not yet affected fund availability, which increased slightly in the first quarter. Of banks responding to the survey, 98.8 percent indicated that no loans were reduced or refused due to a shortage of funds. Still, collateral requirements remained the same or increased slightly for most farm loans throughout the District due to concerns over reduced working capital and annual increases in carry-over debt (Chart 6). Bankers also expressed concerns over increased debt-to-asset ratios, especially for younger farmers with high borrowing needs.

Farmland Values

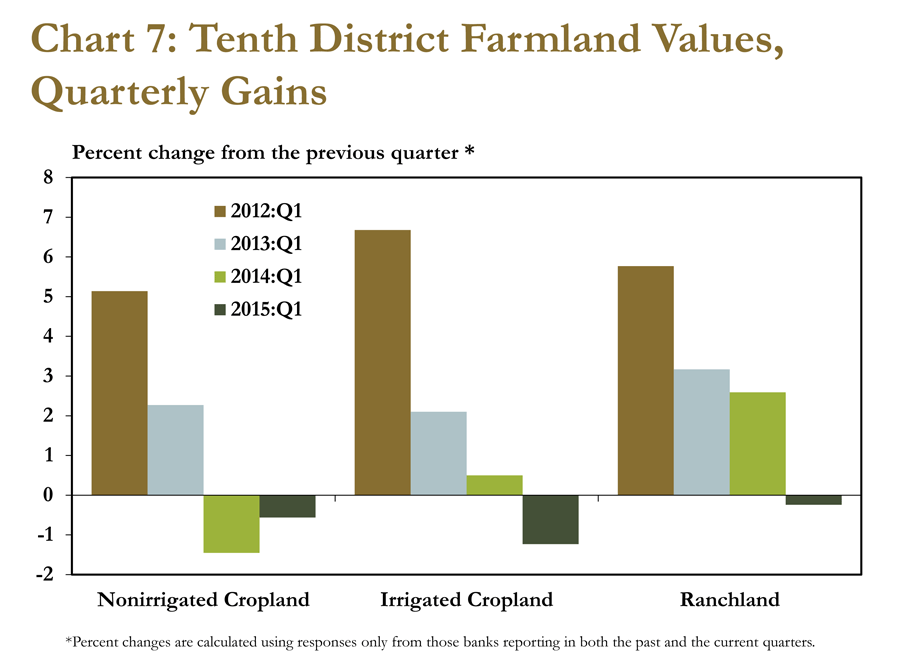

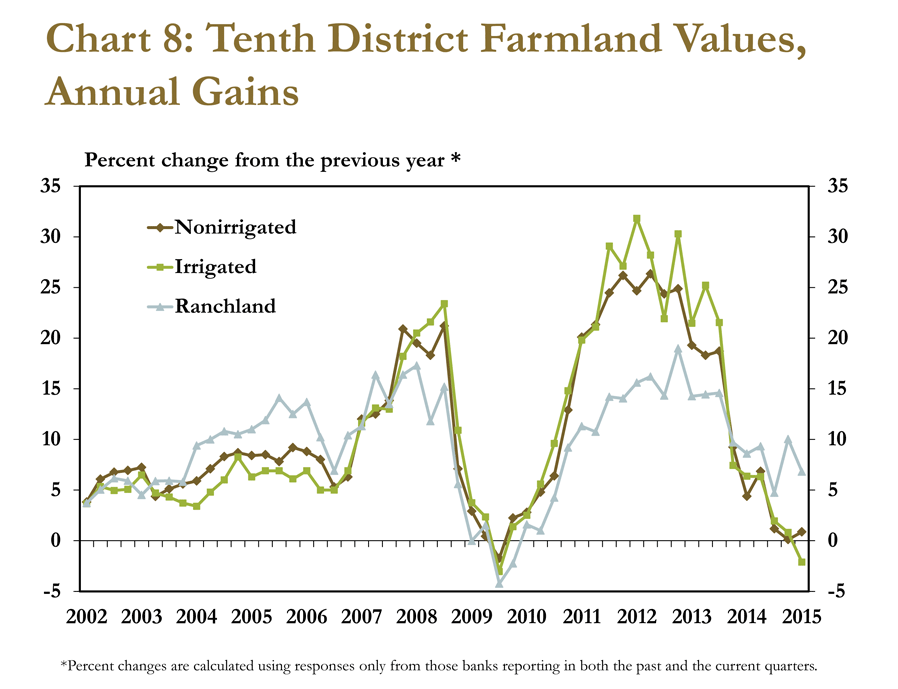

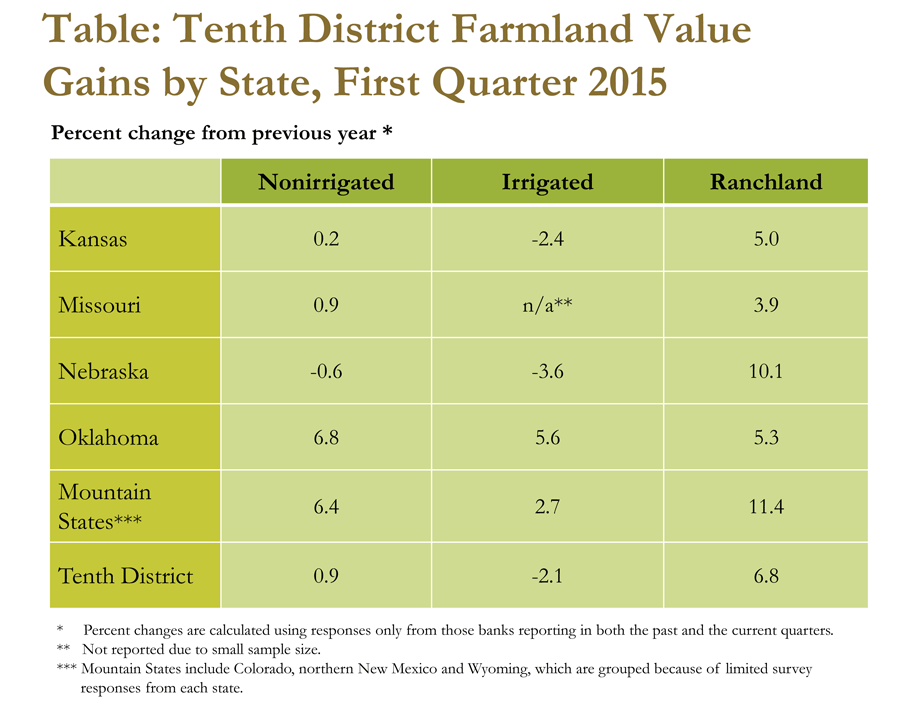

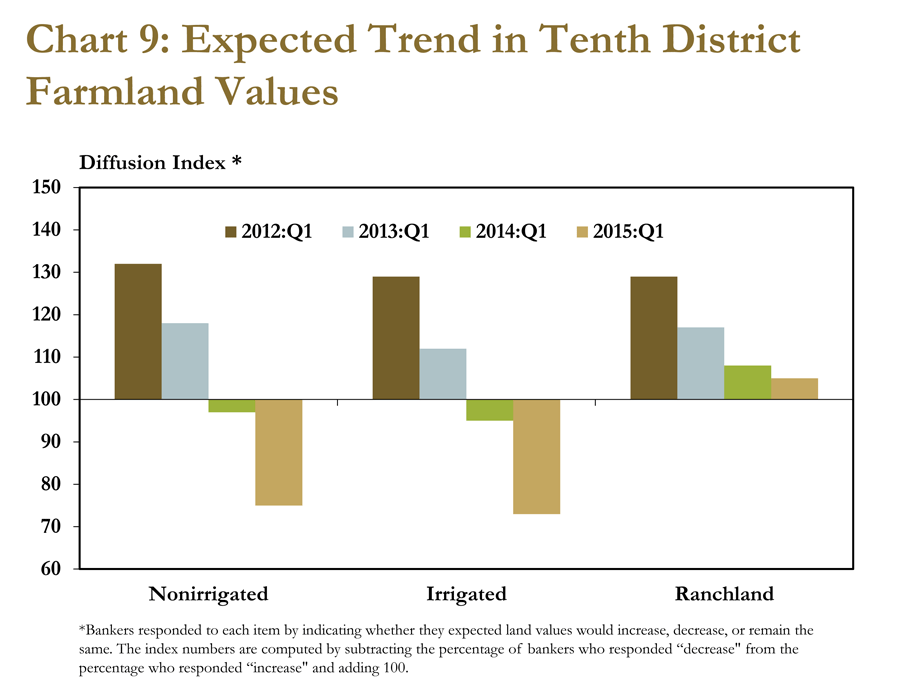

Amid further declines in farm income, bankers reported that Tenth District cropland values edged down in the first quarter (Chart 7). In fact, irrigated cropland values declined in the first quarter, falling slightly below year-ago levels for the first time in more than five years (Chart 8). The value of nonirrigated cropland also declined, but was holding just above year-ago levels. Similar to previous surveys, Nebraska posted some of the largest price declines while cropland values in Oklahoma and the Mountain States remained the most resilient (Table). Looking ahead, very few bankers expect price appreciation and more than a quarter of survey respondents expect cropland values to decline further in the next three months (Chart 9). Still, a majority of bankers anticipates that cropland values will hold steady, partly due to a limited supply of farms for sale.

Tenth District ranchland values generally held firm in the first quarter of 2015 and year-over-year gains remained strong. In contrast to the crop sector, where lower incomes were starting to place downward pressure on cropland values, bankers reported profits in the cattle sector were continuing to support high ranchland values. Ranchland in Nebraska and the Mountain States appreciated the most during the past year with somewhat smaller gains reported in Kansas and Oklahoma, due in part to dry pasture conditions. Looking ahead, bankers expect continued strength in the cattle sector and increasing cattle inventories will sustain demand, and prices, for ranchland.

Conclusion

Low crop prices placed added stress on net farm incomes and contributed to weaker credit conditions in the first quarter. As farm incomes fell, cropland values moderated and more producers depended on financing to cover operating expenses. Sufficient funds were available to meet increases in loan demand, but declines in repayment rates as well as slight increases in carry-over debt, collateral requirements and loan renewals and extensions suggest that credit quality may become more of a concern moving forward.