New small business commercial and industrial (C&I) lending_ continued to decline in the second quarter, decreasing 16.8 percent from the same period in 2022 and 1.2 percent from the previous quarter. Respondents reported declining loan demand for the fifth consecutive quarter, with the largest percentage of respondents reporting a decrease since the survey began. The 141 respondents to the survey indicated that credit standards tightened while credit quality continued to decrease, and interest rates generally rose, consistent with the current rate environment. Most respondents indicated that lending to small businesses was unconstrained by available liquidity.

Chart 1: Small Business Loan Balances Remained Steady Quarter-Over-Quarter

Skip to data visualization tableNote: Items are calculated using a subset of 103 respondents that completed the FR 2028D for the last five quarters surveyed.

Sources: Call Report, Schedule RC-C Part I, items 4. Commercial and Industrial Loans and 12. Total Loans and Leases Held for Investment and Held for Sale, Small Business Administration, and FR 2028D, items 4.b and 5.c.

| Quarter-Over-Quarter | Total Loans | C&I Loans | Small Business C&I Loans |

|---|---|---|---|

| 2022:Q3 | 1.49 | 2.01 | -4.11 |

| 2022:Q4 | 1.03 | 1.86 | 1.36 |

| 2023:Q1 | 2.34 | 2.76 | 1.07 |

| 2023:Q2 | 1.52 | -0.73 | -0.02 |

| Year-Over-Year 2023:Q2 | 6.54 | 5.98 | -1.79 |

Quarter-over-quarter, small business loans remained relatively flat. C&I loan balances decreased by 0.7 percent, while total loan balances increased by 1.5 percent. When compared to the second quarter of 2022, small business C&I loan balances decreased by 1.8 percent. This decline is consistent with weaker loan demand and tightening credit standards reported by survey respondents. Despite the year-over-year decrease in small business loans, total loans and total C&I loans increased 6.5 percent and 6 percent, respectively.

Chart 2: New Small Business Lending Declines

Skip to data visualization tableNote: Items are calculated using a subset of 103 respondents that completed the FR 2028D for the last five quarters surveyed. All loan types referenced in Chart 2 refer to small business lending.

Source: FR 2028D, items 7.b and 8.c.

| Quarter-Over-Quarter | Total New C&I Loans | New C&I Term Loans | New C&I Credit Lines |

|---|---|---|---|

| 2022:Q3 | -12.64 | -9.63 | -17.53 |

| 2022:Q4 | 3.30 | -1.60 | 12.04 |

| 2023:Q1 | -6.73 | -7.66 | -5.28 |

| 2023:Q2 | -1.17 | -1.07 | -1.31 |

| Year-Over-Year 2023:Q2 | -16.81 | -18.77 | -13.62 |

Compared to second quarter 2022, total small business loan balances decreased 16.8 percent, driven by an 18.8 percent decrease in term loans and a 13.6 percent decrease in lines of credit. The year-over-year decline in small business lending is consistent with the rising rate environment, weaker loan demand and tightening credit standards reported by survey respondents.

Chart 3: Fixed Rate Credit Line Usage Increases

Skip to data visualization tableSource: FR 2028D, items 5.b and 5.c.

| Quarter | Total | Fixed Rate | Variable Rate |

|---|---|---|---|

| 2017:Q4 | 38.28 | 36.33 | 38.44 |

| 2018:Q1 | 38.79 | 29.62 | 39.87 |

| 2018:Q2 | 38.84 | 35.07 | 39.20 |

| 2018:Q3 | 37.91 | 39.85 | 37.71 |

| 2018:Q4 | 40.76 | 43.25 | 40.49 |

| 2019:Q1 | 41.05 | 43.66 | 40.77 |

| 2019:Q2 | 39.71 | 41.38 | 39.53 |

| 2019:Q3 | 39.43 | 37.56 | 39.66 |

| 2019:Q4 | 39.73 | 37.15 | 40.04 |

| 2020:Q1 | 39.98 | 36.42 | 40.34 |

| 2020:Q2 | 35.26 | 37.69 | 34.99 |

| 2020:Q3 | 33.46 | 40.64 | 32.66 |

| 2020:Q4 | 32.20 | 40.72 | 31.33 |

| 2021:Q1 | 30.83 | 38.20 | 30.16 |

| 2021:Q2 | 30.77 | 39.17 | 29.97 |

| 2021:Q3 | 32.00 | 44.04 | 30.94 |

| 2021:Q4 | 31.56 | 41.86 | 30.71 |

| 2022:Q1 | 31.79 | 41.35 | 31.00 |

| 2022:Q2 | 32.08 | 36.64 | 31.63 |

| 2022:Q3 | 31.70 | 37.28 | 31.11 |

| 2022:Q4 | 32.49 | 39.80 | 31.63 |

| 2023:Q1 | 32.37 | 40.43 | 31.54 |

| 2023:Q2 | 32.86 | 47.29 | 31.64 |

Use of fixed rate lines of credit increased from 40 percent in the first quarter to approximately 47 percent in the second quarter, driven by large bank activity_. This is the largest increase in fixed rate usage since the inception of the survey; however, fixed rate lines only accounted for 8 percent of total credit lines. Total credit line usage remained stable in the second quarter at 33 percent and was consistent with the previous seven quarters’ responses.

Chart 4: Rates Increase on New Term Loans

Skip to data visualization tableNote: Items are calculated using a subset of 103 respondents that completed the FR 2028D for the last five quarters surveyed.

Source: FR 2028D, item 7.c.

| Quarter | Rural Fixed New Term Loans | Rural Variable New Term Loans | Urban Fixed New Term Loans | Urban Variable New Term Loans |

|---|---|---|---|---|

| 2022:Q2 | 4.60 | 5.06 | 4.83 | 5.30 |

| 2022:Q3 | 5.65 | 6.24 | 5.58 | 6.45 |

| 2022:Q4 | 6.70 | 7.30 | 6.37 | 7.65 |

| 2023:Q1 | 7.37 | 7.63 | 6.93 | 8.00 |

| 2023:Q2 | 7.77 | 8.25 | 7.31 | 8.72 |

Median interest rates increased for new small business term loans in the second quarter 2023. The highest reported rates were for variable rates offered at urban banks which were reported as 8.7 percent, about a 72-basis point increase from the first quarter 2023. The lowest reported rates were for fixed rates offered at urban banks, which were reported as 7.3 percent._

Chart 5: Rates Increase on New Lines of Credit

Skip to data visualization tableNote: Items are calculated using a subset of 103 respondents that completed the FR 2028D for the last five quarters surveyed.

Source: FR 2028D, item 8.d.

| Quarter | Rural Fixed New LOC | Rural Variable New LOC | Urban Fixed New LOC | Urban Variable New LOC |

|---|---|---|---|---|

| 2022:Q2 | 4.70 | 5.77 | 4.50 | 5.55 |

| 2022:Q3 | 5.64 | 6.78 | 5.46 | 6.84 |

| 2022:Q4 | 7.34 | 7.97 | 6.34 | 8.29 |

| 2023:Q1 | 7.50 | 8.37 | 6.59 | 8.61 |

| 2023:Q2 | 7.44 | 9.04 | 7.08 | 8.92 |

Median interest rates on new small business lines of credit increased in the second quarter 2023, which is consistent with the increase of 58 basis points for the three-month Treasury rate in the same period. The highest were variable rates offered at rural banks, which were reported as 9.0 percent, about a 67-basis point increase from the first quarter 2023. The lowest were fixed rates offered at urban banks which were reported as 7.1 percent.

Chart 6: New Loans with Interest Rate (IR) Floors Increase

Skip to data visualization tableSources: FR 2028D, items 7.a, 7.f, 8.a, 8.e and Federal Reserve Bank of St. Louis, 3-Month Treasury Constant Maturity Rate.

| Quarter | Percent of Loan Balances with IR Floor | Three-Month Treasury Rate |

|---|---|---|

| 2017:Q4 | 8.07 | 1.21 |

| 2018:Q1 | 6.22 | 1.56 |

| 2018:Q2 | 8.86 | 1.84 |

| 2018:Q3 | 9.43 | 2.04 |

| 2018:Q4 | 8.64 | 2.32 |

| 2019:Q1 | 7.98 | 2.39 |

| 2019:Q2 | 8.15 | 2.30 |

| 2019:Q3 | 8.58 | 1.98 |

| 2019:Q4 | 8.80 | 1.58 |

| 2020:Q1 | 8.00 | 1.11 |

| 2020:Q2 | 9.82 | 0.14 |

| 2020:Q3 | 8.60 | 0.11 |

| 2020:Q4 | 8.39 | 0.09 |

| 2021:Q1 | 5.47 | 0.05 |

| 2021:Q2 | 5.85 | 0.03 |

| 2021:Q3 | 5.67 | 0.04 |

| 2021:Q4 | 5.85 | 0.06 |

| 2022:Q1 | 5.01 | 0.52 |

| 2022:Q2 | 4.87 | 1.72 |

| 2022:Q3 | 5.04 | 3.33 |

| 2022:Q4 | 5.14 | 4.42 |

| 2023:Q1 | 5.02 | 4.85 |

| 2023:Q2 | 5.77 | 5.43 |

The three-month Treasury rate increased by 58 basis points in second quarter 2023, and the percentage of new variable-rate loans with interest rate floors increased slightly from 5 to 5.8 percent, representing the highest quarter-over-quarter increase since second quarter 2020.

Chart 7: Large and Midsized Banks Report Increase in Credit Line Usage

Note: Chart 7 shows diffusion indexes for credit line usage. The diffusion indexes show the difference between the percent of banks reporting decreased credit line usage and those reporting increased credit line usage. Net percent refers to the percent of banks that reported having decreased (“decreased somewhat” or “decreased substantially”) minus the percent of banks that reported having increased (“increased somewhat” or “increased substantially”). _

Source: FR 2028D, items 11 and 12.

In the second quarter, 32 percent of respondents reported a change in credit line usage, with 8 percent of respondents, on net, indicating that credit line usage increased. On net, about 5 percent of large banks and 4 percent of midsized banks reported an increase, while 1 percent of small banks reported a decrease.

Of the banks reporting an increase, 44 percent cited changes in local or national economic conditions as a very important reason, while 33 percent cited changes in borrower’s business revenue or other business specific reasons. Of the banks reporting a decrease, 59 percent cited changes in pricing (rates, fees, etc.).

The reported increase in credit line usage is consistent with a shift to increased debt financing observed in other key indicators such as elevated consumer credit card debt. _ Total household credit card debt surpassed $1 trillion for the first time last quarter._

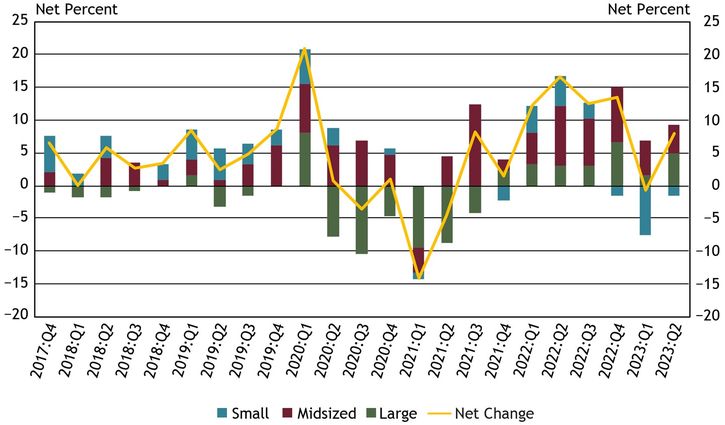

Chart 8: Respondents Report Declines in Loan Demand for Fifth Consecutive Quarter

Note: Chart 8 shows diffusion indexes for loan demand. The diffusion indexes show the difference between the percent of banks reporting weakened loan demand and those reporting stronger loan demand. Net percent refers to the percent of banks that reported having weakened (“moderately weaker” or “substantially weaker”) minus the percent of banks that reported having stronger loan demand (“moderately stronger” or “substantially stronger”).

Source: FR 2028D, item 13.

About 49 percent of respondents reported a change in small business loan demand in the second quarter of 2023, a decrease of 3 percent from the first quarter. This marks the fifth straight quarter of respondents reporting a net decline in loan demand. On net, about 24 percent of respondents indicated weaker loan demand across all bank sizes. Three of the last four quarters represented new record declines since the survey began in 2017.

The timing of softer loan demand aligns with the Federal Reserve’s monetary policy tightening since mid-2022. It is also consistent with the External LinkJuly 2023 Federal Reserve Senior Loan Officer Opinion Survey (SLOOS), where about 54 percent of respondents reported weaker C&I loan demand from small firms (annual sales of less than $50 million) over the prior three months.

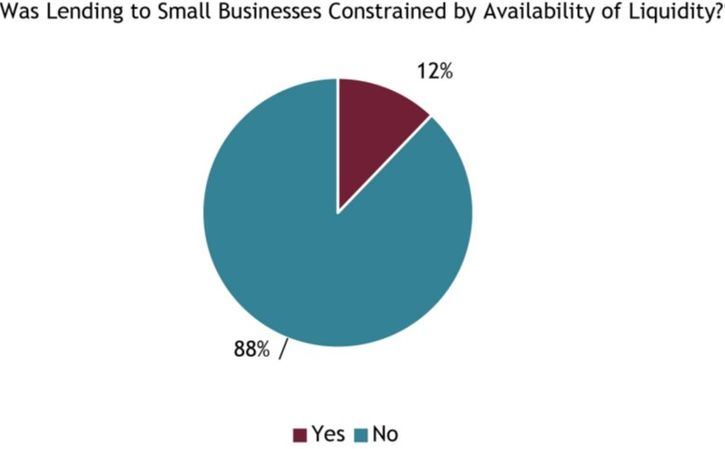

Chart 9: Most Respondents Indicate Lending Not Constrained by Availability of Liquidity

Source: FR 2028D, Special Question.

About 88 percent of respondents indicated their lending to small businesses was not constrained by the availability of liquidity in the market. This is a decline of about 2 percent from the first quarter of 2023. About 17 percent of small banks reported lending was constrained by the availability of liquidity, with about 11 and 10 percent of midsized and large banks, respectively, reporting constraints. For the respondents who indicated lending was constrained, the most cited reason was greater competitive pressures for deposits (93 percent).

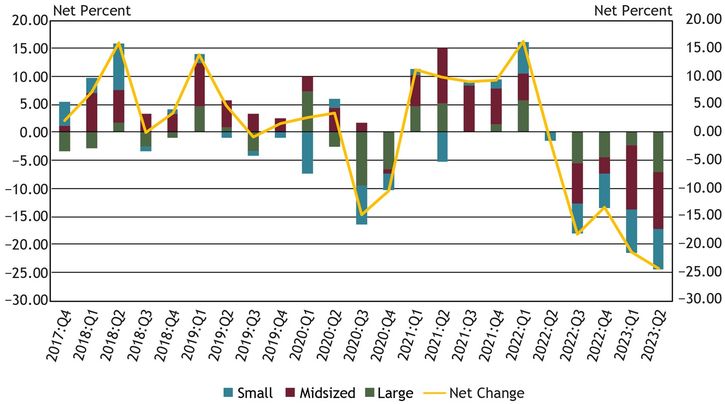

Chart 10: Overall Credit Quality Continues to Decline

Note: Chart 10 shows diffusion indexes for credit quality of applicants. The diffusion indexes show the difference between the percent of banks reporting a decline in credit quality and those reporting improvement in credit quality. Net percent refers to the percent of banks that reported declining credit quality (“declined somewhat” or “declined substantially”) minus the percent of banks that reported improving credit quality (“improved somewhat” or “improved substantially”).

Source: FR 2028D, items 20 and 21.

About 16 percent of survey respondents, on net, reported a decrease in applicant credit quality. This is the fifth consecutive period in which respondents of all bank sizes, on net, reported a decrease. Of the respondents reporting a change in credit quality, whether an increase or decrease, 55 percent cited the liquidity position of business borrowers as a very important reason for a change. Other commonly cited reasons for a change include credit scores, debt-to-income level of business owners, quality of business collateral and recent business income growth. The decrease in applicant credit quality reported by firms is consistent with the negative outlook of loan availability reported by small businesses in the External LinkJune 2023 NFIB Survey of Loan Availability.

Chart 11: Application Approval Rates Decline

Skip to data visualization tableSource: FR 2028D, items 14.a and 15.

| Quarter | Small | Midsized | Large |

|---|---|---|---|

| 2017:Q4 | 88.14 | 75.33 | 51.07 |

| 2018:Q1 | 87.00 | 86.15 | 56.78 |

| 2018:Q2 | 86.32 | 80.90 | 48.71 |

| 2018:Q3 | 85.07 | 85.50 | 52.83 |

| 2018:Q4 | 82.91 | 85.18 | 55.04 |

| 2019:Q1 | 89.81 | 86.15 | 55.12 |

| 2019:Q2 | 89.68 | 81.50 | 55.45 |

| 2019:Q3 | 79.00 | 80.93 | 54.01 |

| 2019:Q4 | 86.87 | 76.18 | 53.58 |

| 2020:Q1 | 87.44 | 75.45 | 51.93 |

| 2020:Q2 | 87.98 | 95.12 | 74.54 |

| 2020:Q3 | 86.52 | 89.81 | 38.33 |

| 2020:Q4 | 89.52 | 79.64 | 45.56 |

| 2021:Q1 | 89.73 | 88.23 | 51.24 |

| 2021:Q2 | 93.50 | 89.83 | 46.85 |

| 2021:Q3 | 71.20 | 85.20 | 49.78 |

| 2021:Q4 | 81.00 | 87.23 | 50.50 |

| 2022:Q1 | 83.15 | 77.35 | 51.31 |

| 2022:Q2 | 83.25 | 80.43 | 51.83 |

| 2022:Q3 | 86.77 | 86.50 | 48.34 |

| 2022:Q4 | 86.38 | 68.93 | 47.82 |

| 2023:Q1 | 86.96 | 67.96 | 49.66 |

| 2023:Q2 | 84.46 | 67.44 | 48.42 |

Overall application approval rates slightly declined. The most cited reason for denying a loan was borrower financials (66 percent). Other commonly cited reasons were credit history and collateral.

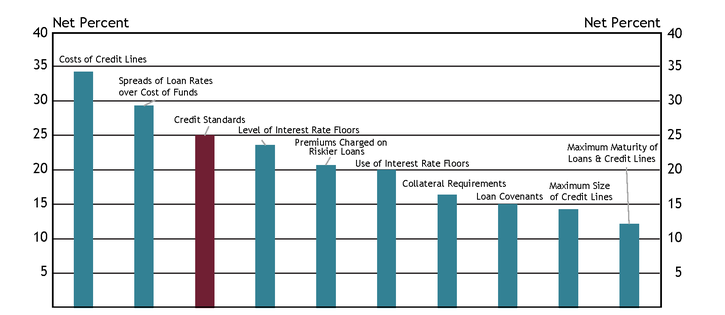

Chart 12: Respondents Reported Tightening Credit Standards for the Seventh Consecutive Quarter

Note: Chart 12 shows diffusion indexes for credit standards (red bar) and various loan terms. The diffusion indexes show the difference between the percent of banks reporting tightening terms and those reporting easing terms. Net percent refers to the percent of banks that reported having tightened (“tightened somewhat” or “tightened considerably”) minus the percent of banks that reported having eased (“eased somewhat” or “eased considerably”).

Source: FR 2028D, items 16, 17, 18 and 19.

About 28 percent of respondents reported a change in credit standards in the second quarter, down from 36 percent in the first quarter. Of those indicating a change in credit standards, 25 percent, on net, reported tightening credit standards (red bar). This is the seventh consecutive quarter that respondents have reported tightening credit standards and is consistent with the tightening credit standards reported on the External LinkJuly 2023 Senior Loan Officer Opinion Survey on Bank Lending Practices.

On net, respondents indicated that all loan terms tightened with the cost of credit lines and the spreads of loan rates over cost of funds tightening the most. About 87 percent of respondents cited less favorable or more uncertain economic outlook as a somewhat important or very important reason for tightening. Other commonly cited reasons were worsening of industry-specific problems and reduced tolerance for risk.

Other contributors to the release include Lauren Bennett, Nicholas Bloom, Thomas Hobson, Alli Jakubek, Stefan Jacewitz, Emily Robinson, and Tony Walker.

Endnotes

-

1

Small business lending refers to commercial and industrial lending to organizations generally defined as having less than five million in gross annual revenue, unless otherwise noted.

-

2

Large banks have total assets greater than $10 billion.

-

3

Urban and rural classification is determined exclusively by the bank’s head office location and US Census Population data.

-

4

Small banks have total assets of $1 billion or less, midsized banks have total assets between $1 billion and $10 billion and large banks have total assets greater than $10 billion.

-

5

Source: FRED, Consumer Loans: Credit Cards and Other Revolving Plans.

-

6

Source: FRBNY Consumer Credit Panel/Equifax