In June 2018, the Supreme Court found that American Express (Amex) Company’s anti-steering rules did not violate federal antitrust law. This was the first antitrust case decided by the Supreme Court to involve a two-sided platform—that is, a platform that creates value for two distinct groups of end users by facilitating interactions between them.

The Supreme Court’s competitive analysis and decision in the case sparked considerable debate among antitrust scholars as to how courts should conduct economic analysis in antitrust cases involving two-sided platforms. This Payments System Research Briefing provides an overview of the Supreme Court’s decision, scholars’ reactions to how the court defined the relevant market and determined anticompetitive effects, and potential implications of the decision for future antitrust cases involving payment networks.

The Amex Case

In 2010, the Department of Justice (DOJ) and several states filed a lawsuit against Amex, Visa, and Mastercard alleging that the fees and rules they imposed on merchants violated federal antitrust law. While the DOJ reached a settlement with Visa and Mastercard, the Amex case went to trial, with the Supreme Court issuing a decision in 2018.

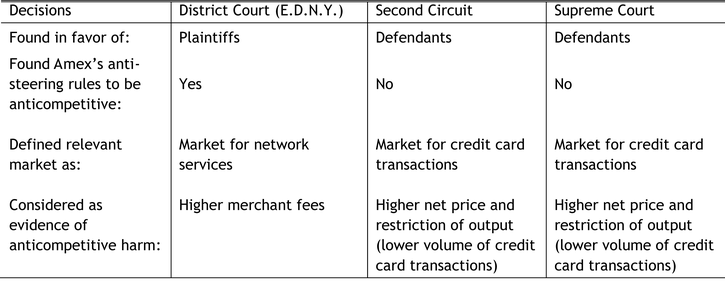

Amex’s anti-steering rules require merchants who want to accept Amex cards to agree not to discourage or “steer” customers from using their Amex card—for example, by offering discounts or in-kind incentives to customers who use other credit cards. These rules concerned the DOJ and states because steering is one of the only ways merchants can offset Amex’s ability to charge them higher fees for services relative to other credit card networks. These higher fees may translate to higher costs for consumers if merchants pass them on to consumers by raising retail prices. To prove a violation of antitrust law, the plaintiffs—the DOJ and states—needed to show that Amex’s rules had “a substantial anticompetitive effect that harms consumers in the relevant market” (Ohio v. American Express Co., 138 S. Ct. 2280 (2018))._Table 1 summarizes the decisions the District Court (Eastern District of New York), Second Circuit, and Supreme Court made in the Amex case. Vital to the outcome of any antitrust case are a court’s definition of the relevant market and its measure of anticompetitive effects. In the Amex case, the District Court defined the relevant market differently than the Second Circuit and the Supreme Court, and also considered different evidence as demonstrative of anticompetitive harm (United States v. Am. Express Co., 88 F. Supp. 3d 143. (E.D.N.Y. 2015); United States v. Am. Express Co., 838 F.3d 179, 203 (2d Cir. 2016)). As a result, the courts reached different conclusions. While the District Court found that Amex’s anti-steering rules violated antitrust law, the Second Circuit overturned the lower court’s decision, ruling in favor of Amex, and the Supreme Court affirmed the Second Circuit’s decision.

Table 1: Summary of Court Decisions in the Amex Case

Relying on precedent, the District Court defined the relevant market as the network services market where card networks offer card acceptance services for merchants._ Based on this definition, the District Court found that Amex’s merchant prices had risen dramatically and that Amex had the power to repeatedly and profitably raise those prices without worrying about merchants choosing not to accept its cards. In contrast, the Second Circuit and Supreme Court differentiated the Amex case from precedent and defined the relevant market as the market for credit card transactions as a whole, including both merchants and cardholders. The Supreme Court elaborated further, stating that credit card networks “facilitate a single, simultaneous transaction between participants” and cannot “sell transaction services to either cardholders or merchants individually.” The Second Circuit also argued—and the Supreme Court agreed—that evidence of increased merchant fees alone is insufficient to prove that Amex’s conduct is anticompetitive. Because merchants and cardholders jointly determine whether a transaction occurs, both courts deemed the net price—merchant fees minus cardholder rewards—to be the appropriate price measure for assessing the competitive effects of the anti-steering rules.

In finding that Amex’s anti-steering rules were not anticompetitive, the Supreme Court argued that the rules did not lead to an increase in the net price. Since the volume of credit card transactions has risen over time, the Supreme Court argued that even if the net price did increase, the increase could not have been due to a decrease in competition. To prove anticompetitive effects, plaintiffs would have had to show that “Amex’s antisteering provisions increased the cost of credit-card transactions above a competitive level, reduced the number of credit-card transactions, or otherwise stifled competition in the credit-card market” (Ohio v. American Express Co., 138 S. Ct. 2287–2288 (2018)). The plaintiffs did not, and the Supreme Court found in favor of Amex. As a result, Amex-accepting merchants are unable to steer consumers to less expensive payment card options.

Debate Surrounding the Supreme Court’s Economic Analysis

Antitrust scholars differ in their opinions on the Supreme Court’s analysis and decision in the Amex case. Scholars who support the Supreme Court’s decision unanimously back its definition of the relevant market but have differing opinions on how it evaluated the competitive effects of Amex’s anti-steering rules. Scholars who do not support the decision disagree with the Supreme Court on both issues.

Market definition

Like the courts, antitrust scholars disagree on how the relevant market in the Amex case should be defined. Some scholars support the Supreme Court’s definition of a single relevant market that includes both merchants and cardholders (the “single-market” approach); others advocate for treating merchants and cardholders as two separate antitrust markets (the “separate-markets” approach). This difference in opinion stems in large part from the lack of consensus on the antitrust treatment of two-sided platforms._

Supporters of the higher courts’ single-market approach argue that Amex competes in the market for credit card transactions. These scholars assert that because a credit card transaction can only take place when both the cardholder and merchant agree to it simultaneously, it is necessary to define one single antitrust market that encompasses both cardholders and merchants. These scholars also assert that the single-market approach is less likely than the separate-markets approach to lead to a misruling in the Amex case (Evans and Schmalensee 2018). Specifically, they argue that the separate-markets approach causes courts to ignore the procompetitive benefits of the challenged conduct. In the Amex case, the anti-steering rules led to an increase in cardholder rewards, which benefits not only cardholders but also merchants by incentivizing cardholders to spend more. By failing to consider the benefits of increased cardholder rewards for cardholders and merchants, these scholars contend, the courts may mistakenly find the anti-steering rules to be anticompetitive. The single-market approach, in contrast, ensures that the courts consider the competitive effects on both sides of the platform in their antitrust assessment.

Advocates of the separate-markets approach, however, point out that the relevant antitrust market—both in theory and in practice—has traditionally been defined as “the set of products…that exercise some competitive restraint on each other” (Motta 2009). Typically, these products are goods or services that consumers consider to be substitutes for each other. The Second Circuit and Supreme Court, however, departed from this traditional notion of “consumption substitutes” in their market definition and instead placed a pair of goods that are jointly produced, or “production complements”—the merchant transaction and cardholder transaction—in the same antitrust market.

Many scholars in the separate-markets camp also contend that placing cardholders and merchants, who are a buyer-seller pair, in the same antitrust market would render sound antitrust analysis impossible (Hovenkamp 2019). The single-market approach ignores the fact that cardholders and merchants are distinct groups of users whose economic interests are not fully aligned. The single-market approach also fails to consider differences in competitive conditions and in the level of sophistication and usage behaviors of cardholders and merchants, which may affect the overall level of benefits that each user group obtains (Katz and Sallet 2018).

Competitive effects

The Supreme Court stated that one way for plaintiffs to show that conduct is anticompetitive is to provide “proof of actual detrimental effects on competition, which could include reduced output, increased prices, or decreased quality in the relevant market” (Hovenkamp 2019)._ In the Amex case, the Supreme Court considered two types of direct evidence of anticompetitive effects: an increase in the net price on Amex’s platform and a reduction in output in the credit card transactions market as a whole._

The Supreme Court’s assessment of the competitive effects of the anti-steering rules drew widespread criticism from antitrust scholars. The court’s interpretation of the absence of changes in the net price as an absence of anticompetitive harms was particularly controversial, receiving little support even from defenders of the court’s market definition. The court’s analysis of the anti-steering rules’ effects on output in the credit card market—the output test—was less contentious than its net price analysis. Although supporters of the separate-markets approach remained critical of the Supreme Court’s analysis, advocates of the single-market approach widely affirmed its use of the output test.

Effect of the anti-steering rules on the net price. The Supreme Court asserted that because Amex’s anti-steering rules did not increase the net price, it did not cause net competitive harm to its cardholders and merchants, and, therefore, was not anticompetitive. Implicit in the Supreme Court’s analysis were two assumptions: first, that the net price is a sufficient statistic for evaluating whether Amex’s anti-steering rules caused anticompetitive harm to its users as a whole, and second, that anticompetitive harms to merchants are justified by offsetting procompetitive benefits to cardholders.

However, many scholars regard the Supreme Court’s focus on net price as a misguided application of “one-sided logic” in a two-sided market (Katz and Sallet 2018). In its analysis, the Supreme Court interpreted the net price statistic as the two-sided market counterpart of the price statistic in one-sided markets, in that a higher net price level would be a sign of weaker competition in the credit card market and vice-versa. But scholars contend that, unlike the one-sided price statistic, the net price statistic lacks meaningful economic interpretation. The two user groups—cardholders and merchants—are distinct. Each user group considers only the fees the platform charges to their group, not the sum of fees across the two groups (the net price), when deciding whether to join the platform or to use the platform’s product (Katz and Sallet 2018; Wright and Yun 2019). Scholars thus argue that the competitive implications of a change in the net price are not the same as those of a change in price in standard one-sided antitrust markets.

More critically, these scholars call attention to how the Supreme Court’s interpretation of the net price statistic is at odds with the definition of a two-sided platform. By focusing only on the change in the net price and ignoring any changes in the allocation of fees between merchants and cardholders (the price structure), the Supreme Court implicitly assumed that changes in price structure do not affect the volume of Amex card transactions. This assumption contradicts the definition of a two-sided platform in economic research—if the transaction volume on a platform depends only on the sum (net price) but not the allocation of fees across user groups (price structure), then the platform is by definition not two-sided (Rochet and Tirole 2006). On a two-sided platform such as Amex, a change in price structure—how much one side of the market is paying relative to the other—can affect the volume of transactions even if the net price level—the sum of fees across both sides—is the same. Thus, any competitive analysis that fails to consider how Amex’s anti-steering rules affected its price structure will result in “an incomplete understanding of whether the firm possesses sufficient market power to harm competition and consumers” (Katz and Sallet 2018).

Some scholars also challenged the Supreme Court’s presumption that because the net price did not increase, there was no net anticompetitive harm from Amex’s anti-steering rules. Previous studies have shown that even when the net price does not change, a change in price structure still affects overall user benefit. In addition, a change in price structure alters how benefits from an Amex transaction are distributed across user groups. In particular, an increase in cardholder rewards accompanied by an offsetting increase in merchant fees will raise the cardholders’ share of benefits relative to the merchants’.

Effect of the anti-steering rules on output. Another antitrust tool courts commonly use to evaluate anticompetitive effects is the output test. Many courts regard “a change in output as a proxy for the effects of [a challenged] conduct on competition…so that whether [the] conduct raises or lowers output is the most important test of whether it is illegal” (Katz 2019). The Supreme Court made a similar argument in the Amex case, stating that even if the anti-steering rules did raise the two-sided price, they did not reduce output (the overall volume of credit card transactions) and were, therefore, not anticompetitive.

Many scholars, particularly those in the single-market camp, share the Supreme Court’s view. In fact, some scholars have suggested that a change in output better captures effects on overall user benefit in a two-sided market given that a two-sided market’s output depends, by definition, on both the net price and price structure (Wright and Yun 2019). Because Amex operates in a two-sided market, these scholars favor the Supreme Court’s use of the output test to assess the competitive effects of Amex’s anti-steering rules.

Many supporters of the separate-markets approach, however, question the validity of the Supreme Court’s analysis. Some contend that the Supreme Court used the wrong benchmark because an increase in the volume of transactions over time does not indicate the absence of anticompetitive harm. To these scholars, the right benchmark is the volume of transactions that would have occurred (at the same point in time) absent the anti-steering rules (Frankel 2018).

More crucially, even if the Supreme Court had used the “right” benchmark, no general economic result backs the assertion that a greater transaction volume means the absence of competitive harms (Katz 2019). Some scholars have identified several scenarios under which an increase in output may not benefit users of a two-sided platform as a whole. Of particular relevance is a scenario in which the platforms impose pricing restrictions on sellers. Credit card networks’ nondiscrimination rules, such as Amex’s anti-steering rules, constitute a form of price restriction—they prevent merchants in the card network from charging customers different prices based on their payment method or card brand. Such pricing restrictions may result in too much output; thus, further increases in production may decrease the benefits that users on the platform obtain as a whole (Katz 2019). Therefore, scholars critical of the output test benchmark caution against interpreting an increase in the volume of card transactions as evidence that Amex’s anti-steering rules did not cause competitive harm.

Implications of the Ruling for Antitrust Cases Involving Payment Networks

The Supreme Court’s ruling in the Amex case has led to concerns about the implications for future antitrust cases. One concern is that the decision will “make it difficult to challenge the pricing practices of many two-sided platforms on antitrust grounds” (Sarin 2020). Another is that almost any business that “offers a service and must attract both retailers and end consumers” can claim to be two-sided (Brief for John M. Connor et al. as Amici Curiae Supporting Petitioners, Ohio v. American Express Co., U.S. (2018) (No. 16–1454)). This concern may be overstated given that the market is defined more narrowly as a transactions platform rather than just a two-sided platform. Nevertheless, classifying payment networks as transactions platforms may make courts unable to find any payment network restrictions on merchants anticompetitive unless there is tangible harm to consumers. If this indeed becomes the new precedent, plaintiffs may no longer be able to rely on the courts as a means of public intervention in the payment industry.

The Supreme Court’s ruling in the Amex case may provide an opportunity to assess whether the courts are the right venue to ensure competitive payments markets. In many other countries, public intervention into the payment industry has shifted from courts to regulations or legislation (Hayashi and Maniff 2014). Many scholars state that because economic analysis of two-sided markets is inherently complex, it is difficult to come up with general rules of thumb that courts can apply in antitrust cases involving two-sided platforms (Sarin 2020)._ A two-sided platform’s conduct can have different competitive implications depending on a variety of factors, such as the level of competition on each side of the platform, whether users can choose their level of participation, and user sophistication. Moreover, economic research on competition does not provide courts with clear guidelines on market definition, creating a lack of clarity for courts and competition authorities that seek guidance in this critical area of antitrust (Wright and Yun 2019). This lack of clarity may lead courts to “cherry-pick a new economic theory for each case so as to yield the result preferred” (Manne and Wu 2019).

Endnotes

-

1

The full statement reads as follows: “To determine whether a restraint violates the rule of reason, the parties agree that a three-step, burden-shifting framework applies. Under this framework, the plaintiff has the initial burden to prove that the challenged restraint has a substantial anticompetitive effect that harms consumers in the relevant market. If the plaintiff carries its burden, then the burden shifts to the defendant to show a procompetitive rationale for the restraint. If the defendant makes this showing, then the burden shifts back to the plaintiff to demonstrate that the procompetitive efficiencies could be reasonably achieved through less anticompetitive means.

-

2

In fact, the District Court rejected Amex’s relevant market definition in terms of “transactions,” finding it “plainly inconsistent” with Second Circuit precedent (United States v. Am. Express Co., 88 F. Supp. 3d 143. (E.D.N.Y. 2015)).

-

3

While all three courts and most antitrust scholars consider Amex to be a two-sided platform, there remains some debate as to whether Amex is in fact two-sided.

-

4

As the dissenting judges in the Amex case point out, “direct proof of actual detrimental effects does not [traditionally] require a market definition” (Hovenkamp 2019).

-

5

Anticompetitive effects are often demonstrated by higher prices or lower output (United States v. American Express Co., 88 F. Supp. 3d 143 (2015)).

-

6

For example, “[t]he nature of two-sided markets can make the traditional logic of economics—and antitrust—hard to apply… In a traditional market, a price that can be sustained at a level higher than the cost of providing a product is indicative of a market failure. …This logic does not carry over to two-sided markets” (Sarin 2019).

References

Evans, David S., and Richard Schmalensee. 2018. “External LinkTwo-Sided Red Herrings.” SSRN, October.

Frankel, Alan S. 2018. “External LinkAnother Side to the Story: American Express and the Quest for Efficient Payments Systems.” Antitrust, vol. 33, no. 1, pp. 44–49.

Hayashi, Fumiko, and Jesse Leigh Maniff. 2014. “Interchange Fees and Network Rules: A Shift from Antitrust Litigation to Regulatory Measures in Various Countries.” Federal Reserve Bank of Kansas City, Payments System Research Briefing, October.

Hovenkamp, Herbert. 2019. “External LinkPlatforms and the Rule of Reason: The American Express Case.” Columbia Business Law Review, vol. 2019, no. 1, pp. 35–88.

Katz, Michael L. 2019. “External LinkPlatform Economics and Antitrust Enforcement: A Little Knowledge Is a Dangerous Thing.” Journal of Economics & Management Strategy, vol. 28 no. 1, pp 138–152.

Katz, Michael L., and Jonathan Sallet. 2018. “External LinkMultisided Platforms and Antitrust Enforcement.” Yale Law Journal, vol. 127, no. 7, pp. 2142–2175.

Manne, Geoffrey A., and Tim Wu. 2019. “External LinkOhio v American Express.” Journal of Antitrust Enforcement, vol. 7, no. 1, pp. 104–127.

Motta, Massimo. 2009. “Market Definition and the Assessment of Market Power.” Competition Policy: Theory and Practice, pp. 101–136. New York: Cambridge University Press.

Rochet, Jean‐Charles, and Jean Tirole. 2006. “External LinkTwo‐sided Markets: A Progress Report.” RAND Journal of Economics, vol. 37, no. 3, pp. 645–667.

Sarin, Natasha. 2020. “External LinkWhat’s in Your Wallet (and What Should the Law Do About It?).” University of Chicago Law Review, vol. 87, no. 2, pp. 553–594.

Wright, Joshua D., and John M. Yun. 2019. “External LinkBurdens and Balancing in Multisided Markets: The First Principles Approach of Ohio v. American Express.” Review of Industrial Organization, vol. 54, no. 4, pp. 717–740.

Jesse Leigh Maniff is a payments specialist at the Federal Reserve Bank of Kansas City. Ying Lei Toh is an economist at the bank. The views expressed are those of the authors and do not necessarily reflect those of the Federal Reserve Bank of Kansas City or the Federal Reserve System.