Use of the Federal Reserve’s overnight reverse repurchase (ON RRP) facility soared in 2022 amid rapidly declining commercial bank reserves and slower deposit growth, potentially complicating the Federal Open Market Committee’s (FOMC) efforts to reduce its balance sheet. Banking industry analysts have suggested that increased ON RRP use reflects deposit migration from capital-constrained banks to money market funds (MMFs) (Chavez-Dreyfuss 2022; Covas 2021). As a result, calls have intensified for regulators to renew pandemic-era exemptions to the supplementary leverage ratio (SLR), which would provide additional room for banks to accumulate Treasuries while the Fed reduces its balance sheet._

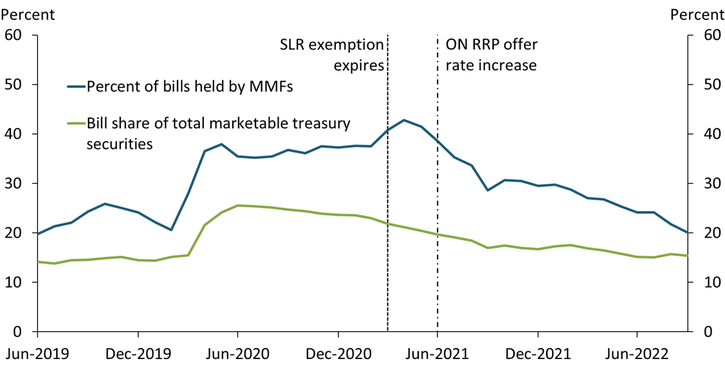

We argue that exempting banks from the SLR once more may not have the desired effects. When a pandemic exemption to the SLR expired in March 2021, bank deposit growth slowed and ON RRP usage increased. However, ON RRP take-up significantly outpaced net MMF inflows during 2021, suggesting factors other than deposit migration contributed to the ON RRP’s rise (Fulmer 2021). First, market investments for MMFs, statutorily limited to short-maturity assets, became scarcer as outstanding Treasury bills began to decline in 2020:Q2. Chart 1 shows that the share of U.S. debt financed by short-term Treasury bills peaked in mid-2020, but bills outstanding have since declined by $1.5 trillion, moving the share toward historical averages (green line). Second, Federal Reserve asset purchases continued until March 2022, creating additional liquidity that flowed into both banks and MMFs. Third, administrative changes to support monetary policy implementation during a period of softening money market yields made the ON RRP more attractive to counterparties._ In particular, the Fed relaxed ON RRP eligibility criteria, raised daily ON RRP counterparty limits, and increased the ON RRP offer rate. More eligible funds, larger counterparty limits, and higher offer rates all helped increase ON RRP usage during this time. Indeed, the share of total Treasury bills outstanding held by MMFs declined after these changes (blue line).

Chart 1: Treasury bill supply has declined, as has MMF demand for Treasury bills

Sources: U.S. Securities and Exchange Commission (SEC), U.S. Treasury, and authors’ calculations.

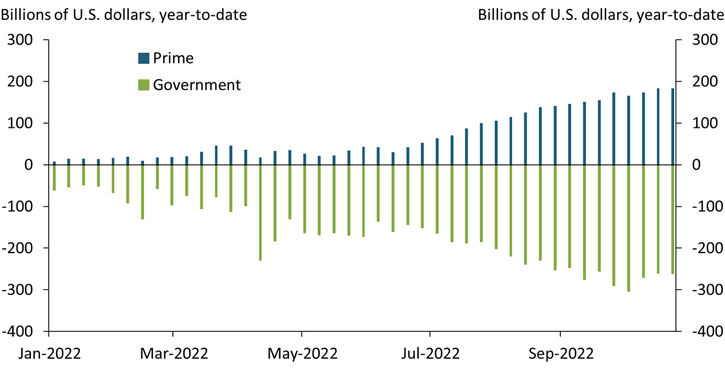

ON RRP use continued to increase in 2022, though the drivers appear to have changed. ON RRP take-up peaked in September 2022 amid declining reserve balances and deposit outflows, perpetuating the idea that MMF inflows have increased use of the ON RRP._ However, Chart 2 shows that MMFs experienced cumulative net outflows in 2022. Although prime MMF assets increased during the year (blue bars), outflows at government MMFs (green bars), the largest ON RRP users, more than offset those inflows.

Chart 2: MMFs have reported cumulative outflows in 2022

Sources: SEC and authors’ calculations.

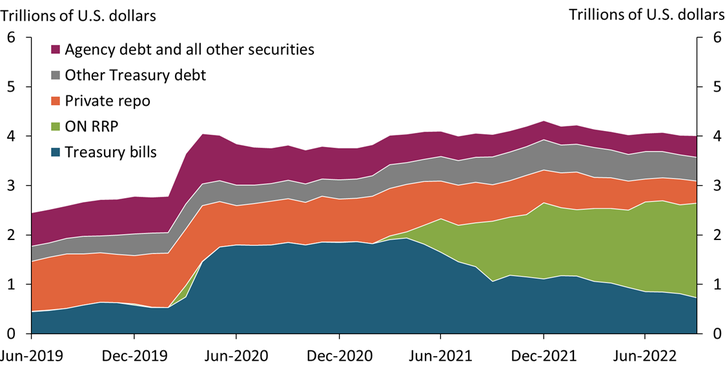

Increasing ON RRP usage at a time of net MMF outflows suggests that market factors other than deposit migration are likely driving changes in reserves and ON RRP usage in 2022. First, a large share of the decline in bank reserves is explained by increases in the Federal Reserve’s other liabilities. In particular, higher-than-expected tax receipts increased Treasury General Account balances at the Federal Reserve by $600 billion while simultaneously drawing down reserves and bank deposits (Goldfarb 2022). Second, ON RRP take-up increased because of changes in short-term funding markets, led by aggressive monetary policy tightening this year intended to counter rising inflation. Increases in the target range for the federal funds rate were accompanied by higher ON RRP offer rates, which improved the facility’s attractiveness relative to other investments. Aggressive policy tightening also increased uncertainty about the pace of tightening and the terminal rate. ON RRP access shields counterparties from interest rate risk, which is critical when policy uncertainty is elevated. Indeed, higher ON RRP take-up has helped nearly halve the weighted average maturity of MMF investments this year._ Chart 3 shows that while Treasury bills (blue area) once made up the largest government MMF investment, their share has declined with lower bill supply and higher interest rate risk._ Meanwhile, ON RRP usage (green area) continues to grow faster than not only Treasury bills but also private repo and agency debt.

Chart 3: Government MMFs have substituted into ON RRP from Treasury bills and private repo

Sources: SEC, U.S. Treasury Office of Financial Research, and authors’ calculations.

The current situation of declining reserves and rising ON RRP usage presents a challenge to the FOMC’s objective to shrink the Federal Reserve’s balance sheet. With reserves currently declining faster than assets, reserves could decline to a level consistent with an ample reserves regime without significant reductions in the balance sheet._ Although policymakers could try to encourage yield-seeking investors to migrate from MMFs to bank deposits by making the ON RRP less attractive to counterparties, this solution is not without complications. First, a lower ON RRP offer rate could be challenging to implement, as it might lead the federal funds rate to dip below the target range more frequently. Second, lowering the ON RRP offer rate or reducing counterparty limits could reduce rates on other money market instruments, as short-term investment yields tend to move together. Reduced yields would tempt banks to lower deposit rates, undermining efforts to reduce ON RRP take-up through migration from MMFs to deposits. Third, cash balances at money funds may remain elevated even at lower ON RRP rates because alternative short-term funding instruments that compensate large investors for counterparty and interest rate risk are limited._

Endnotes

-

1

In April 2020, federal bank regulators exempted reserves and treasuries from the supplementary leverage ratio (SLR), a measure of tier 1 regulatory capital to total assets and certain off-balance sheet exposures, to increase banks’ balance sheet capacity for these assets. Large bank holding companies must hold an SLR ratio of at least 5 percent.

-

2

Continued policy accommodation also threatened to push MMF yields into negative territory (Mackenzie and Smith 2021). See the External LinkFOMC Minutes throughout 2021 for additional details and discussions.

-

3

As of 2022:Q3, bank assets are about flat since year-end 2021, as more than $1 trillion of loan and other asset growth has offset an $800 billion reserve outflow and a nearly $300 billion decline in the value of available-for-sale securities. On the liabilities side, deposits have fallen more than $300 billion while non-deposit funding has increased by more than $400 billion. Book equity is down, on net, about $150 billion due to lower accumulated other comprehensive capital.

-

4

See Table 6 of the External LinkSEC Money Market Fund Statistics. Lower maturity mitigates interest rate risk by reducing duration.

-

5

Current MMF bill demand is driven largely by funds that are (1) not ON RRP counterparties and (2) invest exclusively in Treasuries.

-

6

Although the level of reserves consistent with an ample reserves regime is highly uncertain, one illustrative projection has assumed that it is equivalent to 8 percent of GDP—the average reserves level in December 2019 (Federal Reserve Bank of New York 2022). In efforts to avoid a repeat of the 2019 repo market stress episode, the FOMC introduced a standing repo facility (SRF) that can supply reserves to banks on demand (Afonso and others 2022). If the SRF proves to be inadequate in an extreme scenario though, the Federal Reserve can intervene directly to keep markets operational.

-

7

Institutional clients are typically governed by rules that limit alternative investments such as unsecured bank deposits in preference to government money fund investments secured by treasury and agency debt securities. Moreover, ON RRP access likely enhances this effect by providing additional counterparty risk protection. Achieving similar protection through bank deposits is costly for large cash investors because deposit insurance is capped at $250,000 per account.

References

Afonso, Gara, Lorie Logan, Antoine Martin, William Riordan, and Patricia Zobel. 2022. “External LinkThe Fed’s Latest Tool: A Standing Repo Facility.” Federal Reserve Bank of New York, Liberty Street Economics (blog), January 13.

Chavez-Dreyfuss, Gertrude, 2022. “External LinkAnalysis: U.S. Banks Face Trillion-Dollar Reverse Repo Headache.” Reuters, August 2.

Federal Reserve Bank of New York, 2022. “External LinkOpen Market Operations during 2021.” Federal Reserve Bank of New York Markets Group, May.

Fulmer, Sean, 2021. “External LinkThe Federal Reserve Remains Unconcerned As Usage of its Reverse Repo Facility Approaches $1 Trillion.” Yale Program on Financial Stability, July 23.

Goldfarb, Sam, 2022. “External LinkShrinking Deficits Cushion Fed’s Retreat from Markets.” Wall Street Journal, August 22.

Mackenzie, Michael, and Colby Smith, 2021. “External LinkFed Urged to Aid Money Market Funds as Negative Rates Loom.” Financial Times, June 15.

W. Blake Marsh and Rajdeep Sengupta are senior economists at the Federal Reserve Bank of Kansas City. The views expressed are those of the authors and do not necessarily reflect the positions of the Federal Reserve Bank of Kansas City or the Federal Reserve System.