Banks typically experience weakness in loan demand during recessions, and the pandemic-driven recession was no exception. However, this weakness in loan demand persisted even as the economy steadily recovered. One explanation for this persistent weakness may be continuing disruptions to supply chains. Disruptions to the flow of goods and materials through complex supply chains began early in the pandemic but were exacerbated in 2021, generating inventory shortages in some industries and preventing many firms from meeting consumer demand.

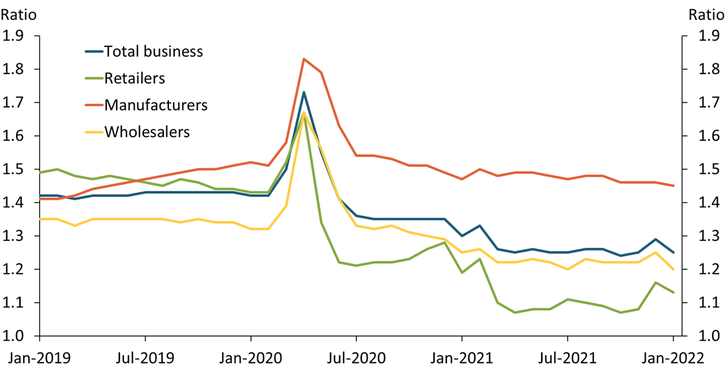

Chart 1 shows that retailers have faced the largest declines in inventories relative to sales during the pandemic (Helper and Soltas 2021). In 2020, all business sectors underwent a brief, sharp rise in inventories relative to sales, as sales plunged during lockdown restrictions and businesses were left with vast stocks of unsold goods. Since the start of 2021, however, the value of firms’ inventories relative to monthly sales has declined across all sectors (blue line), with especially acute declines for retailers (green line), who have likely faced the steepest supply constraints. Because retail firms are downstream in the supply chain, they are not only vulnerable to disruptions in the flow of goods to their own warehouses, but also to manufacturers’ backlogs and delays in their suppliers’ deliveries.

Chart 1: Retailers faced the largest decline in inventory relative to sales during the pandemic, particularly in early 2021

Source: U.S. Census Bureau (Federal Reserve Economic Data).

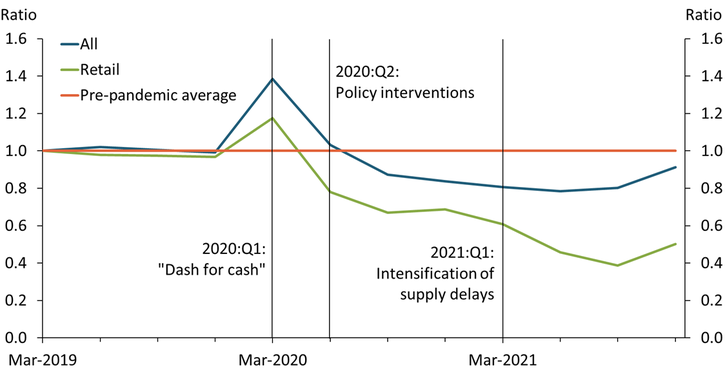

Declining inventories appear to have disproportionately reduced retailers’ demand for loans. Retail firms reduced their drawdowns on revolving credit lines more than firms across all sectors. Changes in revolving credit balances typically result from changes in firms’ liquidity needs, making drawdowns an especially useful measure of firm demand for credit._ Chart 2, which is based on loan-level data from large banks, shows that revolving balances rose sharply for all firms at the onset of the pandemic in 2020:Q1, when firms drew down their lines of credit to insure against a future tightening of credit standards (Acharya and Steffen 2020)._ Once fiscal and monetary support measures were introduced in 2020:Q2, firms quickly repaid what they borrowed in the previous quarter as well as a portion of their preexisting borrowings, and revolving balances declined below pre-pandemic levels. When supply constraints intensified in 2021:Q1, however, revolving balances remained steady for firms overall (blue line), but declined among retail firms (green line). Combined with diminished retail inventories, the decline in retail firms’ revolving balances suggests that supply bottlenecks weighed especially heavily on their demand for loans.

Chart 2: Revolving balances declined steeply among retail firms relative to all sectors

Sources: Board of Governors of the Federal Reserve System and U.S. Census Bureau.

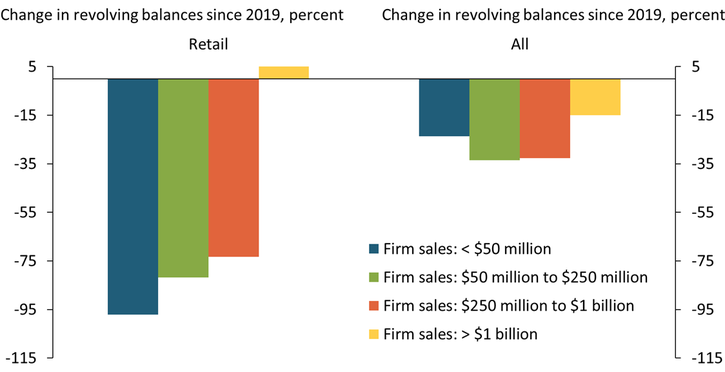

Loan demand appears to have been weakest among the smallest retail firms, suggesting they may have been even less equipped to overcome supply bottlenecks than their larger counterparts. Chart 3 shows changes in revolving balances in 2021:Q4 relative to 2019 averages by firm size based on net sales. The blue bar shows that retail firms with net sales of less than $50 million reduced their revolving balances by 95 percent, while retail firms with greater net sales engaged in progressively smaller reductions. Within each firm size category, however, revolving balances fell more sharply for retail firms relative to firms in other sectors.

Chart 3: Small retail firms reduced their revolving balances more than large firms and peers across sectors

Source: Board of Governors of the Federal Reserve System.

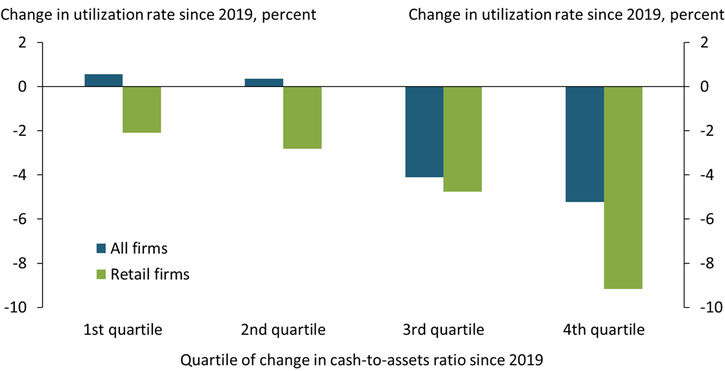

Although supply constraints appear to have weighed especially heavily on loan demand in the retail sector, the cash buffers that firms built up during the pandemic have likely also restrained loan demand. To capture the effect of firms’ cash buffers, we separate firms into quartiles based on changes in their cash-to-asset ratios from 2019 to 2021:Q4 (higher quartiles denote firms with greater increases in their cash balances relative to assets during this period). Chart 4 shows how the utilization rate, measured as the ratio of revolving balances drawn by firms relative to the limits on their credit lines, changed for firms in each quartile during the same period._ Overall, firms that accumulated cash balances were more likely to rely on their internal funds and curtail demand for bank loans. Retail firms with larger increases in their cash buffers relative to assets (third and fourth quartiles, green bars) reduced credit drawdowns much more than firms across business sectors (third and fourth quartiles, blue bars). These trends suggest that cash balances served as an alternative to bank loans, and retail firms relied more on their internal funds than did firms across sectors.

Chart 4: Firms with larger increases in their cash-to-asset ratio used their credit lines less intensively

Note: Chart shows the change in the credit line utilization rate for each quartile of change in the cash-to-asset ratio among retail firms and firms from all sectors.

Sources: Board of Governors of the Federal Reserve System and Compustat.

Firm demand for bank loans—especially at small banks—will likely continue to be suppressed by supply bottlenecks as COVID-19 cases reemerge in other parts of the world and geopolitical tensions escalate. Supply bottlenecks are likely to weigh especially heavily on loan demand from small firms in the retail sector, as larger firms may be better positioned to use their capital to overcome supply constraints._ In this way, supply constraints may exacerbate the trend toward concentration in the retail sector and confer an even bigger market share to large firms at the cost of small firms that typically borrow from community banks (Smith and Ocampo 2022). As a result, community banks that predominantly serve small businesses may continue to face persistent downward pressure on demand for bank loans even as large banks start to meet stronger demand. Additionally, the large cash buffers many firms accumulated during the pandemic are currently weakening their demand for bank loans. In response to policy tightening, firms may choose to continue drawing on their cash buffers for an extended period instead of tapping lines of credit. In sum, even as the economy continues to recover, loan demand will likely remain relatively muted due to supply bottlenecks and firms’ cash buffers rather than a weakness in the recovery.

Endnotes

-

1

Drawdowns from revolving lines of credit better reflect firm demand for bank loans than balances on term loans. Changes in balances on revolving lines of credit typically result from changes in firms’ liquidity needs, but banks retain the ability to restrict borrowing from credit lines with covenants, which are applied more commonly on small firms (Chodorow-Reich and others 2021). Greenwald, Krainer, and Paul (2021) show that the majority of unused balances on credit lines could be drawn without violating covenants. In contrast, term loan balances are more directly influenced by bank supply decisions. Unlike with pre-committed credit lines, banks may restrict or expand term loans in response to changes in a firm’s prospects at the time of application. Finally, banks specialize in developing relationships with firms, which gives them access to private information essential in designing contracts for credit lines (Berger and Udell 1995). Banks thereby have a comparative advantage over nonbanks in providing credit lines, whereas term loans have been increasingly financed by nonbank institutional investors (Nini 2008).

-

2

The Federal Reserve’s FR Y-14Q Schedule H1B, used in Charts 2, 3, and 4, is a loan-level regulatory report filed quarterly by banks with greater than $100 billion in assets.

-

3

Chart 4 is based on the merged sample of publicly listed firms that appear in both FR Y-14Q and Compustat, which represents 33 percent of total commitments for revolving loans in the FR Y-14Q sample. The merge is based on the tax identifier and yields 2,081 unique firms over the period 2019:Q1 to 2021:Q4. Chodorow-Reich and others (2021) identified 4,686 matched firms between 2015:Q1 and 2020:Q2. Over the same period, we obtained 3,201 matched firms, based on a preliminary match with Business Entity Cross Reference Service, followed by a match with Compustat using Fedmatch (Cohen and others 2021). We are grateful to W. Blake Marsh for his advice on matching FR Y-14Q with Compustat and for providing helpful references.

-

4

The largest retailers used their financial resources to minimize supply delays, such as chartering private cargo ships (Nassauer and Paris 2021).

References

Acharya, Viral, and Sascha Steffen. 2020. “External LinkThe Risk of Being a Fallen Angel and the Corporate Dash for Cash in the Midst of COVID.” Review of Corporate Finance Studies, vol. 9, no. 3, pp. 430–471.

Berger, Allen N., and Gregory F. Udell. 1995. “External LinkRelationship Lending and Lines of Credit in Small Firm Finance.” Journal of Business, vol. 68, no. 3, pp. 351–381.

Chodorow-Reich, Gabriel, Olivier Darmouni, Stephan Luck, and Matthew Plosser. 2021. “External LinkBank Liquidity Provision across the Firm Size Distribution.” Journal of Financial Economics, forthcoming.

Cohen, Gregory J., Jacob Dice, Melanie Friedrichs, Kamran Gupta, William Hayes, Isabel Kitschelt, Seung Jung Lee, W. Blake Marsh, Nathan Mislang, Maya Shaton, Martin Sicilian, and Chris Webster. “External LinkThe U.S. Syndicated Loan Market: Matching Data.” Journal of Financial Stability, vol. 44, no. 4, pp. 695–723.

Greenwald, Daniel L., John Krainer, and Pascal Paul. 2021. “External LinkThe Credit Line Channel.” Federal Reserve Bank of San Francisco, working paper no. 2020-26, November.

Helper, Susan, and Evan Soltas. 2021. “External LinkWhy the Pandemic Has Disrupted Supply Chains.” White House Council of Economic Advisers (blog), June 17.

Nassauer, Sarah, and Costas Paris. 2021. “External LinkBiggest U.S. Retailers Charter Private Cargo Ships to Sail Around Port Delays.” Wall Street Journal, October 10.

Nini, Greg. 2008. “External LinkHow Non-Banks Increased the Supply of Bank Loans: Evidence from Institutional Term Loans.” SSRN, March.

Smith, Dominic A., and Sergio Ocampo. 2022. “External LinkThe Evolution of U.S. Retail Concentration.” ArXiv, February 12.

Padma Sharma is an economist at the Federal Reserve Bank of Kansas City. Jacob Dice is a research associate at the bank. The views expressed are those of the authors and do not necessarily reflect the positions of the Federal Reserve Bank of Kansas City or the Federal Reserve System.