Home values appreciated rapidly in recent years. For non-homeowners, the recent surge in housing prices exacerbated housing affordability concerns. For existing homeowners, appreciation in home values raised homeowners’ equity levels. Many homeowners recently tapped into their newly found equity using home equity lines of credit (HELOCs), reversing years of broad-based declines in the use of that credit instrument. In this edition of the Rocky Mountain Economist, we show that the use of HELOCs has been much more prevalent in states where home values appreciated most quickly, including several Rocky Mountain states. Households that recently opened a new HELOC typically used some of the funds to reduce credit card debt and other personal debt, though debt consolidation does not appear to be the primary use of funds from HELOCs.

Home equity lines of credit are making a comeback

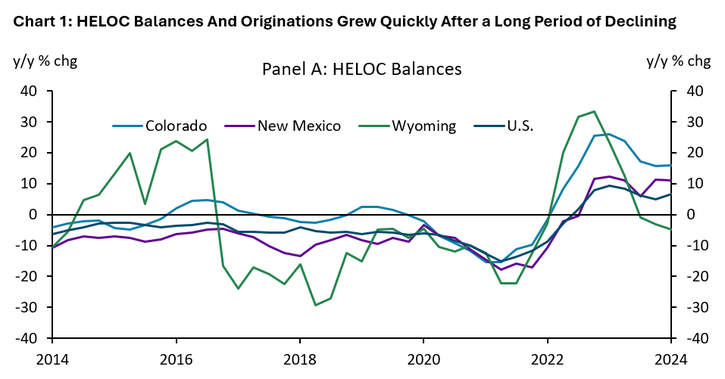

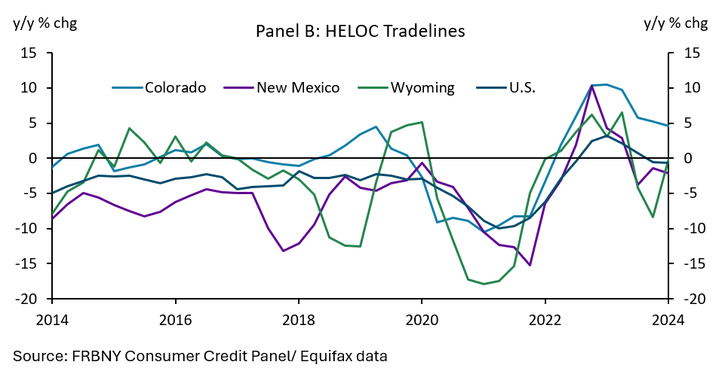

HELOC balances started to grow across the Rocky Mountain region early in 2022 following a decade when balances were generally declining. Chart 1 shows the regional use of HELOCs based on information from the Federal Reserve Bank of New York Consumer Credit Panel/Equifax - data, which are from a nationally representative anonymous random sample of Equifax credit files.i The recent turning point in the trajectory of HELOC balances in the region is consistent with the national trend. In Colorado and New Mexico, growth in HELOC balances remained elevated into the first quarter of 2024 at 15% and 11%, respectively, compounding on top of eight consecutive quarters of growth. Balances stabilized in Wyoming in the first quarter of 2024 after a similar surge in the use of HELOCs during 2022 and 2023.

Some of the recent growth in HELOC balances is due to households tapping existing lines of credit, but much of it is due to growth in the number of households originating new lines of credit. Colorado, New Mexico, and Wyoming experienced growth in the number of new HELOCs originated between 2022 and 2024 after either zero growth or persistent declines over the last decade. Growth in HELOC originations has since slowed in recent quarters, particularly in New Mexico and Wyoming. Nonetheless, the prevalence of HELOCs increased substantially following the surge in originations during 2022 and 2023.

As home value appreciation built equity, more homeowners began to tap into it

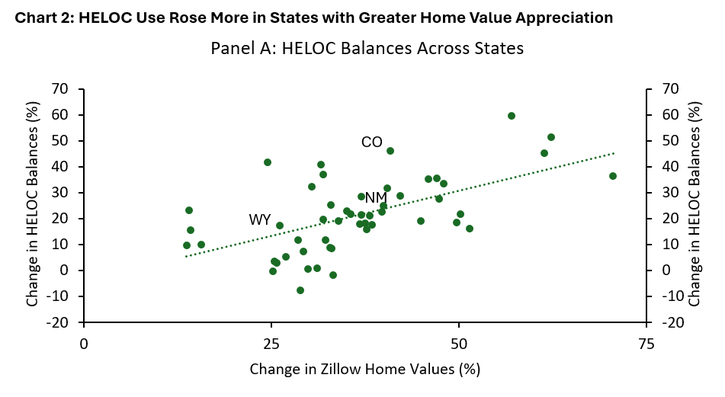

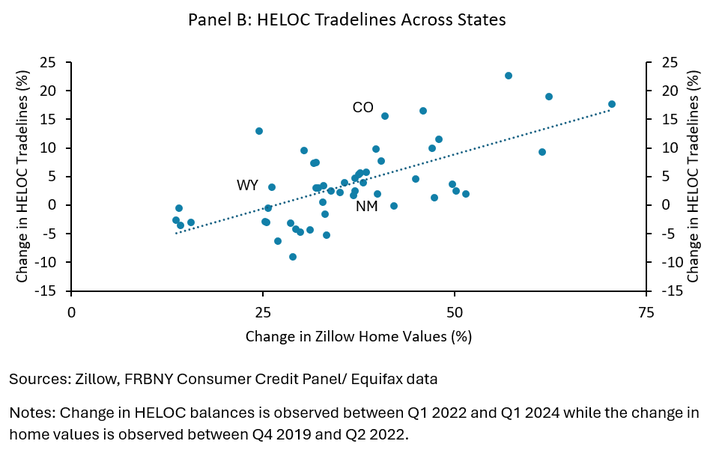

Rising balances and originations of new credit lines were more prevalent in states that experienced greater appreciation in home values in recent years, which added to homeowners’ equity. The Rocky Mountain region, in particular, saw outsized levels of growth in home prices in recent years. Rocky Mountain states such as Idaho, Montana and Arizona experienced the fastest home value appreciation in the U.S., between 2019 and 2022.ii These mountain states also saw some of the fastest growth in HELOC balances and tradelines, whereas states with lower home value appreciation such as Arkansas and Louisiana experienced slower growth, or even declines, in balances over the same period. Chart 2 shows this relationship across all U.S. states, specifically illustrating the correlation between housing price appreciation between 2019 and 2022, and growth in HELOC use between 2022 and 2024.

New Mexico and Wyoming closely align with the national pattern. Wyoming experienced comparatively lower home price appreciation as well as lower HELOC growth. New Mexico saw both average home value growth and comparatively average growth in HELOC balances and tradelines. Colorado led most of the nation with some of the fastest growth in HELOC balances and tradelines despite ranking closer to the middle of the pack regarding home value growth. Home prices had been appreciating relatively more quickly in Colorado for several years prior to the pandemic-era surge, which may have contributed to the higher-than-average uptake in HELOCs by Colorado households recently. While many household-specific factors influence the choice to obtain a HELOC, the rapid appreciation of home values over the last few years likely played a part in the growth in HELOC balances in certain states, as rapid gains in home equity may have facilitated households’ willingness and ability to obtain a HELOC as well as increasing the maximum loan amount they could obtain.

Homeowners use HELOCs partly to consolidate certain other high-cost debts

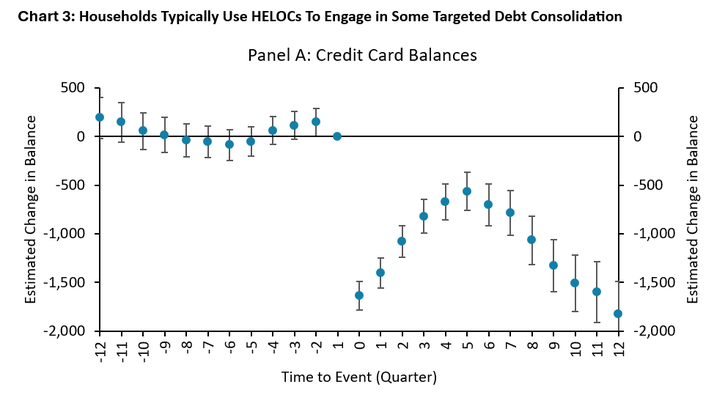

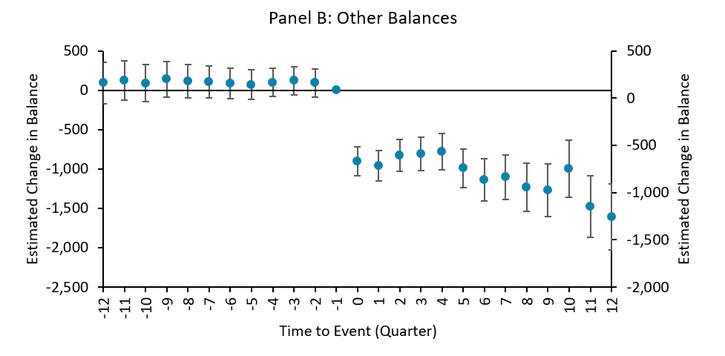

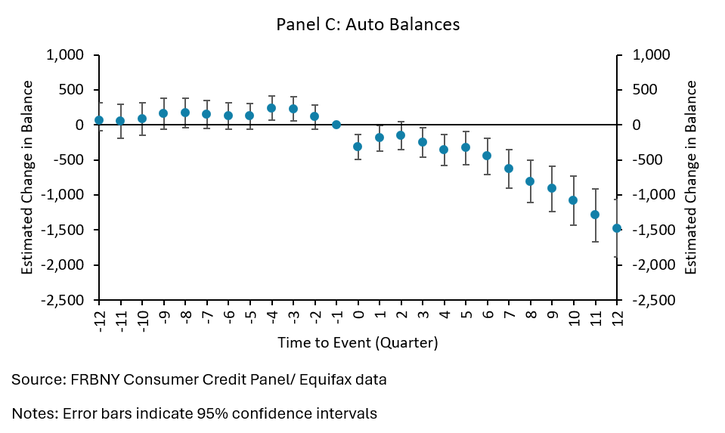

Once a household has access to, and begins to draw upon, a home equity line of credit, it has several options for how to deploy this new debt tool. For example, households can use the credit to finance expensive upgrades or maintenance to their homes. They can also use a HELOC as a tool to consolidate other debt, which could be especially appealing for households that have elevated levels personal debt with a relatively high interest expense. Chart 3 shows the trajectories of credit card debt, auto debt and other non-mortgage personal debt among households that were part of the recent wave of newly opened HELOCs, looking twelve quarters before and after opening a new credit line. The estimates in Chart 3 are based on individual household responses from the New York Fed’s Consumer Credit Panel based on anonymized Equifax data.

The typical household exhibits an immediate and somewhat persistent drop in credit card debt and other personal debt levels upon opening a HELOC, indicating some debt consolidation. Auto debt levels, however, show a less pronounced drop in debt levels, suggesting that any use of a HELOC for debt consolidation by households is targeted mainly at high-interest rate debt. The typical reduction in credit card balances and other personal debt balances, approximately $2500 altogether, is an order of magnitude smaller than the typical draw on a new HELOC, roughly $40,000. In other words, while households do engage in some targeted debt consolidation, that is not the primary use of these additional debts taken by households.

Looking Ahead

While the trend in HELOC use turned direction and accelerated quickly in recent years, this shift does not indicate a substantial shift in consumer debt levels. HELOC balances account for merely 2% of total household debt with the vast majority of households choosing not to tap into the equity they have rapidly accumulated over the last few years. However, the increased use of HELOCS have some, albeit limited, implications for the path of consumption. Increased HELOC usage creates an increased flow of capital to households that supports their spending in the near-to-medium term, which is even more notable in a relatively high interest rate environment. Conversely, the additional debt burden taken on by these households by opening a HELOC can hamper their consumption growth in the long run, especially considering that the amount of debt consolidation a typical homeowner engages in is of little consequence compared to the HELOC balance that must eventually be repaid. Despite its relevance to only a limited group of borrowers, ongoing developments in HELOCS can provide meaningful insight about the path of consumption growth and the health of household balance sheets moving forward.

__________

i More information is available from the NY FED External Linkhere.

ii See the previous Rocky Mountain Economist article by Greene, Rodziewicz and Sly 2023 for more information about the outsized increase in shelter prices within the region.