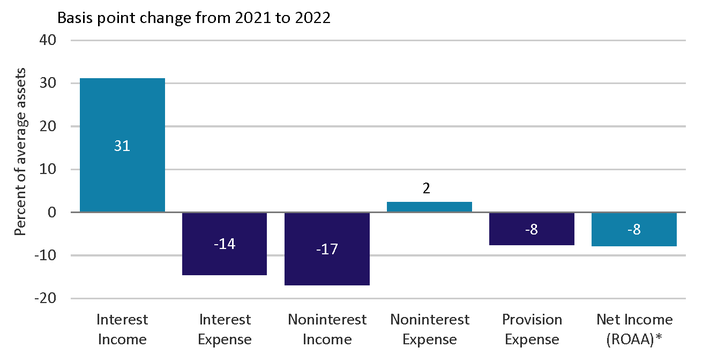

Earnings Component Change Impact on Return on Average Assets (ROAA)

* The change in net income as a percentage of average assets includes other items impacting earnings, including taxes, gain/loss from the sale of loans, etc.

Note: Increases in expense items shown as negative values (reduction) to ROAA, while decreases in expenses shown as positive value (benefit) to ROAA.

Source: Reports of Condition and Income.

- Community banking organization_ (CBO) ROAA remains above pre-pandemic levels but declined slightly, by 8 basis points (bps), from 2021 to 2022. While earnings benefitted from improvements in net interest income (interest income minus interest expense), this was offset by a decline in noninterest income and an increase in provision expense.

- Net interest income at CBOs increased by 17 bps year-over-year, as increases in interest income continue to outpace increases in interest expense. Interest income was boosted by improved asset yields as a result of strong loan growth and rising interest rates, while funding costs have lagged the quick pace of rate increases.

- A decline in noninterest income was the largest contributor to lower earnings in 2022, declining 17 bps year-over-year. The decline in noninterest income was mainly driven by decreased gains on the sale of loans and income from deposit service charges. • Provision expense increased in 2022, approaching a more normal, pre-pandemic level. Provision expense had remained low for numerous quarters but has increased in order to keep pace with elevated loan growth.

Questions or comments? Please contact KC.SRM.SRA.CommunityBankingBulletin@kc.frb.org

Endnotes

-

1

Community banking organizations are defined as having less than $10 billion in total assets.

The views expressed are those of the authors and do not necessarily reflect the positions of the Federal Reserve Bank of Kansas City or the Federal Reserve System.