The COVID-19 pandemic created unprecedented uncertainty across the nation’s financial sector, and community banking organizations_ (CBOs) were no exception. In response to the pandemic, the government implemented various economic stimulus programs which included direct payments to consumers. Economic stimulus activity caused the money supply_ to increase by over $2 trillion in 2Q 2020, an increase of over 13 percent (Q/Q), and led to a massive influx of deposits in the banking system. Balance sheets grew rapidly as deposits were added, causing a corresponding increase in total assets at CBOs of 9 percent, or $215 billion, in 2Q 2020. Growth was primarily in lower-yielding assets given the abrupt surge in deposits with limited corresponding opportunities to deploy the funds.

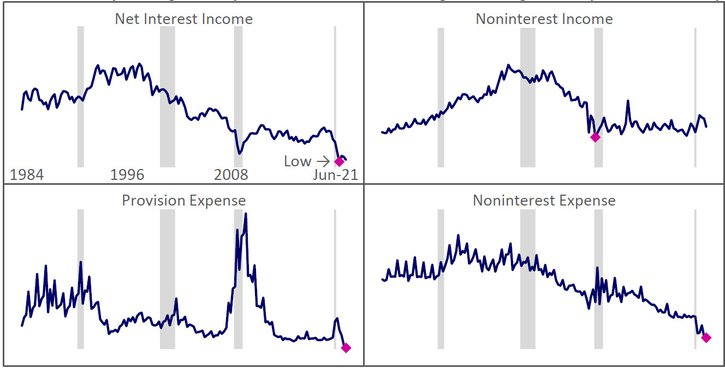

As a result of the sudden increase in assets, net interest income as a percentage of average assets is at an all-time low, yet offset by all-time lows in noninterest expense and provision expense as a percentage of average assets (see Chart 1). Pre-tax net income has remained strong despite continued economic uncertainties, reaching its highest level since 2007, driven primarily by exceptional declines in provision expense.

Chart 1: Primary Earnings and Expenses at CBOs as a Percentage of Average Assets (1984 – June 2021)

Source: Reports of Condition and Income

Depressed net interest income as a percentage of average assets creates a challenge for maintaining historic profitability levels as net interest income accounts for nearly 75 percent of current total CBO revenues. In fact, 30 percent of CBOs had an institutional record low_ net interest income as a percentage of average assets in either 2020 or 2021. Net interest margins continue to be compressed by inflated balance sheets and the low interest rate environment.

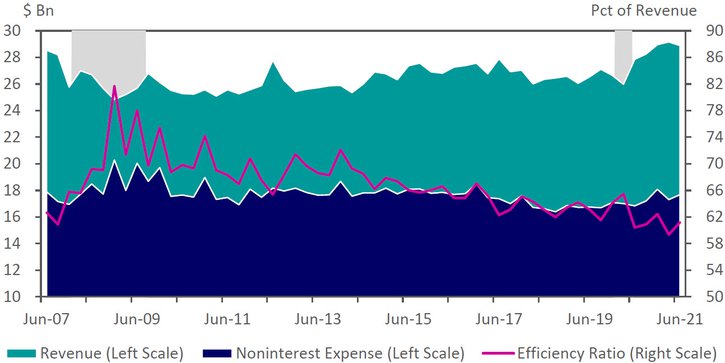

Total CBO revenue levels have increased during the pandemic, exceeding $28 billion in 2Q 2021. Noninterest expense levels have remained steady and have helped offset profitability pressures caused by lower average yields on earnings assets. Growth in total revenue combined with stable noninterest expense is evident in the decline of the CBO efficiency ratio to levels not seen since before the previous financial crisis (see Chart 2). Noninterest expense has fallen to just over 60 percent of revenue, suggesting a strong ability to satisfy overhead expense.

Chart 2: Efficiency Ratio at Community Banks

Note: Efficiency ratio calculated as noninterest expense as a percentage of revenue

Source: Reports of Condition and Income

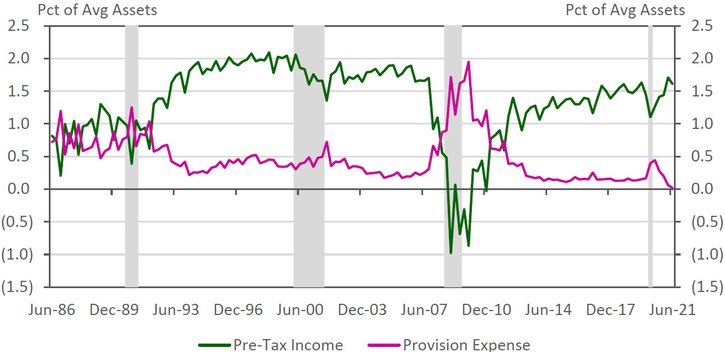

While maximizing net interest income and minimizing noninterest expense are important long-term drivers of CBO earnings, short-term profitability has historically been influenced substantially by trends in provision expense (see Chart 3). Dramatic swings in earnings are often caused by the need to increase provision expense quickly during times of financial stress. At the onset of the pandemic, CBOs increased provision expense given the possibility of credit deterioration in loan portfolios. As significant deterioration has failed to materialize through 2Q 2021, provision expense has tapered off from its pandemic high to near zero, signaling CBOs view their level of allowance for loan and lease losses as adequate.

Chart 3: Pre-Tax Income and Provision Expense

Source: Reports of Condition and Income

CBO net income could decline from its current high if net interest income remains compressed and provision expense returns to historical levels. However, at current revenue levels, CBOs appear able to meet ongoing financial obligations and operate at a profitable level. While current net income measures present an optimistic picture, absent normal investment opportunities and increasing rates, CBOs may feel pressure to take on additional risk to maintain strong profitability measures. Loosening underwriting standards or finding innovative ways to generate yield could present new risks to future earnings at a time when uncertainty persists.

Questions or comments? Please contact KC.SRM.SRA.CommunityBankingBulletin@kc.frb.org

Endnotes

Justin Reuter is an advanced risk specialist at the Federal Reserve Bank of Kansas City. The views expressed are those of the author and do not necessarily reflect the positions of the Federal Reserve Bank of Kansas City or the Federal Reserve System.