Profitability Analysis

Source: Reports of Condition and Income

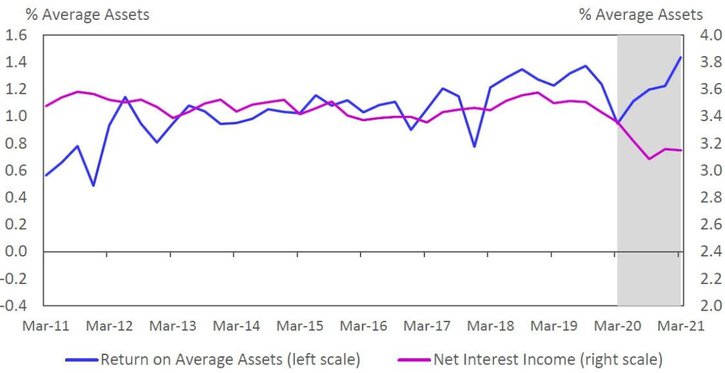

- Return on average assets, a key profitability measure for community banking organizations (CBOs), improved in the first quarter of 2021 and is back to the ten-year peak experienced in 2019. This improvement is primarily attributable to provision expense declining from heightened levels seen early in the pandemic.

- Net interest income (NII), a key component of CBO earnings, compressed in 2020 when measured against average asset levels and remains at a historical low in the first quarter. The decline in NII as a percentage of average assets was due to inflated balance sheets from participation in the Paycheck Protection Program (PPP) and, to a lesser degree, the low interest rate environment. Despite lower NII ratios driven by the influx of low-yielding PPP loans, banks actually saw a nominal increase in the absolute dollar volume of overall income.

- CBOs increased allowance for loan and lease loss (ALLL) account balances last year in preparation for potential credit portfolio deterioration caused by the COVID-19 pandemic. Through the first half of 2020, provision expense totaled over 0.40 percent of average assets (up from 0.16 percent in 2019), but provision expense has moderated to 0.06 percent of average assets in the first quarter, signaling that CBOs view ALLL levels appropriate given lesser remaining uncertainty.

Questions or comments? Please contact KC.SRM.SRA.CommunityBankingBulletin@kc.frb.org

Reference

Note: Community banking organizations (CBOs) are defined as having $10 billion or less in total assets.