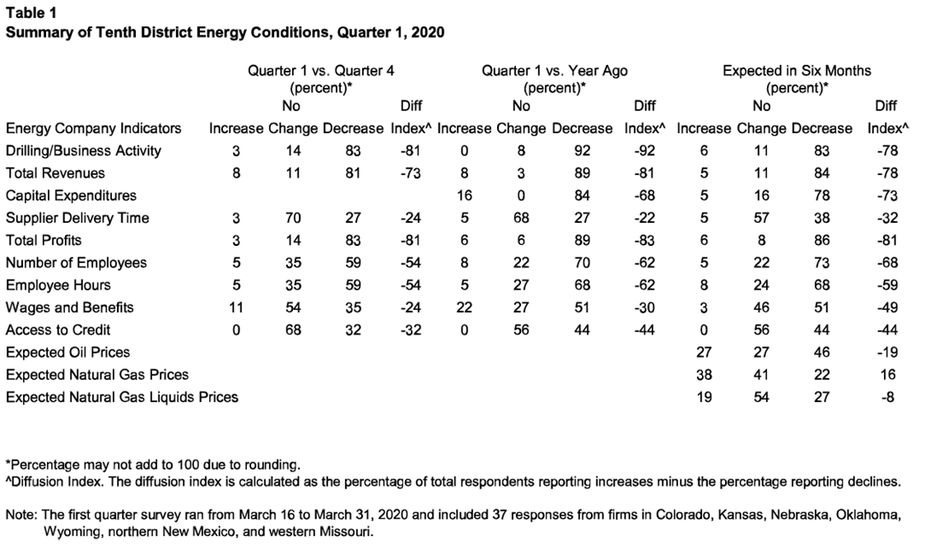

Summary of Quarterly Indicators

Tenth District energy activity decreased at a steep pace in the first quarter of 2020, as indicated by firms contacted between March 16th and March 31st, 2020 (Tables 1 & 2). The drilling and business activity index fell from -48 to -81, the lowest reading in survey history (since early 2014), indicating a continued, deep decrease in activity (Chart 1). The revenues and profits indexes fell sharply to levels last seen in Q1 2015. Indexes for employment and employee hours indexes also decreased significantly, and the wages and benefits index turned negative. Additionally, the indexes for supplier delivery time and access to credit declined further.

Chart 1.

Drilling/Business Activity Index vs. a Quarter Ago

Skip to data visualization table| Date | Drilling/Business Activity |

|---|---|

| 2017Q1 | 55 |

| 2017Q2 | 43 |

| 2017Q3 | 7 |

| 2017Q4 | 13 |

| 2018Q1 | 37 |

| 2018Q2 | 26 |

| 2018Q3 | 45 |

| 2018Q4 | -13 |

| 2019Q1 | 0 |

| 2019Q2 | 7 |

| 2019Q3 | -23 |

| 2019Q4 | -48 |

| 2020Q1 | -81 |

Year-over-year indexes also declined substantially. The year-over-year drilling and business activity index sank further, from -50 to -92, a record survey low. Indexes for total revenues, capital expenditures, delivery time, profits, employment, employee hours, and access to credit decreased again in the first quarter, marking over six months in negative territory. The year-over-year index for wages and benefits also turned negative.

Expectations indexes dropped further. The future drilling and business activity index worsened from -21 to -78, the weakest outlook for activity since Q4 2014. The future capital expenditures, delivery time, profits, employment, employee hours, wages and benefits, and access to credit indexes decreased again in Q1 2020. The future revenues and profits indexes dropped steeply to the most negative readings in survey history. Price expectations for oil and natural gas liquids decrease compared to the previous quarter, while price expectations for natural gas rose.

Summary of Special Questions

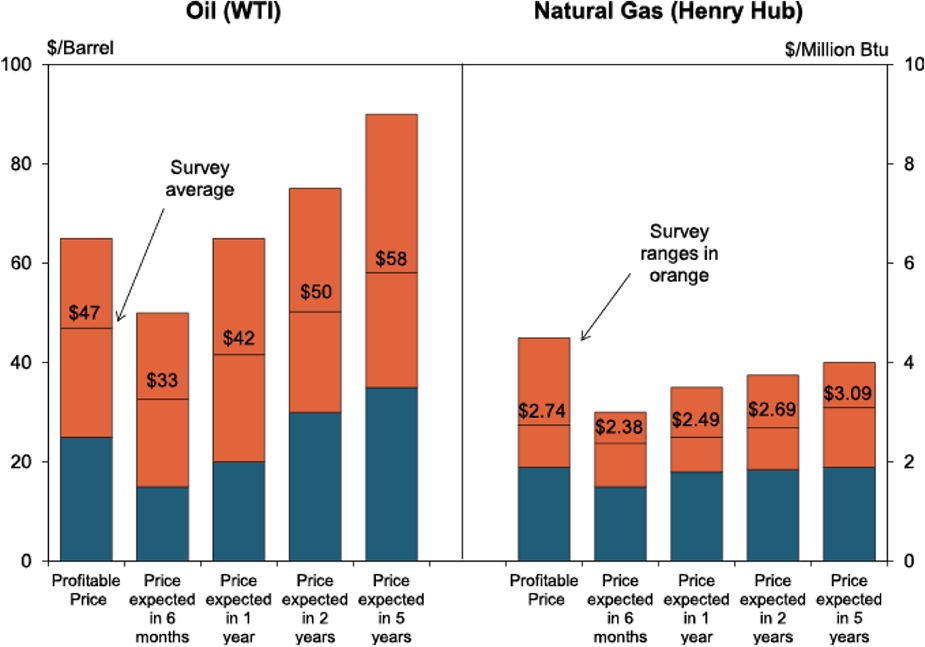

This quarter firms were asked what oil and natural gas prices were needed for drilling to be profitable on average across the fields in which they are active (in alternate quarters they are asked what price they need for a substantial increase in drilling). The average oil price needed was $47 per barrel, with a range of $25 to $65 (Chart 2). This average was below the prices reported in 2019, and the lowest recorded profitable price. The average natural gas price needed was $2.74 per million Btu, with responses ranging from $1.90 to $4.50.

Chart 2. Special Question - What price is currently needed for drilling to be profitable for oil and natural gas, and what do you expect the WTI and Henry Hub prices to be in six months, one year, two years, and five years?

Source: Federal Reserve Bank of Kansas City

Firms were again asked what they expected oil and natural gas prices to be in six months, one year, two years, and five years. Expected oil prices were much lower than previous price expectations. The average expected WTI prices were $33, $42, $50, and $58 per barrel, respectively. Expectations for natural gas prices also decrease from last quarter. The average expected Henry Hub natural gas prices were $2.02, $2.34, $2.57, and $2.94 per million Btu, respectively.

Firms were also asked about their expectations of firm solvency if low oil prices persist (Chart 3). Contacts anticipated on average that 61 percent of firms would remain solvent in the next year if the WTI price of oil were to stay at $30 per barrel, and 64 percent of firms would remain solvent if the WTI price of oil were to stay at $40. Respondents expected considerably fewer firms to remain solvent if oil prices stay low for more than one year.

Finally, respondents were asked if they have seen additional pressure from investors or customers regarding environmental practices (Chart 4). 58 percent of firms indicated they have seen increased pressure regarding environmental practices over the last 24 months. Over 48 percent of firms reported gas flaring as a top environmental concern from investors and customers, and 45 percent listed water management and carbon emissions (other than gas flaring) as a top environmental concern.

Chart 3.

Special Question - If the WTI price of oil were to stay at $30 per bbl or $40 per bbl for an extended period of time, what share of firms in your industry would remain solvent for the following time periods?

Skip to data visualization table| Length of Time | $30/bbl | $40/bbl |

|---|---|---|

| Less than 1 year | 61 | 64 |

| 1-2 years | 44 | 54 |

| 2+ years | 36 | 48 |

Chart 4.

Special Question - What areas of environmental practices are investors or customers most concerned about (choose all that apply)?

Skip to data visualization table| Areas of Environmental Practices | Percent |

|---|---|

| Gas flaring | 48 |

| Water management | 45 |

| Carbon emissions (other than gas flaring) | 45 |

| Sources of electricity (e.g. local or renewable etc.) | 13 |

| Reclamation | 10 |

| Land use | 6 |

| Waste management | 3 |

| Other | 23 |

Table 1 - Summary of Tenth District Energy Conditions, Quarter 1, 2020

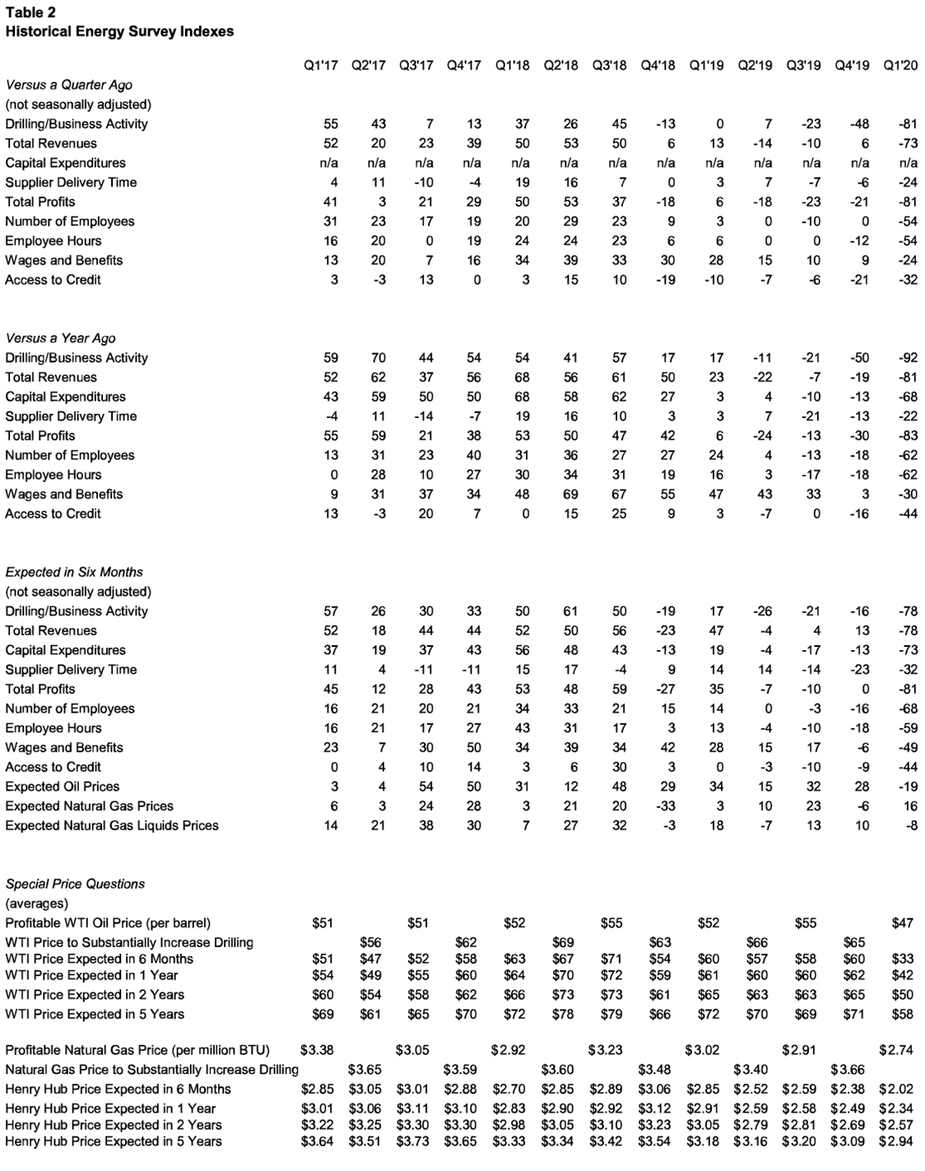

Table 2 - Historical Energy Survey Indexes

Source: Federal Reserve Bank of Kansas City

Selected Comments

“These are unprecedented times. The combination of the supply shock (Saudi and Russia supply increase) and demand shock (COVID-19) are introducing challenges we have never seen before. We are hunkering down to live within cash flow.”

"We cannot continue producing oil below the cost to produce it. Prices must go up, but there is a world-wide oversupply keeping prices down."

"Long term $30 per barrel (oil price) will lead to massive consolidation and insolvency. I'm estimating that some will be able to hang on for another year, but two years probably reduces E&Ps significantly."

"I don't know of any companies that can operate profitably at that price ($40/bbl oil). The ones that stay solvent have cash reserves, refining or other revenue streams to keep them solvent."

"Long term, $40 is not enough. Some will be able to survive but many/ most will not."

"The longer the price stays at $30 the more likely our competitors will fail. Even those who have hedged have likely only hedged a portion of their production and likely for a year or two out."

"The oilfield is generally highly leveraged and these commodity prices will not sustain the bulk of firms in the industry."

"Electrical demand for transportation fuel will help natural gas prices stabilize, along with LNG exports giving natural gas the ability to become a fungible global commodity."

"Saudi/Russia fight for market share could last 6-18 months. COVID-19 demand destruction likely to last 3 months."

"The next year is going to be bad due to the demand destruction related to the shutdown of the world economy due to COVID-19. As the market balances over the next 18-24 months prices should start to improve."

"(In response to COVID-19) we are taking protective measures, encouraging some to work at home, and restricting business travel. We are also looking at cutting costs, because it is affecting business."