Summary of Quarterly Indicators

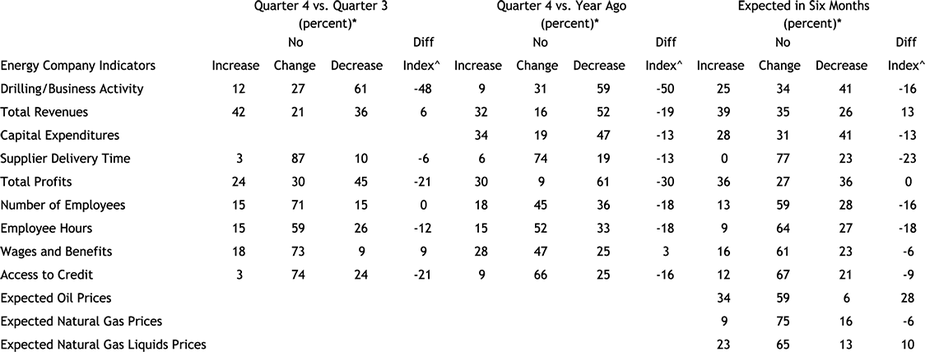

Tenth District energy activity dropped further in the fourth quarter of 2019, as indicated by firms contacted between December 16th and December 31st, 2019 (Tables 1 & 2). The drilling and business activity index fell from -23 to -48, indicating a continued, significant decrease in activity following a slight expansion earlier in 2019 (Chart 1). However, the revenues index improved slightly, the wages and benefits index remained positive, and the employment index was flat. The supplier delivery time, profits, employee hours, and access to credit indexes all declined.

Chart 1.

Drilling/Business Activity Index vs. a Quarter Ago

Skip to data visualization table| Date | Drilling/Business Activity |

|---|---|

| 2016Q4 | 64 |

| 2017Q1 | 55 |

| 2017Q2 | 43 |

| 2017Q3 | 7 |

| 2017Q4 | 13 |

| 2018Q1 | 37 |

| 2018Q2 | 26 |

| 2018Q3 | 45 |

| 2018Q4 | -13 |

| 2019Q1 | 0 |

| 2019Q2 | 7 |

| 2019Q3 | -23 |

| 2019Q4 | -48 |

Most year-over-year indexes decreased as well. The year-over-year drilling and business activity index deteriorated further, from -21 to -50. Indexes for total revenues, capital expenditures, delivery time, profits, employment, and employee hours declined again in the fourth quarter. The year-over-year index for access to credit also turned negative. Only the year-over-year index for wages and benefits remained slightly positive.

Expectation indexes remained mostly negative. The future drilling and business activity index was -16, following a reading of -21 in Q3. The future capital expenditures, delivery time, profits, employment, employee hours, and access to credit indexes decreased again in Q4. The future wages and benefits index also turned negative. On the other hand, the future profits index was flat and the future revenues index expanded. Price expectations for oil and natural gas liquids eased slightly compared to the previous quarter, but remained positive. However, price expectations for natural gas fell.

Summary of Special Questions

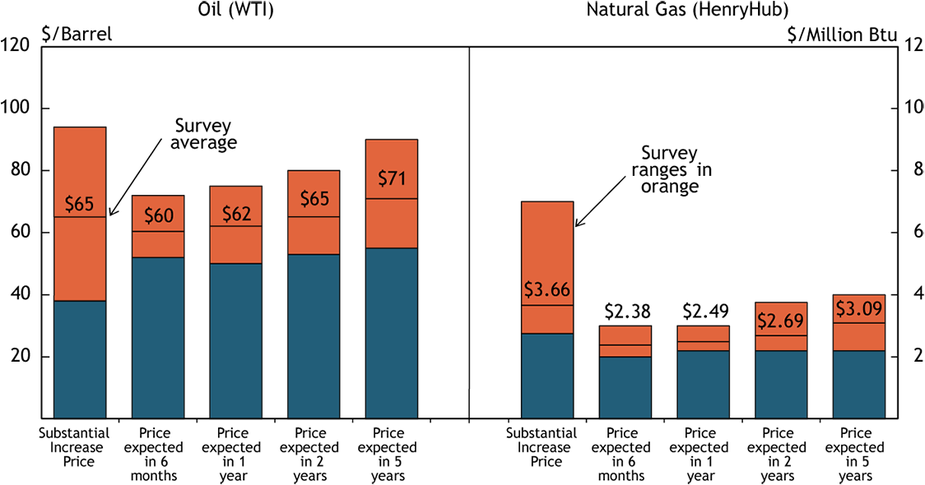

This quarter firms were asked what oil and natural gas prices were needed on average for a substantial increase in drilling to occur (in alternate quarters they are asked what price they need to be profitable on average across the fields in which they are active). The average oil price needed was $65 per barrel, with a range of $38 to $94 (Chart 2). This average was below the price reported in the second quarter of 2019, but up slightly from the fourth quarter of 2018. The average natural gas price needed was $3.66 per million Btu, with responses ranging from $2.75 to $7.00.

Chart 2. Special Question - What price is currently needed for a substantial increase in drilling to occur for oil and natural gas, and what do you expect the WTI and Henry Hub prices to be in six months, one year, two years, and five years?

Source: Federal Reserve Bank of Kansas City

Firms were again asked what they expected oil and natural gas prices to be in six months, one year, two years, and five years. Expected oil prices were slightly higher than Q3 2019, but similar to Q1 2019 price expectations. The average expected WTI prices were $60, $62, $65, and $71 per barrel, respectively. Expectations for natural gas prices decreased from last quarter. The average expected Henry Hub natural gas prices were $2.38, $2.49, $2.69, and $3.09 per million Btu, respectively.

Firms were also asked about their cash flow expectations for 2020 compared to 2019 (Chart 3). Nearly 37 percent of surveyed firms indicated they anticipate higher cash flow for 2020 compared to 2019, while 33 percent expect it will be down, and 30 percent expect no material change.

Finally, respondents were asked in what quarter they expect the U.S. rig count to begin rising again (Chart 4). Over 20 percent predicted an uptick in rig counts in Q2 2020 and 25 percent expected the U.S. rig count to increase in Q3 2020. However, over 33 percent reported they do not believe the rig count will increase in 2020 and listed timeframes extending into 2021 or later.

Chart 3.

Special Question - What are your firm cash flow expectations for 2020 compared to 2019?

Skip to data visualization table| Cash Flow Expecations | Percent |

|---|---|

| Down significantly | 13 |

| Down slightly | 20 |

| No material change | 30 |

| Up slightly | 33 |

| Up significantly | 3 |

Chart 4.

Special Question - In what quarter does your firm expect the U.S. rig count to begin rising again?

Skip to data visualization table| Quarter | Percent |

|---|---|

| Q1 2020 | 4.2 |

| Q2 2020 | 20.8 |

| Q3 2020 | 25 |

| Q4 2020 | 16.7 |

| Other or After 2020 | 33.3 |

Table 1 - Summary of Tenth District Energy Conditions, Quarter 4, 2019

Source: Federal Reserve Bank of Kansas City

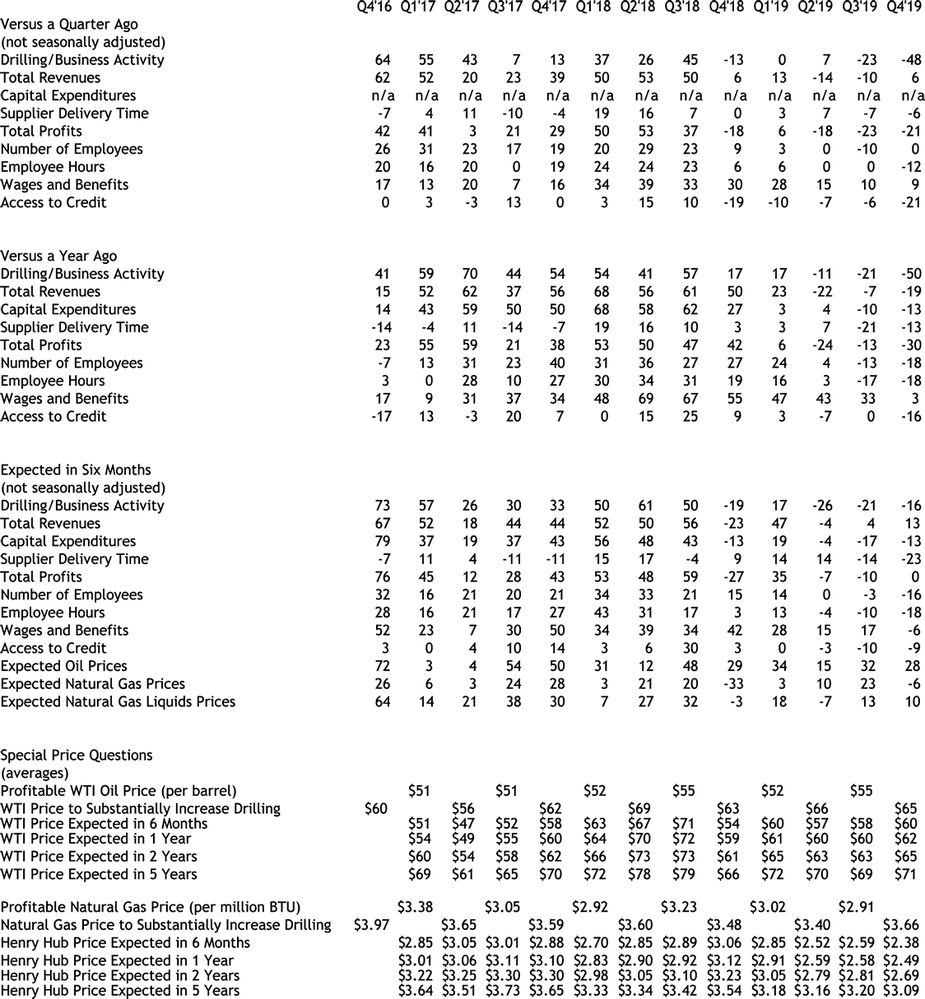

Table 2 - Historical Energy Survey Indexes

Source: Federal Reserve Bank of Kansas City

Selected Comments

“We have an abundant supply of natural gas. The shale production has produced a lot of gas with the oil. In some instances companies have had to pay people to take the gas (negative price). We need more infrastructure (pipe lines).”

“I see a stable supply of oil and limited demand growth.”

“Abundant supply of oil and there is lots of spare capacity in the world to produce more oil.”

“It seems like US shale is the swing producer of crude and that a long term price of $65 will keep the market balanced for the foreseeable future.”

“Middle East conflicts/demand are driving our expectations.”

“OPEC+ desires a higher price and have made cuts to achieve the same. Markets are slowly reaching a balance.”

“The mid-continent infrastructure is fading rapidly. No people, no services, no investment, no oil.”

“New technology and techniques, along with better coordination with the drilling team, have decreased completion times.”

“An uptick in pricing will lead to a small pickup [in rig count]. There are a few on the sidelines who’ve waited for price stability.”

“Current rig efficiency should keep a large recovery in rig count from increasing anytime soon.”

“Credit is drying up for large exploration companies. Less capital is on hand for exploration.”

“Production declines will push E&P customers to start to complete previously drilled wells and start to build inventory of uncompleted wells.”