Summary of Quarterly Indicators

Growth in Tenth District energy activity expanded solidly in the second quarter of 2018, as indicated by firms contacted between June 15th and June 29th (Tables 1 & 2). Most quarterly indexes increased in the second quarter. The total revenues, total profits, and wages and benefits indexes edged up while the supplier delivery time index inched lower (Chart 1). The employment index rose to the highest level since early 2017, while the employee hours index remained unchanged. The drilling and business activity index moderated slightly from 37 to 26. The access to credit index rose from three to 15, matching the record high last reached in 2014.

Chart 1.

Drilling/Business Activity Index vs. a Quarter Ago

Skip to data visualization table| Date | Drilling/Business Activity |

|---|---|

| 2015Q2 | -37 |

| 2015Q3 | -37 |

| 2015Q4 | -56 |

| 2016Q1 | -72 |

| 2016Q2 | 0 |

| 2016Q3 | 26 |

| 2016Q4 | 64 |

| 2017Q1 | 55 |

| 2017Q2 | 43 |

| 2017Q3 | 7 |

| 2017Q4 | 13 |

| 2018Q1 | 37 |

| 2018Q2 | 26 |

Year-over-year indexes were mixed. The wages and benefits index increased to the highest level in survey history, while the year-over-year capital expenditures index decreased modestly after the first quarter record high. The access to credit index improved moderately, and the employment and employee hours indexes increased slightly. The drilling and business activity and total revenues indexes fell modestly, while the supplier delivery time and total profits indexes edged lower but remained at high levels.

Expectations continued to grow strongly. The future drilling and business activity index expanded from 50 to 61, and the supplier delivery time, wages and benefits, and access to credit indexes edged higher. The total revenues and employment indexes inched down. After increasing during the first quarter, the capital expenditures and employee hours expectations indexes moderated, but remained well above zero. Price expectations for oil fell from 31 to 12, which a number of firms attributed to the announcement of OPEC’s production increases. On the other hand, price expectations for natural gas continued to expand moderately.

Summary of Special Questions

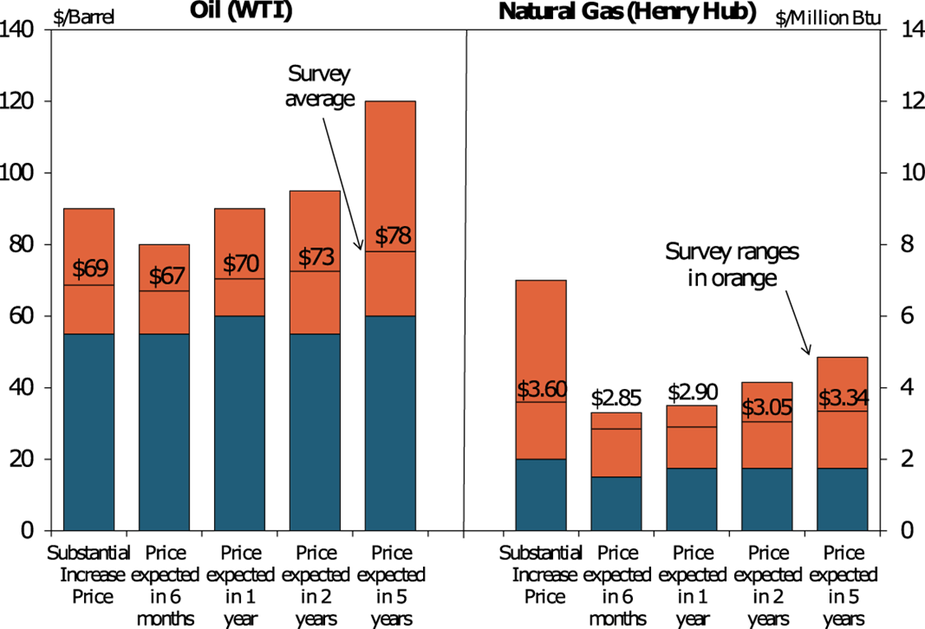

This quarter firms were asked what oil and natural gas prices were needed for a substantial increase in drilling to occur. The average oil price needed was $69 per barrel, with a range of $55 to $90 (Chart 2). This average was up from the $56 and $62 averages reported in the second and fourth quarters of 2017, respectively. The average natural gas price needed was $3.60 per million Btu, with responses ranging from $2.00 to $7.00.

Chart 2. Special Question - What price is currently needed for a substantial increase in drilling to occur for oil and natural gas, and what do you expect the WTI and Henry Hub prices to be in six months, one year, two years, and five years?

Source: Federal Reserve Bank of Kansas City

Firms were again asked what they expected oil and natural gas prices to be in six months, one year, two years, and five years. Expected oil prices increased since the last quarter. The average expected WTI prices were $67, $70, $73, and $78 per barrel, respectively. Meanwhile natural gas price expectations inched higher. The average expected Henry Hub natural gas prices were $2.85, $2.90, $3.05, and $3.34 per million Btu, respectively.

Firms were also asked about potential issues that might limit near-term growth in their primary area of activity. Half of respondents reported that problems finding workers and cost inflation could limit near term growth (Chart 3). Specifically, firms noted difficulties in filling low and mid-skill positions due to a lack of available or experienced applicants. Roughly 30 percent of those surveyed also expected a lack of pipeline capacity for oil and natural gas to limit near term growth. Most firms also reported strong capital spending plans.

Chart 3.

Which of the following, if any, do you expect to limit near-term growth inactivity in the top area in which your firm is active? (Please check all that apply)

Skip to data visualization table| Area | Percent |

|---|---|

| Workers | 50 |

| Inflation | 50 |

| Gas capacity | 32 |

| Oil capacity | 29 |

| Equipment | 21 |

| Infrastructure | 21 |

| Other | 14 |

Finally, firms were asked about the level of business risk associated with lower operational activity, decreased oil demand, financing constraints, higher OPEC production levels, and tighter regulation. Sixty-five percent of respondents anticipated a medium business risk from higher OPEC production levels (Chart 4). Over forty percent listed tighter regulation as a medium business risk.

Chart 4.

What level of risk do you see for your business from the following factors over the next year?

Skip to data visualization table| Level | Lower operational productivity | Decreased oil demand | Financing Constraints | Higher OPEC production levels | Tighter Regulation |

|---|---|---|---|---|---|

| None | 26 | 13 | 23 | 3 | 10 |

| Low | 55 | 65 | 42 | 19 | 37 |

| Medium | 16 | 23 | 29 | 61 | 43 |

| High | 3 | 0 | 6 | 16 | 10 |

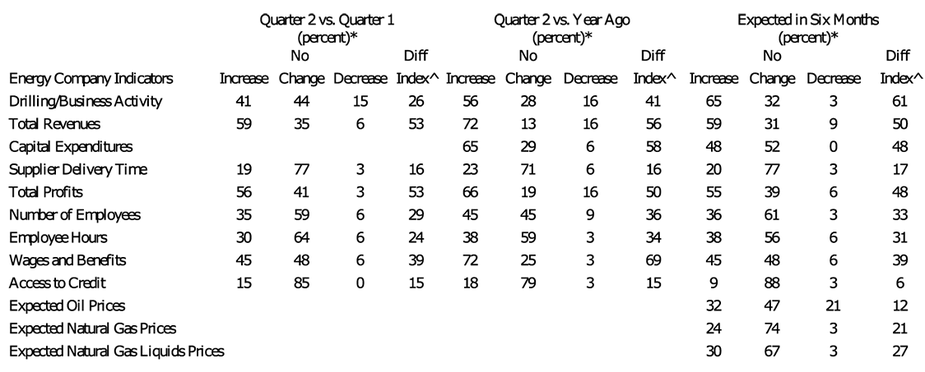

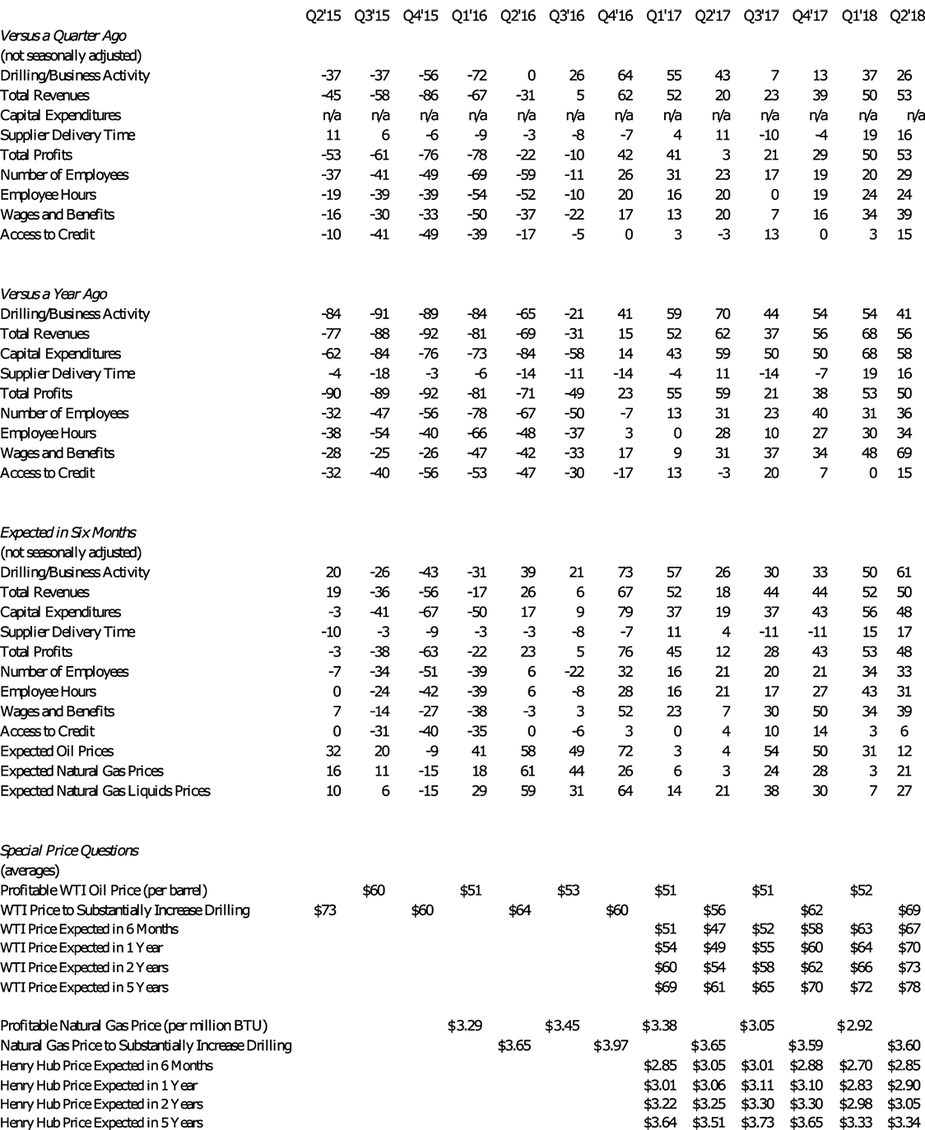

Table 1 - Summary of Tenth District Energy Conditions, Quarter 2, 2018

*Percentage may not add to 100 due to rounding. ^Diffusion Index. The diffusion index is calculated as the percentage of total respondents reporting increases minus the percentage reporting declines. Note: The second quarter survey ran from June 15, 2018 to June 29, 2018 and included 34 responses from firms in Colorado, Kansas, Nebraska, Oklahoma, Wyoming, northern New Mexico, and western Missouri.

Source: Federal Reserve Bank of Kansas City

Table 2 - Historical Energy Survey Indexes

Source: Federal Reserve Bank of Kansas City

Selected Comments

“Supply and demand for oil seem to be in fair balance. Currently we see a little more downside pressure than upside due to potential increases in supply from the U.S., Saudi Arabia and Russia.”

“Geopolitical pressures on supplies and continued positive economic conditions around the world are driving our expectations for oil prices.”

“Commodity prices and our ability to raise prices are currently driving our business plans over the next six months.”

“The large supplies of natural gas and good wells keep prices low. LNG will increase the values once they are on line.”

“There is too much supply of natural gas. Too much gas with new completions are filling pipes.”

“Permian Basin oil and gas pipelines are at or near capacity, which results in lower price differentials to index prices. The threat of production curtailments are driving our business plans in the near future.”

“We are concerned about the impact of tariffs on pipe supply and equipment.”

“Any gain we can make through proven technologies that allows us to grow in our efficiencies will translate towards improved income and higher wages. A happy workforce is a well-paid workforce.”

“Automation and big data will allow us to leverage our manpower, but we still expect modest increases in headcount.”