The Kansas City Financial Stress Index (KCFSI) was created in 2009 to capture key features of financial stress using 11 financial market indicators (Hakkio and Keeton 2009). The 11 indicators are classified into two groups: one group represents yield spreads, and the other group summarizes the volatility of asset prices. The statistical method underlying the KCFSI eliminates idiosyncratic noise in the indicators to extract the common component driving all of them. While the current KCFSI identifies widely recognized episodes of financial stress over recent decades, some input variables are likely to become less relevant over time as economic and regulatory environments change. We revamp the KCFSI to accommodate one particular change: the diminishing relevance of the London Interbank Offered Rate (LIBOR).

Regulatory changes announced by the Financial Conduct Authority in the United Kingdom will eliminate LIBOR by 2021 and are likely to force financial institutions to use another benchmark interest rate in their contracts (The Economist 2018). The current KCFSI relies on LIBOR for the TED spread, which is defined as the difference between the three-month LIBOR and the three-month secondary market Treasury bill rate. However, the cost of borrowing collateralized by Treasury securities (also known as the Treasury repo rate) is increasingly being used instead of LIBOR as an alternative benchmark for money market rates.

Motivated by this change, we replace the TED spread in the KCFSI with the spread between the Treasury repo rate and the three-month Treasury bill rate to construct a revised measure of financial stress. One challenge in constructing this revised measure is that the Depository Trust and Clearing Corporation (DTCC) Treasury repo index based on actual transactions is available only starting in 2005, whereas the current measure of the KCFSI uses LIBOR data beginning in 1990. To bridge this gap, we also use survey data for the repo rate from the Federal Reserve Bank of New York starting in February 1998. We regress the DTCC Treasury repo index (RR) onto a constant and the survey-based measure of the repo rate (RRS) to obtain a predicted DTCC Treasury repo index (RR*) as follows:

where a and b are parameter estimates, and e is a residual that captures unexplained variation in RR. We impute the DTCC Treasury repo rate for the 1998–2004 period using predicted values from the regression and splice this measure with the transaction-based repo rate starting in 2005. However, we are still missing data before 1998. To construct a revised KCFSI, we take additional steps to impute the data from 1990 to 1998. In this case, we back out values for the repo rate using the statistical relationship between the repo rate and other input variables to the KCFSI from 1998 to 2018. This gives us values for all the input variables since 1990, including the imputed values for the repo rate from 1998 to 2004. We apply the same statistical method of extracting the common component of different indicators to construct the KCFSI based on this new dataset.

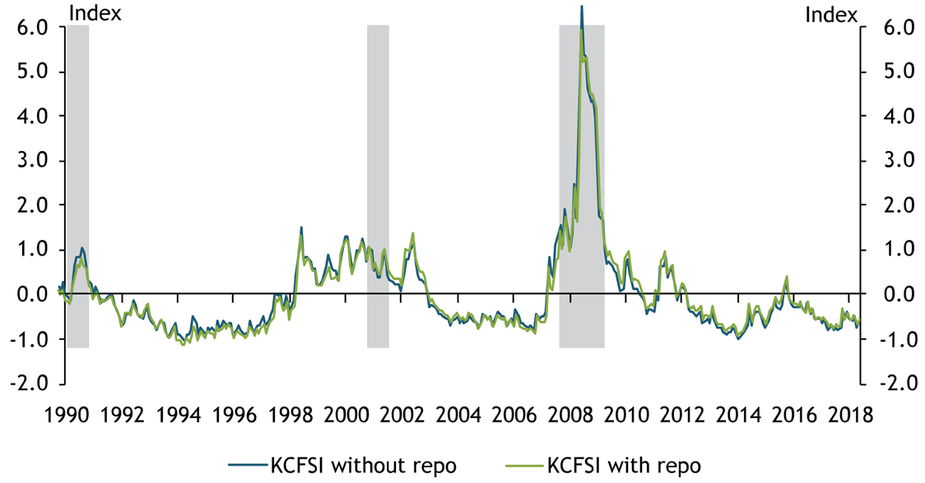

Chart 1 shows the current KCFSI using LIBOR alongside the revised KCFSI using the Treasury repo rate. The two measures are highly correlated, suggesting the repo rate does not create big changes in the KCFSI. Hence, we conclude that the Treasury repo rate is an appropriate replacement for LIBOR in the KCFSI and plan to publish the revised KCFSI using the repo rate starting in November 2018.

Chart 1: Federal Reserve Bank of Kansas City's Financial Stress Index with and without Repo Rate Replacing TED Spread

Note: Gray bars denote National Bureau of Economic Research (NBER)-defined recessions. The KCFSI is normalized to a variable whose mean and standard deviation are zero and one, respectively.

Sources: Federal Reserve Bank of Kansas City, NBER, DTCC (Haver Analytics), and authors’ calculations.

References

The Economist. 2018. “External LinkA Scramble to Replace LIBOR Is Under Way,” September 27.

Hakkio, Craig S., and William R. Keeton. 2009. “Financial Stress: What Is It, How Can It Be Measured, and Why Does It Matter?” Federal Reserve Bank of Kansas City, Economic Review, vol. no. 2, pp. 5–50.

Thomas Cook is a data scientist at the Federal Reserve Bank of Kansas City. Taeyoung Doh is a senior economist at the bank. Akshat Gautam, a research associate at the bank, helped prepare the Bulletin. The views expressed are those of the authors and do not necessarily reflect the positions of the Federal Reserve Bank of Kansas City or the Federal Reserve System.