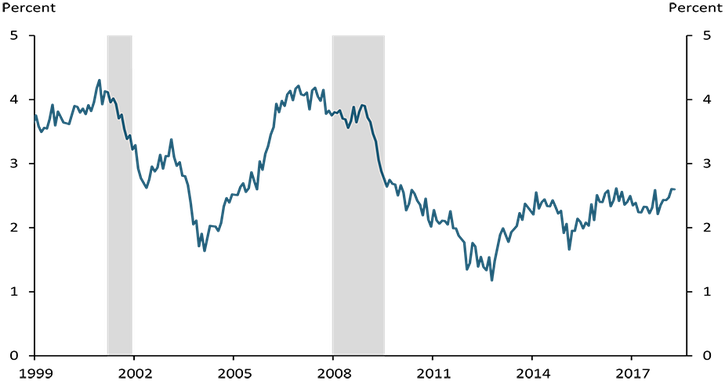

Although unemployment and other measures of labor underutilization have returned to their pre-crisis levels, wage growth has remained modest since the Great Recession. The modest pace of wage growth since the end of the Great Recession is at odds with its behavior during the previous recession, when wage growth rebounded more quickly and sharply. Chart 1 shows the year-over-year percentage change in average hourly earnings of production and nonsupervisory workers. By late 2005, roughly four years after the end of the 2001 recession, year-over-year wage growth had surpassed 3 percent, and it reached 4 percent shortly thereafter. In contrast, nearly nine years after the end of the Great Recession, year-over-year wage growth has still not reached 3 percent.

Chart 1: The Path of Wage Growth over the Past Two Cycles

Notes: Wage growth is measured as the year-over-year percent change in average hourly earnings of production and nonsupervisory employees. Gray bars denote National Bureau of Economic Research (NBER)-defined recessions.

Sources: Bureau of Labor Statistics (Haver Analytics) and NBER (Haver Analytics).

Because employment relationships are typically long-lasting, individual wages may respond not only to current labor market conditions but also to how much wages were able to adjust in the past._ For example, firms that were unable to cut wages during recessions may compensate for that inability by giving smaller wage increases as the economy recovers._ Consistent with this explanation, we document a systematic relationship between wage growth today and the incidence of nominal wage rigidities a year ago (that is, the share of workers with zero wage change last year compared with two years ago)._ Importantly, this relationship holds true even when we account for labor market slack, proxied by the unemployment rate, suggesting nominal wage rigidities may help explain aggregate wage growth above and beyond what typical indicators suggest.

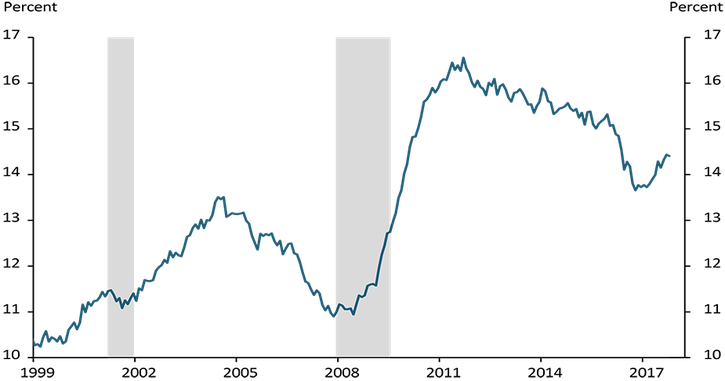

To illustrate how nominal wage rigidities have behaved over the past two recessions and recoveries, Chart 2 presents the 12-month centered average of the share of individuals with zero nominal wage change in a particular year relative to the previous year. These data are taken from the Federal Reserve Bank of San Francisco’s Wage Rigidity Meter, which is constructed from Current Population Survey (CPS) data on individuals that have not changed jobs over the course of a year._

Chart 2: The Path of Nominal Wage Rigidities Over the Past Two Cycles

Notes: Nominal wage rigidities refer to the share of workers in the same job who report no year-over-year wage change. Gray bars denote National Bureau of Economic Research (NBER)-defined recessions.

Sources: Federal Reserve Bank of San Francisco and NBER (Haver Analytics).

The chart shows that following both the 2001 recession and the Great Recession, the share of workers with zero nominal wage change first increased and then gradually declined. However, the decline following the Great Recession was much more sluggish. Indeed, while nominal wage rigidities are below their post-Great Recession peak of 16.5 percent, they are still well above the peaks observed in the previous recovery—and they appear to be rising again.

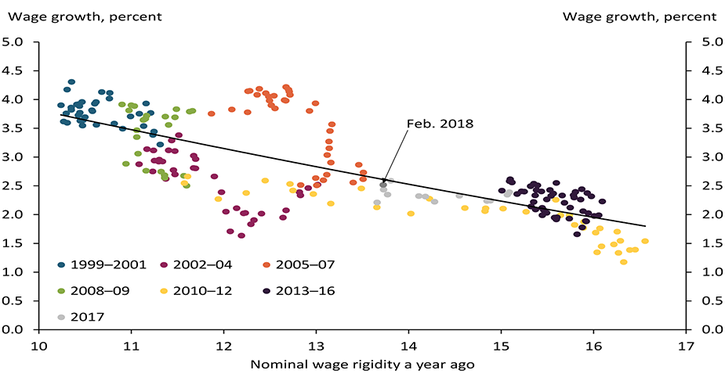

To assess whether a high share of workers with zero nominal wage change is associated with lower future wage growth, Chart 3 plots annual wage growth in a given month against nominal wage rigidities from the same month one year prior. For example, the dark gray dot represents wage growth in February 2018 plotted against nominal wage rigidities in February 2017.

Chart 3: The Relationship between Nominal Wage Rigidities a Year Ago and Wage Growth Today

Notes: Wage growth is measured as the year-over-year percent change in average hourly earnings of production and nonsupervisory employees. Nominal wage rigidities refer to the share of workers in the same job who report no year-over-year wage change.

Sources: Bureau of Labor Statistics (Haver Analytics), Federal Reserve Bank of San Francisco, and authors’ calculations.

The chart shows a clear negative relationship between wage growth and nominal wage rigidities one year prior. Notably, these two variables have co-moved over the two most recent business cycles in a systematic fashion. The blue dots representing the 1999–2001 period and the green dots representing the 2008–09 period overlap, showing that prior to and during the two most recent recessions, wage growth was high and rigidities were low. Once both recessions ended, rigidities rose and wage growth fell. Indeed, after the 2001 recession, wage growth fell below 2 percent as rigidities exceeded 12 percent (magenta dots). The first few years after the Great Recession show a similar dynamic (yellow dots). However, during this period, wage growth fell slightly more than after the 2001 recession, as the share of workers with zero nominal wage growth topped 16 percent.

Importantly, though, the recent path of wage growth and wage rigidities is very much in line with historical norms: the light gray dots, representing data from 2017, and the dark gray dot, which represents data from February 2018, are essentially on top of the black line, which represents the best fit between wage growth and prior wage rigidity. Thus, the arguably lackluster wage growth in 2017 and the first two months of 2018 is consistent with a high share of workers with zero nominal wage growth over the past several years.

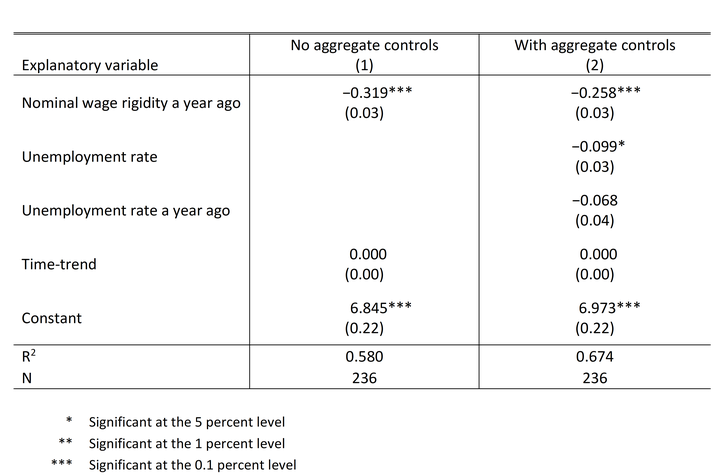

To more formally assess this relationship, Table 1 presents the results of a linear regression of wage growth today on nominal wage rigidities one year ago. The estimated coefficient in column (1) implies that a one percentage point increase in nominal wage rigidities is associated with a 0.32 percentage point decrease in nominal wage growth a year later. Column (2) shows that this relationship holds even when accounting for the current and prior state of the labor market, measured as the national unemployment rate today and one year ago. Specifically, the estimated coefficient implies that a one percentage point increase in nominal wage rigidities is associated with a 0.26 percentage point decrease in nominal wage growth a year later, which is economically and statistically similar to the coefficient estimated in column (1)._

Table 1: Explaining Wage Growth Using Nominal Wage Rigidities and the Unemployment Rate

Note: Robust standard errors are in parentheses.

Sources: Bureau of Labor Statistics (Haver Analytics), Federal Reserve Bank of San Francisco, and authors’ calculations.

Overall, our results suggest that the recent period of modest wage growth is unsurprising, given the high and persistent level of nominal wage rigidities. The results in Chart 3 and Table 1 suggest that for wage growth to meet or exceed 3 percent next year, nominal wage rigidities this year would have to fall by about 2 percentage points to 12.5 percent. In other words, nominal wage rigidities would need to return to levels last seen at the onset of the Great Recession—and at an unprecedented pace. For comparison purposes, after the 2001 recession, it took nearly three years for nominal wage rigidities to fall 2 percentage points from their peak of 13.5 percent. Thus, the recent uptick in nominal wage rigidities suggests wage growth is unlikely to ramp up dramatically next year.

Endnotes

-

1

For example, Beaudry and DiNardo (1991) find that past labor market conditions have persistent effects on individual wages, which is more consistent with an implicit contract or agreement between worker and firm, rather than a spot market whereby wages react only to changes in current conditions.

-

2

Elsby (2009) shows that firms may be reluctant to increase wages during good times, anticipating they won’t be able to cut wages in the future.

-

3

For related empirical research, see Card and Hyslop (1997); Lebow, Saks, and Wilson (2003); Dickens and others (2007); Barratieri, Basu, and Gottschalk (2014); and Daly, Hobijn, and Wiles (2011).

-

4

Details are available at External Linkhttps://www.frbsf.org/economic-research/indicators-data/nominal-wage-rigidity/

-

5

More formally, a Wald test suggests we can reject the null hypothesis of equality of the two coefficients (nominal wage rigidity a year ago) in columns (1) and (2) only at the 10 percent level.

References

Barattieri, Alessandro, Susanto Basu, and Peter Gottschalk. 2014. External Link“Some Evidence on the Importance of Sticky Wages.” American Economic Journal: Macroeconomics, vol. 6, no. 1, pp. 70–101.

Beaudry, Paul, and John Dinardo. 1991. External Link“The Effect of Implicit Contracts on the Movement of Wages Over the Business Cycle: Evidence from Micro Data.” Journal of Political Economy, vol. 99, no. 4, pp. 665–688.

Card, David, and Dean Hyslop. 1997. “Does Inflation ‘Grease the Wheels of the Labor Market’?” in Christina D. Romer and David H. Romer, eds., Reducing Inflation: Motivation and Strategy. Chicago: University of Chicago Press.

Daly, Mary C., Bart Hobijn, and Theodore S. Wiles. 2012. External Link“Dissecting Aggregate Real Wage Fluctuations: Individual Wage Growth and the Composition Effect.” Federal Reserve Bank of San Francisco Working Paper 2011-23, May.

Dickens, William T., Lorenz Goette, Erica L. Groshen, Steinar Holden, Julian Messina, Mark E. Schweitzer, Jarkko Turunen, and Melanie E. Ward. 2007. External Link“How Wages Change: Micro Evidence from the International Wage Flexibility Project.” Journal of Economic Perspectives, vol. 21, no. 2, pp. 195–214.

Elsby, Michael W. L. 2009. External Link“Evaluating the Economic Significance of Downward Nominal Wage Rigidity.” Journal of Monetary Economics, vol. 56, no. 2, pp. 154–169.

Lebow, David E., Raven E. Saks, and Beth Anne Wilson. 2003. External Link“Downward Nominal Wage Rigidity: Evidence from the Employment Cost Index.” Advances in Macroeconomics, vol. 3, no. 1, pp. 1–28.

José Mustre-del-Río is an economist at the Federal Reserve Bank of Kansas City. Emily Pollard is a research associate at the bank. The views expressed are those of the authors and do not necessarily reflect the positions of the Federal Reserve Bank of Kansas City or the Federal Reserve System.