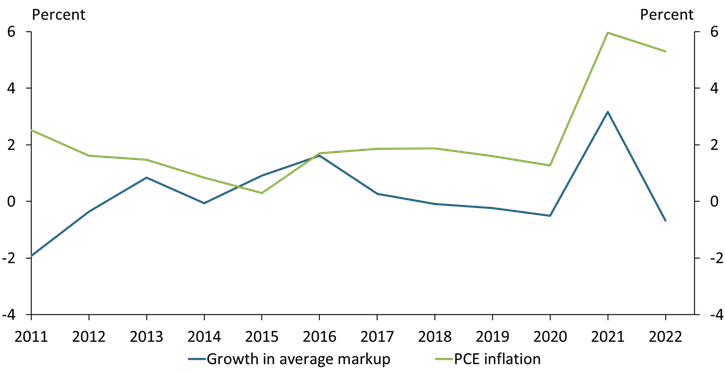

Sources: U.S. Bureau of Economic Analysis (Federal Reserve Bank of St. Louis FRED), Compustat, and authors’ calculations.

Growth in the average markup of publicly traded firms (that is, the price firms charge above their costs) fell sharply from 3.2 percent in 2021 to −0.7 percent in 2022. This decline could have substantially reduced inflation if firms’ costs had remained constant, since inflation is the sum of markup growth plus growth in the marginal cost of production. However, the pace of inflation—as measured by the price index for personal consumption expenditures (PCE)—fell by only 0.7 percentage points, suggesting rapid cost growth drove inflation in 2022.

See more research from Charting the Economy.