Economic growth in Nebraska has become increasingly unbalanced. At first glance, the state’s economy appears solid, with a low unemployment rate, steady increases in wages and strengthening real estate markets. A closer look, however, reveals some industries are growing while others are less robust. Some regions show ongoing signs of optimism, whereas indicators are more negative in other parts of the state.

Service-based firms in Nebraska have continued to add jobs, but employment growth outside of the services sector has been weak. Moreover, these service-oriented businesses tend to be concentrated in the state’s three most populous counties: Douglas, Lancaster and Sarpy. Job growth has remained steady in these metropolitan counties, but the rest of the state has weakened significantly as the adverse effects of a softening farm economy have taken hold.

The State-Level Picture

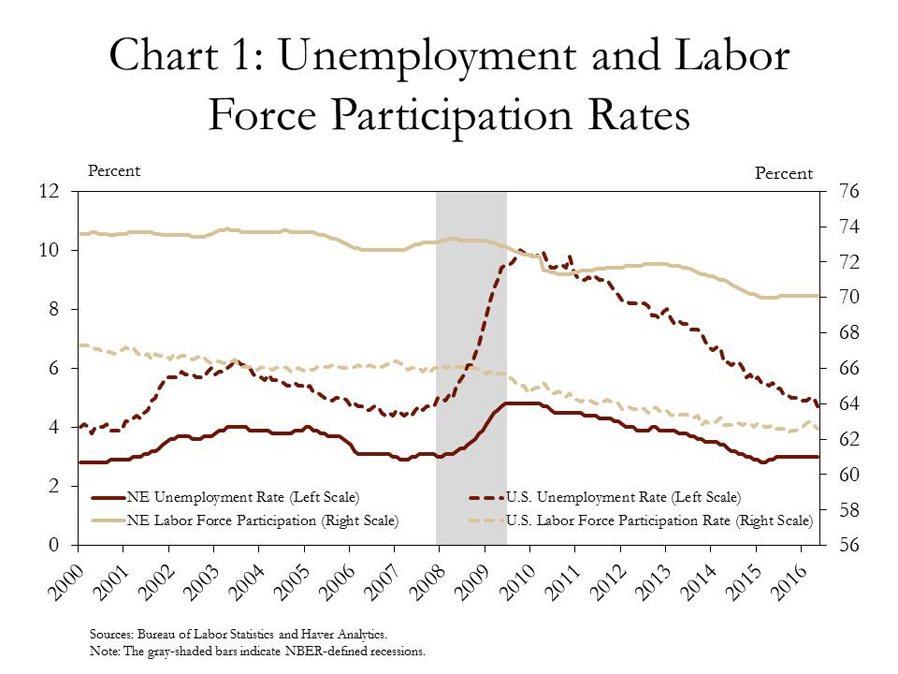

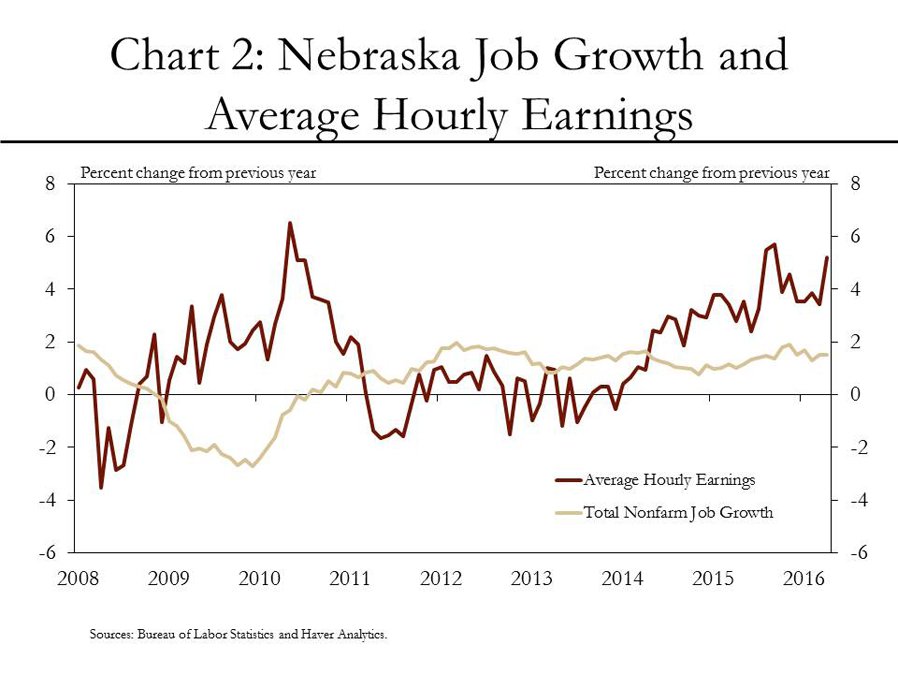

Overall, Nebraska’s labor market has remained relatively strong through the first half of 2016. Nebraska’s unemployment rate of 3.0 percent was third lowest in the country behind South Dakota and New Hampshire, and is similar to its lows prior to the most recent recession (Chart 1). Similarly, Nebraska’s labor force participation rate as of May was fourth highest in the country at 70.1 percent. And while the state’s participation rate has trended down, it has remained significantly higher than the nation’s rate. Although job growth has fluctuated somewhat, the average rate of growth through April has been slightly higher than the post-recession average and wages have continued to increase (Chart 2).

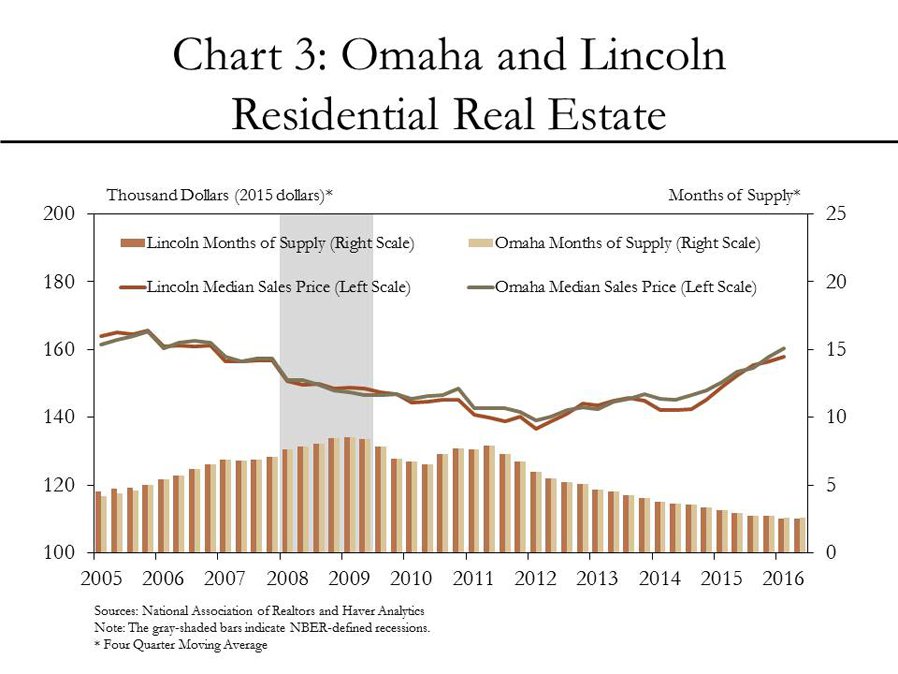

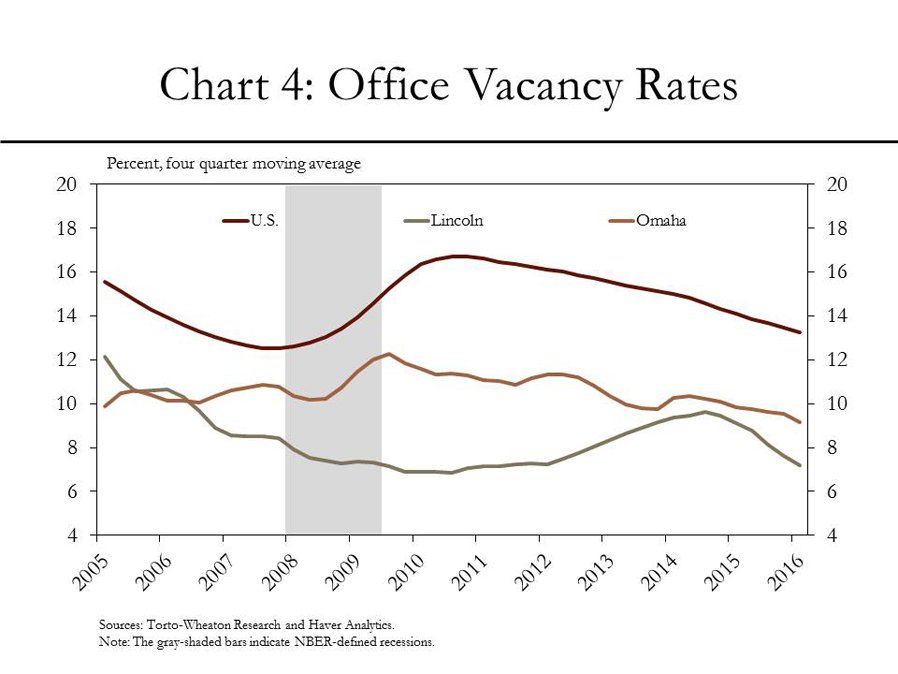

The state’s residential and commercial real estate industries also have continued to strengthen in 2016. Median house prices increased steadily through 2015 and, as of March 2016, had nearly reached pre-recession peaks in both Omaha and Lincoln in inflation adjusted terms (Chart 3). Steady gains in prices have been supported by tighter inventories in residential real estate markets, particularly in the state’s metro areas. Commercial real estate markets also have strengthened further as office vacancy rates have continued to edge lower (Chart 4).

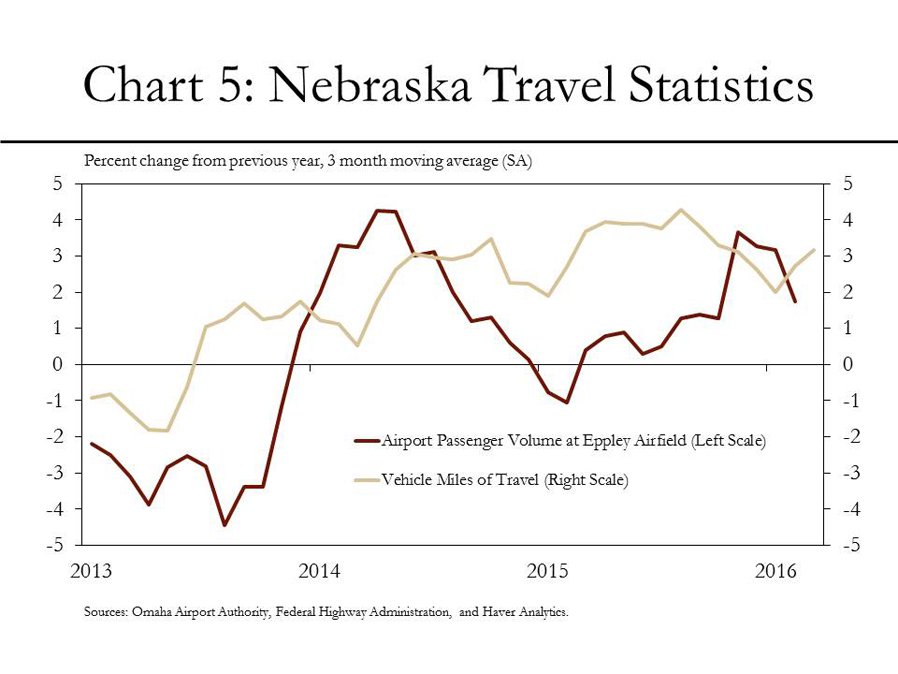

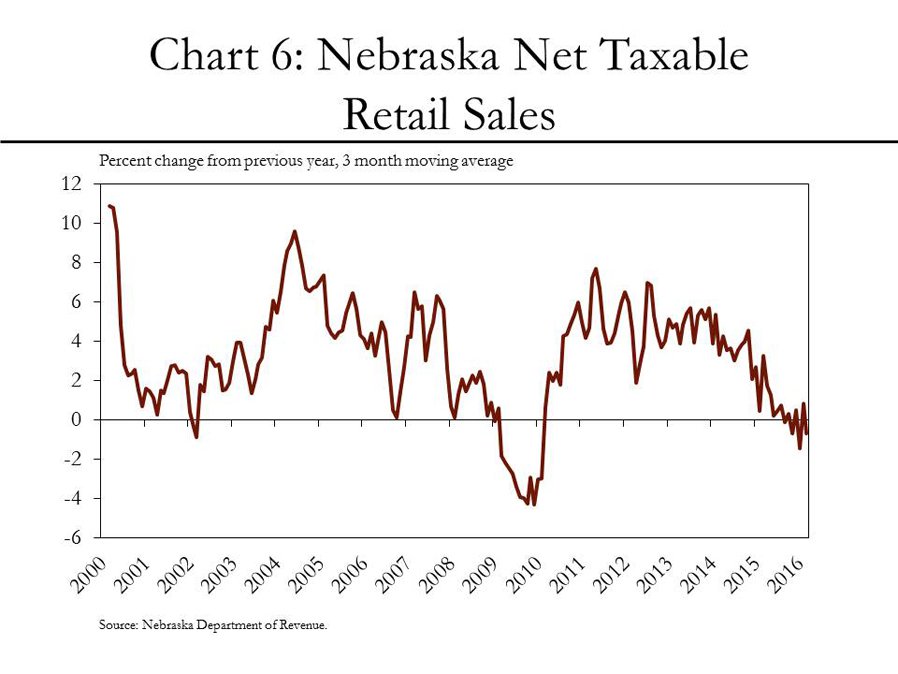

Some consumer indicators in Nebraska also have pointed to a steady path of economic activity. For example, air traffic at Eppley Airfield in Omaha has averaged an increase of nearly 2 percent during the last six months for which data are available (Chart 5). Similarly, recent increases in vehicle-miles traveled suggest steady improvement in economic activity in the state following the last recession. Retail sales in the state also expanded steadily through mid-2015 (Chart 6). This indicator, however, has softened recently, highlighting some of the intensifying weakness in parts of the state economy.

Diverging Growth

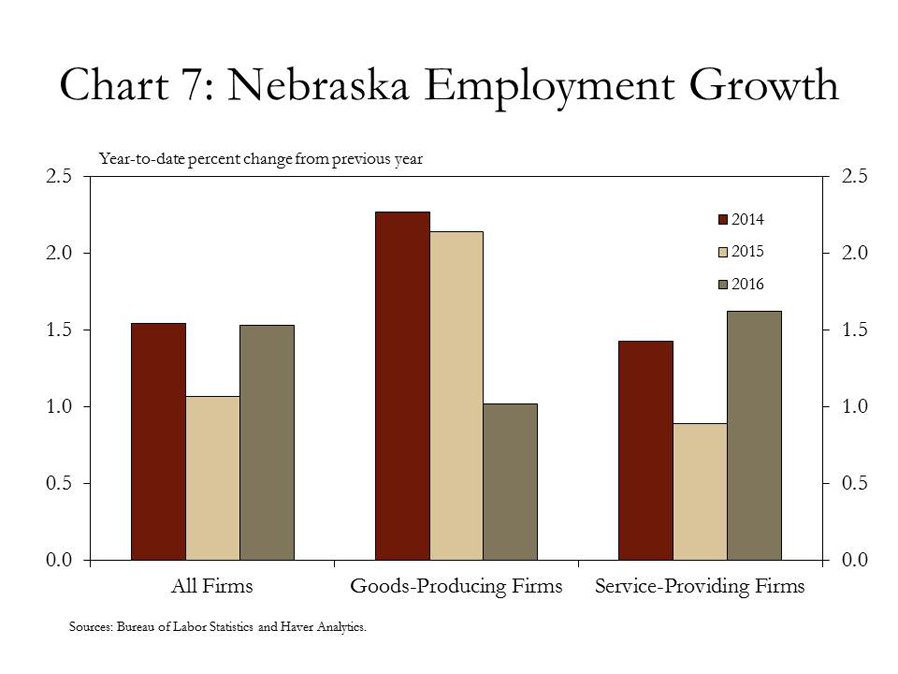

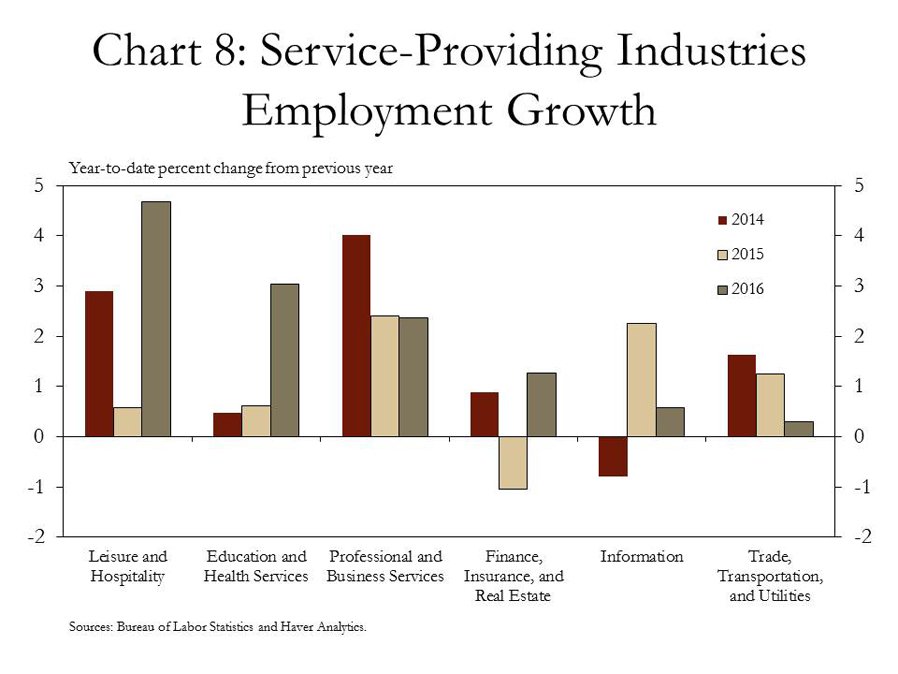

Despite the statewide signs of optimism, much of the recent employment growth in Nebraska has been concentrated in the services sector. Through May 2016, job growth at service-providing firms outpaced goods-producing firms by more than 50 percent (Chart 7). Employment gains in Nebraska’s services sector largely have been driven by sharp increases in employment among businesses connected to leisure and hospitality, and education and health services, but also other service-providing firms (Chart 8).

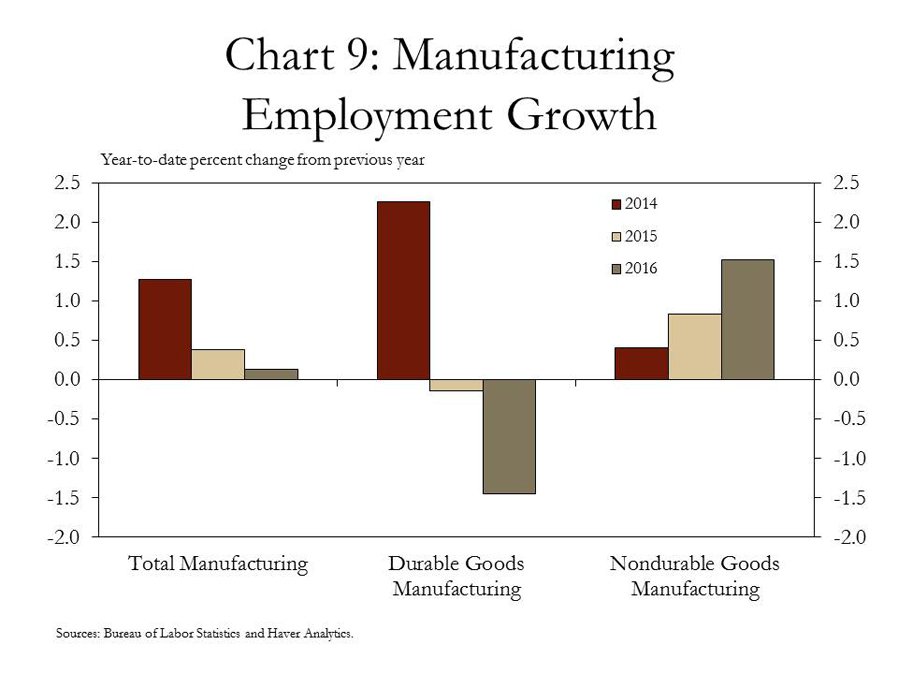

In contrast to the accelerating pace of growth at service-based firms, job growth among goods-producing firms has weakened. Through May, goods-producing firms added jobs at an average rate of only 1.0 percent, down from more than 2.0 percent a year ago. Illustrating the divergence in growth over a longer time horizon, employment at service-providing firms has increased 6.2 percent since January 2008, near the beginning of the last recession. Meanwhile, employment at goods-producing firms has declined 2.1 percent over the same period. The softness in employment among goods-producing firms has been most notable at manufacturers of durable goods, where employment has declined nearly 1.5 percent since the beginning of 2016 (Chart 9).

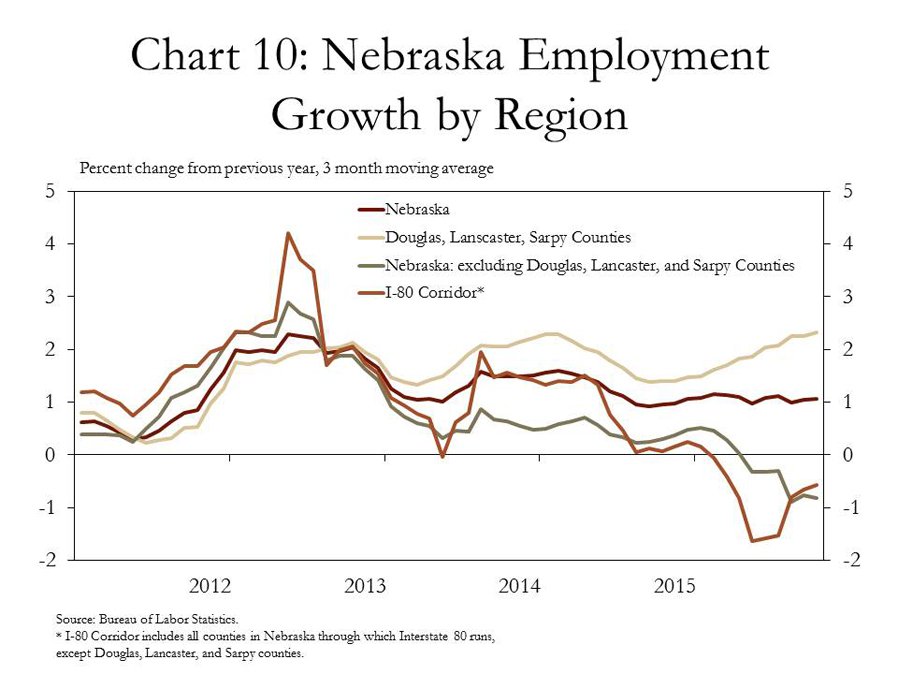

Job growth also has diverged regionally throughout the state. Employment growth has remained robust in the state’s most populous metro counties: Douglas, Lancaster and Sarpy, which tend to have a higher concentration of services-sector jobs (Chart 10). Growth has been notably weaker, though, in the rest of the state, which depends more heavily on manufacturing and commodities. Perhaps most notably, employment growth along the Interstate-80 corridor weakened dramatically through 2015, even as growth in the state’s three most populous counties picked up.

Rural Headwinds

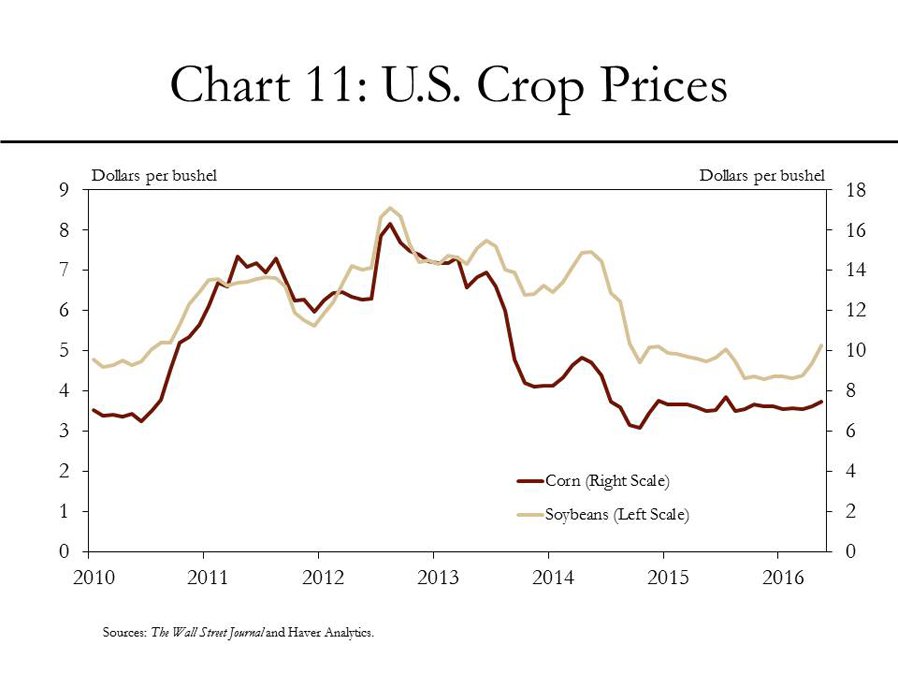

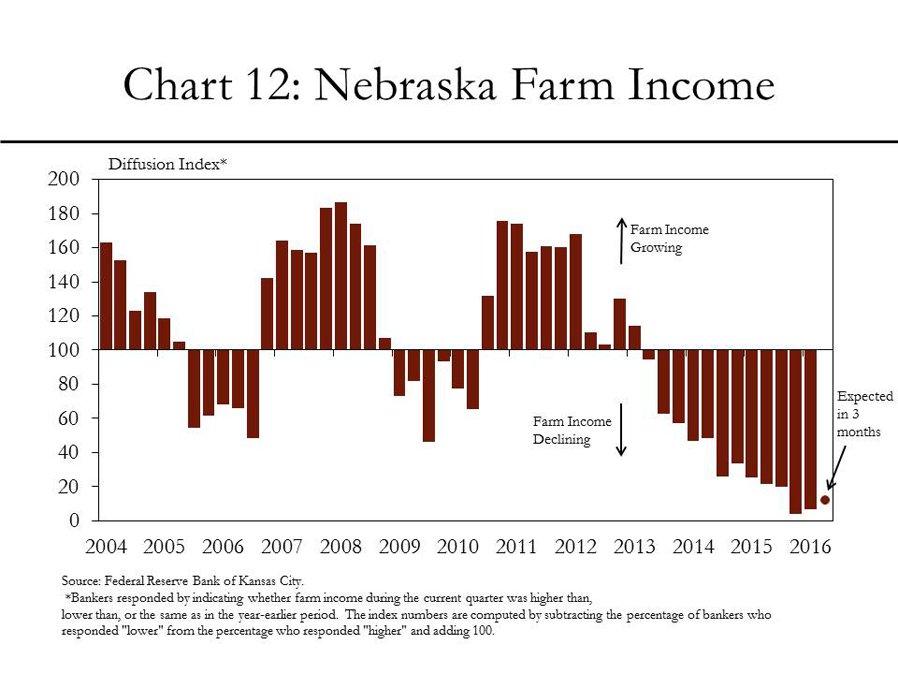

The increasing divergence in economic growth in Nebraska has expanded due to persistent headwinds in the state’s farm economy and its connection to manufacturing. Although crop prices rebounded modestly in the second quarter, due primarily to developing weather concerns, a prolonged period of low commodity prices has suppressed farm income in Nebraska (Charts 11 and 12).

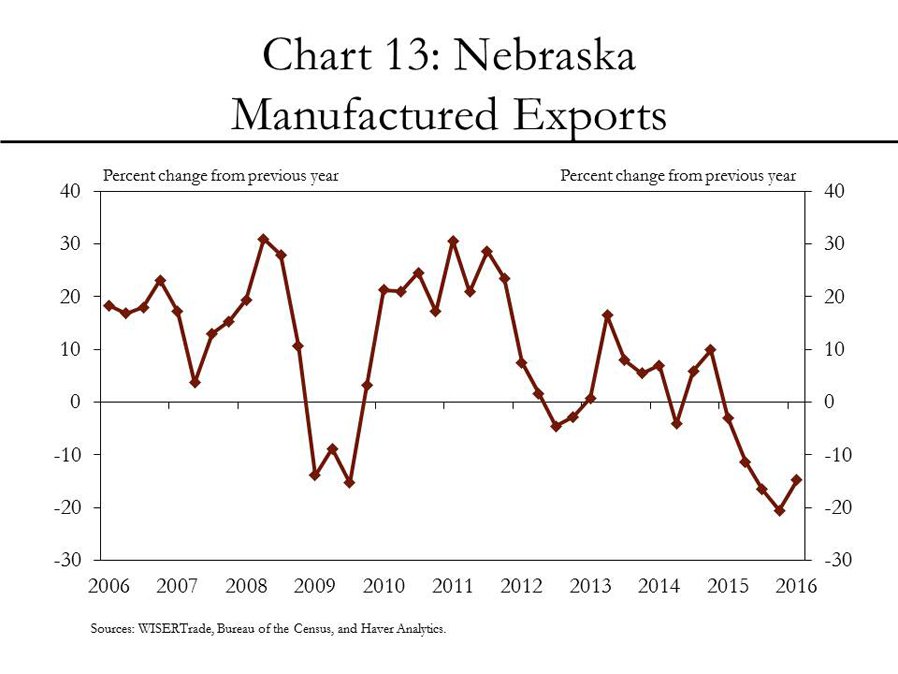

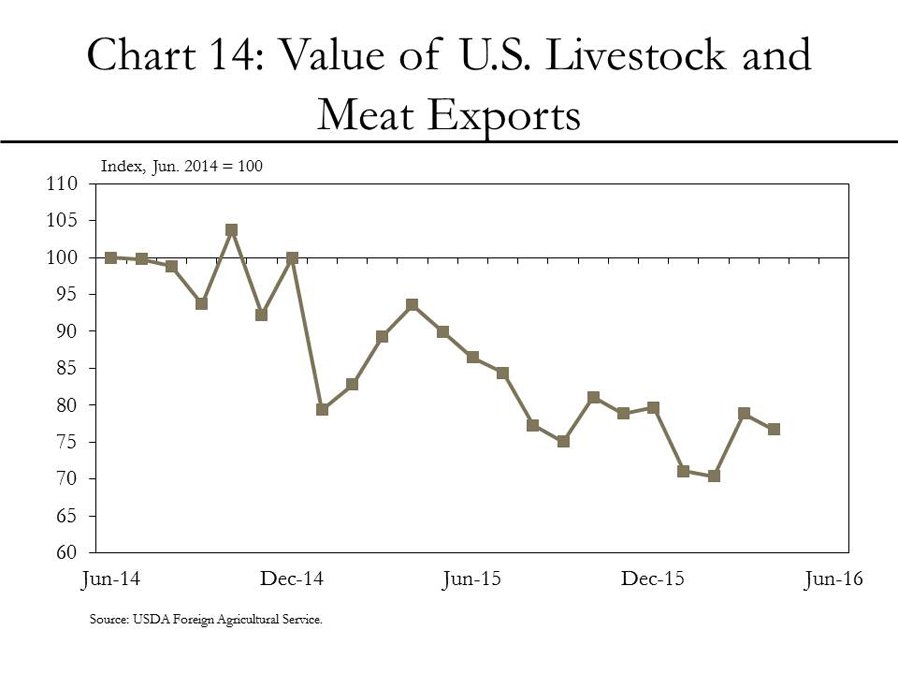

The downturn in the state’s farm economy has affected economic activity among other industries connected to the agricultural supply chain. Through April, manufactured exports shipped from Nebraska had declined an average of 14.7 percent from a year earlier (Chart 13). These declines have been consistent with national trends that have shown a persistent decline in U.S. exports of beef and pork, which represent a significant share of Nebraska manufactured exports (Chart 14).

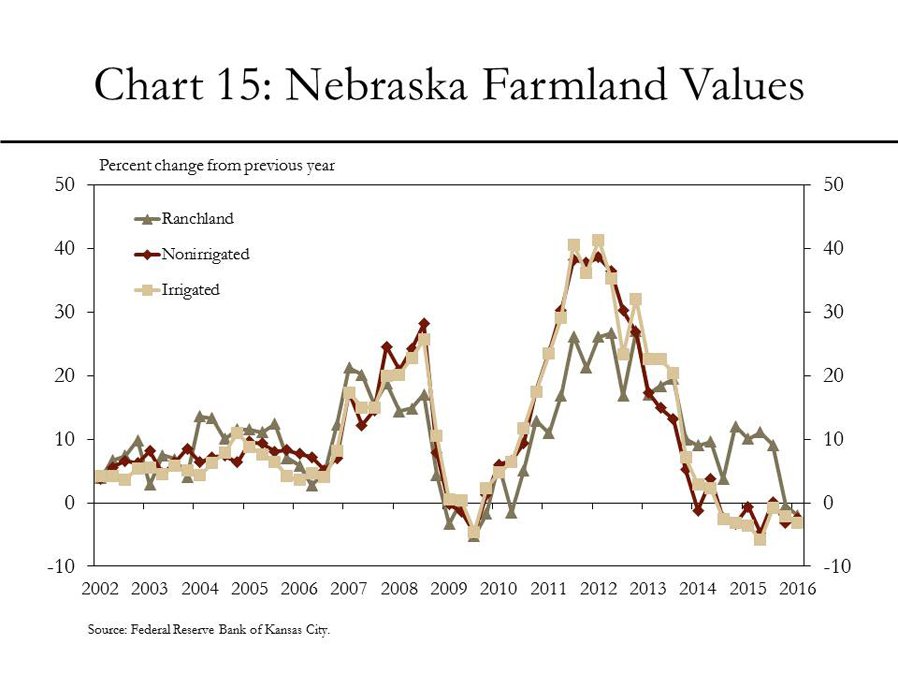

Further reflecting divergence in the state economy, farm real estate prices have declined steadily in recent quarters despite the ongoing increases in residential real estate prices. In fact, the value of non-irrigated cropland in Nebraska has declined in every quarter since mid-2014 following the drop in crop prices in 2013 (Chart 15). In the first quarter of 2016, each type of farmland in Nebraska (non-irrigated and irrigated cropland and ranchland) declined from a year earlier for the first time since 2014.

Conclusion

The strength of Nebraska’s services sector, with its majority of jobs concentrated in just a few counties, has masked some of the intensifying weaknesses in economic activity throughout the state. Although state-level indicators suggest Nebraska’s economy has expanded consistently, industry-level and region-specific measures show economic activity has diverged. This divergence appears to be driven, in part, by the slowdown in the farm sector and its corresponding effect on parts of the state’s manufacturing sector.

The views expressed in this article are those of the authors and do not necessarily reflect the views of the Federal Reserve Bank of Kansas City or the Federal Reserve System.