Oklahoma real estate conditions generally remained solid through the third quarter of 2015, even after slight declines in statewide employment and income since spring. But an increasingly sluggish outlook for the state’s important oil and gas industry and a recent upsurge in state unemployment claims suggest a potential for some future difficulties. In light of these concerns, this edition of The Oklahoma Economist examines historical trends for residential and commercial construction and finds there has been much less building heading into this downturn in the oil and gas industry than in some previous episodes.

State economic outlook remains sluggish

Past editions of The Oklahoma Economist reported total employment in Oklahoma began a decline in February, that through October had resulted in a drop in jobs of about half of a percent. Sharp employment declines in the energy sector early in the year spilled over to related industries, causing job losses in sectors such as manufacturing and transportation; other sectors important to the state such as healthcare and hospitality, however, continued to grow. Oklahoma real personal income also fell in the second quarter, the most recent quarter available, and state tax revenues have been below year-ago levels since May. These Oklahoma trends have been in contrast to the national economy, which generally has grown solidly in 2015.

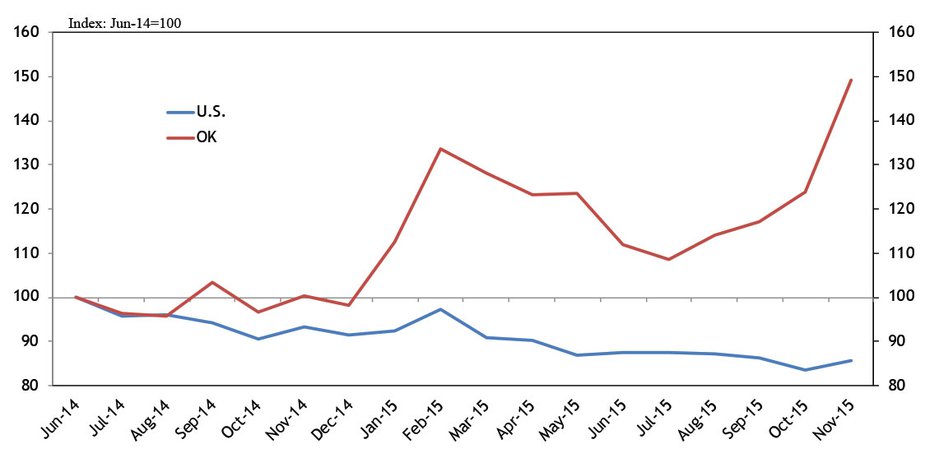

The outlook for the state's important oil and gas sector has continued to deteriorate in recent months, creating concerns about economic growth in the future. In the Federal Reserve Bank of Kansas City's third quarter energy survey, regional oil and gas firms indicated they do not expect oil prices to return to a level that would produce a profit until at least 2017. Add in a recent decline in natural gas prices, and many energy firms say they plan significant cuts to capital spending in 2016 and expect their employment next year to be about 7 percent less than this year. In recent weeks, new claims for unemployment insurance have increased again, with the November average surpassing the heightened level reached in the spring (Chart 1).

Chart 1. Initial Claims for Unemployment Insurance

Source: U.S. Bureau of Labor Statistics.

Real estate largely holding up, but some early signs of strain

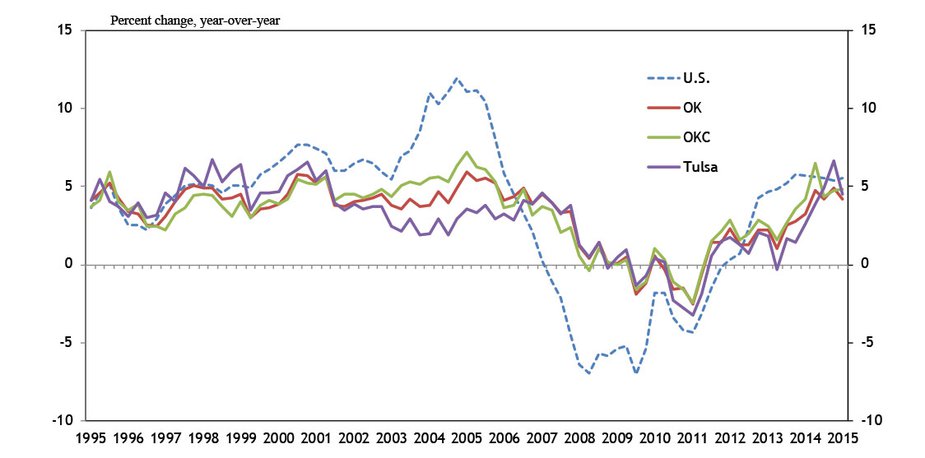

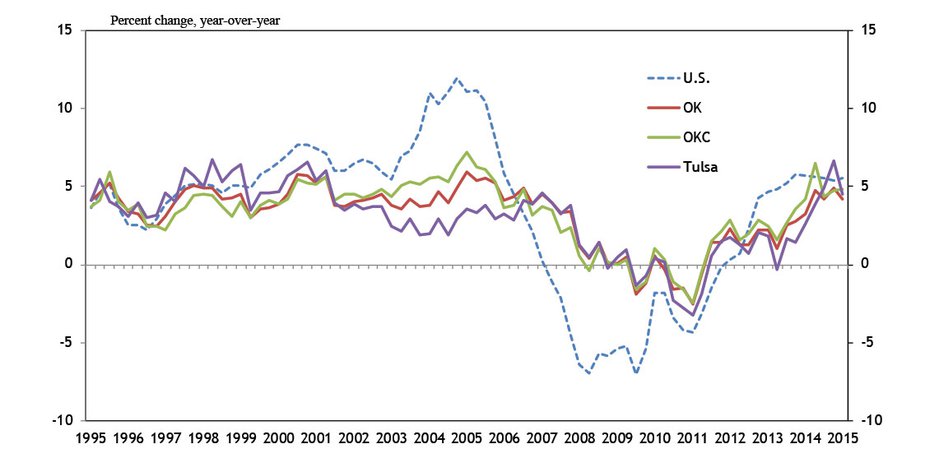

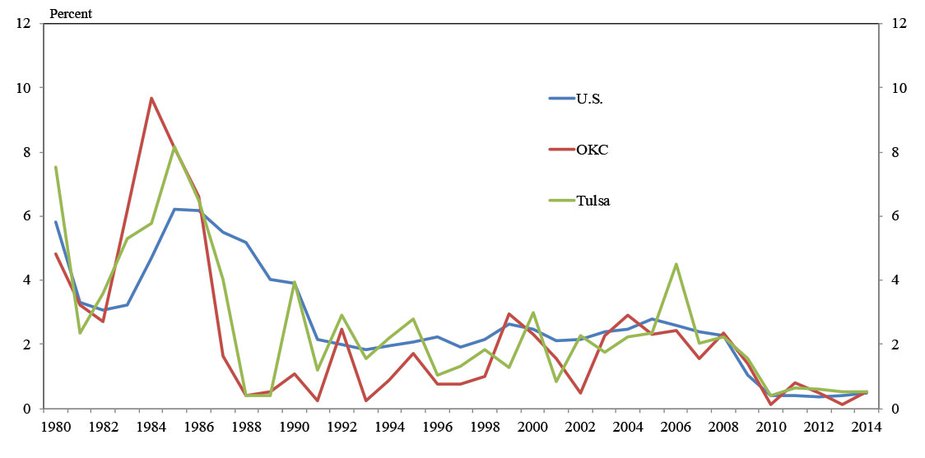

Despite the sluggish state economy, broad measures of Oklahoma real estate conditions have largely held up. For example, home prices statewide and in the two large metro areas continued to grow at around a 5 percent year-over-year rate through the third quarter (Chart 2). Inventories of unsold homes remained low in the Oklahoma City and Tulsa metro areas through October, at about four to five months' supply. In commercial real estate, office vacancy rates in the Oklahoma City and Tulsa metro areas were low and stable through midyear. In contrast, the office vacancy rate in Houston, another key U.S. oil and gas city, has increased sharply (Chart 3).

Chart 2. Single-Family Home Prices

Source: FHFA.

Chart 3. Office Vacancy Rates

Chart 3. Office Vacancy Rates

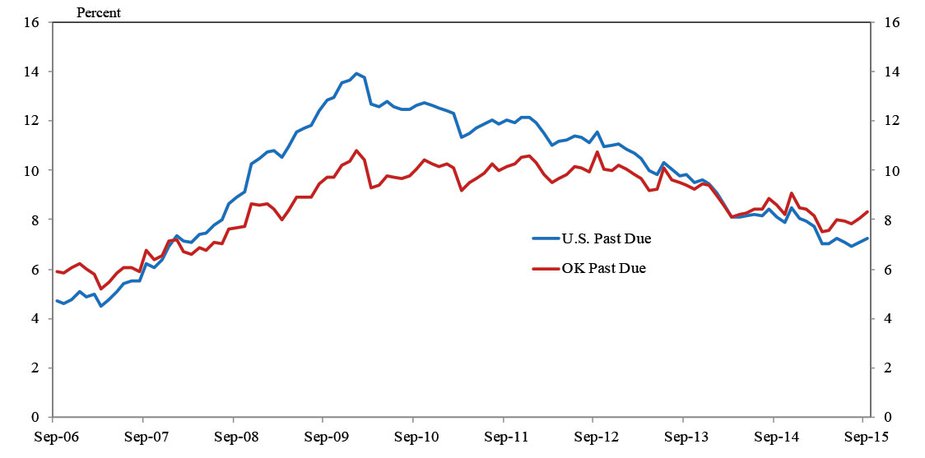

Trends in repayment of real estate loans in the state have also shown only modest signs of stress to date. The number of mortgages past due more than 30 days has increased slightly since spring but there are fewer delinquencies than a year ago (Chart 4). And in the third quarter, FDIC data show the share of nonresidential real estate loans more than a month past due at Oklahoma banks was largely unchanged from a year ago.

Chart 4. Share of Mortgages Past Due (30+days)

Source: Lender Processing Services.

But with the economic outlook in the state remaining sluggish, a look at historical trends may provide perspective about future real estate risks. In particular, the pace of residential and commercial construction in Oklahoma in recent years compared to past oil booms may highlight how much excess space could open up if economic difficulties persist.

Construction growth in recent years slower than in past building booms

An examination of historical trends in construction in Oklahoma shows there has been less building entering this oil downturn than in several similar past instances—especially compared with the early 1980s. While this is particularly true of commercial real estate—including office and retail—it also is the case for single-family home construction. Data on apartment construction and industrial space expansion are for shorter time periods, but show similar trends.

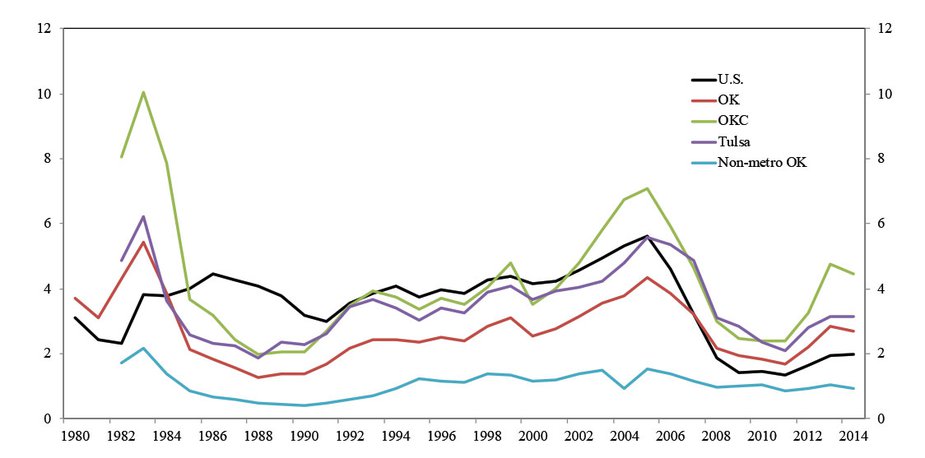

In single-family residential, the pace of new housing permits issued per thousand Oklahoma residents was up considerably in 2013 and 2014 from the pace in the three years after the 2008 financial crisis, and was also higher than in the nation (Chart 5). That trend persisted through the first three quarters of 2015. But this recent increased rate of home construction still remains significantly lower than previous peaks in 1983 and 2005, and slightly less than 1999 levels. In each of those past cases, oil prices—and then Oklahoma’s economy—declined sharply within a few years, stressing the housing market. Looking across the state, recent home construction in the state’s two large metro areas also has been significantly less than 1983 and 2005 peaks, while homebuilding in non-metro areas has remained on a longer-term trend of modest decline.

Chart 5. Single-Family Housing Permits per Thousand Residents

Source: U.S. Census Bureau.

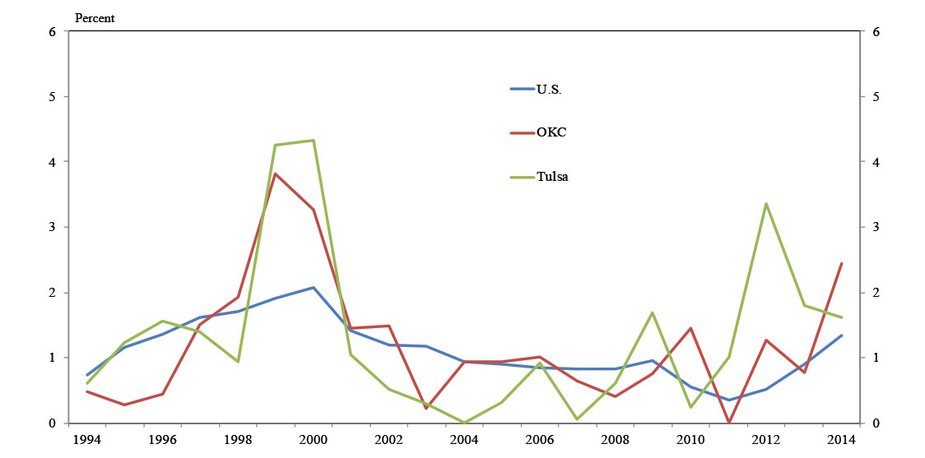

Trends for apartment construction are slightly different. In both the Oklahoma City and Tulsa metro areas in recent years, apartment construction has greatly outpaced the nation (Chart 6). Even so, the recent pace of apartment construction in either metro area has not been quite as rapid as during the apartment boom of 1999-2000._

Chart 6. Apartment Units Added

Source: TWR.

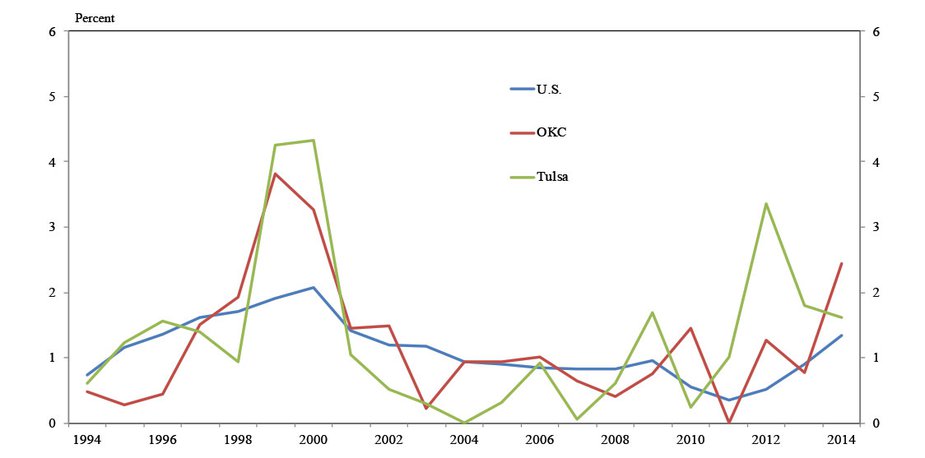

In office markets, the amount of leasable square footage added in the Oklahoma City metro area has increased recently while the Tulsa metro area has seen only modest growth (Chart 7). However, the recent pace of new office completions pales in comparison to the early 1980s, when Oklahoma City metro office space increased more than 6 percent annually from 1980 to 1984._ The recent pace of growth in Oklahoma City and Tulsa office construction is also less than in several other periods since the 1980s. It is likewise significantly less than in Houston, which may help explain the more stable office vacancy rates in Oklahoma even as vacancies Houston this year have increased sharply.

Chart 7. Office Square Footage Added*

*Includes only competitively rented space.

Source: TWR.

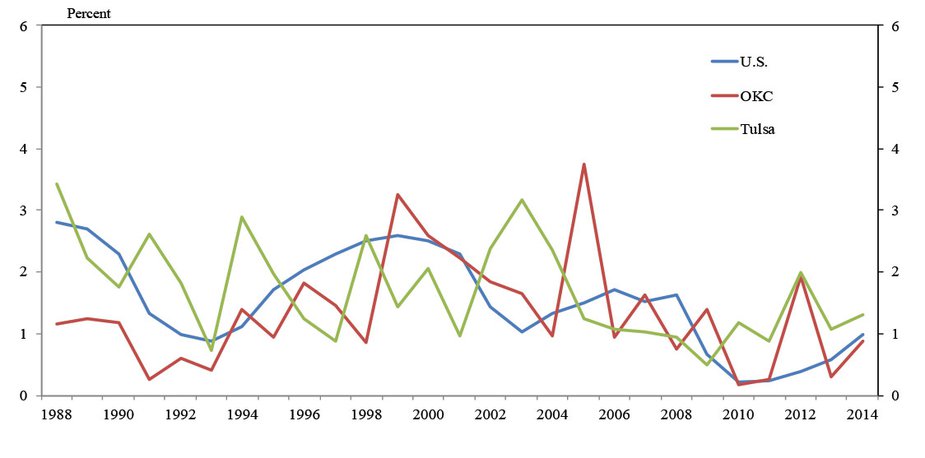

For industrial space, trends differ slightly between the two large Oklahoma metros. Industrial completions have significantly outpaced the nation in the Tulsa metro area since 2010, likely, in part, to support rapid growth during that period in the oil and gas sector (Chart 8). In the Oklahoma City metro, trends have largely mirrored the recent sluggish national rate of expansion in industrial space, although considerable space was added in 2012. In both Oklahoma metros, however, the recent pace of industrial space growth trails its longer-term average.

Chart 8. Industrial Square Footage Added*

*Includes only competitively rented space.

Source: TWR.

In contrast to most other real estate sectors, retail construction in Oklahoma and the nation has remained very sluggish since the 2008 financial crisis (Chart 9). The Oklahoma City and Tulsa metro areas in recent years each increased leasable shopping center space by about half a percent annually, a pace similar to the nation, though well below historical levels.

Chart 9. Shopping Center Square Footage Added*

*Includes only competitively rented space.

Source: TWR.

Conclusion

Even as job losses have increased in Oklahoma this year, real estate conditions have remained generally stable. Further sluggishness in the state’s economy, however, could increase stress on the real estate sector. Yet, analysis of past trends in Oklahoma real estate shows that there was generally much less building in the state in the past few years than in previous oil booms. This lack of overbuilding may be helpful for real estate conditions if economic sluggishness in the state persists.