Since mid-2015, Oklahoma has lost more jobs in manufacturing than in its struggling oil and gas sector. The state’s decline in factory activity the past year has significantly outpaced the nation and nearby states. This edition of The Oklahoma Economist investigates what has driven the sharp decline in Oklahoma manufacturing and whether the downturn may be ending. It finds that job losses mostly have been at the state’s metals and machinery factories—many of which produce goods for the oil and gas sector—and the outlook of these manufacturers recently has become less pessimistic.

The collapse in Oklahoma manufacturing

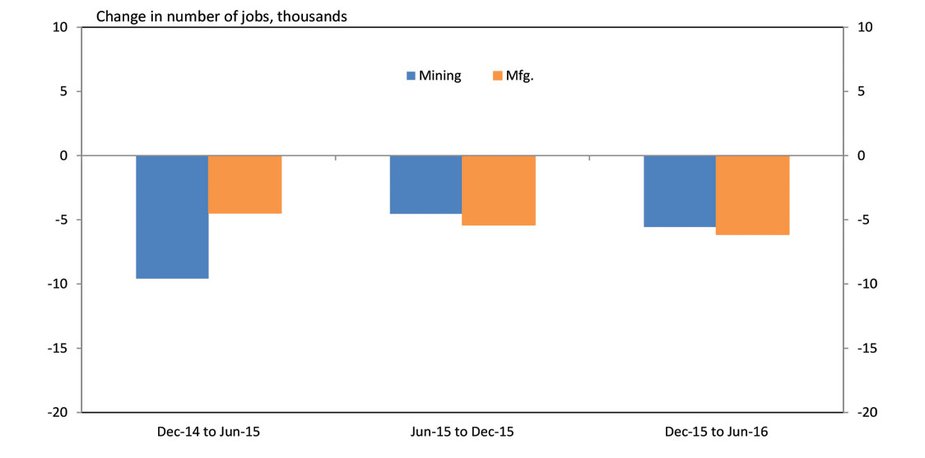

Since hitting a post-Great Recession peak of more than 141,000 jobs in late 2014, employment in Oklahoma’s manufacturing sector has declined more than 10 percent through July 2016, to a little more than 125,000 jobs. The loss of 16,000 factory jobs was only slightly less than the 21,000 mining sector jobs lost during the same period (“mining” in Oklahoma consists almost completely of oil and gas), although mining’s percentage drop of 33 percent was much larger. But in both the second half of 2015 and first half of 2016, manufacturing lost slightly more jobs than mining, although again the percentage drop was smaller (Chart 1).

Chart 1. Total Employment

Source: BLS

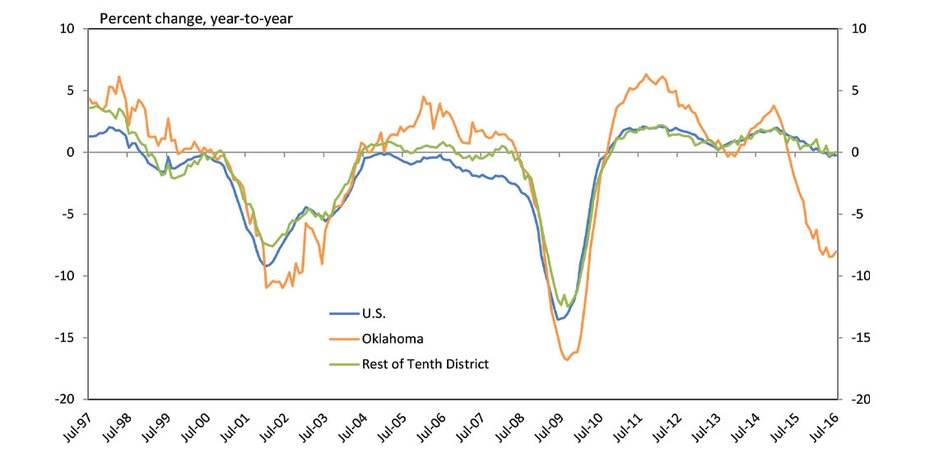

Chart 2. Manufacturing Employment

Source: BLS

Oklahoma’s decline in manufacturing employment was sharper than in the nation or the other six states of the Federal Reserve’s Tenth District (Chart 2). Indeed, the percentage drop in manufacturing employment in the state rivals the steep decline in the same sector during the 2001 U.S. recession and is similar to the collapse in U.S. manufacturing during the Great Recession of 2007-09. Meanwhile, national and regional manufacturing employment over the past year has declined only slightly.

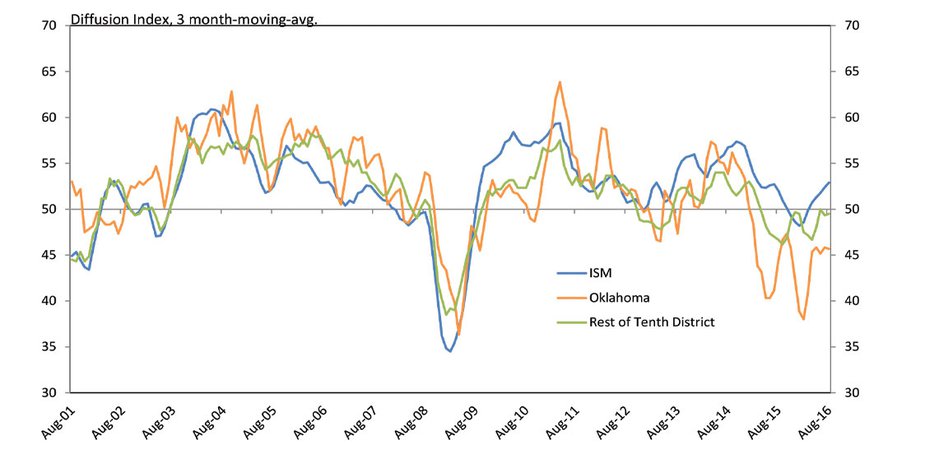

Chart 3. Manufacturing Survey Composite Indexes

Source: FRBKC Manufacturing Survey, ISM

Other manufacturing sector indicators show similar results. The Kansas City Fed’s monthly manufacturing survey shows Oklahoma factories in the survey reported more declines over the past 18 months than factories elsewhere in the Tenth District and those surveyed by the national Institute for Supply Management (ISM) (Chart 3). In addition, a 17-percent decline in Oklahoma manufacturing exports from the first quarter of 2015 to the first quarter of 2016 was steeper than the declines nationally and in the rest of the Tenth District of 7 percent and 13 percent, respectively.

What is driving the bigger downturn in Oklahoma?

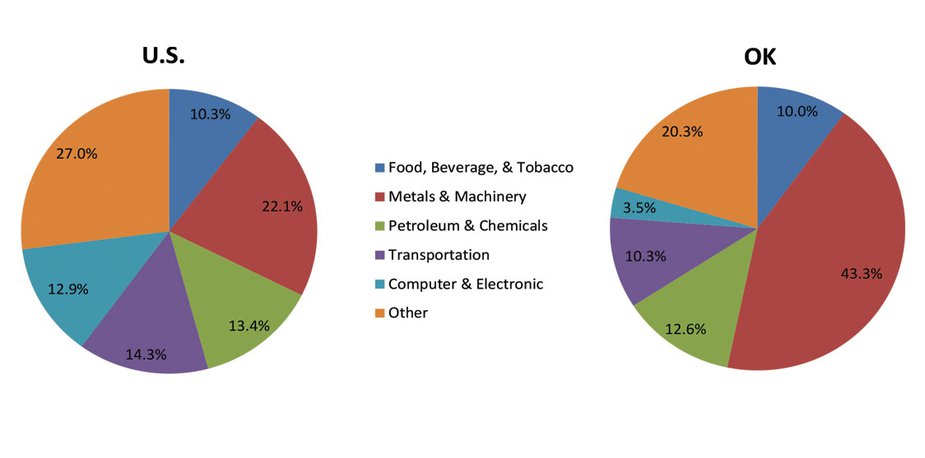

The dramatic difference in the decline over the past year in Oklahoma’s manufacturing sector relative to the nation and the region suggests something unique about Oklahoma’s factory sector. The biggest difference is a much larger concentration in metals and machinery manufacturing, which accounts for more than 43 percent of factory income in the state—almost twice as much as nationally (Chart 4). Oklahoma also has smaller concentrations in computer and electronics manufacturing and transportation equipment manufacturing—especially automobiles—than the nation.

Chart 4. Industry Share of Manufacturing Personal Income (2014)

Source: BEA

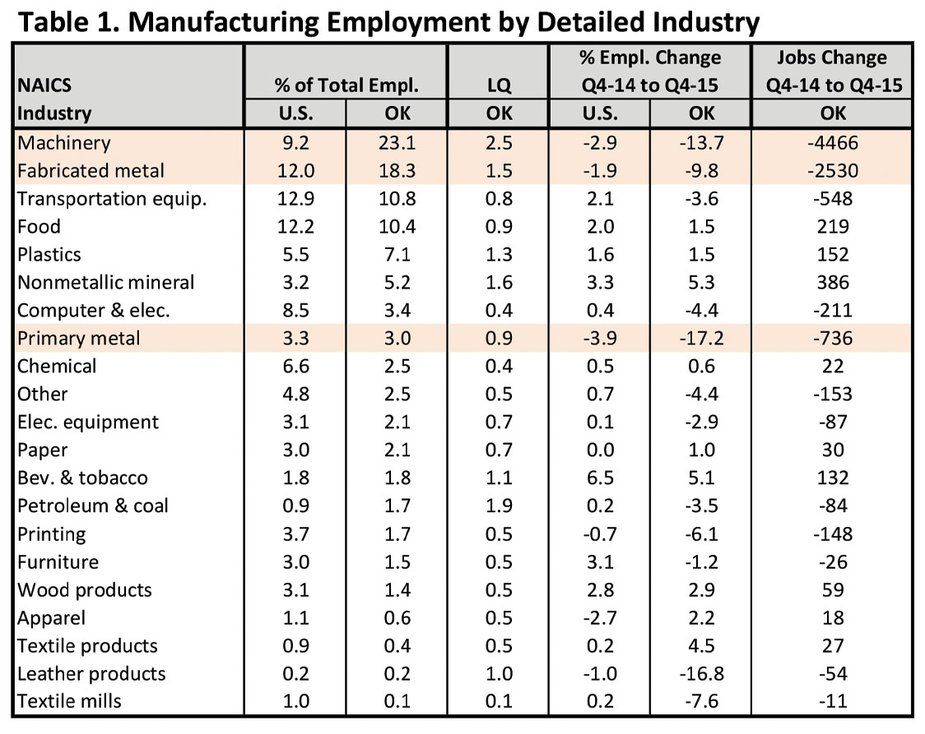

These sectors that distinguish Oklahoma from the nation have diverged lately—with trends unfavorable to overall Oklahoma growth, given the state’s relative concentration in each. Metals and machinery have been among the hardest hit manufacturers nationally, as exports and sales of steel and other metal products have plummeted with the increased value of the dollar and the massive disinvestment in the U.S. energy sector. In 2015, employment nationally declined nearly 3 percent in machinery manufacturing, nearly 2 percent in fabricated metals manufacturing and nearly 4 percent in primary metals manufacturing (Table). Meanwhile, U.S. employment increased during 2015 in computer and electronic manufacturing and in transportation equipment manufacturing, sectors in which Oklahoma has less presence.

Manufacturing Employment by Detailed Industry

Source: BLS QCEW

In Oklahoma, the decline in metals and machinery equipment has been much sharper than in the nation. This is likely because more of the production of metal and machinery products in Oklahoma is oil- and gas-related than is the case in the nation. From the fourth quarter of 2014 to the fourth quarter of 2015 (the most recent quarter available with detailed industry data), factory employment in Oklahoma declined nearly 14 percent in machinery, nearly 10 percent in fabricated metals and more than 17 percent in primary metals. In each case, the decline was more than four times the nation as a whole. Overall, more than 90 percent of the decline in Oklahoma manufacturing jobs during 2015 was in the combined metals and machinery segment.

Impact on Oklahoma’s economy

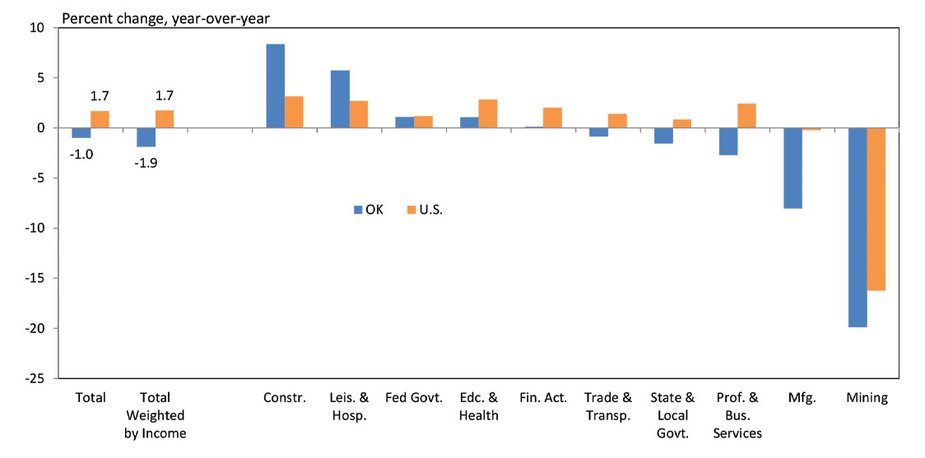

Oklahoma's economy has been hit hard by the decline in employment in manufacturing together with the decline in mining and other sectors affected by the oil and gas downturn. Total state employment in July was down 1 percent from a year ago (Chart 5). Moreover, accounting for each sector’s share of state income, the drop in total employment is equivalent to nearly 2 percent of jobs, given the higher pay in manufacturing and mining relative to other sectors of the economy. Meanwhile, unemployment in the state has increased from a low of 4.0 percent in late 2014 to 5.0 percent in July 2016.

Chart 5. Job Growth by Industry, July 2016

Source: BLS

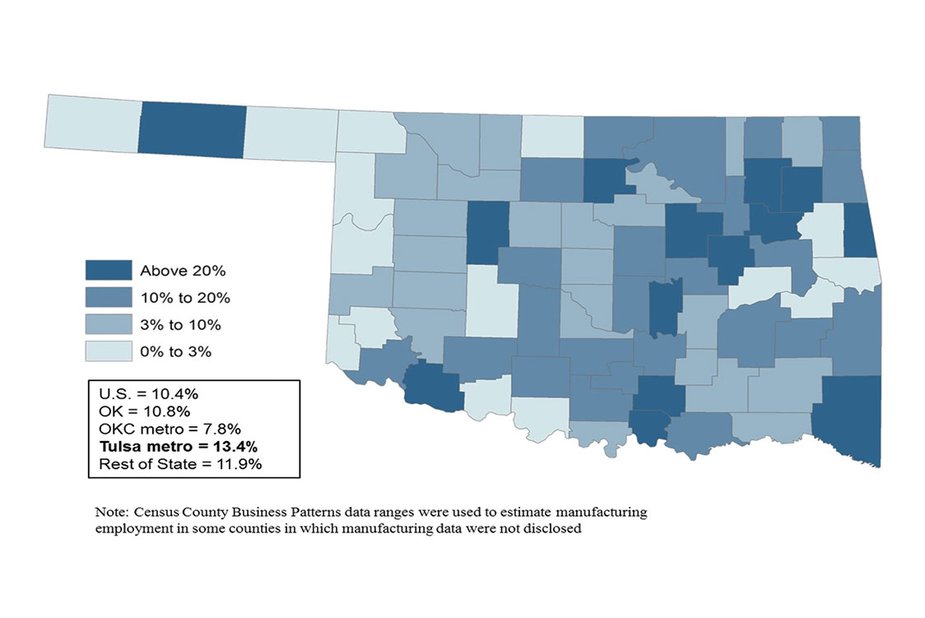

Manufacturing Share of Total Employment (2015)

Source: BLS QCEW

The collapse in manufacturing activity has hit some parts of Oklahoma even harder. While factory employment accounted for a little more than 10 percent of all jobs in 2015—similar to the nation as a whole—the share in 14 counties topped 20 percent (Map). Unemployment has increased more in those 14 counties than the entire state, even though most of those counties have little direct oil and gas activity. Some of the state’s highest manufacturing concentrations are in the Tulsa metropolitan area, where manufacturing accounted for 13.4 percent of total jobs in 2015. Unemployment in the Tulsa metro area has increased from 3.9 percent in December 2014 to 5.4 percent in July 2016.

Outlook for Oklahoma manufacturing

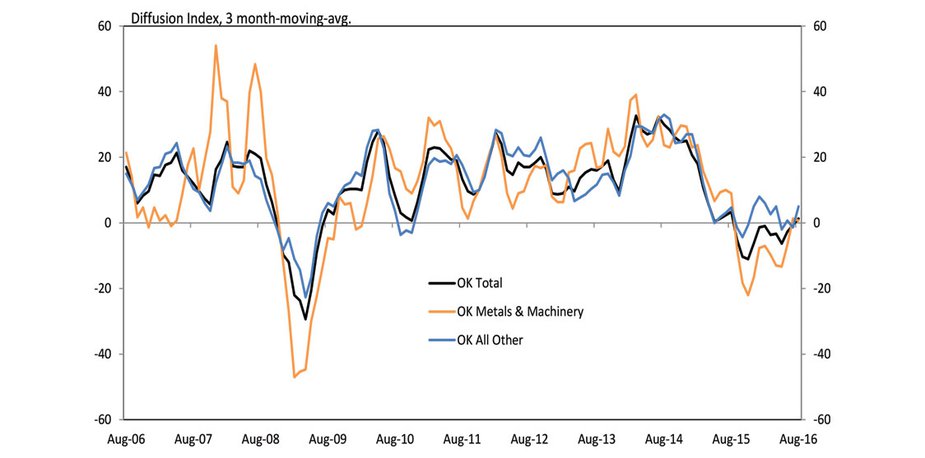

There are signs, however, that the declines in Oklahoma manufacturing may be nearing an end. The Kansas City Fed’s monthly manufacturing survey has shown recent, though modest, improvement in Oklahoma factories’ expectations for future activity. Through August 2016, the three-month moving average of Oklahoma firms’ future outlook was above zero for the first time in a year, suggesting slightly more firms anticipate higher activity over the next six months than expect lower activity (Chart 6). Looking just at metals and machinery manufacturers, which have suffered the most from the downturn, expectations have also moved slightly above zero after lagging considerably in recent years.

Chart 6. Oklahoma Manufacturing Expectations

Source: FRBKC Manufacturing Survey

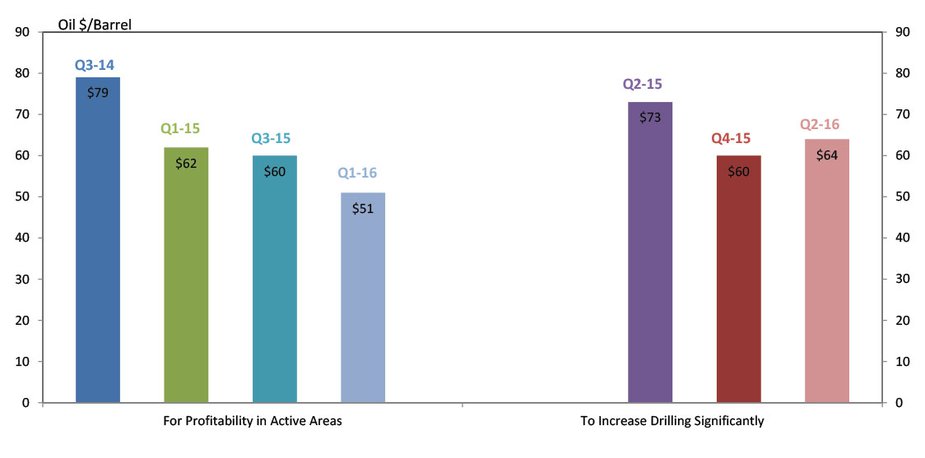

Chart 7. KC Fed Energy Survey Oil Prices Needed

Source: FRBKC Energy Survey

Because many metals and machinery factories in the state produce goods for the oil and gas sector, the outlook for factory activity is closely tied to the outlook for energy prices. The Kansas City Fed’s latest quarterly energy survey indicated the average oil price needed for firms to be profitable was $51 a barrel, with $64 being the average price needed to significantly increase drilling (Chart 7). Thus, the recent increase in oil to near $50—and subsequent small increase in drilling rig counts—has likely helped reduce pessimism among some metals and machinery manufacturers. However, for sizable gains in production to occur at factories heavily reliant on the energy sector, oil prices likely will need to move substantially higher.

Conclusion

Oklahoma’s manufacturing sector has been hit hard over the past 18 months, shedding more than 16,000 jobs. Most of these jobs have been at metals and machinery plants, many of which produce goods for the struggling oil and gas sector. Unemployment rates in manufacturing-intensive counties in the state have risen even more than the state’s overall joblessness. However, recent survey data suggest factories in the state are becoming somewhat less pessimistic and now expect flat to slightly higher activity in the months ahead, including at some metals and machinery manufacturers.