The economic outlook for both the United States and the Rocky Mountain region continues to be highly uncertain and linked with the course of the COVID-19 pandemic. The prospects for recovery in the labor market in the near term, therefore, are tied closely to the success of health measures put in place to slow the spread of the virus. Over the longer term, recovery in the labor market will depend on a number of factors, including how deep the scars from the recent cuts in employment embed themselves among the labor force. When workers are separated from their jobs, they can lose more than a source of income. Jobs help workers gain experience, develop skills and access training that builds proficiency and fuels career progression. These lost opportunities are examples of labor market scarring that pose longer-run risks to recovery in the labor market.i For employers, the need to train a new workforce once economic activity picks up can slow recovery, as the cost of training for some positions is significant. Policymakers continue to point to such concerns about lasting damage to the economy and risks to labor market recovery. In this edition of the Rocky Mountain Economist we highlight on-the-job training for workers in the United States and the Rocky Mountain region and document job losses across occupations that vary in their required amounts of on-the-job training during this public health-induced downturn.

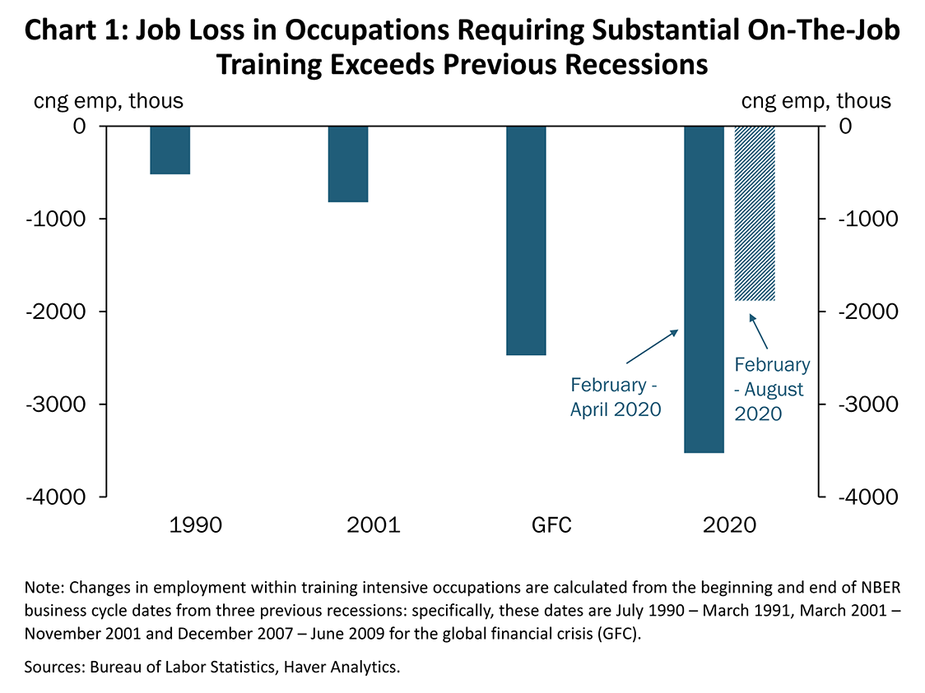

From January to April, when national employment numbers hit a recent low, 3.5 million jobs were lost across the United States in occupations that require substantial on-the-job training. In the Rocky Mountain region, job losses in these training-intensive occupations totaled more than 75,000 individual positions. In comparison, these losses exceed the loss of similar jobs during the global financial crisis by 40%. Since April, nearly 1.7 million jobs that require substantial job-related training were regained nationwide. This rebound in hiring may have been swift enough to maintain much of the human capital that was built previously, somewhat mitigating the degree of scarring in the labor market.

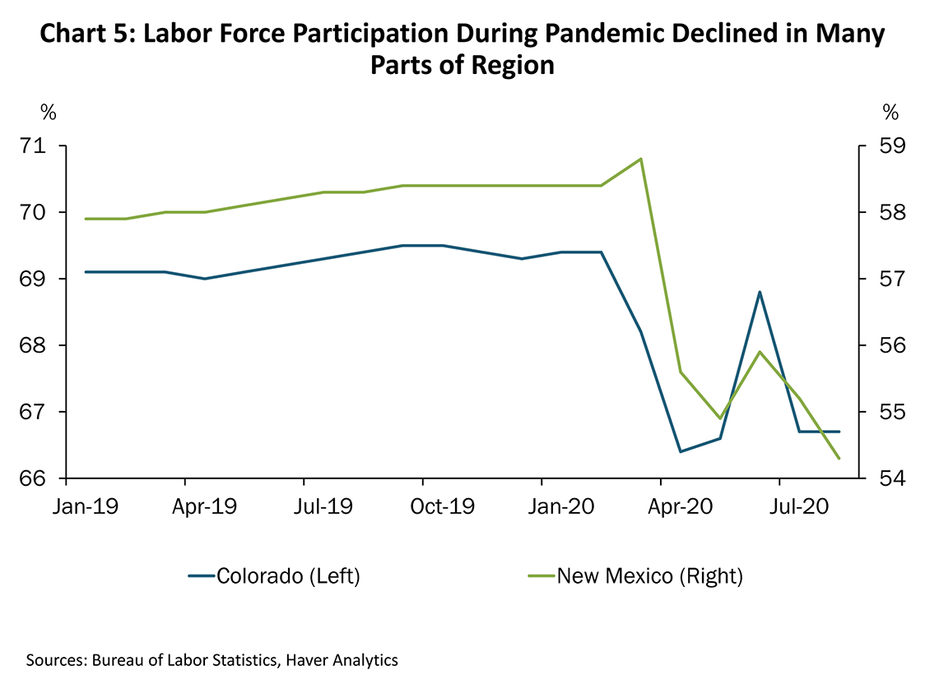

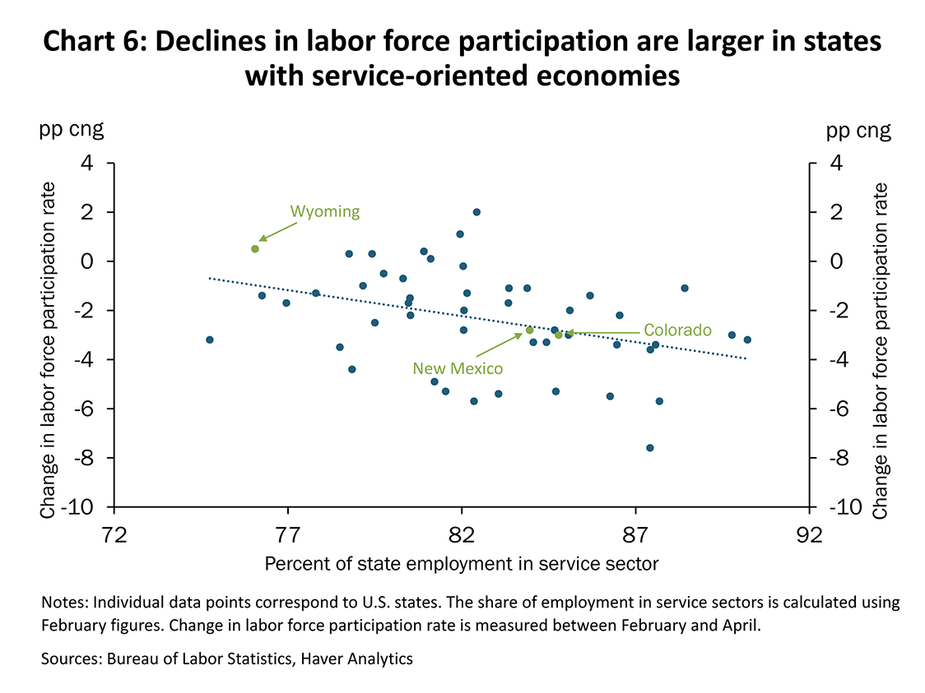

A staggering amount of jobs were also lost this year in industries and occupations that require relatively little on-the-job training. Although these occupations, which are more prevalent in service sectors, have less need for on-the-job training, other potential forms of labor market scarring may pose challenges to recovery. As the pandemic persists, many individuals face difficult decisions about working amid concerns regarding contagion risks, adequate childcare and the use of public transportation, among many other considerations. Indeed, labor force participation throughout the region declined at the onset of the pandemic and since has recovered only modestly. Nationwide, relatively more workers exited the labor force in states with larger shares of service sector employment. These facts highlight the potential for lasting damage even in parts of the labor market where the need for on-the-job training is less intensive.

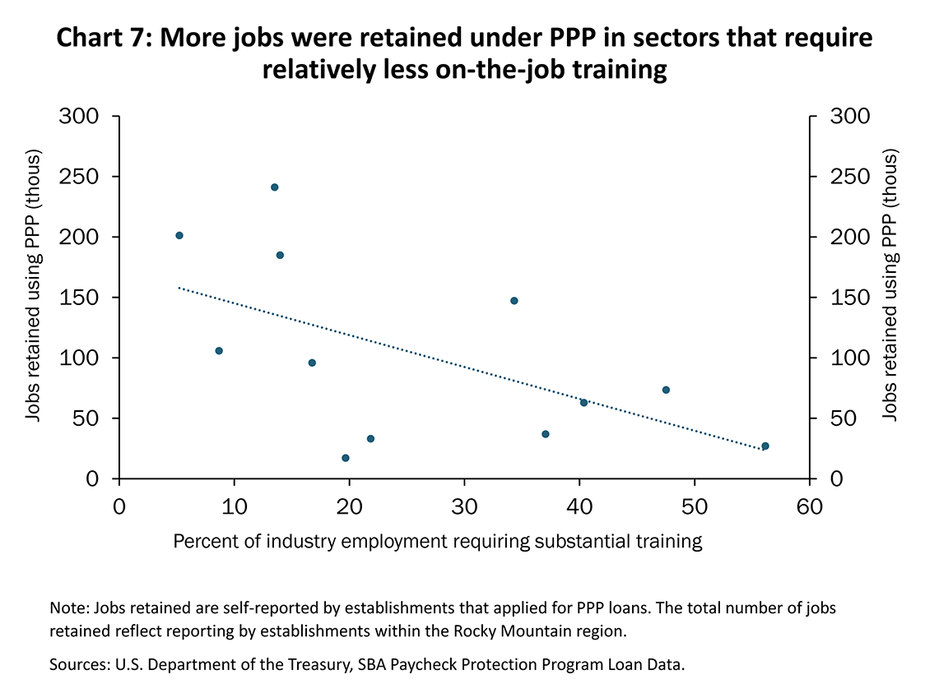

Finally, we show that the reported number of jobs retained through the Paycheck Protection Program (PPP) in the region was larger in sectors of the economy that require less on-the-job training. In other words, PPP funds were allocated to sectors that experienced the largest declines in employment and parts of the economy where workers were most inclined to leave the labor force. Yet, the allocation of this program perhaps leaves policy scope to address the potential for lasting damage associated with worker training costs.

Recent and Historical Job losses with On-The-Job Training

The change in labor market conditions that occurred in early 2020 was sudden, profound and unprecedented. Within months, the overall rate of unemployment transitioned from a 50-year low of 3.5% nationally to a record high of nearly 15%. Service sector employment saw the largest decline, primarily due to the contagion risk for COVID-19, which led to both a loss in consumer demand for services that involve face-to-face interaction, as well as public policies that expressly prohibited using these services to inhibit community spread. Once this risk diminishes, however, the outlook for labor market recovery likely will be tied to additional factors, including the ability of businesses to recruit new workers and build their skills. For many businesses, an effective workforce requires substantial amounts of on-the-job training. Chart 1 documents losses in training-intensive jobs earlier this year in the United States and compares them with losses in the previous three recessions.

We classify occupations as needing substantial training if workers require more than one month to gain proficiency.ii Information on requirements for on-the-job training used here come from the Bureau of Labor Statistics’ (BLS) Employment Projections Program, which reports the typical time workers need to spend with employers in training to gain proficiency in a specific occupation. Also from the BLS, Occupational Employment Statistics data contains employment levels within these occupations, which enables us to track changes in employment across occupations with varying training requirements, as well as across states and time.

The Rocky Mountain region faced a proportion of job loss in positions that require substantial on-the-job training similar to the U.S. figures (Chart 1). Between February and April, 75,000 jobs were lost throughout the region in occupations that require substantial training, though 30,000 jobs in these occupations were regained through the summer. The longer the remaining 45,000 positions are unavailable, the likelihood of eventual new hires undergoing new training increases. In turn, these parts of the job market may be more likely to experience a sluggish recovery. Quantifying the potential costs to retrain workers or the delays to recovery because of the loss of human capital is difficult. But, by way of comparison, the number of lost jobs since January that require substantial training is comparable with the number lost during the 2007-09 recession around the global financial crisis (GFC), which was followed by a tepid recovery in overall employment levels.

Varying Requirements for On-The-Job Training

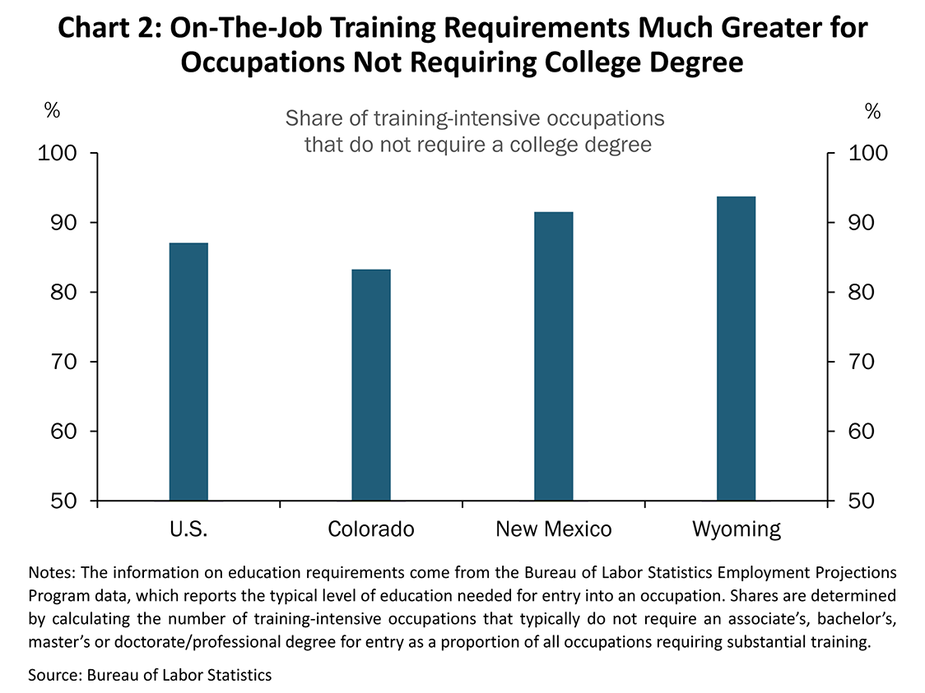

Nearly 20% of all occupations require substantial amounts of on-the-job training, and these training requirements are much more common in positions that do not typically require workers to have a college degree (Chart 2). In other words, non-college educated workers may be more exposed to lasting challenges from lost job-related training than college-educated workers.

Requirements for on-the-job training vary widely across industries. For example, less than 6% of the workforce in the education & health services sector is employed in occupations that require substantial employer-related training. In contrast, more than half the workforce in the manufacturing sector requires substantial on-the-job training. Even more onerous, 7% of workers in the mining, oil and gas sector require more than one year of training to gain proficiency. This industry variation in training requirements also drives differences across the region as states have different economic footprints. In Wyoming and New Mexico, most non-college educated workers in occupations that require substantial on-the job training are employed in the mining, oil and gas industry, while in Colorado the manufacturing industry has the largest number of workers in training-intensive occupations.

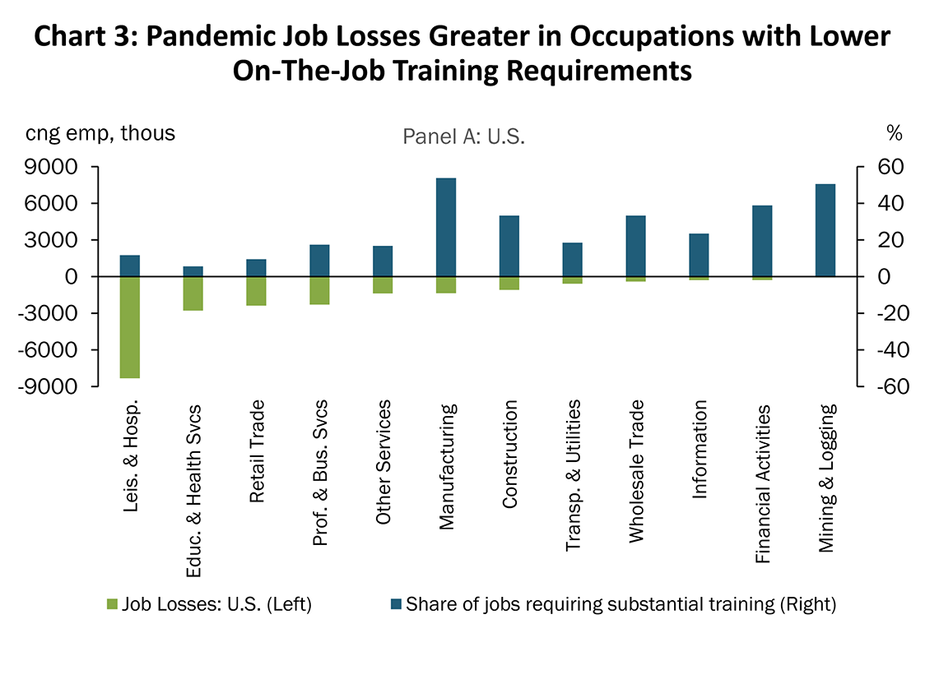

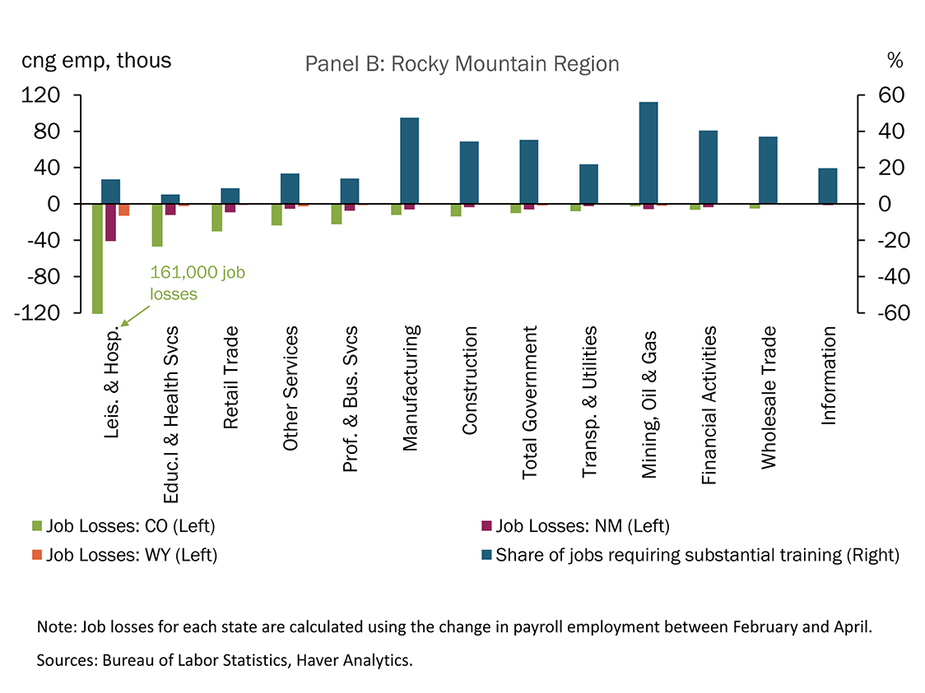

Recent job losses also have varied significantly across sectors and tend to be more extensive in sectors that require relatively less on-the-job training. Chart 3 illustrates details across all private industries regarding both recent job losses and the share of the workforce requiring substantial training within each industry; panel A illustrates national figures while panel B shows regional job losses among the Rocky Mountain states.

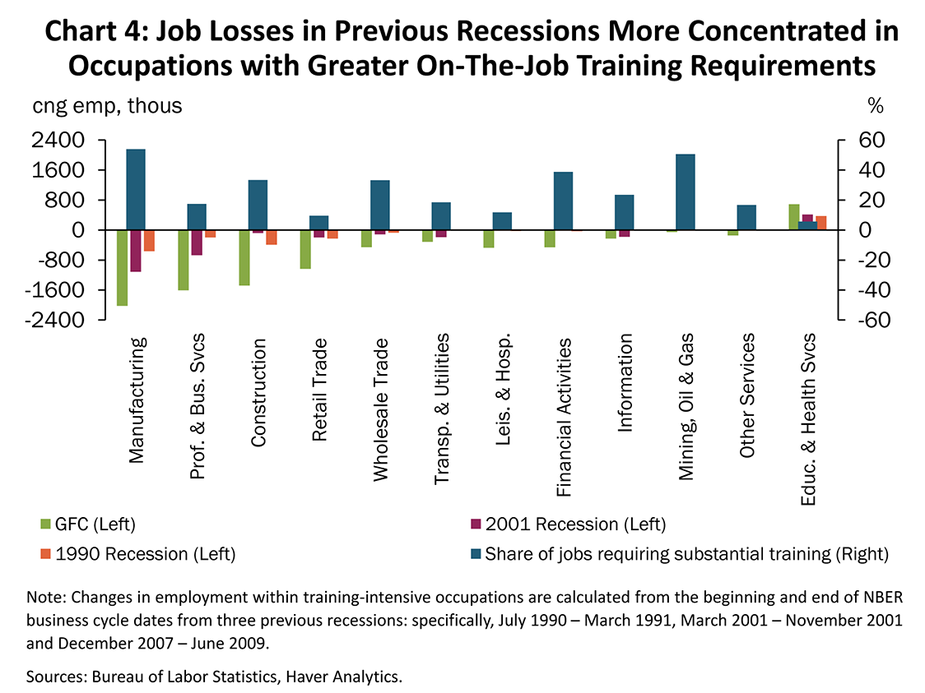

Chart 3 shows that, although a historically large amount of training-intensive jobs was lost this year, even more jobs were lost in occupations that require little on-the-job training. These job losses, which were precipitated by a public health shock, differ from previous recessionary periods, which were caused by economic or financial shocks. Accordingly, the recent rise in unemployment differs from previous recessionary periods in that they were concentrated primarily in service sectors rather than goods-producing sectors. To show this fact Chart 4 contrasts national job losses across the last three recessions, clearly depicting the uniqueness of this public health-induced downturn.

In each prior recession over the last 30 years, job losses were largest in the manufacturing sector and primarily concentrated in goods sectors. Put differently, historically, job losses tend to be concentrated in occupations that require substantial amounts of training. This year, job losses have been largest in the leisure and hospitality sector, where training requirements are lower. Also, significant job losses have occurred in the education and health services sector--which actually showed gains in employment during previous recessions--and in other service sectors that typically exhibit smooth levels of employment through historical downturns.

Other Risks for Lasting Damage to Labor Markets

Although most job losses this year were for workers in occupations that require relatively less training, the ongoing and persistent nature of the health-related shock can lead to other lasting challenges for labor market recovery. Mustre-del-Río and Pollard (2019) show that even moderate spells of lost earnings can have significant consequences for lifetime earnings levels. In addition, the decision to seek employment or not now is marred by additional considerations. Among them are the potential contagion risks for occupations that require close proximity to co-workers or customers, challenges to find childcare as many schools and other facilities have closed, and the difficulties in finding employment opportunities amid an overall decline in labor demand. Each of these considerations can lead to lasting challenges for labor market recovery as the fraction of workers that participates in the labor force declines. As an example, Tüzemen and Tran (2019) document the decline in labor force participation that occurred following the global financial crisis and discuss the uneven recovery among different worker groups. Chart 5 shows that the labor force participation rate declined in New Mexico and Colorado at the onset of the pandemic and has yet to fully recover, while the fraction of Wyoming residents engaged in the labor force (not shown) remained relatively stable through the first half of the year.

The nature of the public health-induced downturn heightens concerns about lasting damage to labor markets due to declining participation. Recall from Chart 3 that unprecedented numbers of jobs were in service sectors of the economy (alongside the large number of jobs lost in training-intensive occupations). Declines in labor force participation this year have been somewhat larger where the service sector is a larger part of the local economy. To see this fact, Chart 6 plots the change in the participation rate that occurred within each state between February and April against the share of the state’s workers that are employed in service sector.

PPP Loans, Jobs Retained and Worker Training

The Paycheck Protection Program administered by the Small Business Administration provided direct incentives for employers to retain their workforce through the initial months of the pandemic, while also providing a temporary cushion for the labor force against lost wages and earnings. However, the near-term needs of workers and businesses amid the unprecedented decline in economic activity can differ from their longer-term needs for limiting the lasting damage that can occur from lost workforce skills. Participants in the program reported the number of jobs that were to be retained on their applications for PPP loans, which allows us to contrast the use of the program with requirements for on-the-job training across industries. Chart 6 shows that the reported number of jobs retained by employers that received PPP funds were generally higher in sectors that require less on-the-job training.

Conclusion

The magnitude of the job losses during the pandemic in occupations that require substantial training highlights a risk for workers and employers who may be slow to rebuild human capital or recruit into costly positions. Furthermore, the unprecedented magnitude of job losses in service sectors, where workers appear more likely to respond to adverse conditions by leaving the labor force, highlights a risk that economic recovery may be inhibited by a limited availability of workers even as demand returns. Policymakers at national, state and local levels have deployed a broad suite of actions to mitigate these risks of lasting damage to the economy. The amount of jobs that were regained since April and the modest rise in labor force participation toward pre-pandemic levels have alleviated some concerns about persistent scarring in the labor market, but sustained progress is needed to restore the health of the labor market to pre-pandemic levels.

References

- Kozlowski, Julian, Laura Veldkamp and Venky Venkateswaran. 2020. “Scarring Body and Mind: The Long-Term Belief-Scarring Effects of COVID-19,” prepared for the 2020 Jackson Hole Economic Policy Symposium, Navigating the Decade Ahead: Implications for Monetary Policy.

- Mustre-del-Río, José, and Emily Pollard. 2019. “What Explains Lifetime Earnings Differences across Individuals,” Federal Reserve Bank of Kansas City, Economic Review.

- Tüzemen, Didem, and Thao Tran. 2019. “The Uneven Recovery in Prime-Age Labor Force Participation,” Federal Reserve Bank of Kansas City, Economic Review.

Endnotes

i. In addition to labor market scarring, Laura Veldkamp presented a paper at the 2020 Jackson Hole Economic Policy Symposium, written with Julian Kozlowski and Venky Venkateswaran, that highlighted two other forms of scarring that can lead to lasting damage to economies: belief scarring, where individuals’ expectations about the likelihood of large adverse shocks shifts in reaction to COVID-19, and capital scarring, where investments become obsolete at a faster rate than would have occurred absent the pandemic.

ii. Specifically, occupations fall into one of five categories of required on-the-job training: none, short-term, moderate-term, long-term, or internship/residency and apprenticeship. We refer to occupations that require either moderate-term (more than one month and up to one year) or long-term on-the-job training (one year or more) as those requiring “substantial” on-the-job training.