Further strengthening in the U.S. agricultural economy bolstered farm credit conditions in the first quarter. According to Federal Reserve surveys of agricultural credit conditions, farm loan repayment rates continued to improve at a rapid pace. Following multiple years of weakness and growing financial stress, bankers reported that farm income was higher than a year ago for the second consecutive quarter and demand for farm loans was subdued. Interest rates on farm loans remained at historic lows, and along with better financial conditions; supported widespread increases in farmland values.

Strength in markets for most major agricultural commodities has led to higher prices and expanded profit opportunities across the sector in recent months. Together with robust financial support from government aid programs related to the pandemic, conditions have led to a rapid improvement in farm finances. While prospects for the cattle industry have strengthened less substantially and drought continued to stress producers in many areas of the country, the overall outlook for farm income and credit conditions remained significantly improved from recent years.

First Quarter Federal Reserve District Ag Credit Surveys

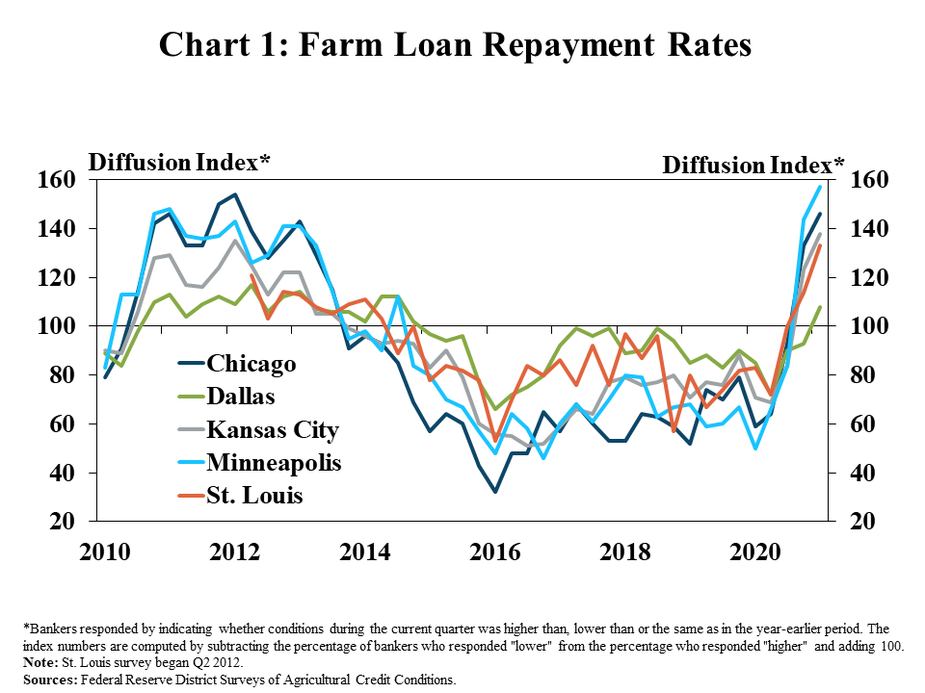

Farm loan repayment rates increased rapidly across the bulk of farm country in the first quarter. In aggregate, survey respondents reported an increase in the rate of loan repayment for the second consecutive quarter in most regions (Chart 1). Repayment rates improved for the first time since 2014 in the Dallas District, and were higher across all areas in the same quarter for the first time since 2013.

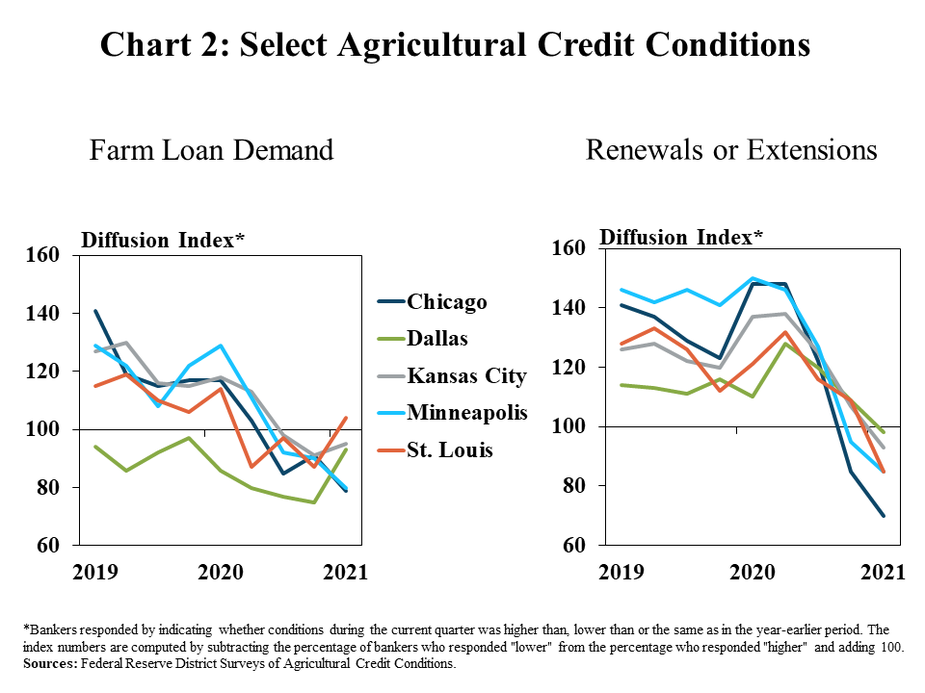

Demand for farm loans remained dampened while renewal and extension activity dropped considerably in some areas. Farm loan demand declined at a modest pace in all Districts except St. Louis and instances of renewals or extensions were lower than a year ago across all regions (Chart 2). Demand for loans dropped at a slightly faster pace in the Chicago and Minneapolis Districts than others.

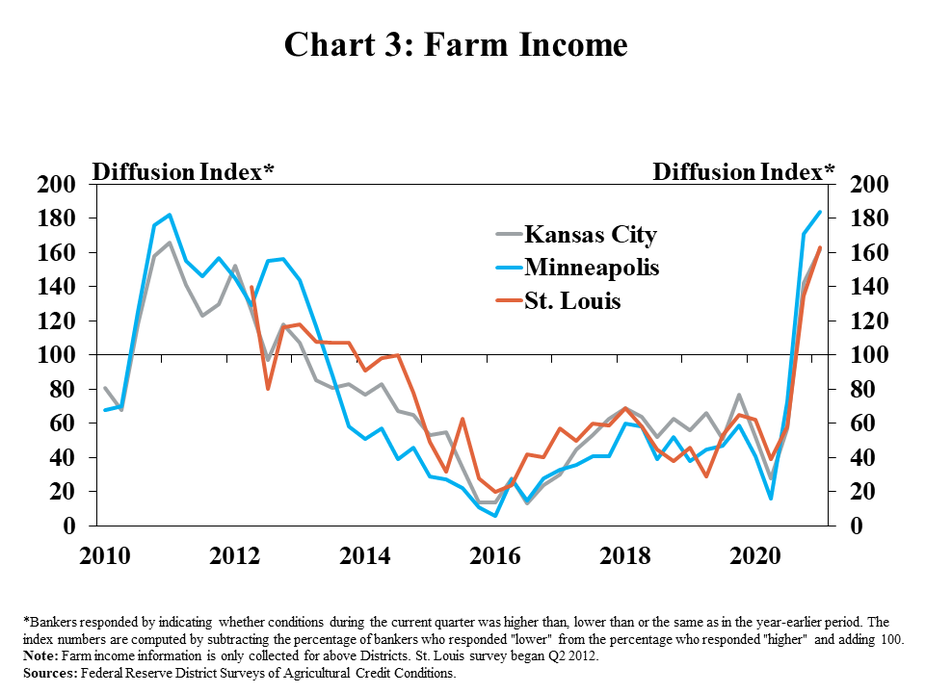

Contributing to the improvement in credit conditions, farm income also strengthened rapidly. Respondents across all participating Districts reported higher incomes than a year ago for the second consecutive quarter (Chart 3). Following multiple years of steady deterioration, around 70% of all participating bankers reported that farm income was higher than a year ago.

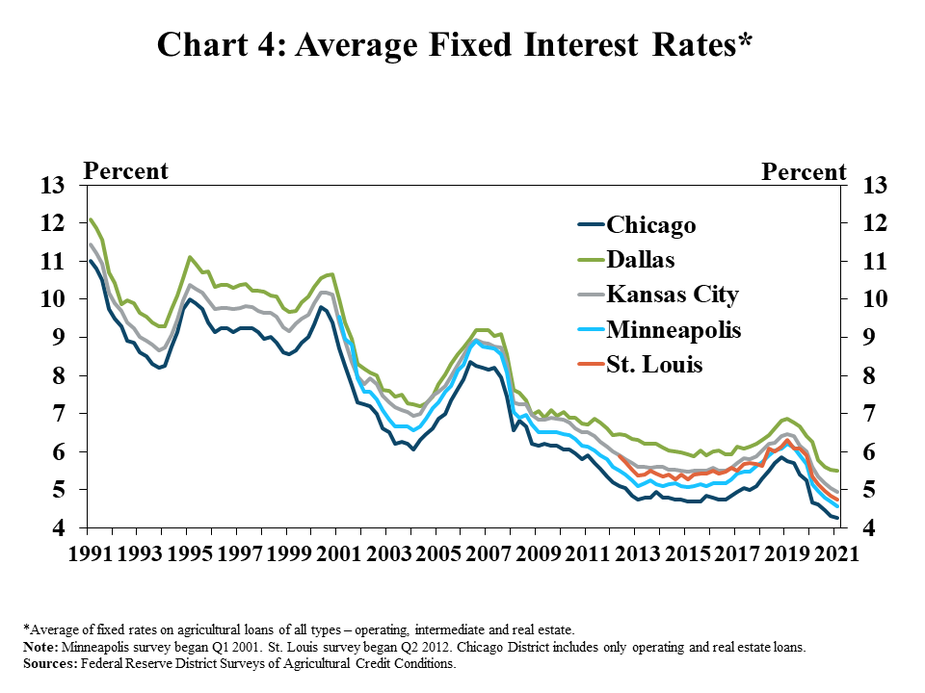

Average interest rates on farm loans remained at historic lows. The average fixed rate on all types of agricultural loans was at least 40 basis points less than a year ago and at least 170 basis points less than the 20-year average across all Districts in the first quarter (Chart 4). The average rate charged for financing agricultural production remained comparably higher in the Dallas District and lower in the Chicago District.

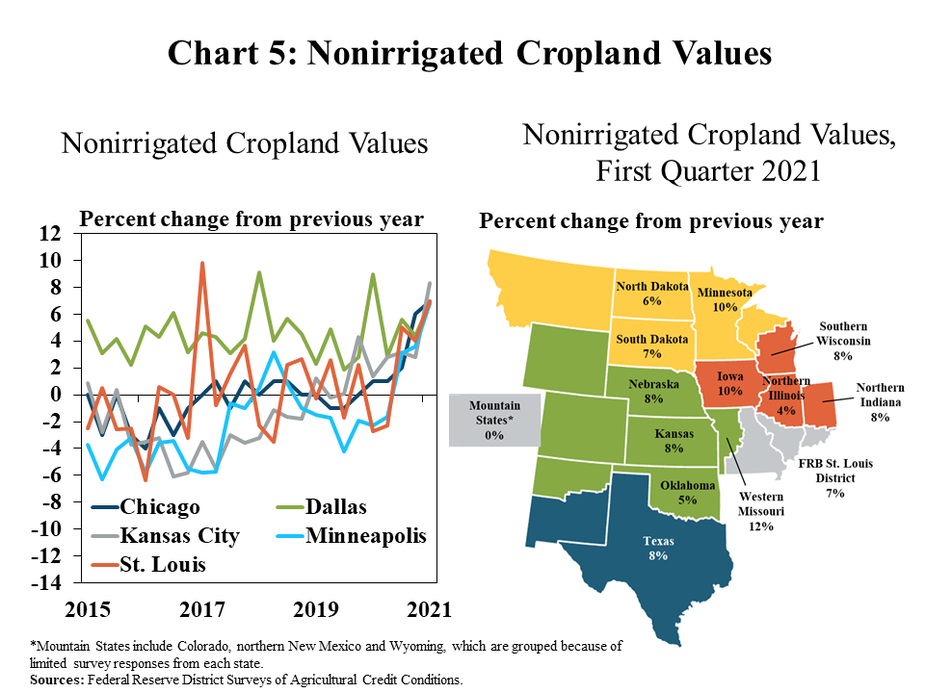

Strength in the farm economy and low interest rates also supported farm real estate values in all regions during the first quarter. The value of nonirrigated cropland increased by 7% on average across all Districts (Chart 5). The gains in real estate values were also consistent throughout most states, with the exception of the Mountain States, where exceptional and intensifying drought has led External Linkto a less substantial improvement in financial conditions.