Farmland values surged in the third quarter according to Federal Reserve Surveys of Agricultural Credit Conditions. The value of nonirrigated cropland increased by 12% or more in all participating Districts. The rapid increase was also consistent across most states, with annual increases of more than 20% in some areas. Supporting farm real estate markets, interest rates on farm loans remained at historic lows and strong farm finances drove further improvement in agricultural credit conditions.

Despite persistent concerns about increases in input costs, agricultural lenders expected farm income and credit conditions to remain strong through the end of the year alongside elevated commodity prices. The accompanying surge in farmland values has bolstered farm balance sheets and provided additional support to the sector. Alongside prospects for further strength in commodity markets, the outlook for farm finances and agricultural land values through the end of 2021 remained strong.

Third Quarter Federal Reserve District Ag Credit Surveys

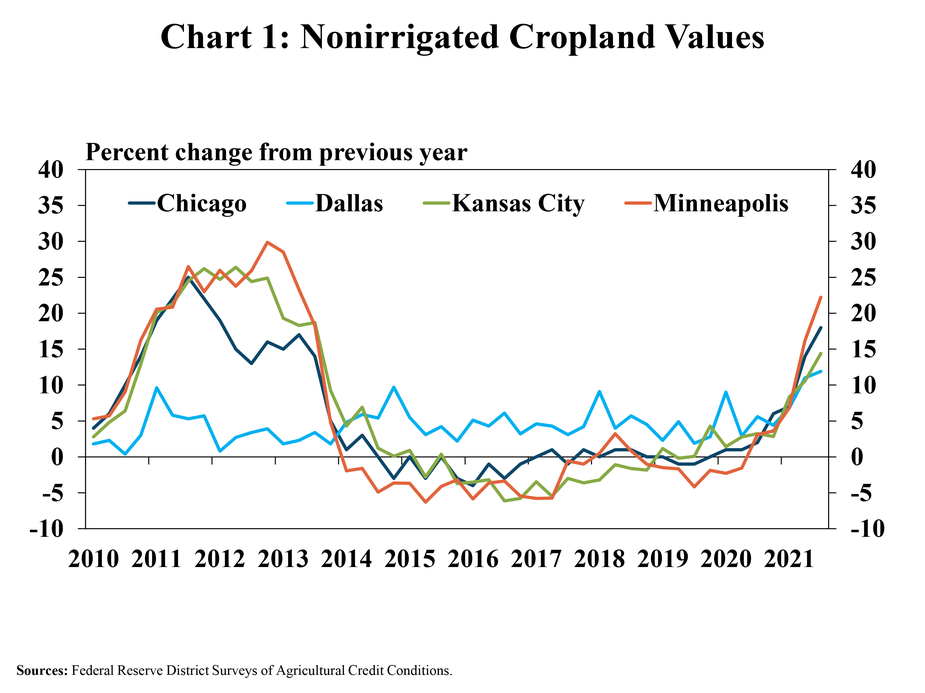

Farm real estate values rose sharply alongside continued strength in the U.S. agricultural economy. The value of nonirrigated cropland increased by an average of about 15% across all participating Districts (Chart 1). The gains from a year ago were the highest in any quarter since 2013 in all regions and have offset reductions in land values that may have occurred in recent years.

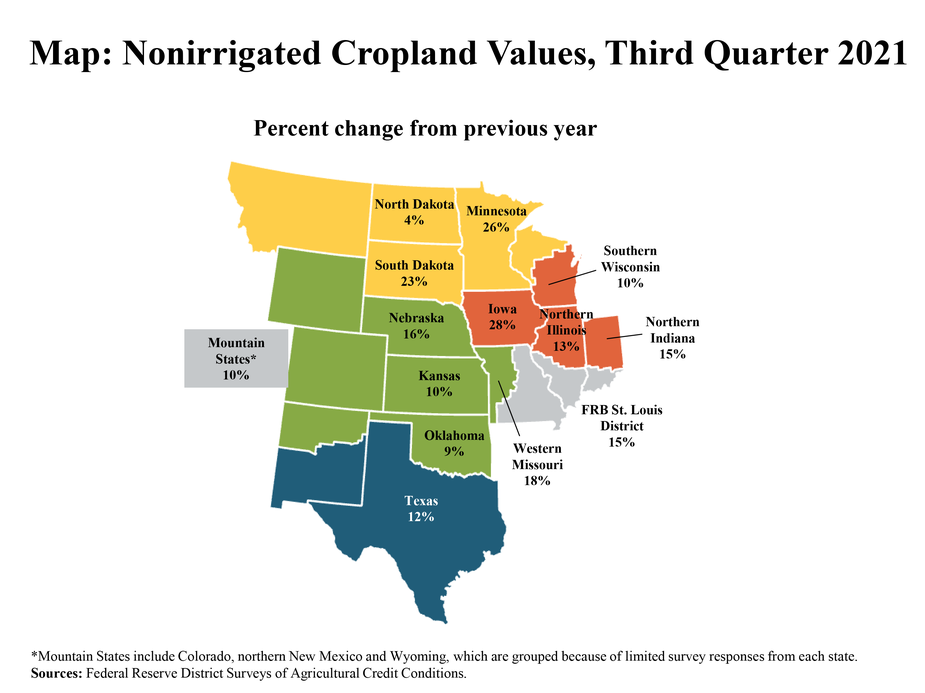

The surge in farm real estate values was consistent across nearly all states. The value of nonirrigated cropland increased nearly 10% or more from a year ago in all states with available data except North Dakota (Map). Values grew by over 20% in Iowa, Minnesota and South Dakota and between 9% and 20% in all other states except North Dakota.

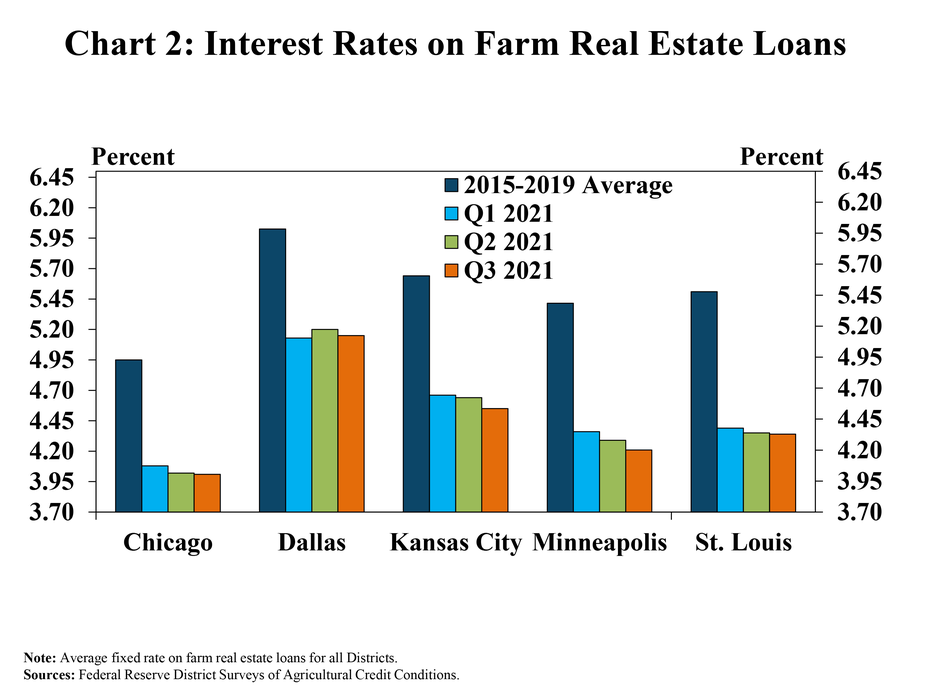

Providing support to agricultural real estate markets, interest rates on farm loans remained historically low. The average fixed rate charged on loans for farmland declined slightly from last quarter and remained at or near an all-time low in all Districts (Chart 2). On average, interest rates were about 100 basis points below the average from 2015 to 2019 which has reduced financing costs and contributed to higher demand for farmland.

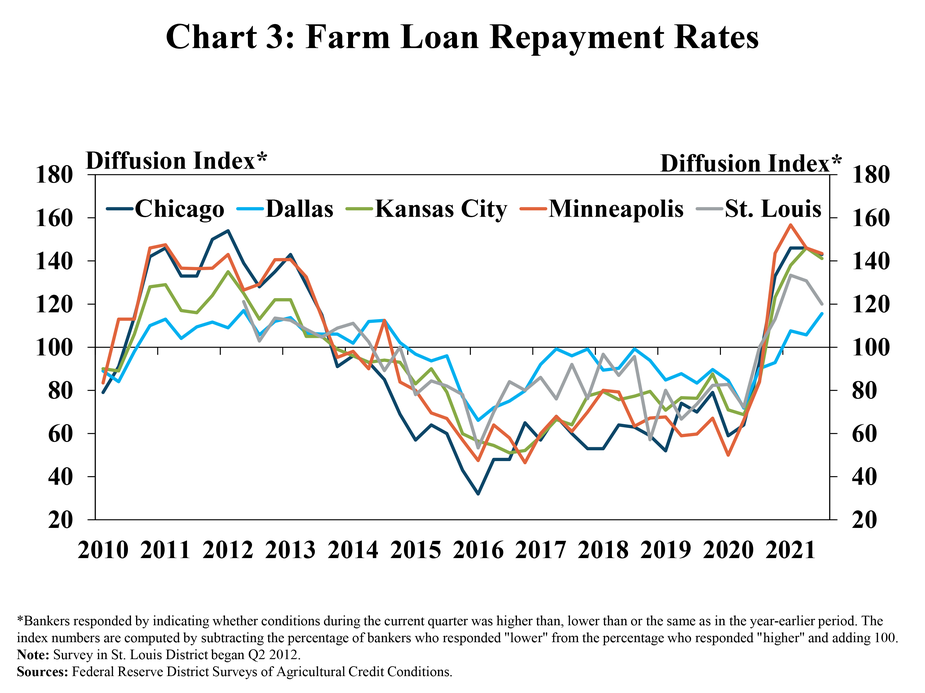

Agricultural credit conditions also continued to improve alongside strong farmland markets. Farm loan repayment rates increased from a year ago at a pace similar to the prior quarter in all Districts (Chart 3). Elevated commodity prices and robust government support have boosted farm finances in 2021, leading to improved credit conditions and contributing to the recent strength in farm real estate values.

Data and Information

Federal Reserve Ag Credit Surveys Historical Data

The views expressed in this article are those of the authors and do not necessarily reflect the views of the Federal Reserve Bank of Kansas City or the Federal Reserve System.