Farm income and credit conditions softened in the third quarter alongside a moderation in the farm economy. According to Federal Reserve District Surveys of Agricultural Credit Conditions, farm income softened from a year ago and loan repayment rates were steady following two years of substantial improvement. Despite more tempered conditions in the agricultural economy and further increases in interest rates, farm real estate values remained strong.

The U.S. agricultural economy has moderated in recent months alongside elevated costs and lower prices for some key commodities. Despite easing from strong levels, agricultural credit conditions and farm loan performance remained strong. Robust financial strength built up over the past two years alongside high farm incomes has continued to support farm finances throughout 2023. Looking ahead, many farm lenders continue to cite interest rates, higher input costs, and drought as key concerns.

Third Quarter Federal Reserve District Ag Credit Surveys

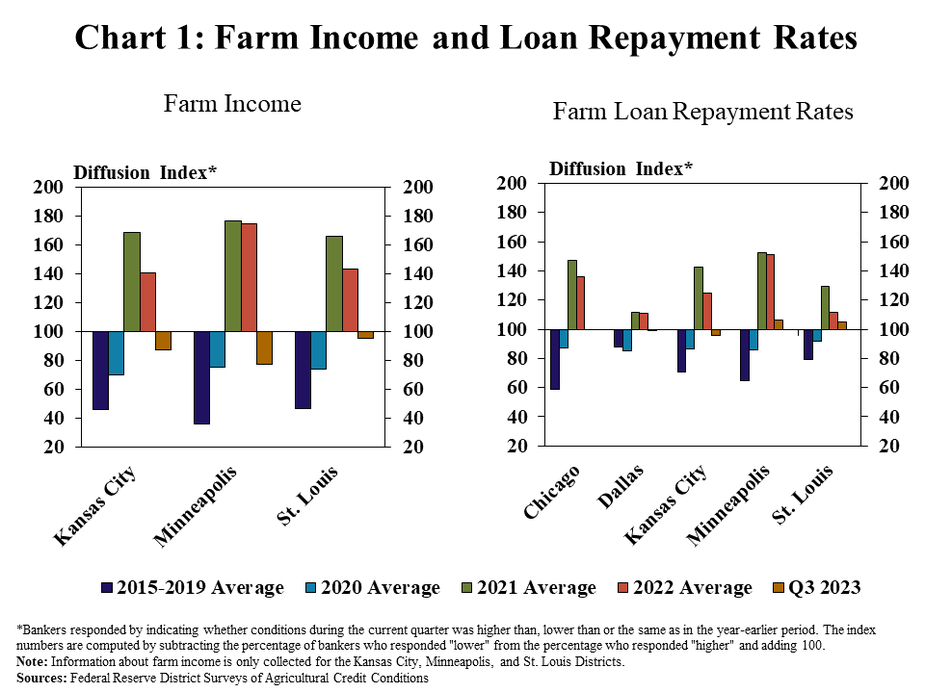

Agricultural credit conditions remained sound, but conditions have eased from a period of considerable strength. According to survey results in participating Districts, farm income softened from a year ago at a modest pace (Chart 1, left panel). Repayment rates on farm loans were largely unchanged in all regions compared with a year ago with similar shares of respondents reporting that repayment was higher and lower than a year ago (Chart 1, right panel).

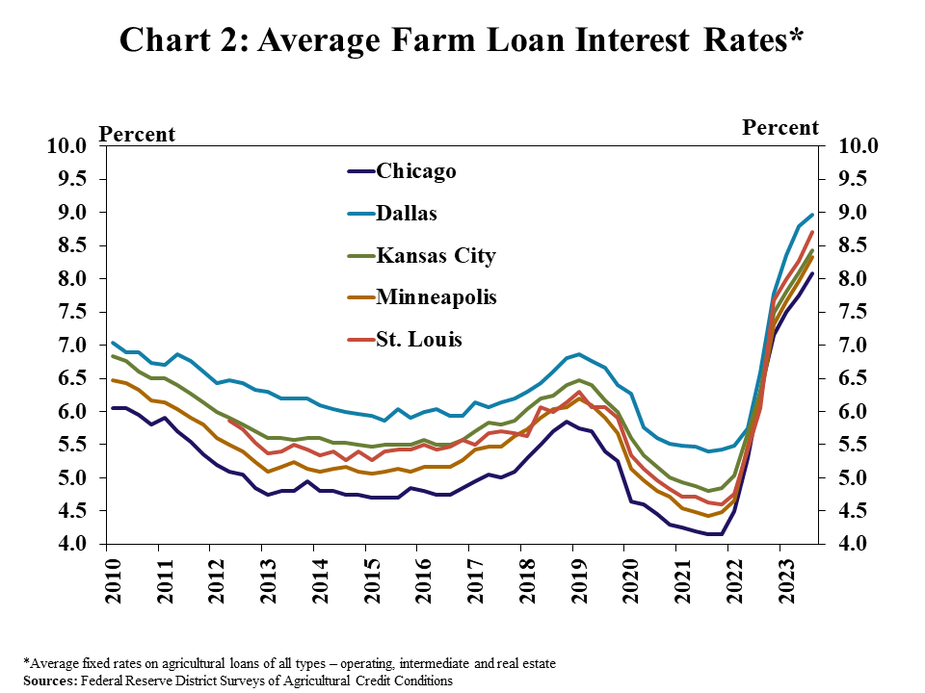

Softening in farm income and loan repayment rates coincide with further increases in interest rates. Interest rates charged on farm loans increased for the eighth consecutive quarter and were the highest in more than 20 years (Chart 2). Average rates on all types of loans climbed to above 8% in all Districts, a steep rise from historic lows in 2021 that has increased financing costs considerably for farm borrowers.

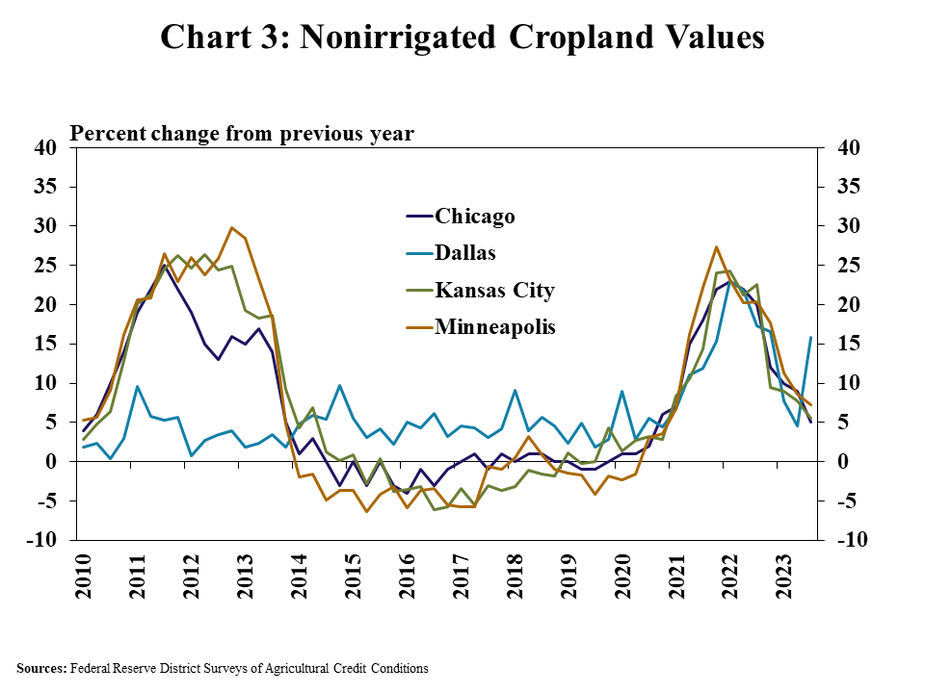

Despite some downward pressures, agricultural real estate values remained strong. Growth in nonirrigated farmland values softened further in the third quarter but remained firm, with increases averaging about 5% from a year ago in most regions (Chart 3). In contrast to most areas, farmland values in the Dallas District grew at a notably stronger pace with some respondents in the region observing robust demand in some areas of Texas.

Data and Information

Federal Reserve Ag Credit Surveys Historical Data

Federal Reserve Ag Credit Surveys Tables

External LinkAbout the Federal Reserve Ag Credit Surveys

The views expressed are those of the authors and do not necessarily reflect the positions of the Federal Reserve Bank of Kansas City or the Federal Reserve System.