Farm lending at commercial banks declined in the third quarter of 2016, but remained elevated as lenders continued to assess the downturn in the U.S. agricultural economy. The need for short-term financing in the farm sector remained high as profit margins remained weak. Alongside growing risk in the sector and slight declines in loan performance, agricultural bankers made additional adjustments to loan terms and continued to rely more heavily on farm real estate as collateral. Farmland values continued to decline at a modest pace, which may put further pressure on agricultural credit conditions for some borrowers.

Section A - Third Quarter Survey of Terms of Bank Lending to Farmers

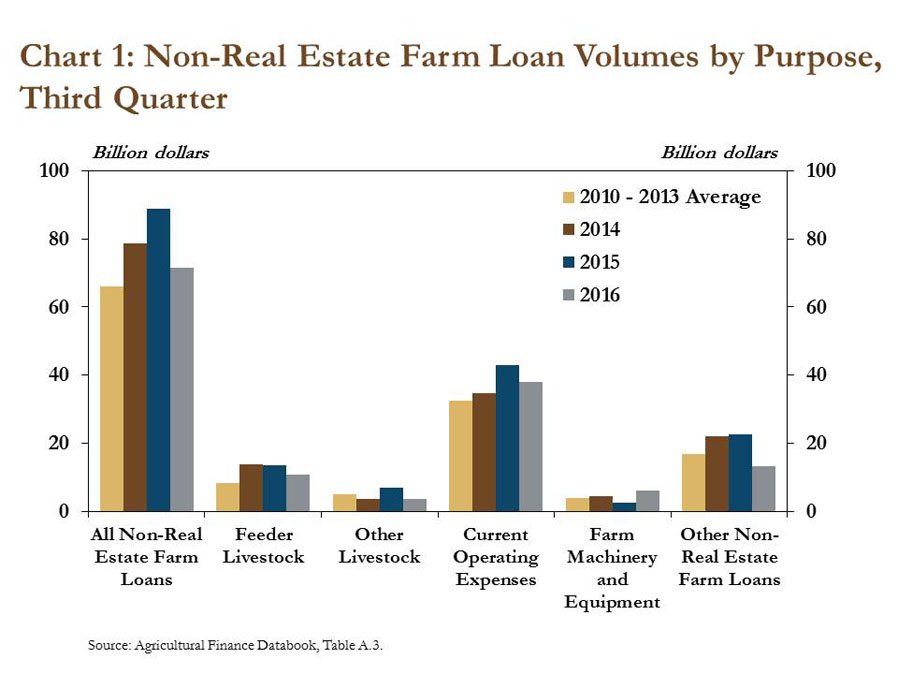

Lending activity in the farm sector declined modestly, but remained relatively strong in the third quarter. Respondents to the Survey of Terms and Bank Lending to Farmers indicated the volume of farm loans originated in the quarter decreased about 19 percent from a year ago, but remained elevated by historical standards (Chart 1). Despite the decline, the volume of farm loans originated for non-real estate purposes was still 8 percent higher than the average from 2010 to 2013.

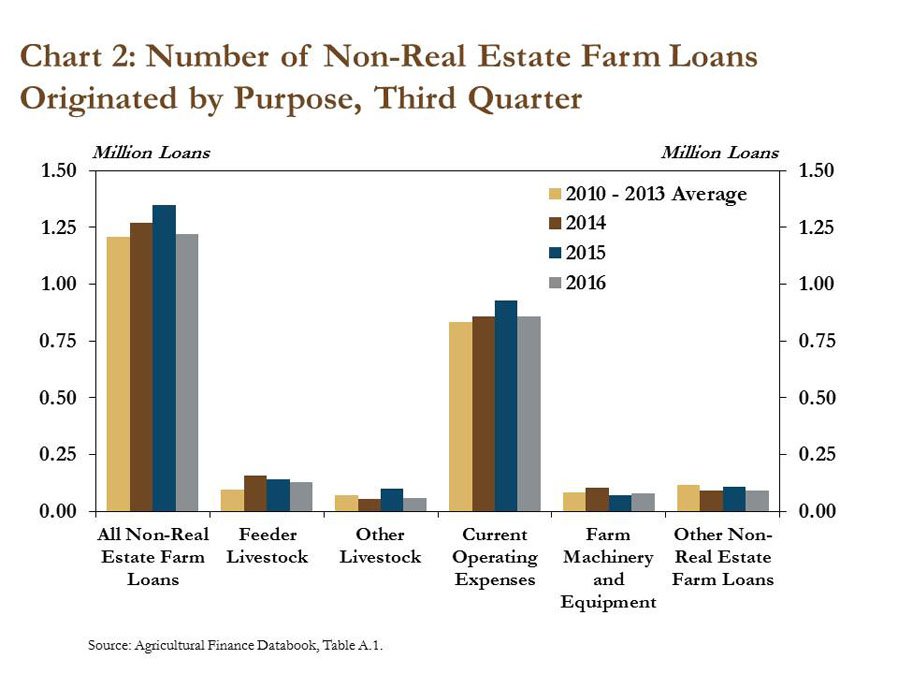

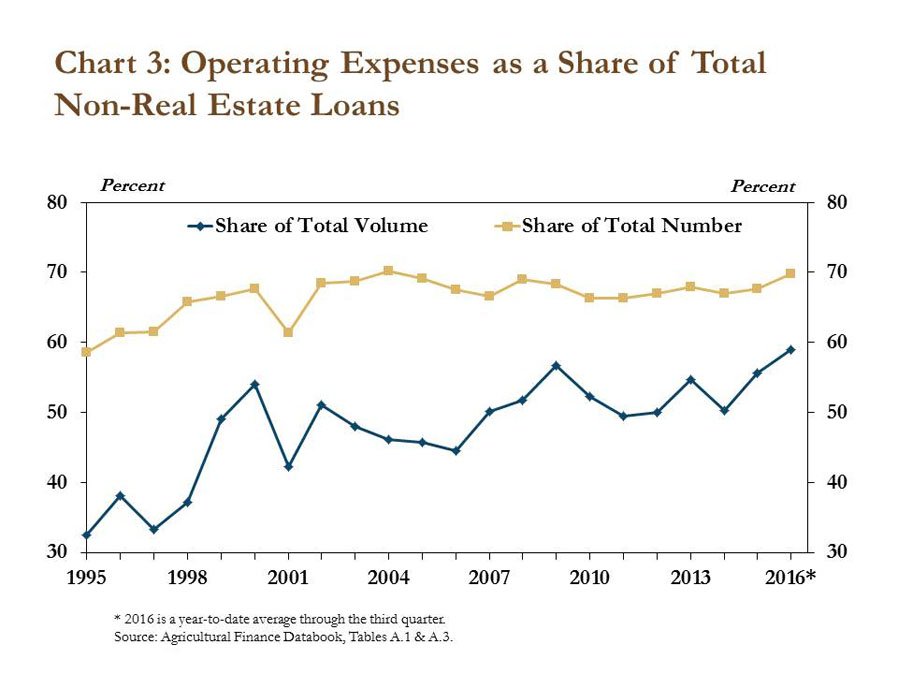

Similar to loan volume, the number of new loans originated in the third quarter also declined somewhat, but was similar to previous years’ averages. Specifically, the number of non-real estate farm loans made by commercial banks to farmers was 1 percent higher than the average from 2010 to 2013, but was down 10 percent from a year ago (Chart 2). Consistent with recent trends, loans for operating expenses continued to drive the demand for new loans. In fact, thus far in 2016, loans used to finance operating expenses have comprised about 70 percent of all non-real estate farm loans and nearly 60 percent of total loan volume (Chart 3).

The decline in non-real estate lending may stem from recent declines in input costs or other measures to reduce costs. In August, U.S. Department of Agriculture (USDA) forecasts anticipated production expenses to decrease nearly 3 percent from a year ago. Additionally, the price of cattle and hogs in August fell 21 percent and 11 percent, respectively, from the previous year. These price declines may also explain the modest decrease in the number and volume of loans used to finance livestock purchases. Finally, the volume of other non-real estate farm loans, which are loans used for a variety of farm purposes, dropped sharply in the third quarter. This decrease may reflect other cutbacks farmers may have made during a time of tight profit margins.

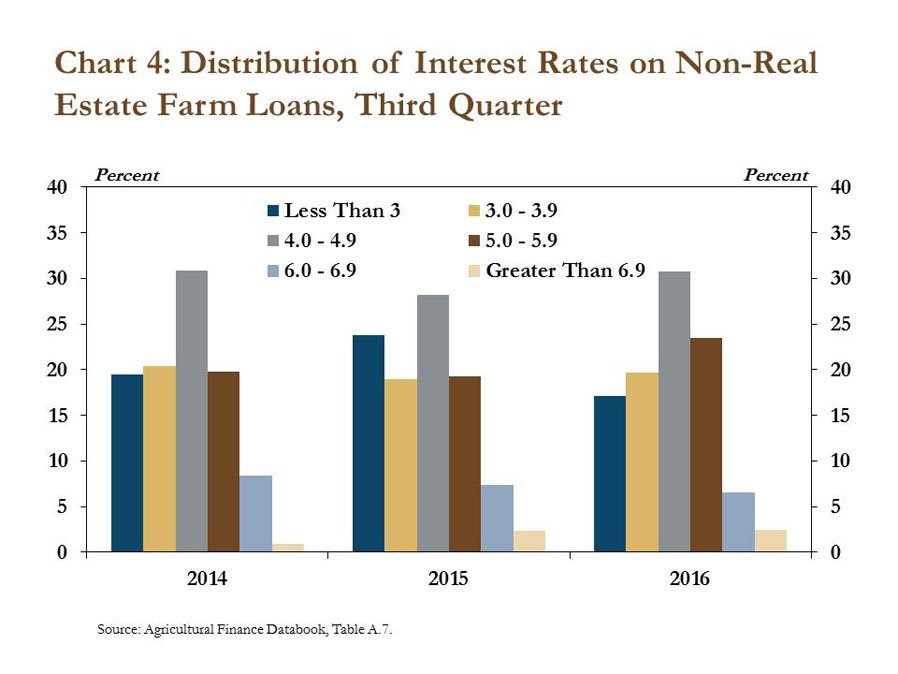

Lenders also further adjusted loan terms as profit margins in the agricultural sector generally remained weak. For example, the share of loans with an interest rate of less than 4 percent declined from 43 percent in 2015 to 37 percent in 2016 (Chart 4). Moreover, the share of loans with a floating interest rate edged above 85 percent for only the second time since 1977. The average maturity period for operating loans also increased above 14 months for only the third time since 1977. Higher interest rates, more variable rate loans and longer maturities may indicate that banks have taken some steps to adjust loan terms in response to additional risk in agricultural lending, which has been characterized recently by weaker profit margins and reduced cash flow.

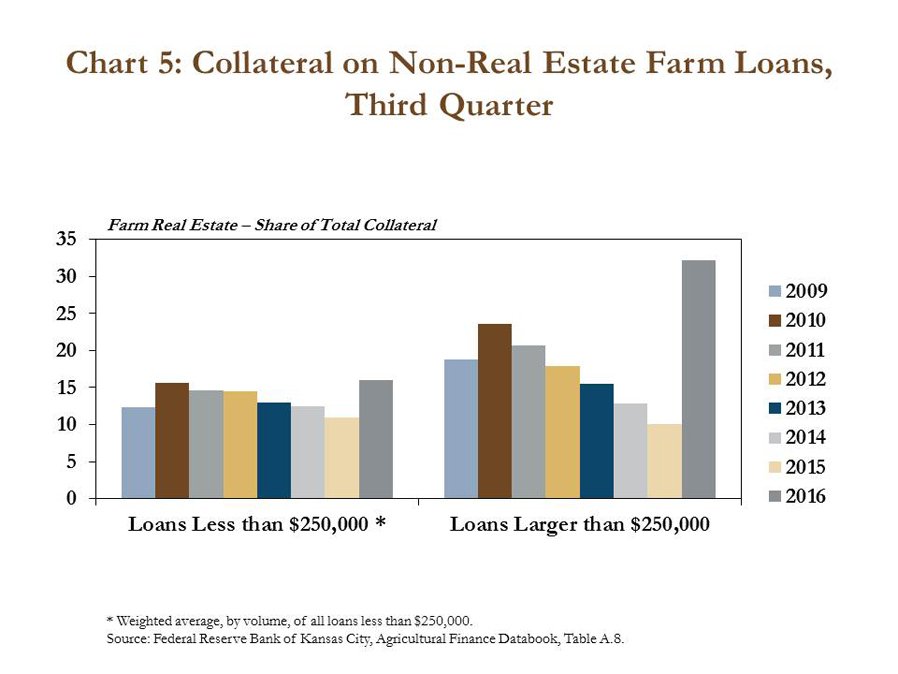

Bankers also sought to adjust the collateral composition of their farm loan portfolios. The use of farm real estate as collateral on non-real estate farm loans increased sharply in the third quarter from a year ago (Chart 5). Most prominently, the share of collateral on loans of more than $250,000 that was comprised of farm real estate increased from 10 percent to 32 percent. The sharp increase reversed a five-year decline in the use of farm real estate as a share of total collateral on non-real estate loans. The increased use of farm real estate as collateral may indicate bankers have sought to shore up loan quality in an environment of extended maturities and reduced liquidity of the borrowing base.

Section B - Second Quarter Call Report

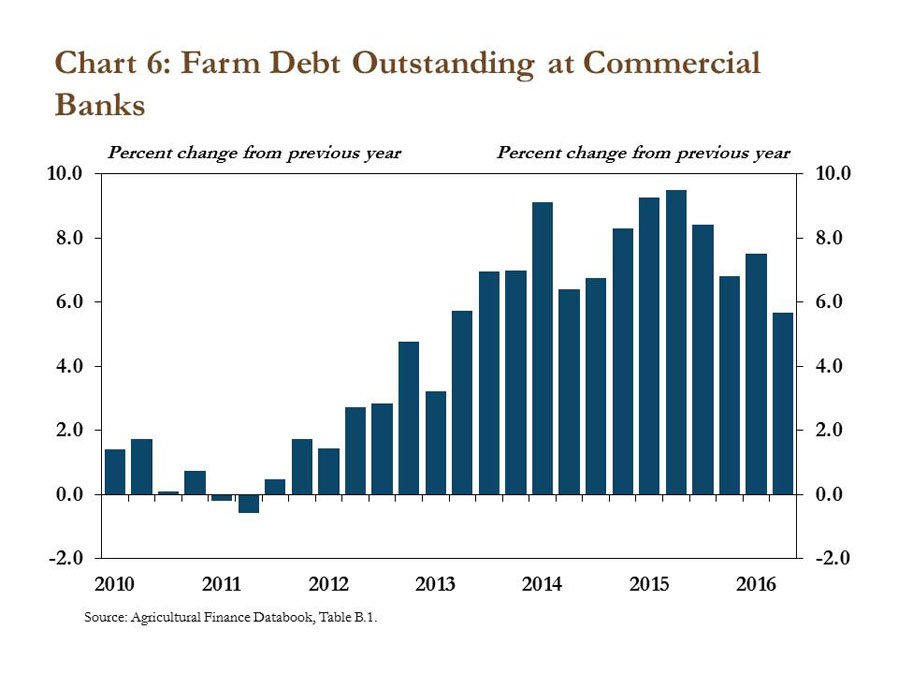

The increase in the use of debt at commercial banks to finance agriculture moderated somewhat in the second quarter. Call Report data from the second quarter indicated total farm debt outstanding increased less than 6 percent from the second quarter of 2015 (Chart 6). Although outstanding debt has increased for 20 consecutive quarters, the second quarter was the first in three years that total farm debt expanded by less than 6 percent.

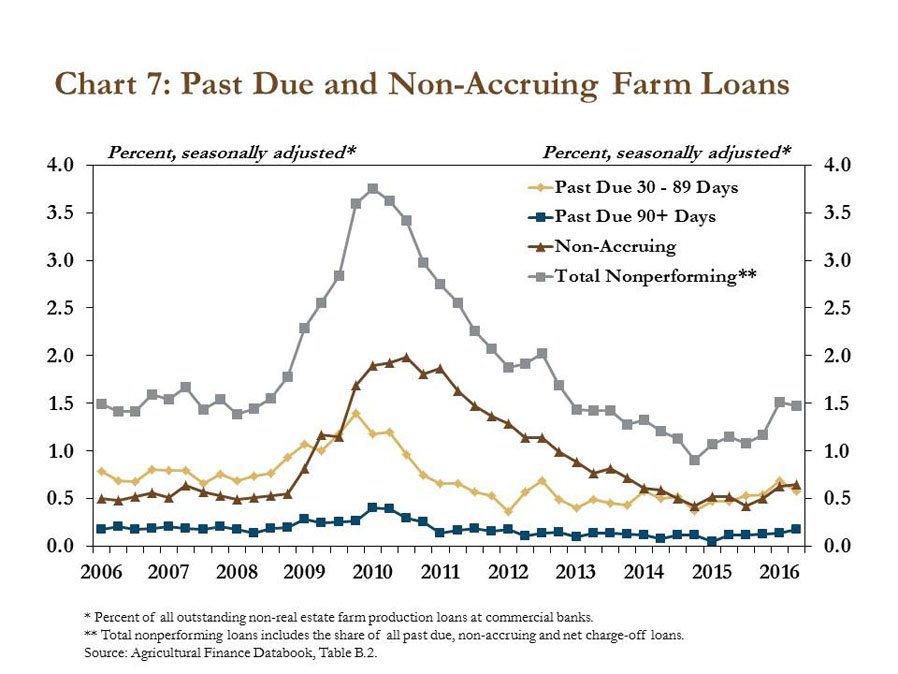

As farm debt increased, the performance of agricultural loans took a small step back in the second quarter. The share of loans past due more than 90 days and non-accruing loans both edged up (Chart 7). Despite a slight decline in the share of loans past due 30 to 89 days, the share of total nonperforming loans has been on a slight upward trend since a relative low point in late 2014 and was also higher than at the same time a year ago. Notably, however, the share of total nonperforming loans in the first two quarters of 2016 remained well below the level following the 2008-09 recession.

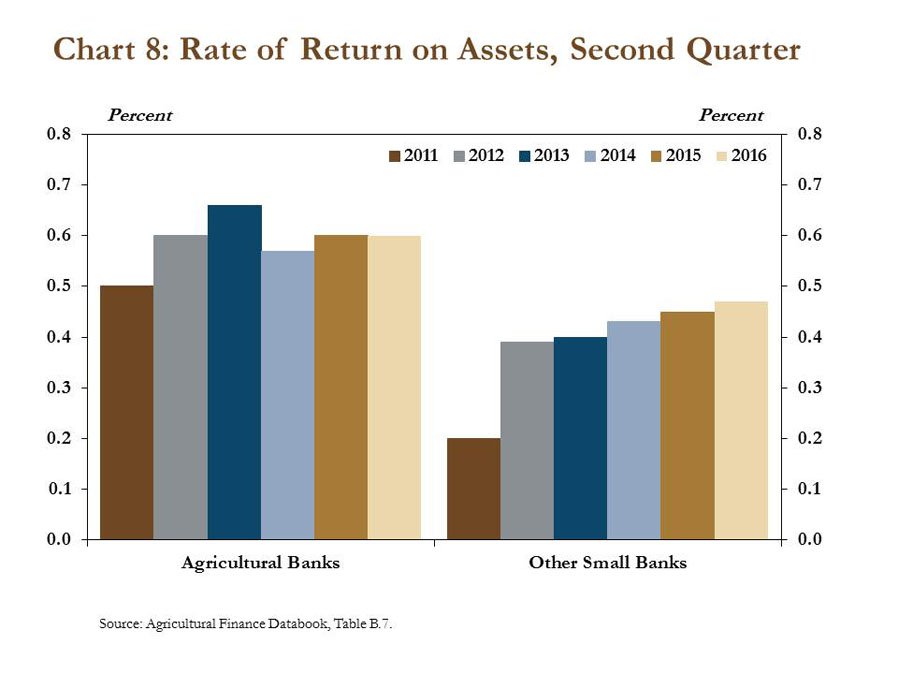

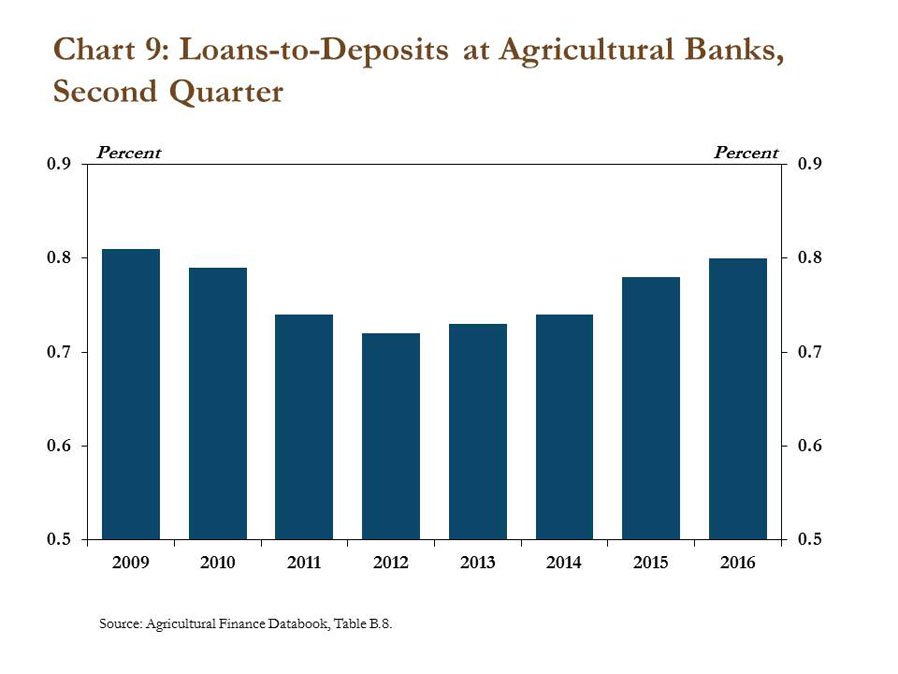

In addition to a higher share of nonperforming loans, the performance of agricultural banks has leveled off somewhat. The rate of return on assets, a typical measure of bank performance, at agricultural banks in the second quarter remained unchanged from a year ago (Chart 8). In contrast, the rate of return on assets at other small banks in the second quarter increased for a fifth consecutive quarter. However, loan-to-deposit ratios at agricultural banks have grown steadily during the recent environment of tighter profit margins in the farm sector. In fact, the loan-to-deposit ratio at agricultural commercial banks has increased from 0.72 in 2012 to 0.80 in the second quarter (Chart 9).

Section C - Second Quarter Regional Agricultural Data

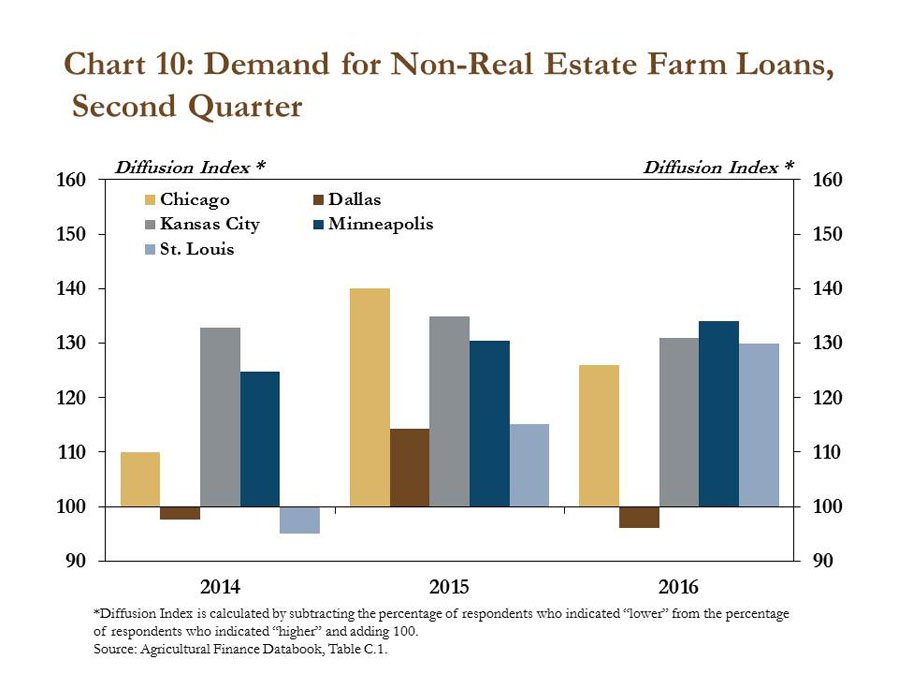

Consistent with data from recent Call Reports, Federal Reserve surveys of agricultural credit conditions also showed generally elevated demand for non-real estate financing in the farm sector. Of the surveys conducted in prominent agricultural areas, only the Dallas District noted a slight decline in demand for non-real estate financing (Chart 10). The crop-intensive districts of Chicago, Kansas City, Minneapolis and St. Louis, however, have reported an increase in loan demand in each quarter since 2014.

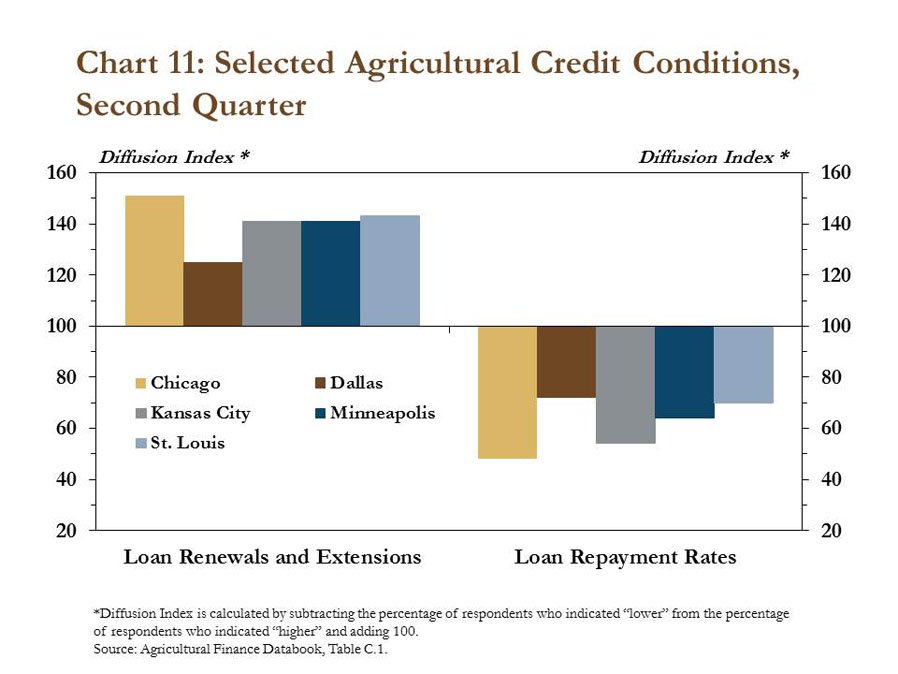

Alongside growing loan demand, agricultural credit conditions remained downbeat from the perspective of the farm borrower. Each district reported a continuing decline in repayment rates of farm loans in the second quarter while demand for loan renewals and extensions continued to rise (Chart 11). Deteriorating credit conditions in the agricultural sector across the country have reflected ongoing weakness in each district’s agricultural economy and have further indicated a growing sense of risk in the farm sector.

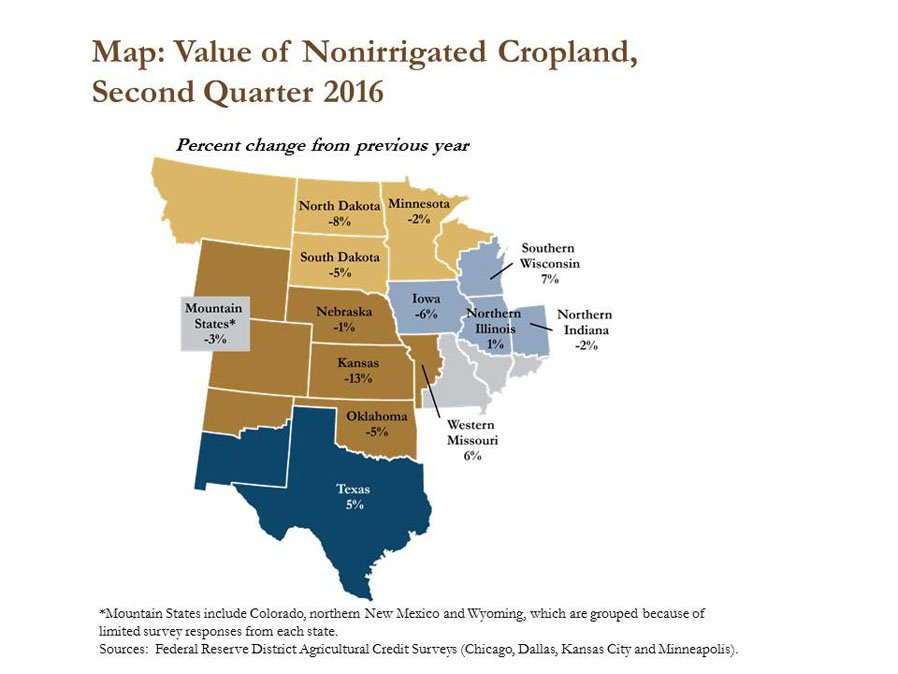

The weak farm economy and downbeat credit environment across Federal Reserve districts also continued to affect farmland values. Responses to Federal Reserve surveys indicate cropland values declined in most states in the second quarter (Map). Although values of nonirrigated cropland have continued to rise in the Dallas District, the Kansas City, Minneapolis and Chicago districts have recorded declines, or no change, in the value of nonirrigated cropland each quarter since 2015.

Conclusion

The need for agricultural financing generally remained high in the third quarter despite a modest decline in farm loan volumes. Banks continued to meet financing needs, and manage risk stemming from gradual deterioration in the U.S. agricultural economy, by making modest adjustments to loan terms. However, if weak profit margins persist, loan performance continues to deteriorate, and farmland values continue to decline, agricultural banks may face greater challenges to manage the risk associated with lending in agriculture.