Agricultural real estate values continued to increase at a rapid pace across farm country through the end of 2021. The increase in the value of farmland has accelerated in recent quarters alongside elevated commodity prices that have boosted profit opportunities and supported broad strength in the U.S. farm economy. Adding support to agricultural real estate markets, farm finances and credit conditions have improved drastically from recent years and interest rates on farm loans remained near historic lows.

The outlook for agricultural credit conditions remained strong looking out to the year ahead. Elevated commodity prices and robust support from government aid programs throughout the pandemic have supported rapid improvement in farm income and credit conditions. Despite concerns about the impact of higher input costs and intensifying drought in some regions, markets for most major commodities remained strong and producers throughout the agricultural sector were poised for sound profit opportunities in 2022.

Fourth Quarter Federal Reserve District Ag Credit Surveys

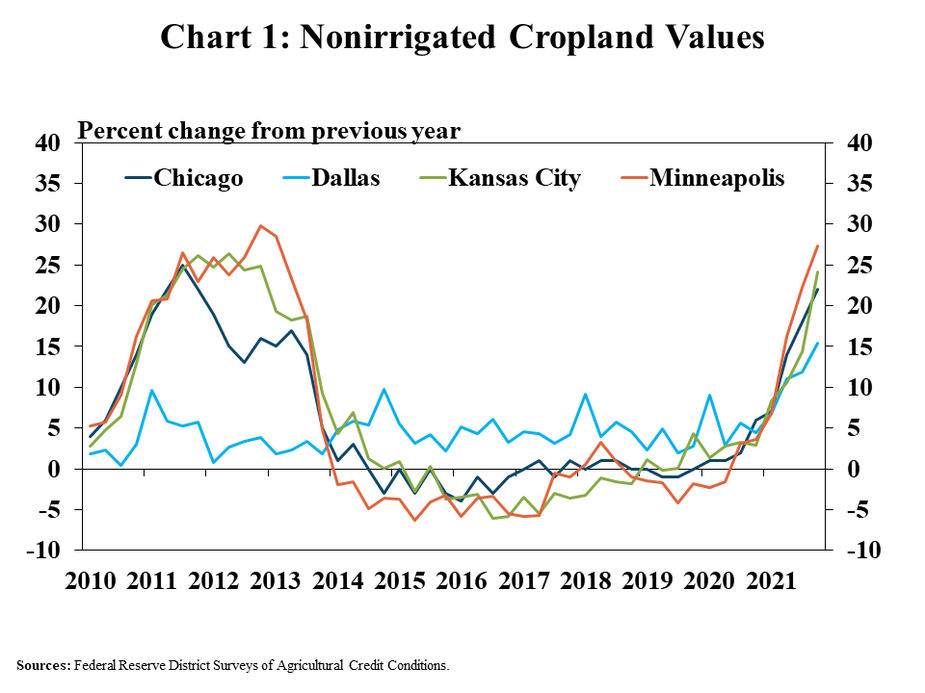

Farm real estate values continued to increase at a rapid pace. The value of nonirrigated cropland was nearly 25% higher than a year ago in all Districts except Dallas (Chart 1). The pace of growth also increased from previous quarters throughout the U.S., accelerating to the fastest rate of growth since 2012 and 2013 in all Districts.

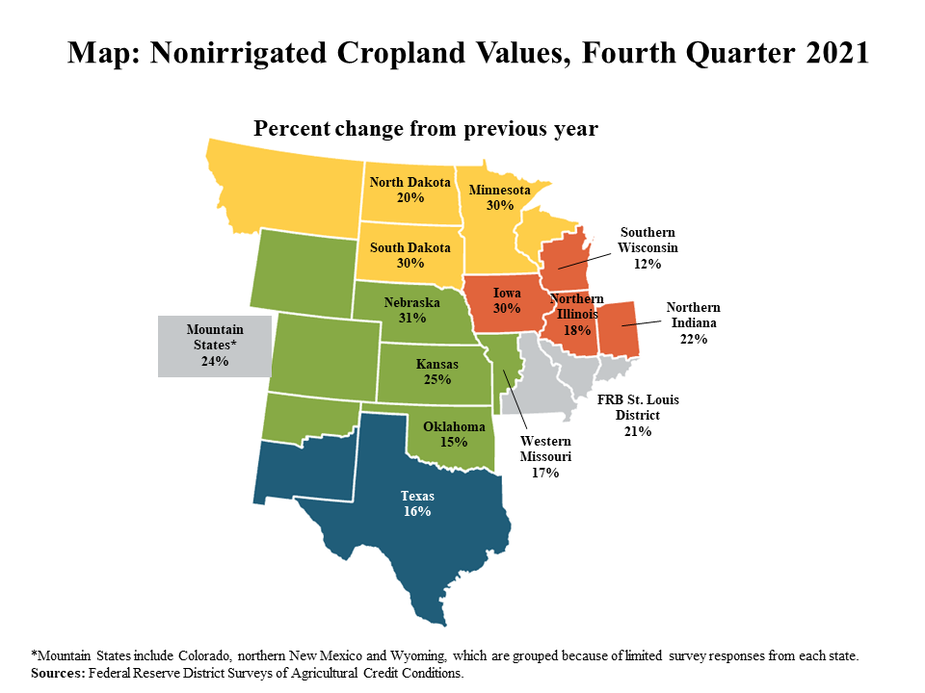

The strength in farm real estate values also remained consistent across all states. Nonirrigated cropland values increased sharply in all states within Districts participating in the survey (Map). The pace of growth was most rapid in Nebraska, Iowa, Minnesota and South Dakota.

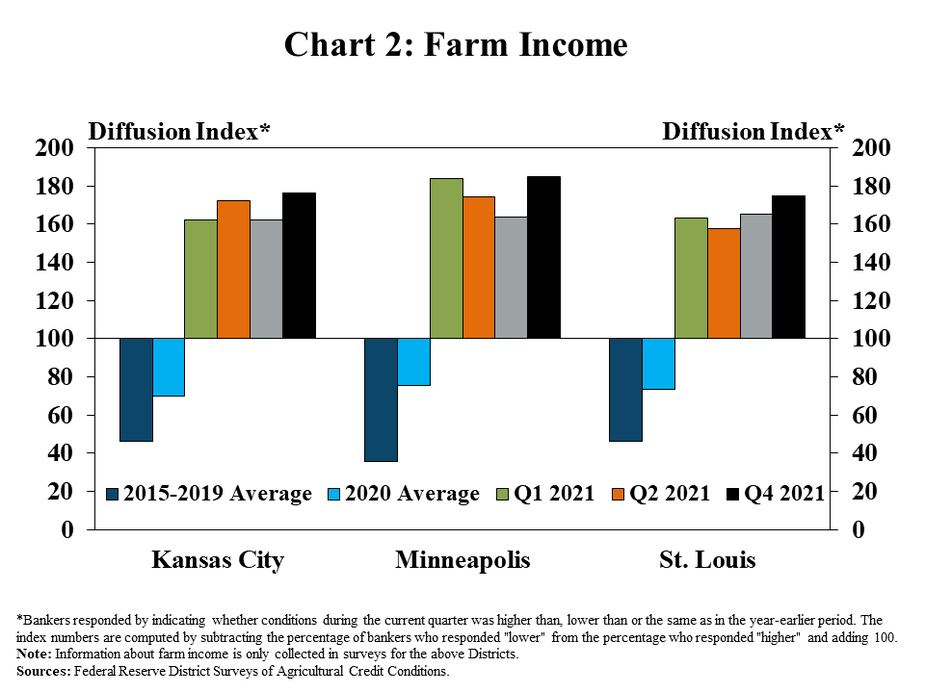

Strong agricultural real estate markets coincided with consistent improvement in farm finances. Alongside elevated commodity prices, bankers in regions participating in the survey reported that farm income was higher than a year ago for the fifth consecutive quarter (Chart 2). The pace of increase was the fastest on record for both the Kansas City and St. Louis Districts and only slightly less than the record for the Minneapolis District.

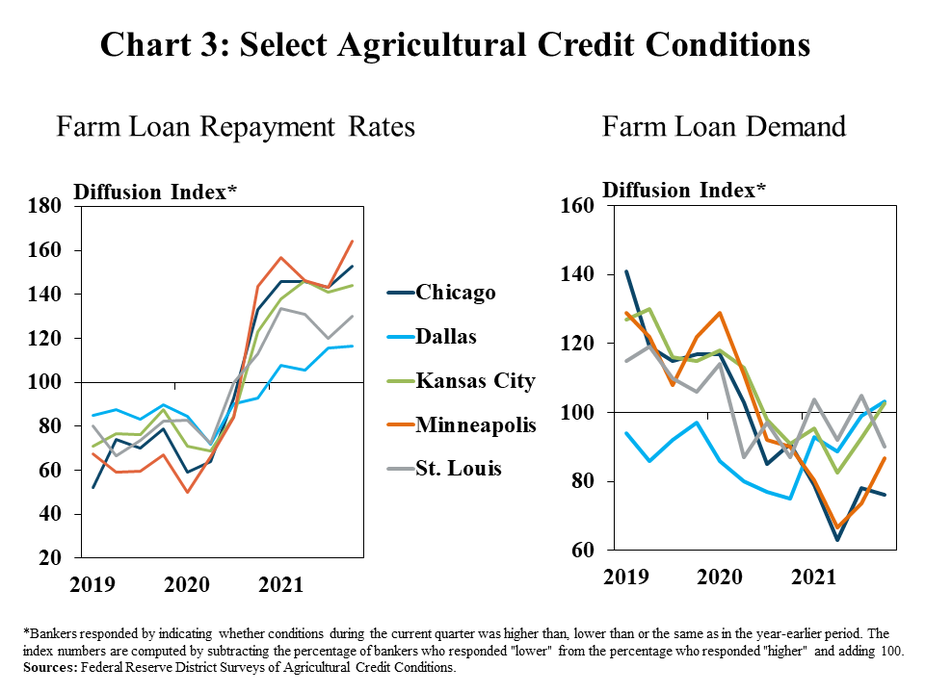

The strength in farm finances also supported further improvement in credit conditions. Farm loan repayment rates continued to increase at a steady pace in all regions (Chart 3, left panel). Higher farm incomes also continued to limit credit needs for some producers and demand for farm loans remained subdued across all areas (Chart 3, right panel).

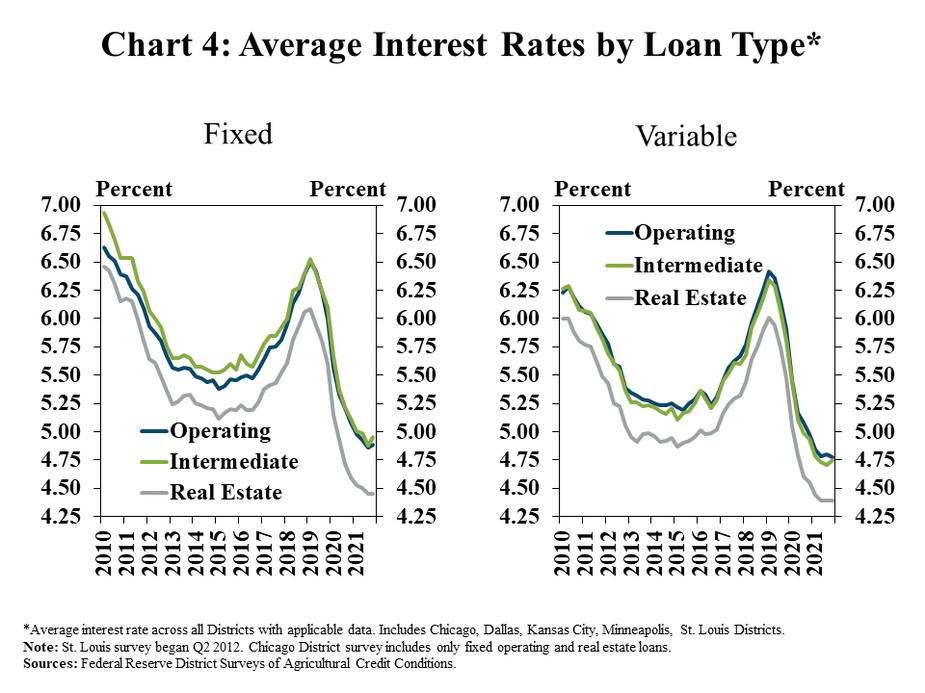

Providing additional support to farm real estate markets, interest rates remained low. Despite increasing slightly from the previous quarter, the average rate charged on all types of farm loans was well below the historical average (Chart 4). Fixed and variable rates on all loan types remained about 190 basis points and 170 basis points less than the average of the last 20 years, respectively.

Data and Information

Federal Reserve Ag Credit Surveys Historical Data

The views expressed in this article are those of the authors and do not necessarily reflect the views of the Federal Reserve Bank of Kansas City or the Federal Reserve System.