Agricultural credit conditions in the Tenth Federal Reserve District tightened further in the second quarter of 2024. Alongside lower crop prices and continued pressure from elevated production expenses, farm income declined at a slightly faster pace than recent quarters, especially in states more concentrated in crop production. In addition, more agricultural banks also reported that farm borrower liquidity had declined relative to last year. Cattle prices continued to rise through mid-year, however, providing some support to farm borrowers and values for ranchland.

Despite sharp declines in farm income and capital spending, agricultural credit stress remained limited, but signs of financial pressure have appeared. Lenders reported modest deterioration in farm finances, farm loan repayment rates declined at a gradual pace similar to recent quarters, and repayment problems on farm loans rose slightly. Any additional weakening in incomes and liquidity could increase the risk of deterioration in credit conditions.

Section 1: Credit Conditions

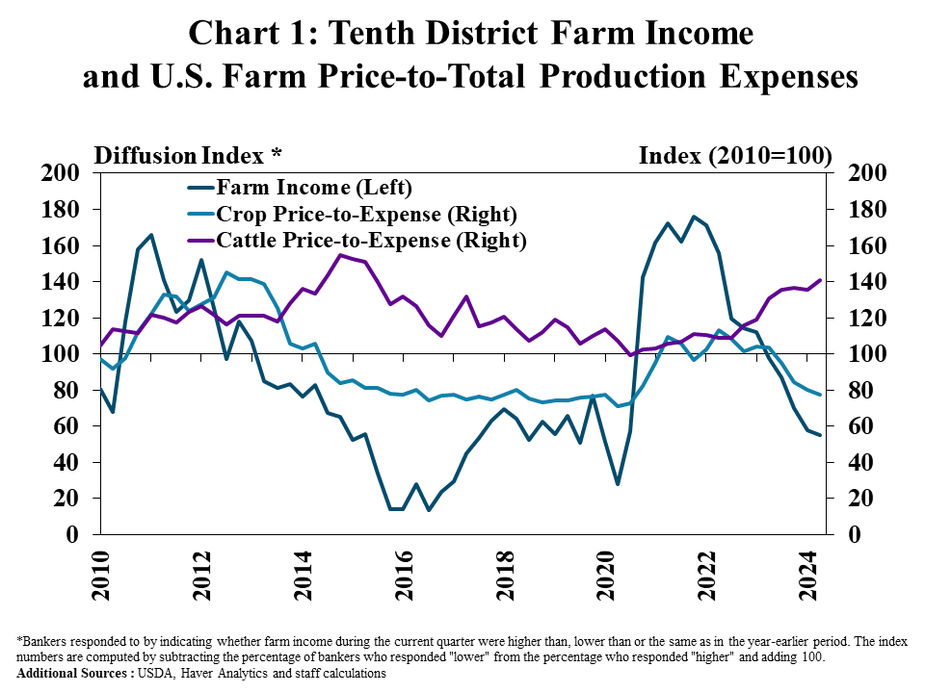

Farm incomes in the Tenth District continued to weaken alongside cost pressures that remained elevated. Although the pace of decline in farm income slowed, more than 60% of agricultural lenders reported that farm income was lower than a year ago (Chart 1). Strong cattle prices have supported profit margins in the cattle sector, but prices for crops have declined faster than production expenses.

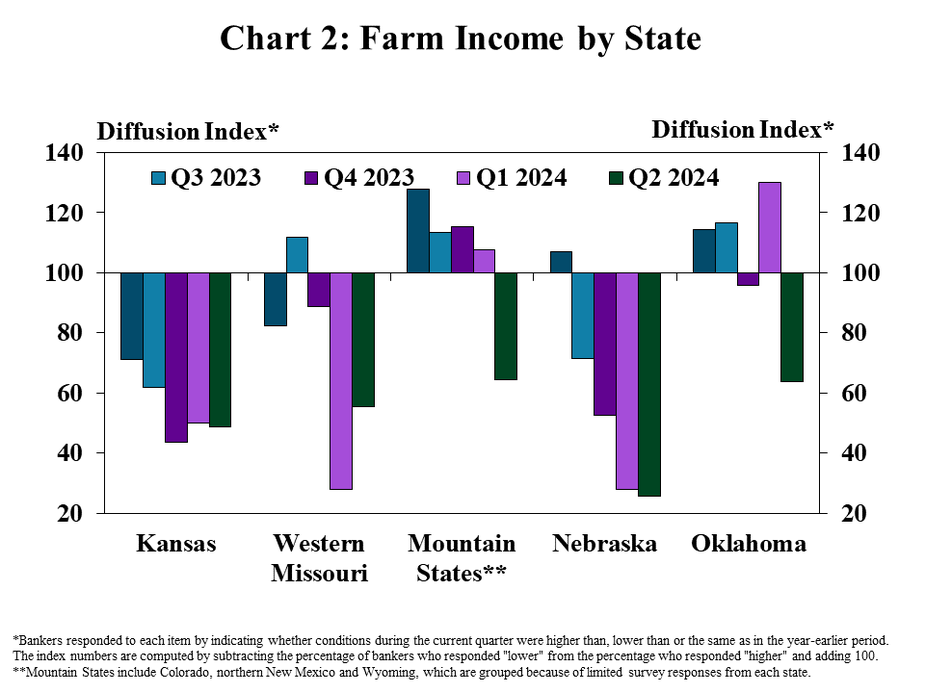

Farm income was lower in all states, but the retraction remained especially pronounced in areas more impacted by low crop prices. The index of farm income was lower in Kansas, Missouri, and Nebraska, where crops make up a larger share of farm revenues (Chart 2). After strengthening last quarter, farm income in the Mountain States and Oklahoma declined in the second quarter as 30% of lenders in those states reported lower farm income than a year ago.

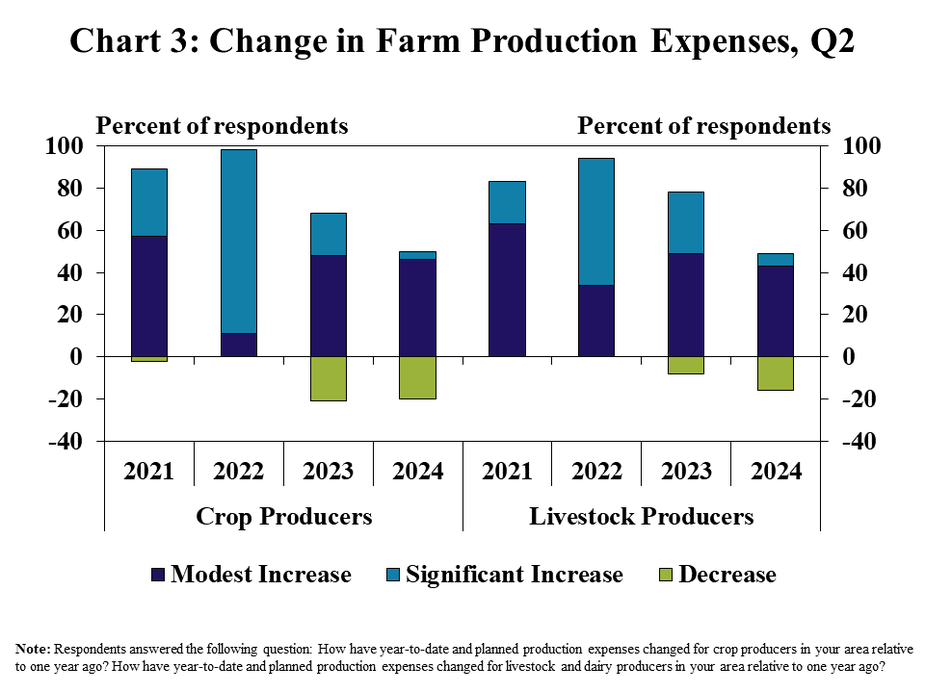

Profits have been squeezed by production costs, which remained elevated but have shown some signs of moderating. About 45% of crop and livestock lenders reported a moderate increase in year-to-date and planned production expenses relative to a year ago, which was similar to last year (Chart 3). In contrast to recent years, however, only 5% of lenders reported significant increases in production expenses and a sizeable share also reported a decline in costs.

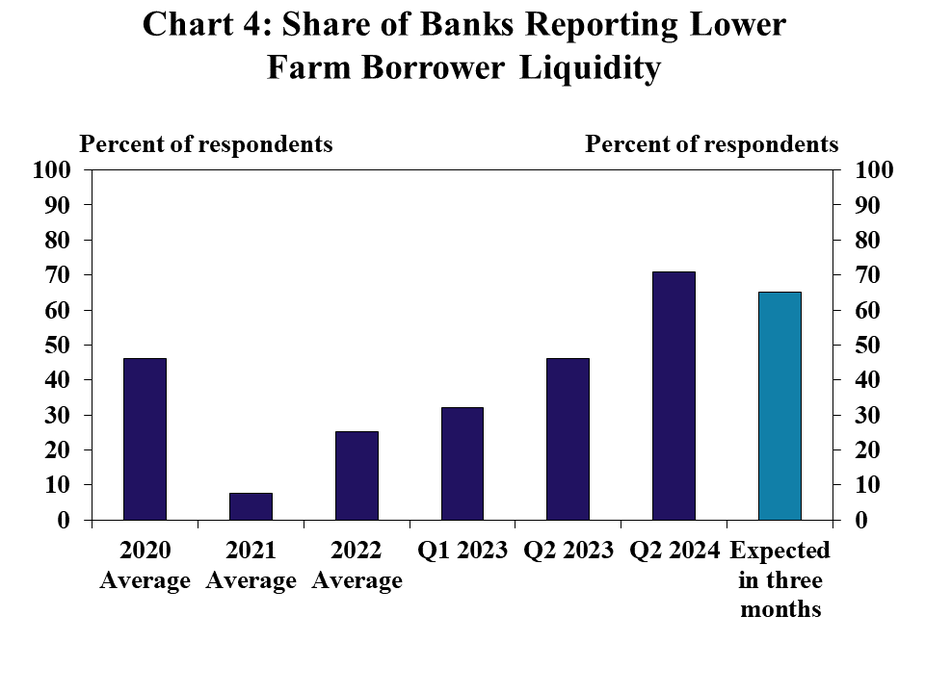

Ongoing expense pressures and low prices for key commodities also further reduced farm liquidity in the region. The share of banks reporting lower farm borrower liquidity has steadily increased since 2021 and climbed to more than 70% in the second quarter (Chart 4). Looking ahead, 65% of banks expected liquidity to continue to decline in the next quarter.

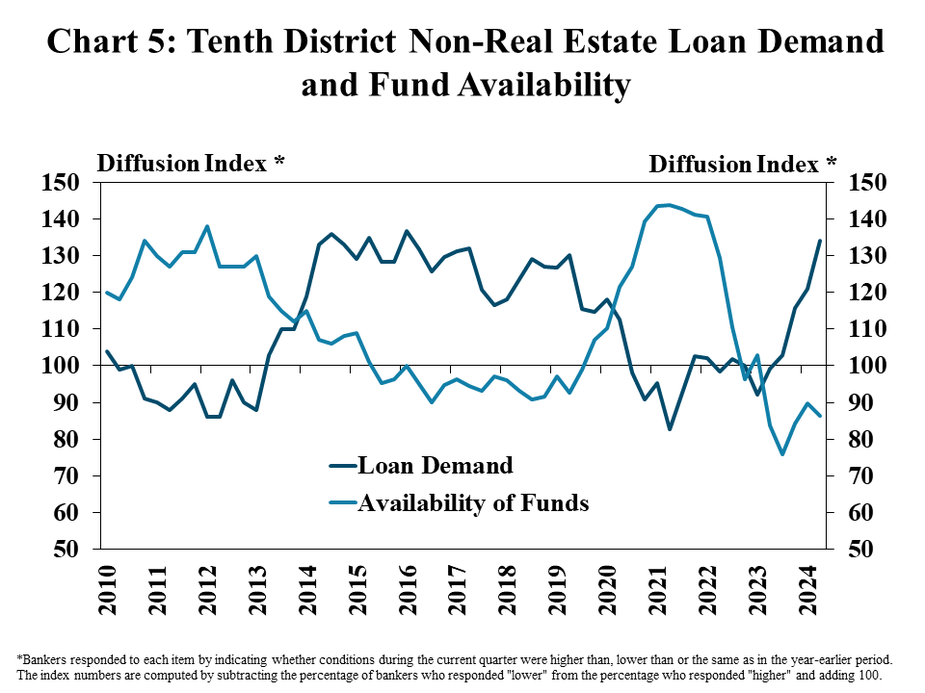

Loan demand in the District rose sharply alongside elevated costs and recent liquidity depletion. Demand for non-real estate farm loans rose at the fastest rate since 2016, with nearly 45% of lenders reporting that demand was higher than a year ago (Chart 5). Although loan demand has increased alongside lower farm incomes, availability of funds has declined at a more moderate pace.

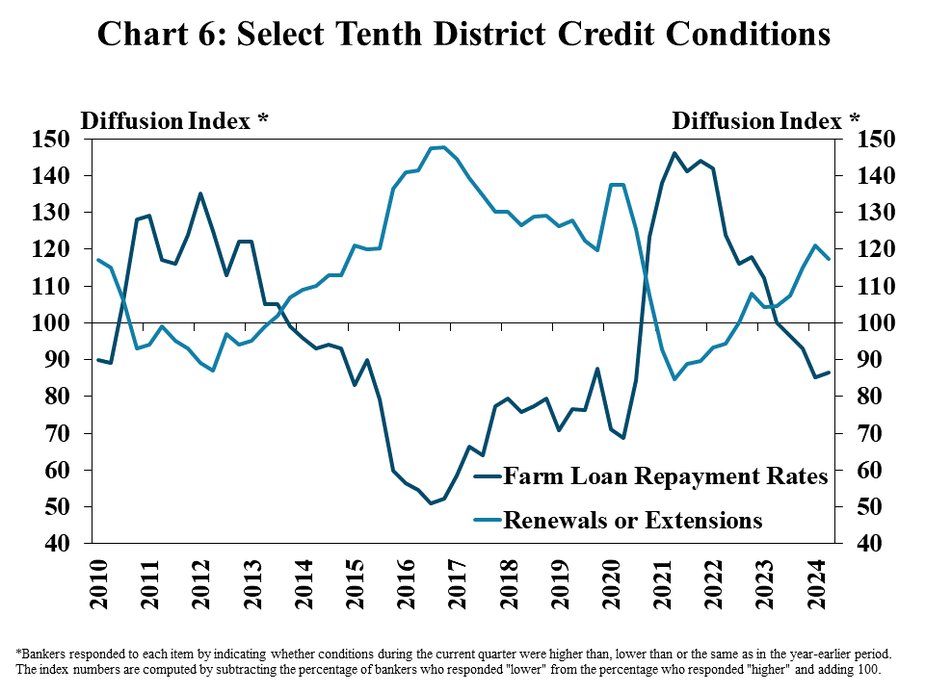

Alongside an increase in demand for new loans, renewals and extensions remained elevated and farm loan repayment rates declined at a similar pace as last quarter. Most agricultural lenders continued to report an increase in renewals and extensions and lower farm loan repayment rates relative to a year ago (Chart 6). However, despite sharp declines in crop prices and income for farm borrowers, agricultural credit conditions have decreased at a comparatively slower pace

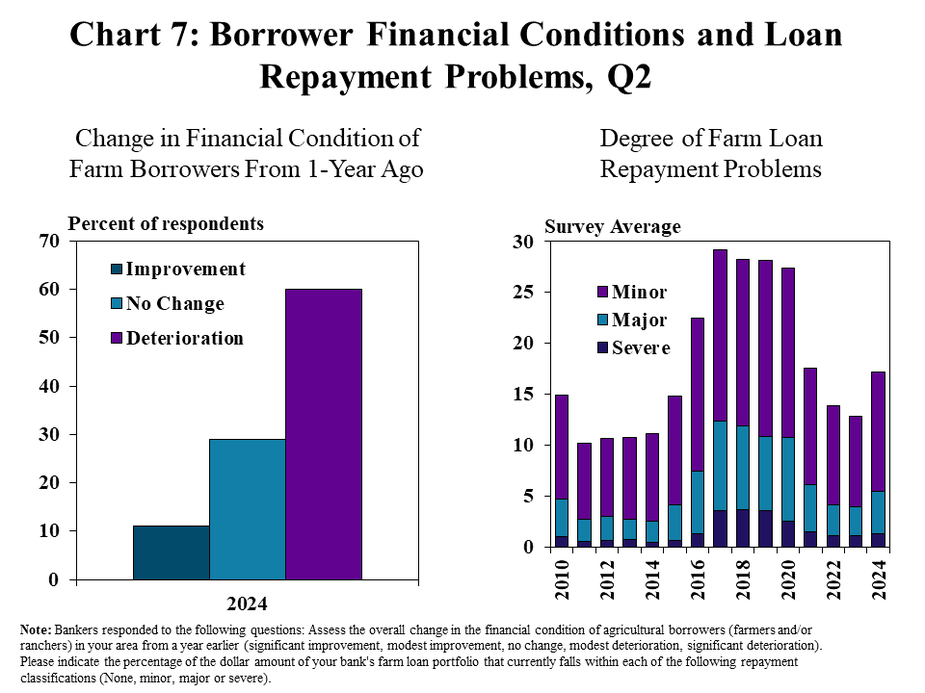

Credit conditions have tightened alongside modest deterioration in farm finances, and loan performance weakened slightly. In the second quarter, 60% of agricultural lenders reported a deterioration in farm borrower financial condition relative to a year ago, while 30% reported no change and 10% reported an improvement (Chart 7). Although 17% of banks reported repayment problems, up from 13% in 2023, a majority of the problems remained minor.

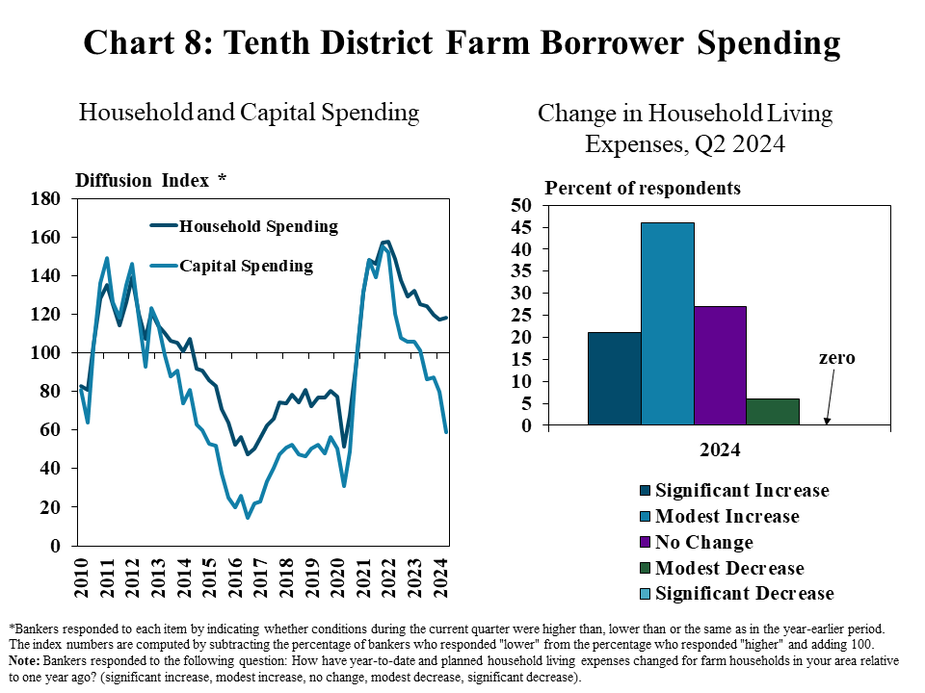

Capital spending remained subdued alongside softer farm finances, but household spending continued to rise gradually. The path of capital and household spending diverged further in the second quarter, as capital expenditures dropped at a faster pace and household expenditures continued to increase at a similar pace as the previous quarter (Chart 8). Nearly half of bankers in the region reported that living expenses for farm borrowers increased modestly compared to last year and more than 20% reported that the increases were significant—which could amplify financial stress for some farm households.

Section 2: Interest Rates and Farmland Values

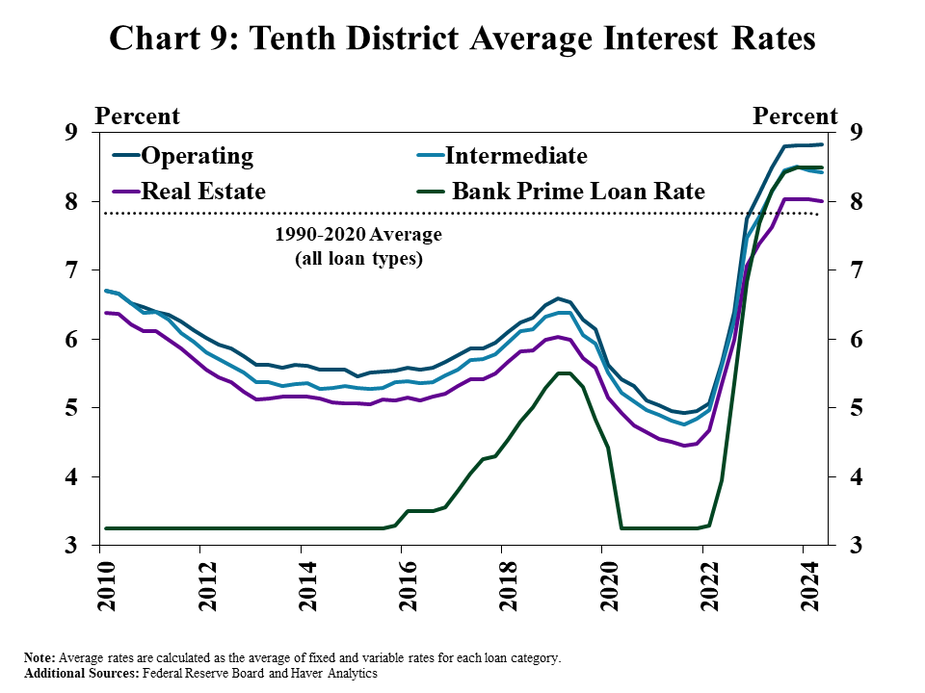

Average interest rates were nearly unchanged from last quarter and remained above average. Interest rates on operating loans ticked up by 1.5 basis points, while rates on intermediate and real estate loans fell by 2 basis points (Chart 9). However, all rates remained above the average over the past 30 years.

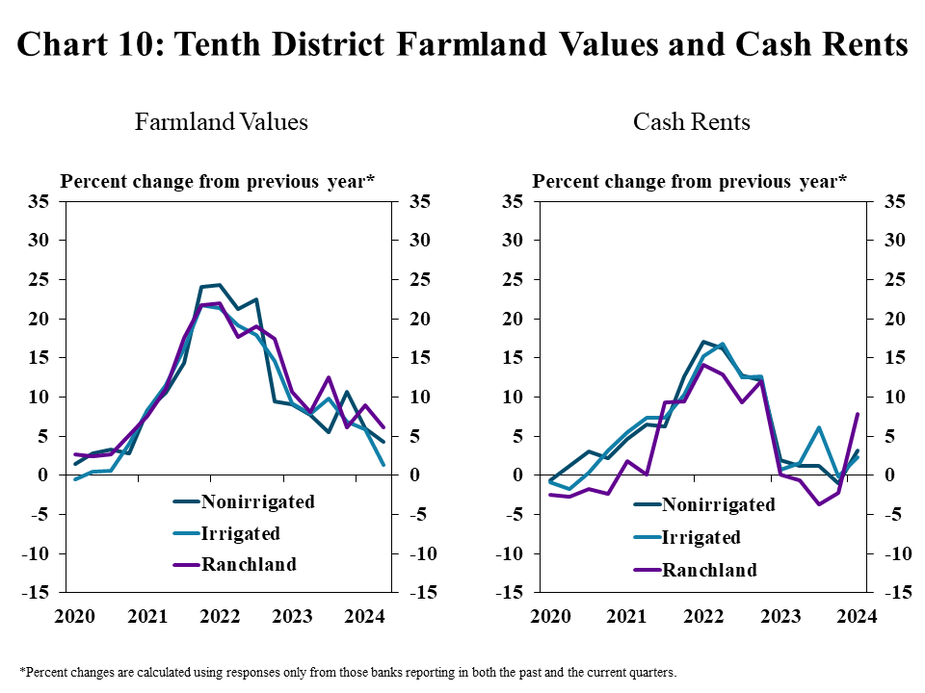

The value of all types of farmland grew at a slower pace, while cash rents rebounded slightly. Values for nonirrigated and irrigated cropland grew less than 5% from a year ago, while ranchland values held firmer and increased 6% (Chart 10). Ranchland cash rents also rebounded more sharply than rents for cropland. In the second quarter, rents for ranchland rose nearly 8% from last year. Stronger prices and profit margins for cattle could be contributing to relatively stronger markets for ranchland in the region.

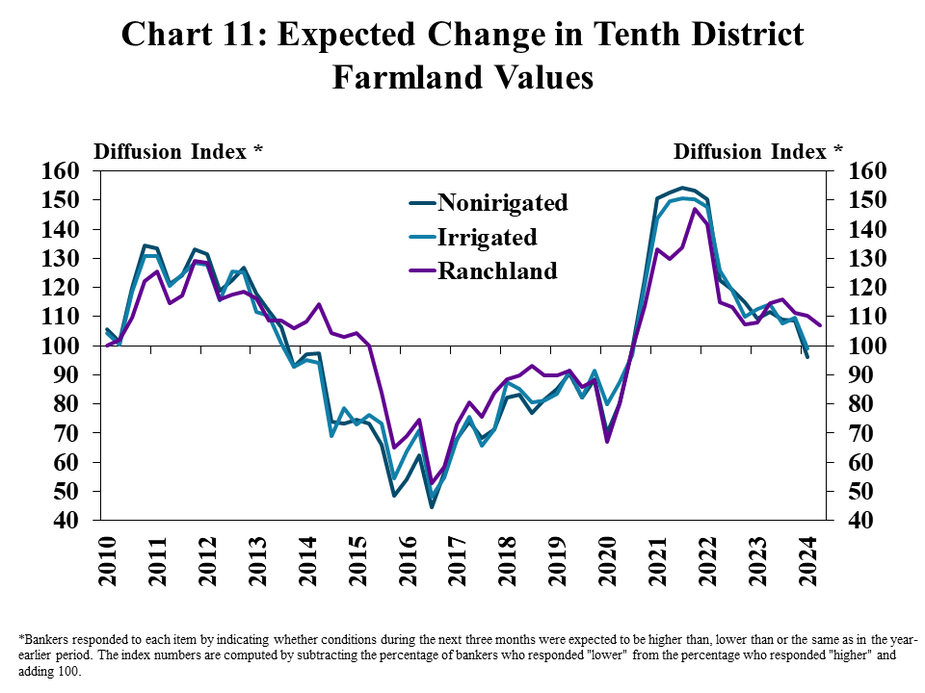

Amid higher interest rates and a general moderation in the farm economy, lenders expected land values to moderate further in the months ahead. About 80% of agricultural lenders expected land values to remain unchanged in the next quarter (Chart 11). However, for the remaining 20%, a larger share of bankers expected cropland values to decline and ranchland values to increase.

Banker Comments Q2 2024

“Beef producers have experienced good margins over the last 12-18 months, but increasing replacement costs and interest costs will reduce margins moving forward.”– Kansas

“Lower grain prices and continued drought are causing stress.”– Kansas

“Inflation has increased family living expenses for our producers. Lower crop prices compared to a year ago is also worrisome to farmers in the area but continued high livestock prices have helped our cattle producers.”– Kansas

“Inflation is having a substantial effect on family living. Equipment upgrades and new purchases are a rare conversation with stressed cash flows.”– Missouri

“We expect profit margins to be reduced in the row crop sector while we should see significant improvement in profit margins in the cattle sector.”– Missouri

“The cattle market has provided much needed profit for cattle producers, but expansion and replacements have a lot of risk for borrower and lenders if a correction is to take place in the near future.”– Missouri

“We are seeing quite a few of our farm lines of credit approaching their max already, which would be a few months earlier than normal.”– Nebraska

“Inflation is keeping household spending higher, liquidity took a hit and we have seen some refinancing needed against land, but land prices are still high even with higher interest rates.”– Nebraska

“Interest rates and commodity prices and primary concerns in our area.”– Nebraska

“If cattle prices maintain, cattle producers will be okay until stockers are purchased, but if cattle prices deteriorate, it could be ugly. Crop farmers with low prices are hurting and yields were all over the spectrum.” – Oklahoma

“Cost of living is increasing significantly and equipment and parts cost are increasing significantly.” - Oklahoma

“Higher rates are straining farmers cash flow and ability to operate with increasing input costs.” Oklahoma

Data: Credit Conditions | Fixed Interest Rates | Variable Interest Rates | Land Values

A total of 132 banks responded to the Second Quarter Survey of Agricultural Credit Conditions in the Tenth Federal Reserve District—an area that includes Colorado, Kansas, Nebraska, Oklahoma, Wyoming, the northern half of New Mexico and the western third of Missouri. Please refer questions to Cortney Cowley, senior economist or Ty Kreitman, associate economist at 1-800-333-1040.

The views expressed are those of the authors and do not necessarily reflect the positions of the Federal Reserve Bank of Kansas City or the Federal Reserve System.