Farmland values in the Tenth District generally held steady in the fourth quarter of 2014 despite further declines in farm income. Most bankers surveyed, however, said they expect cropland values to fall in 2015 alongside reduced expectations for farm income. Amid shrinking profit margins, demand for operating loans to pay for crop inputs is expected to remain elevated, and some bankers expressed concern that loan repayment rates might deteriorate if weak profit margins persist.

Farmland Values and Cash Rents

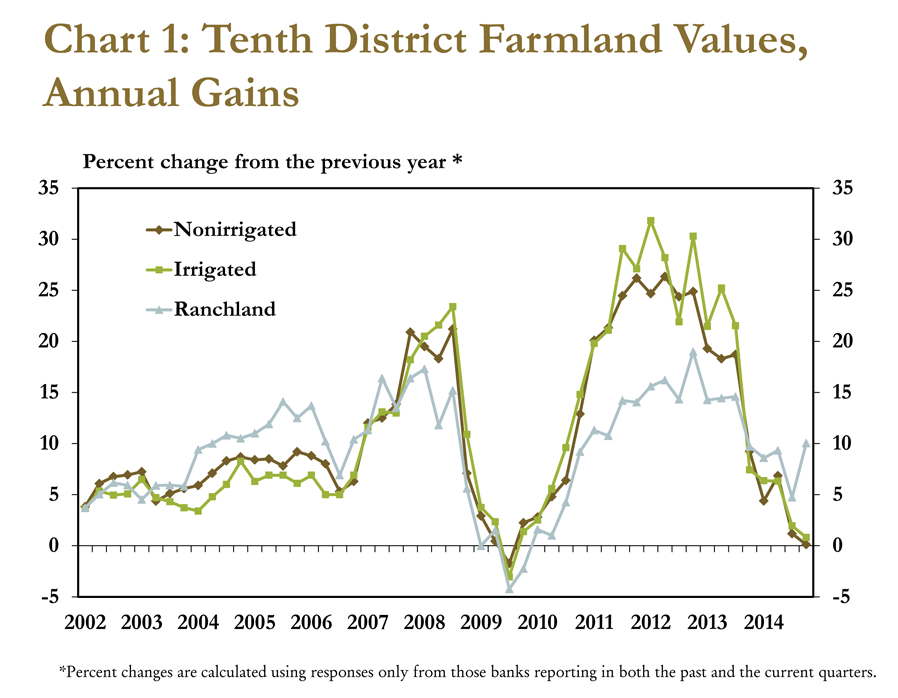

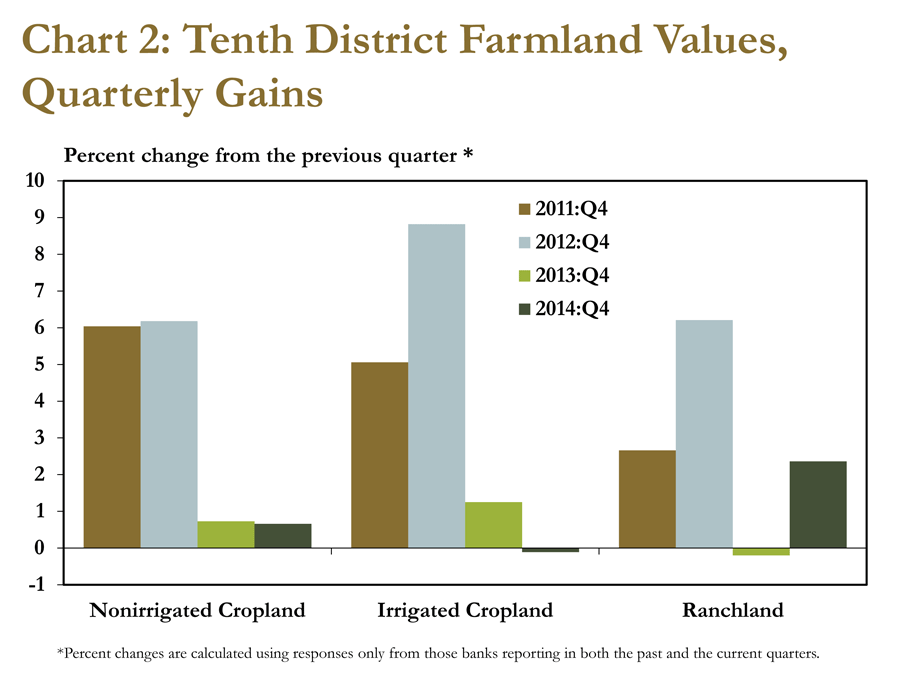

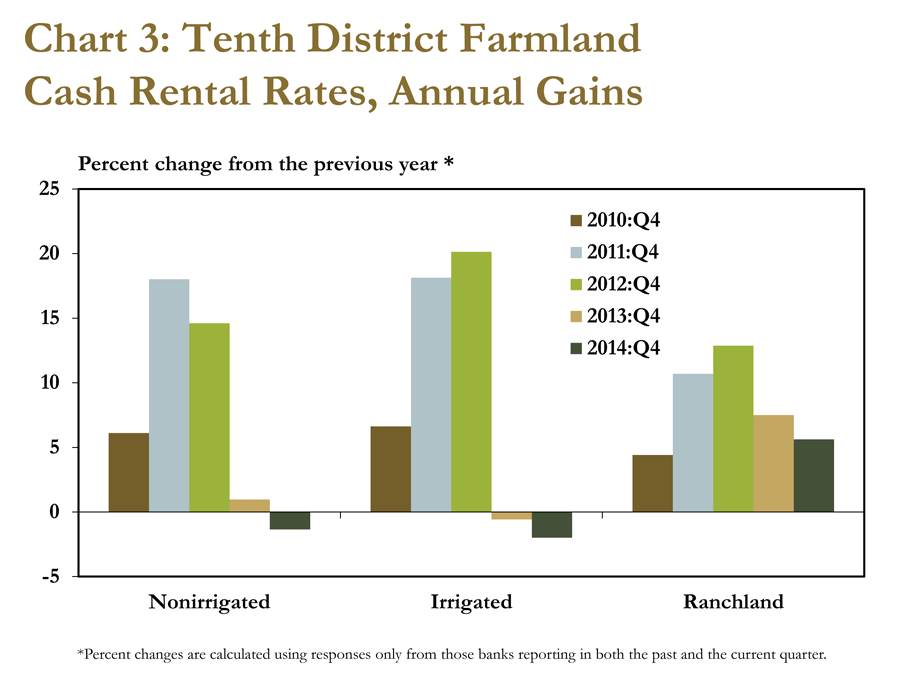

At year-end, cropland values and cash rental rates appeared to be holding fairly steady across most of the District. In the fourth quarter, the average value of nonirrigated cropland equaled year-ago levels and irrigated cropland values increased less than 1 percent (Chart 1). Changes in cropland values from the previous quarter were also relatively small (Chart 2). Bankers reported there was solid demand for good-quality cropland but limited desire for less-productive ground. Cash rental rates also had moderated only slightly from a year ago despite prospects of lower crop revenue in 2015 (Chart 3). While tenants were concerned about weaker profit margins due to low crop prices and high input costs, landlords cited high property taxes during rent negotiations as justification for keeping rents steady.

Fewer farms for sale may be partially supporting current cropland values. Bankers indicated there was significantly less farmland on the market in 2014 and a higher portion was being sold to farmers than in 2013. A majority of farmers who expanded their land holdings said they planned to farm it themselves. Bankers said about 20 percent of farmland sales were to nonfarmers who planned to rent out the land for crop production. However, investment demand for farmland for recreational use or future real estate development was still relatively stable.

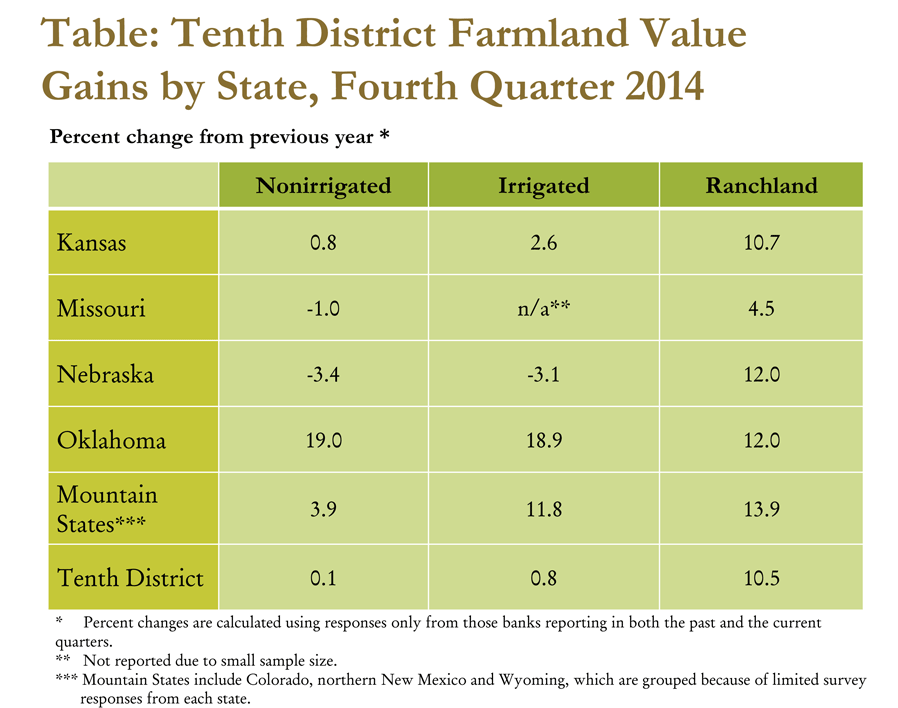

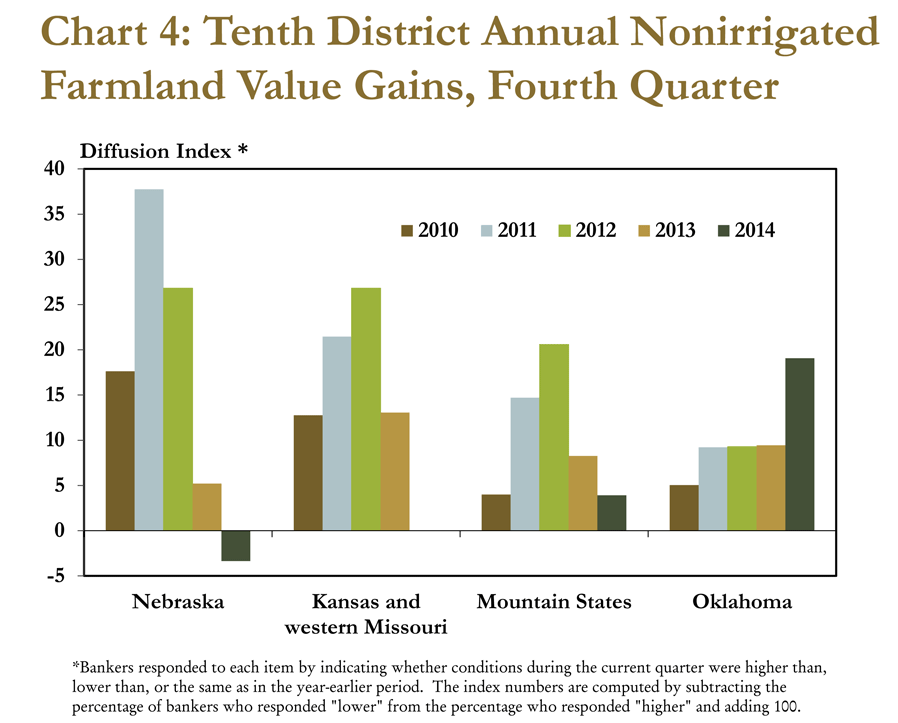

Recent developments, however, did cause cropland values to vary across the District (Table). After reporting some of the most dramatic fluctuations in recent years, Nebraska bankers indicated cropland values declined slightly in 2014 (Chart 4). Cropland values held steady in Kansas and western Missouri while the pace of growth slowed in the Mountain States of Wyoming, Colorado and New Mexico. Bankers in Oklahoma reported that additional gains in farmland values were supported by a relatively strong farm economy underpinned by profits in the livestock sector. In fact, record high prices for both feeder cattle and fed cattle continued to fuel demand for good-quality pasture and drove additional gains in ranchland values across the District.

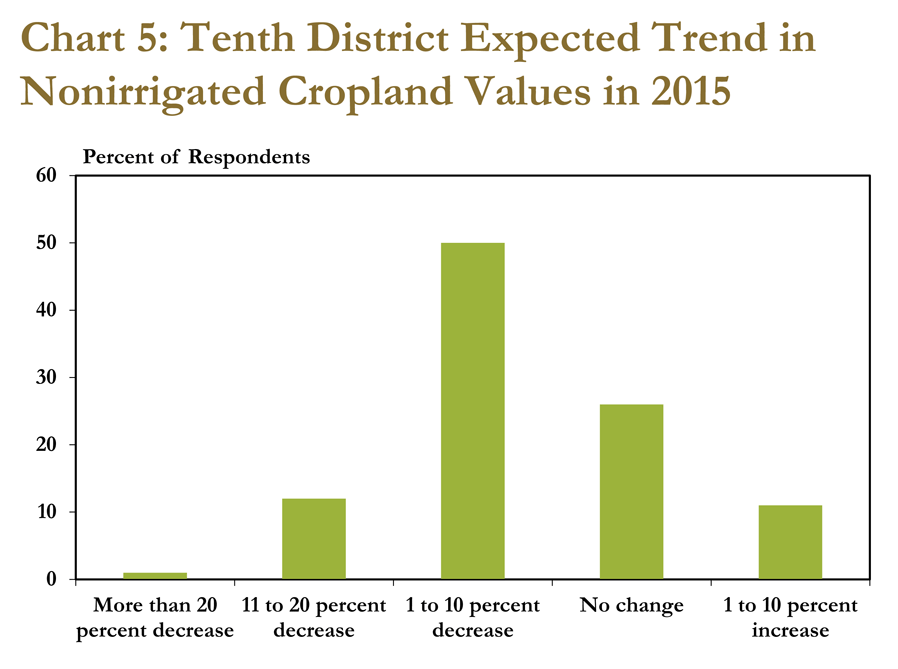

Looking forward, most bankers indicated they expect cropland values to decline in 2015. Asked what change they expect in nonirrigated cropland values a year from now, half of survey respondents said they expect a decline of up to 10 percent while some expect a decline of 10 to 20 percent (Chart 5).

Farm Income and Farm Capital Spending

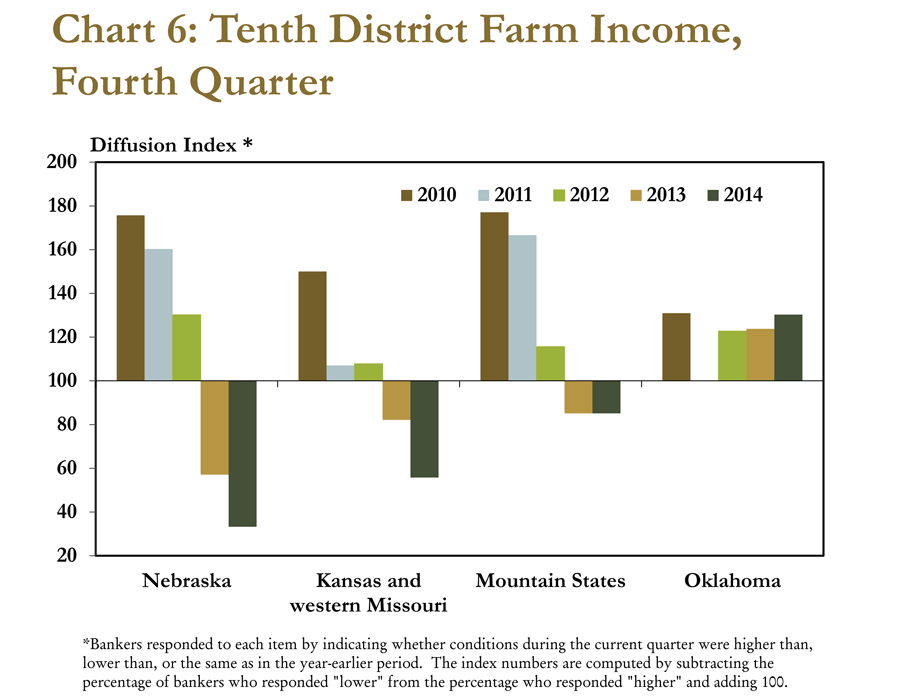

Although farmland values remained relatively stable, farm income continued to weaken across most of the Tenth District. Overall, more than half of survey respondents reported lower incomes in the fourth quarter than a year ago. However, as with farmland values, farm incomes also varied across District states. Lower commodity prices and elevated input costs continued to dampen farm income in Nebraska, Kansas and western Missouri (Chart 6). In fact, farm income growth has weakened annually since 2010, particularly in crop-intensive states such as Nebraska. In contrast, bankers observed that producers in Oklahoma ended 2014 with higher incomes than a year ago.

Although overall farm income continued to soften, livestock producers have experienced record profits. Profit margins remained particularly strong for cow/calf operators due to low feed costs and persistently high feeder cattle prices, which have been supported by reduced U.S. cattle inventories. U.S. cattle inventories have yet to return to pre-drought levels, and the USDA National Drought Mitigation Center recently reported that about 26 percent of the current cattle inventory is in regions hampered by drought. In the Tenth District, large portions of the major cattle producing areas in Oklahoma and Kansas are still affected by moderate to exceptional drought.

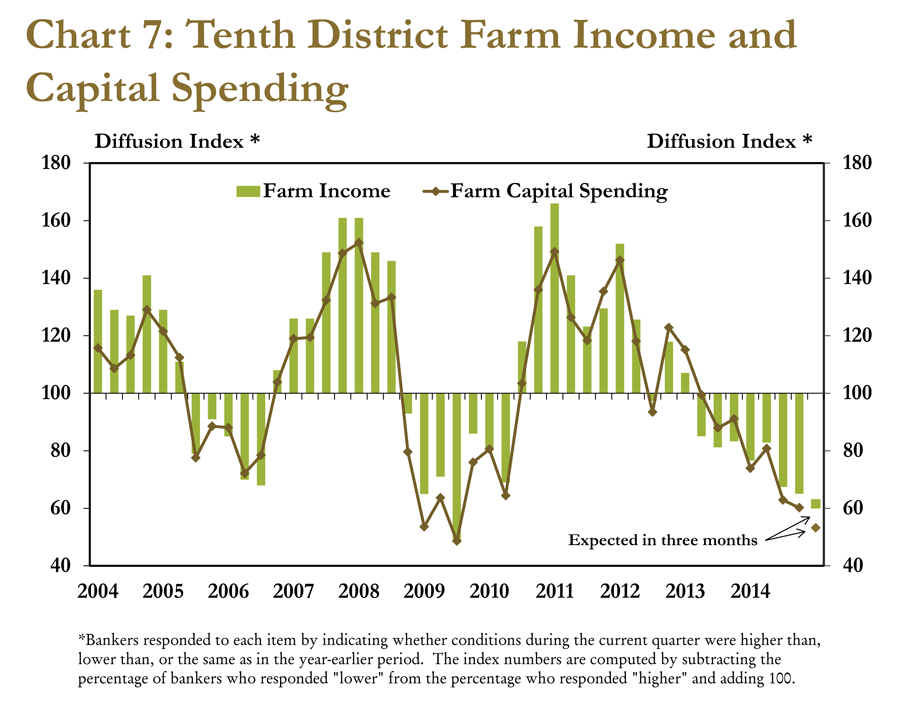

Historically, capital spending has followed income, and capital spending continued that trend in the fourth quarter (Chart 7). Reflecting reduced capital spending, the Association of Equipment Manufacturers reported that U.S. sales of four-wheel drive tractors and self-propelled combines both decreased by about 26 percent in 2014. Oklahoma was the only state in the Tenth District to generate positive growth in capital and household spending on farms in the fourth quarter. Similar to other District states, however, Oklahoma bankers expect farm income, capital spending and household spending to decrease in 2015.

Farm Loan Demand and Credit Conditions

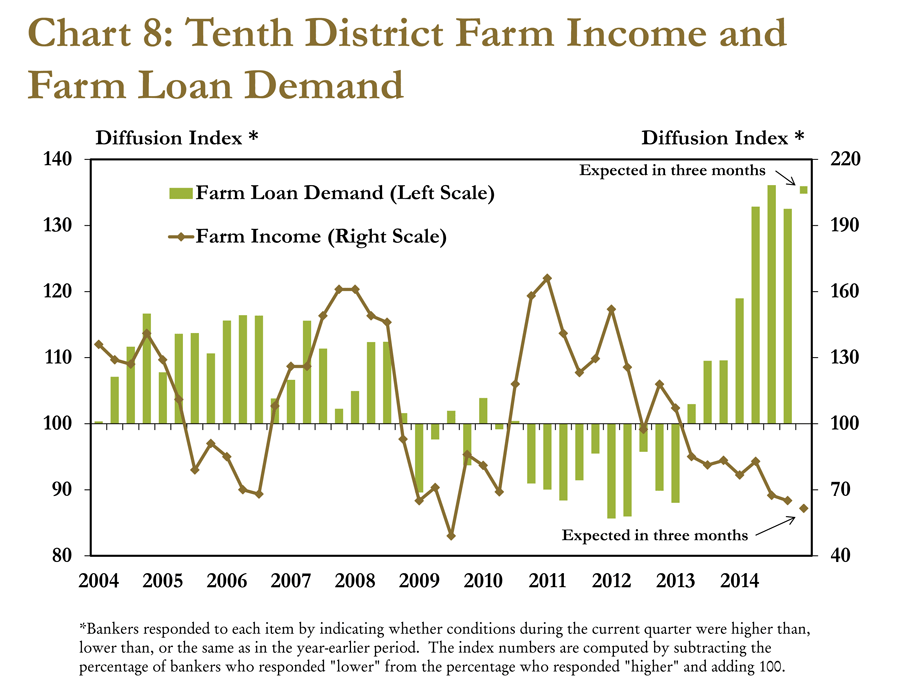

Demand for non-real estate farm loans continued to climb in the fourth quarter as farm income declined (Chart 8). The sharp increase in loan demand has been driven primarily by elevated expenses for production and operations that have persisted amid weaker incomes. For example, according to USDA Agricultural Marketing Service data, the average price of fertilizer has increased by almost 30 percent since 2010. For feedlot operators, a sharp rise in feeder cattle prices has increased the financing needs for feeder cattle purchases. Loan demand is expected to remain elevated into 2015 due to reduced income and expectations of continued high input prices.

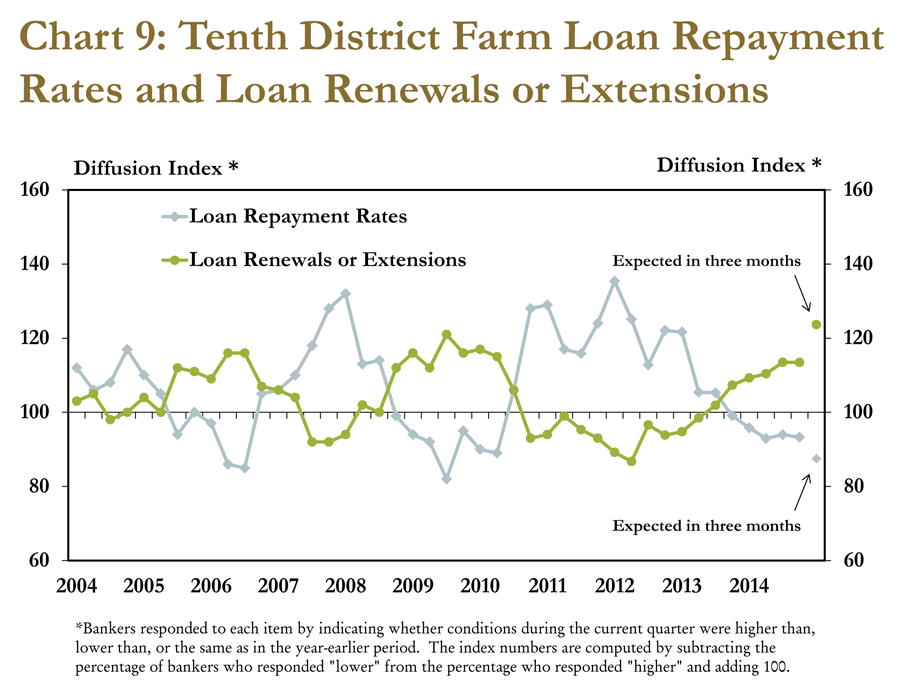

Bankers were positioned to meet increased demand for loans but are concerned that lower incomes might eventually hurt repayment rates. Loan repayment rates remained only slightly lower than last year and requests for loan renewals and extensions rose modestly in the fourth quarter (Chart 9). Looking forward, however, bankers are anticipating further deterioration in loan repayment rates and increased requests for loan renewals and extensions. While collateral requirements were little changed in the fourth quarter and bankers noted funds were available for qualified borrowers, some survey respondents indicated credit standards may tighten in coming months.

Conclusion

Following several years of strong income and gains in cropland values, 2014 appeared to be a turning point for crop producers in the Tenth District. Lower crop prices and elevated input costs trimmed profit margins and slowed cropland value appreciation. More producers borrowed to pay operating expenses and loan repayment rates fell below year-ago levels. Looking forward, bankers expressed concern that tighter profit margins, higher debt levels and a decline in cropland values may adversely affect farm loan performance in 2015.