Price stability

In considering the research, it is beneficial to understand what inflation expectations can mean for the economy.

"In their research, economists Brent Bundick and A. Lee Smith, assistant economist Trenton Herriford and research associate Emily Pollard, looked at responses to the University of Michigan monthly surveys of households regarding their expectations for inflation over the next five to 10 years.

"Expectations about future inflation offer important insight about what consumers expect over the longer term but can also have an important impact on price stability in the near term as well. Bundick notes that economists often use an analogy of inflation expectations acting as an "anchor" to prices.

"Imagine a boat with its anchor firmly planted in the underwater soil," Bundick says. "Waves may cause the boat to move around a bit, but as long as its anchor remains fixed, the boat won’t drive too far away from its intended location.

"Similarly, changes in oil prices or the value of the U.S. dollar can cause some fluctuations in inflation today, but stable expectations about future inflation should help keep inflation from drifting too far from the FOMC’s target."

"However, when longer-term expectations become unmoored or drift, the impact can be significant in the near term because business managers forecast future business conditions when they decide how much to charge consumers for goods or services.

"If the manager expects they will have to pay significantly higher wages over the next year to retain or recruit qualified staff, they will likely choose a higher (selling) price," Bundick says.

Declining expectations

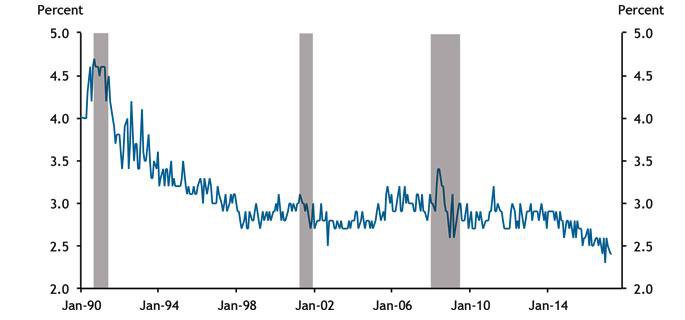

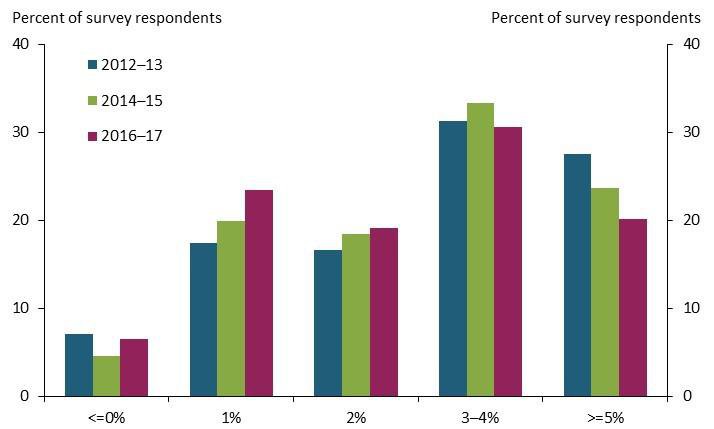

Over the past five years, the number of households in the University of Michigan survey with high inflation expectations over the next five to 10 years has fallen while the number of households with low inflation expectations has increased in roughly equal amounts. Meanwhile, median household inflation expectations began a consistent move lower in 2014 when oil prices plummeted. In July of that year, benchmark West Texas Intermediate crude was priced above $106 per barrel before plummeting through the last half of the year to around $55.1

But while oil prices stabilized, long-term inflation expectations continued to decline and have remained near historical lows. For policymakers, low inflation expectations can present a challenge. In a speech last summer, Federal Reserve Gov. Lael Brainard said that deteriorating inflation expectations below historical norms could present a risk to the inflation outlook over the next few years.2

The idea that inflation can be too low might seem counterintuitive to some. While the damage that high inflation can do to the economy and the purchasing power of consumers is well known, low inflation can also produce its own problems, Smith says, including slowing labor markets, reducing business hiring and halting wage increases.

“Low inflation can be just as problematic as high inflation,” he says. “In the extreme case of deflation, falling prices on goods and services may cause consumers to delay purchases today in favor of waiting for prices to fall further. As a result, deflation can cause consumer spending to stall and slow the pace of economic growth.”

Median longer-term inflation expectations

“From a central bank’s perspective, 2 percent is a bit of a sweet spot,” Smith says. “It is low enough to keep inflation from distorting economic decisions but high enough to keep deflation at bay, grease the wheels of the labor markets and provide adequate room to cut short-term interest rates as needed to stabilize the economy in the midst of an economic downturn.”

The authors write that if the weakness in realized inflation has led some households to lower their inflation expectations, then it could signal a loss of confidence by these consumers in the FOMC’s ability to meet the price stability mandate for monetary policy and its 2 percent inflation target. To explore this issue, the economists matched survey respondents’ inflation expectations with their views about how policymakers have handled the economy.

Overall, despite the change in inflation expectations, the number of households that believe policymakers are doing a “good job” on inflation and the labor market has increased over the past few years. Looking at it in more detail, the researchers found that consumers with lower inflation expectations tend to believe that policymakers are doing a better job at managing unemployment and inflation than households with higher inflation expectations. Moreover, households with inflation expectations of 1 percent are more likely to approve of policymakers’ handling of the economy than those with inflation expectations significantly above 2 percent.

As a result, the authors conclude, policymakers may be less concerned with the recent decline in the median household expectation for longer-run inflation because consumers with low expectations have not expressed greater dissatisfaction with the handling of the economy.

Household longer-term inflation expectations over time

1 Federal Reserve Bank of St. Louis, West Texas Intermediate Crude (WTI) – Cushing, Okla. prices

2 Brainard, Lael. 2016. External Link"The Economic Outlook and Implications for Monetary Policy."