Summary of Quarterly Indicators

Growth in Tenth District energy activity accelerated moderately in the first quarter of 2018, as indicated by firms contacted between March 15th and March 30th (Tables 1 & 2). All quarterly indexes increased in the first quarter. The drilling and business activity index increased from 13 to 37 (Chart 1). The supplier delivery time index jumped back into positive territory, and total profits and wages and benefits also increased considerably. The revenues index improved moderately, and the employee hours and employment indexes were marginally higher. The access to credit index inched up from zero to three.

Chart 1.

Drilling/Business Activity Index vs. a Quarter Ago

Skip to data visualization table| Date | Drilling/Business Activity |

|---|---|

| 2015Q1 | -68 |

| 2015Q2 | -37 |

| 2015Q3 | -37 |

| 2015Q4 | -56 |

| 2016Q1 | -72 |

| 2016Q2 | 0 |

| 2016Q3 | 26 |

| 2016Q4 | 64 |

| 2017Q1 | 55 |

| 2017Q2 | 43 |

| 2017Q3 | 7 |

| 2017Q4 | 13 |

| 2018Q1 | 37 |

Most year-over-year indexes strengthened. The year-over-year capital expenditures index increased to its highest level ever. After two quarters in negative territory, the supplier delivery time index rebounded considerably. The total revenues, profits, and wages and benefits indexes were moderately higher. The employee hours index edged up, while the drilling and business activity index remained flat at high levels. Conversely, the employment index fell modestly, and the access to credit index declined to zero.

Expectations continued to improve. The future drilling and business activity and employee hours indexes rose moderately, while the supplier delivery time index surged back into positive territory from -11 to 15. The employment, profits, capital expenditures, and revenues indexes increased to their highest levels in a year. However, the future wages and benefits and access to credit indexes declined. Price expectations for oil and gas were moderately lower, suggesting that most respondents expected prices to remain close to their levels at the time of the survey.

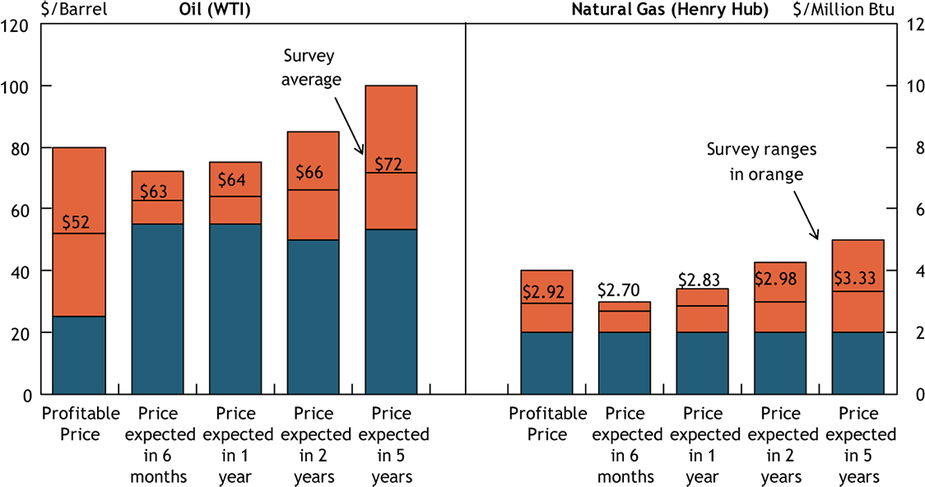

Summary of Special Questions

This quarter firms were asked what oil and natural gas prices were needed to be profitable in the areas in which they were active. The average oil price needed was $52 per barrel, with a range of $25 to $80 (Chart 2). This average was similar to the $51 average reported in the first and third quarters of 2017. The average natural gas price needed was $2.92 per million Btu, with responses ranging from $2.00 to $4.00. This average fell to its lowest level since this question has been asked.

Chart 2. Special Question - What price is currently needed for drilling to be profitable for oil and natural gas, and what do you expect the WTI and Henry Hub prices to be in six months, one year, two years, and five years?

Source: Federal Reserve Bank of Kansas City

Firms were again asked what they expected oil and natural gas prices to be in six months, one year, two years, and five years. Expected oil prices were up slightly since the last quarter. The average expected WTI prices were $63, $64, $66, and $72 per barrel, respectively. Meanwhile natural gas price expectations continued to deteriorate due to the sizeable domestic oversupply and LNG export constraints. The average expected Henry Hub natural gas prices were $2.70, $2.83, $2.98, and $3.33 per million Btu, respectively.

Firms were also asked about the anticipated effects of potential steel and aluminum tariffs on their business. Most respondents expected a low to medium effect (Chart 3). Several said that drilling and pipeline costs would be the most affected, but is a small portion of their total costs.

Chart 3. Special Question: What is the anticipated effect of the potential steel (25%) and aluminum (10%) tariffs on your business?

Skip to data visualization table| Effect | Percent |

|---|---|

| None | 8 |

| Low | 54 |

| Medium | 35 |

| High | 4 |

Firms were also asked about current or anticipated price pressures. Over half of respondents said skilled labor would see medium price pressures (Chart 4). About forty percent reported medium price pressures in logistics and drilling inputs and said services costs were increasing. Equipment and financing were overall expected to see low price pressures. About a fifth of contacts anticipated high price pressures on logistics, equipment and inputs.

Chart 4. Special Question - Are you currently seeing or do you anticipate over the next year any price pressures in the following areas of your business?

Skip to data visualization table| Area | None | Low | Medium | High |

|---|---|---|---|---|

| Unskilled Labor | 38 | 27 | 35 | 0 |

| Skilled Labor | 8 | 27 | 54 | 12 |

| Logistics* | 12 | 31 | 42 | 15 |

| Equipment** | 8 | 40 | 36 | 16 |

| Inputs*** | 13 | 30 | 39 | 17 |

| Financing | 27 | 38 | 27 | 8 |

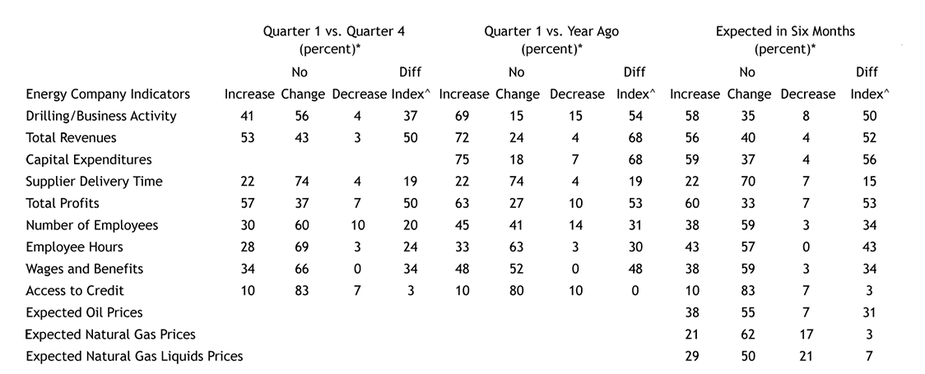

Table 1 - Summary of Tenth District Energy Conditions, Quarter 1, 2018

Source: Federal Reserve Bank of Kansas City

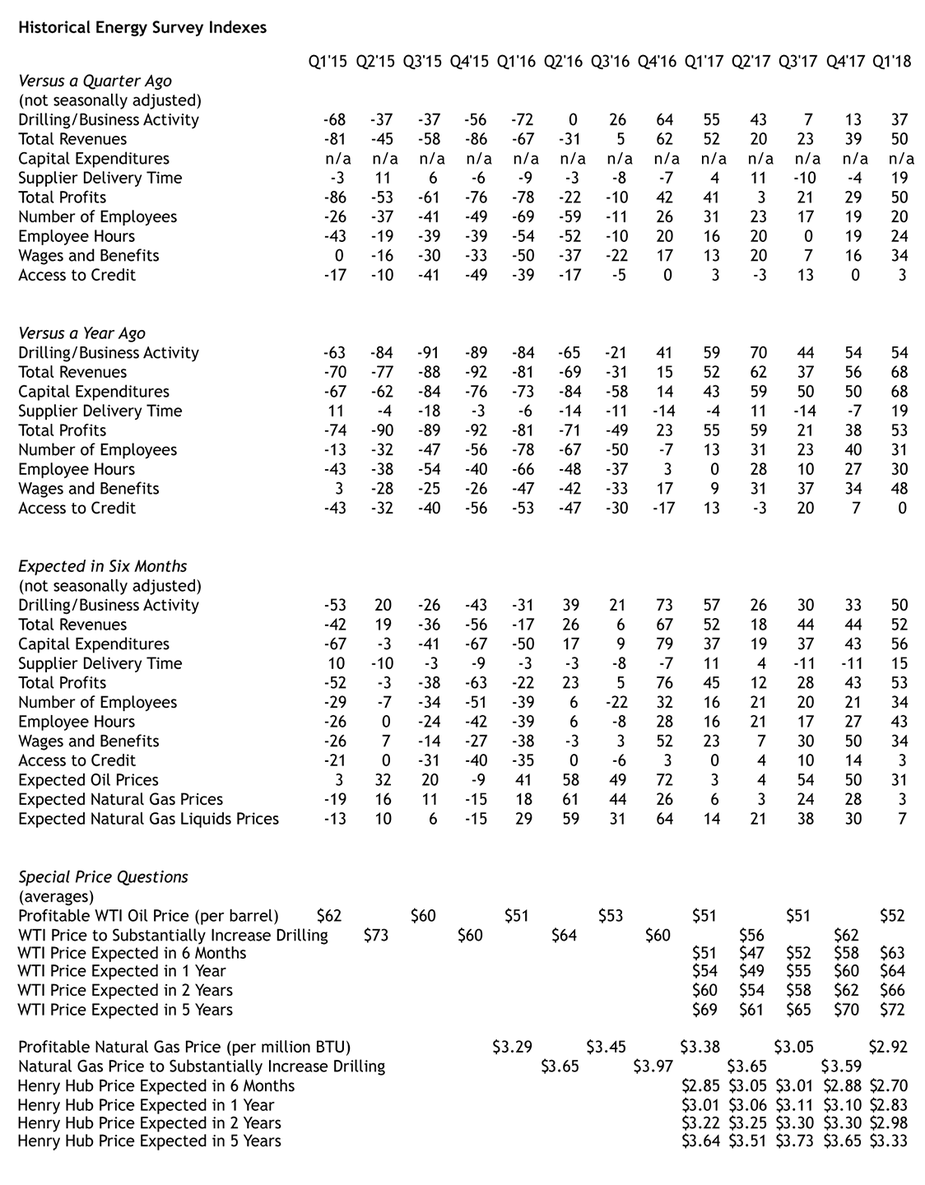

Table 2 - Historical Energy Survey Indexe

Source: Federal Reserve Bank of Kansas City

Selected Comments

“Increasing U.S. light oil production will place downward pressure on the market over the next two years. Export infrastructure and world demand will catch up in two to three years and allow prices to rise with world demand.”

“The development of LNG will help raise the price of natural gas as it gets shipped to other parts of the world, lessening the glut in the U.S.”

“Domestic steel prices have increased, steel is a large component of compressor skids and will increase overall costs 10 to 15 percent with no assurance of being able to pass on these costs down the supply chain.”

“Activity increases are steady ahead, unless an upward price spike occurs, service industry should be able to accommodate any supply cost increases or price pressures with moderate increases in prices. Prices fell 30 percent or more in the downturn and efficiency is up.”

“We continue to drill and fracture wells but there is some concern over the political climate in Colorado and what will happen in the November elections.”

“We are balancing cash flow and capital spending by continuing to work on efficiencies. At current commodity pricing we are forecasting significant free cash flow over spending for fiscal year 2018.”

“Steel tubular goods and flat metal utilized for production tanks and processing equipment will increase our cost of business. Negotiations continue to play out and we anticipate only moderate supply disruption from the announced tariffs. However, the potential for stalled negotiations could have a material effect on U.S. supply resulting in higher costs and lower activity.”

“I think we're in a sweet spot right now where the current oil price promotes responsible development, but the price is not high enough to where the industry overheats.”

“We do not have that much debt, so a small increase in interest rates would have a minimal impact on us.”