Since June 2022, the Federal Reserve has been working to remove policy accommodation by shrinking the size of its balance sheet. Substantial reductions in the balance sheet must come primarily through net reductions in one of three primary Fed liabilities: U.S. Treasury deposits at the Fed (the Treasury General Account or TGA), bank deposits at the Fed (reserves), or money market funds’ “deposits” at the Fed through the overnight reverse repurchase program (ON RRP).

Thus far, the value of assets held in ON RRP has declined relatively rapidly, which may be encouraging for two reasons. First, the ON RRP has grown substantially over the last few years and become a dominant force in the money market fund industry. In the spring of 2021, the program began to steadily grow, surpassing $1 trillion in July and $2 trillion the following May._ The program ultimately peaked in December with nearly $2.7 trillion in assets. Second, changes in the ON RRP may be more tractable than changes in the TGA or in reserves. The TGA, for example, is determined outside of the Fed through the political process. Further, while bank reserves will likely be an important part of future balance sheet reductions, reductions in the ON RRP are generally considered to represent a lower risk to the financial system than large reductions in bank reserves.

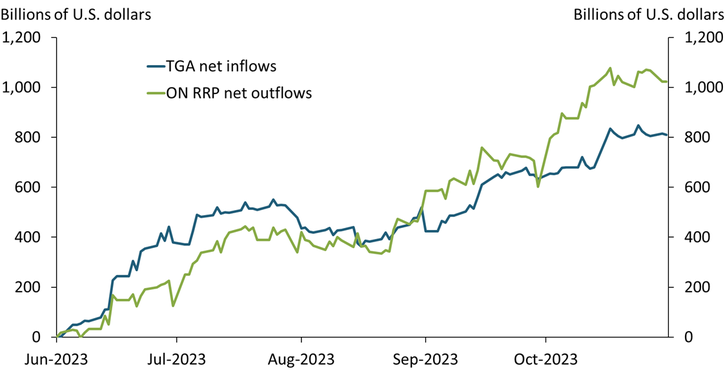

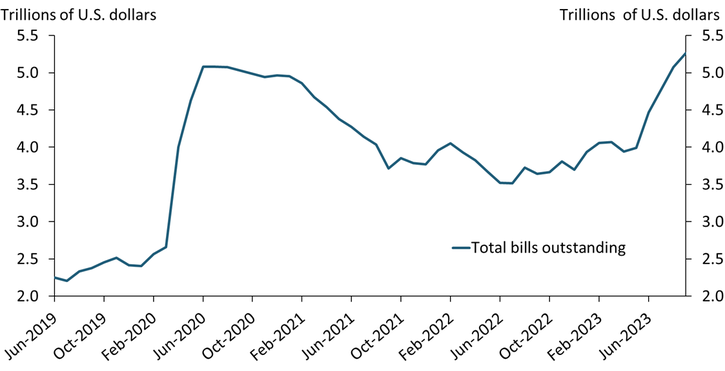

Since the debt-ceiling agreement was signed on June 3, the Treasury has been replenishing the TGA, with some of the money coming directly out of ON RRP. When money market funds purchase Treasury bills outright, instead of placing the same funds at the Fed, dollars shift from the ON RRP to the TGA (with little net effect on the Fed’s balance sheet). As seen in Chart 1, drawdowns of the ON RRP have closely mirrored the runup in the TGA over the last several months. Similarly, as the supply of Treasury bills has increased by more than $1 trillion following the resolution of the debt-limit debate in May, as shown in Chart 2, the assets under ON RRP have fallen by about $1 trillion. However, as of October 2023, the TGA stands at around $830 billion, above the Treasury’s expectation of $750 billion by year-end (U.S. Department of the Treasury 2023). Thus, the recent rapid expansion in the TGA is unlikely to continue, limiting its ability to fuel further rapid reductions in the ON RRP.

Chart 1: The drawdown of the ON RRP facility has closely mirrored the runup of the TGA

Source: Federal Reserve Bank of New York (Haver Analytics).

Chart 2: The volume of Treasury bills outstanding has rapidly increased since the debt ceiling deal

Source: U.S. Treasury.

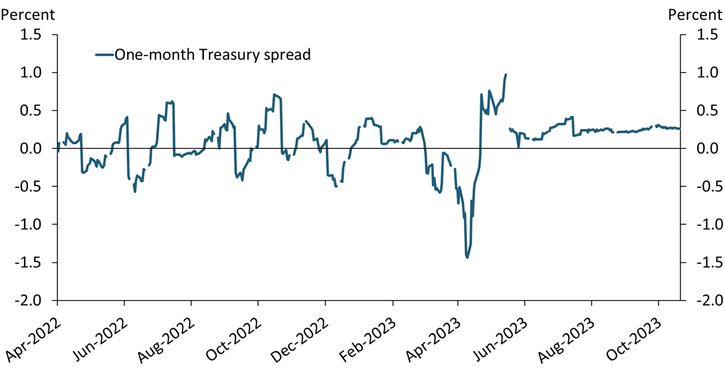

Although the shrinking of the ON RRP facility will likely slow, future reductions will come, in part, through money market funds continuing to shift their funds from the ON RRP into outright purchases of short-term Treasuries. As interest rates have stabilized over the last few months, the short-maturity Treasury bills that money market funds typically invest in have begun consistently paying a premium over the ON RRP award rate. Chart 3 shows that through the period of rapid, consecutive interest rate increases that began in 2022, the yield on one-month bills typically oscillated around the return on the ON RRP, shifting a little higher before an interest rate hike and a little lower after. However, more recently, the Fed has been increasing interest rates less often and by smaller amounts, and the yield on one-month bills has remained consistently higher than the ON RRP award rate since May 2023. This decreasing interest rate uncertainty may make Treasuries a relatively more attractive investment for money market funds compared with the ON RRP.

Chart 3: As interest rates have stabilized, shorter-term Treasury rates have moved consistently higher than the ON RRP award rate

Sources: U.S. Treasury, Federal Reserve Bank of New York (Haver Analytics), and author’s calculations.

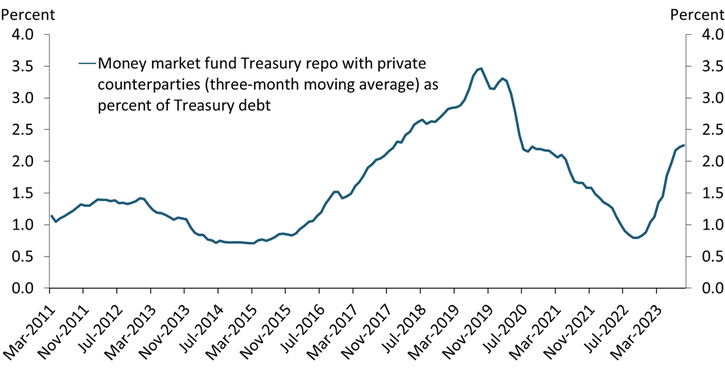

Reductions in the ON RRP could also occur if the Treasury repo market shifts away from the Fed as a counterparty and back to private counterparties. Indeed, the Fed was typically a very small counterparty for repos as recently as 2021; the Fed has since come to dominate the market (Jacewitz 2023). If the private market can support more lucrative repo returns, money market funds could shift out of the ON RRP. However, this outlet may be limited by the ability of the private repo market to absorb much larger volumes. The Fed’s involvement in the repo market has facilitated considerable growth, and the private repo market may be unable to completely accommodate the market’s current size. Today, the repo market for money market funds is roughly three times larger than it was at the start of 2021, and the majority of the current market relies on the Fed as a counterparty. As shown in Chart 4, the private market has never represented more than about 3.5 percent of total U.S. Treasury debt. To absorb the ON RRP at its current value of around $1.1 trillion, the private repo market would have to grow beyond its historical size, from its current 2.3 percent to about 5.6 percent.

Chart 4: Private counterparties are rapidly returning to the repo market

Sources: Securities and Exchange Commission, Office of Financial Research Analysis, U.S. Treasury, and author’s calculations.

However, bank-sponsored money market funds may be reluctant to exit ON RRP for other reasons. The Supplementary Leverage Ratio (SLR), a regulatory measure of a bank’s Tier 1 capital relative to its total leverage exposure, may also influence ON RRP growth (Office of the Comptroller of the Currency 2020; Afonso, Cipriani, and La Spada 2022). From the initial response to the COVID-19 pandemic until March 2021, U.S. Treasury securities were exempt from SLR calculations, thereby increasing banks’ relative capital levels. Once this exemption expired, banks had less capital leeway and were disincentivized from wholesale funding such as repos. Banks may also have redirected deposits into their money market fund affiliates, increasing the size of bank reserves and thus decreasing banks’ SLRs (Jacewitz, Unal, and Wu 2021; Jacewitz and others, forthcoming). With the SLR still binding and the banking industry still flush with cash, bank demand for short-term funding from the repo market may be limited.

In sum, though the value of assets held at the Fed’s ON RRP facility has fallen rapidly from its December 2022 peak, this pace may not continue. The recent decline has come ostensibly from an increase in TGA balances at the Fed. However, the TGA is nearing its projected levels, suggesting substantial further reductions may need to come from another source. Given both the unprecedented inflow of cash banks saw during the COVID-19 pandemic and regulatory limits, demand in money markets may remain low, limiting the speed at which the Fed can further reduce the size of the ON RRP.

Endnotes

-

1

Kirk and Wong (2021) find evidence that a drawdown in the TGA explains most of the early usage.

References

Afonso, Gara, Marco Cipriani, and Gabriele La Spada. 2022. “External LinkBanks’ Balance-Sheet Costs, Monetary Policy, and the ON RRP.” Federal Reserve Bank of New York, Staff Report no. 1041, December.

Jacewitz, Stefan. 2023. “External LinkThe Fed’s Footprint in U.S. Money Market Funds Has Grown Significantly since 2021.” Federal Reserve Bank of Kansas City, Charting the Economy, June 20.

Jacewitz, Stefan, Haluk Unal, and Chengjun Wu. 2022. External Link“Shadow Insurance? Money Market Fund Investors and Bank Sponsorship.” Review of Corporate Finance Studies, vol. 11, no. 2, pp. 414–456.

Kirk, Kyler, and Russell Wong. 2021. “External LinkThe Borrower of Last Resort: What Explains the Rise of ON RRP Facility Usage?” Federal Reserve Bank of Richmond, Economic Brief no. 21-43, December.

Office of the Comptroller of the Currency. 2020. “External LinkSupplementary Leverage Ratio: Interim Final Rule.” OCC Bulletin 2020-52, May.

U.S. Department of the Treasury. 2023. “External LinkTreasury Announces Marketable Borrowing Estimates.” Press release, July 31.

Stefan Jacewitz is a research and policy officer at the Federal Reserve Bank of Kansas City. The views expressed are those of the author and do not necessarily reflect the positions of the Federal Reserve Bank of Kansas City or the Federal Reserve System. This bulletin has been corrected from an earlier version, which misstated the size to which the private repo market would have to grow to absorb the ON RRP.