As reserve balances continue to trend lower, the Federal Reserve is beginning to consider when to halt the decline in reserves and again grow its balance sheet. The Federal Open Market Committee (FOMC) has stated its preference for a balance sheet no larger than necessary to efficiently and effectively implement monetary policy. To achieve this, the FOMC has been passively reducing its asset holdings since October 2017 by reinvesting only a fraction of the securities that mature each month. This balance sheet normalization, together with other factors such as growing demand for currency, has reduced reserve balances from nearly $3 trillion in 2014 to $1.6 trillion in February 2019.

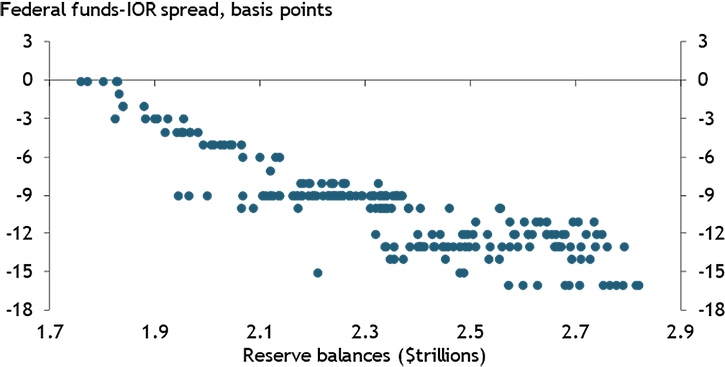

Declining reserves are thought to drive up the spread between the federal funds rate and the interest rate paid on reserves (the IOR rate), with implications for the implementation of monetary policy. Chart 1 illustrates the inverse relationship between reserve balances and the federal funds-IOR spread. While other recent developments, such as the increased pace of Treasury bill issuance, may also affect this spread, the chart shows the decline in reserves from their 2014 peak has coincided with a higher federal funds-IOR spread. This higher spread prompted policymakers to reduce the IOR rate relative to the FOMC’s target range to keep the federal funds rate near the center of the target range. Further reductions in reserve balances will likely continue to drive the federal funds-IOR spread higher, suggesting policymakers will eventually need to stabilize reserve balances to prevent unwanted upward pressure on the federal funds rate.

Chart 1: The Recent Link between Reserve Balances and the Federal Funds-IOR Spread

Notes: Week-ending-Wednesday data from June 2014 through November 2018. Month-ends are excluded.

Sources: Federal Reserve Bank of New York (Haver Analytics), Board of Governors of the Federal Reserve System (Haver Analytics), and author’s calculations.

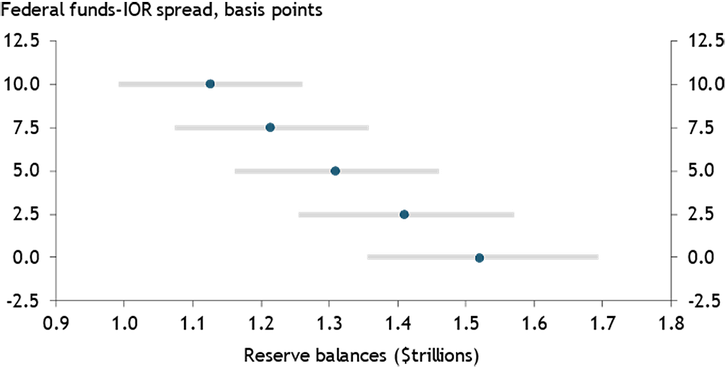

But at what point should the FOMC halt the decline in reserves? To answer this question, I provide model-based projections of the normalized level of reserve balances consistent with alternative scenarios for the federal funds-IOR spread. In Smith (2019), I model the dynamic interactions of reserve balances and the federal funds-IOR spread using a structural vector autoregressive (SVAR) model that also accounts for the role Treasury bill supply may play in influencing these variables. In addition to describing the past evolution of reserves and the federal funds rate, this time series model can be used to predict how these variables will evolve under alternative interest rate scenarios.

Chart 2 shows point forecasts along with 90 percent error bands for the level of reserve balances that, on average, would be consistent with a given federal funds-IOR spread. While the error bands are fairly wide—on the order of about $300 billion—the estimates illustrate a clear pattern: lower reserve balances are associated with a higher federal funds-IOR spread. For instance, if policymakers choose to maintain a near-zero federal funds-IOR spread, then the model predicts that reserve balances will need to settle around $1.5 trillion. However, if policymakers opt for a slightly higher average spread between the federal funds rate and the IOR rate, then reserve balances of about $1.1 trillion may suffice._

Chart 2: Projections of the Normalized Level of Reserve Balances under Alternative Rate Scenarios

Notes: For each federal funds-IOR spread shown in the chart, the level of reserve balances is inferred from the SVAR equation determining the long-run response of the spread to a given change in reserves, similar to Sims and Zha (2006). This equation is then inverted to calculate the level of reserve balances consistent with a given spread. Error bands are constructed using Monte Carlo integration. The estimation sample is October 2017 through November 2018 with week-ending-Wednesday observations. SVAR model details are available in Smith (2019).

Sources: Federal Reserve Bank of New York (Haver Analytics), Board of Governors of the Federal Reserve System (Haver Analytics), and author’s calculations.

In recent months, the federal funds-IOR spread has been close to zero, and the funds rate has fluctuated near the midpoint of the target range. To achieve this, policymakers set the IOR rate 10 basis points below the top of the target range. If policymakers wish to continue reducing reserve balances—leading to a higher federal funds-IOR spread—they may also need to further reduce the IOR rate within the target range. Such an adjustment could be necessary to ensure that the federal funds rate continues to trade near the midpoint of the FOMC’s target range despite the rise in the federal funds-IOR spread. To the extent policymakers are comfortable with a higher federal funds-IOR spread and further reductions in the IOR rate, monetary policy could be implemented with a smaller Federal Reserve balance sheet.

Despite the desire for a balance sheet no larger than necessary to efficiently and effectively implement monetary policy, policymakers may view a higher federal funds-IOR spread as undesirable if it diminishes some of the apparent benefits of the current, abundant reserves regime. In particular, day-to-day volatility in the federal funds rate has been extremely low in recent years. The reduction in interest rate volatility has been especially remarkable compared with the day-to-day fluctuations in the federal funds rate that were typical prior to 2008 when interest was not paid on reserves and thus the IOR rate was zero. While this Bulletin considers only a 10 basis point spread, marginal shifts toward a higher federal funds-IOR spread may, all else equal, invite more frequent, transitory movements in the federal funds rate. Policymakers’ appetite for such fluctuations, weighed against their desire for a leaner balance sheet, will likely influence their decision of how many reserves to supply.

Endnotes

-

1

In either scenario, nominal reserve balances will need to grow at the rate of nominal trend growth in the economy to sustain these spreads over longer horizons. Therefore, these projections are only near-term predictions that implicitly hold prices as fixed.

References

Board of Governors of the Federal Reserve System. 2019. "External LinkFOMC Communications Related to Policy Normalization," January 30.

Sims, Christopher A, and Tao Zha. 2006. "External LinkWere There Regime Switches in U.S. Monetary Policy?" American Economic Review, vol. 96, no. 1, pp. 54–81.

Smith, A. Lee. 2019. "Do Changes in Reserve Balances Still Influence the Federal Funds Rate?" Federal Reserve Bank of Kansas City, Economic Review, vol. 104, no. 1.

A. Lee Smith is a senior economist at the Federal Reserve Bank of Kansas City. The views expressed are those of the author and do not necessarily reflect the positions of the Federal Reserve Bank of Kansas City or the Federal Reserve System.