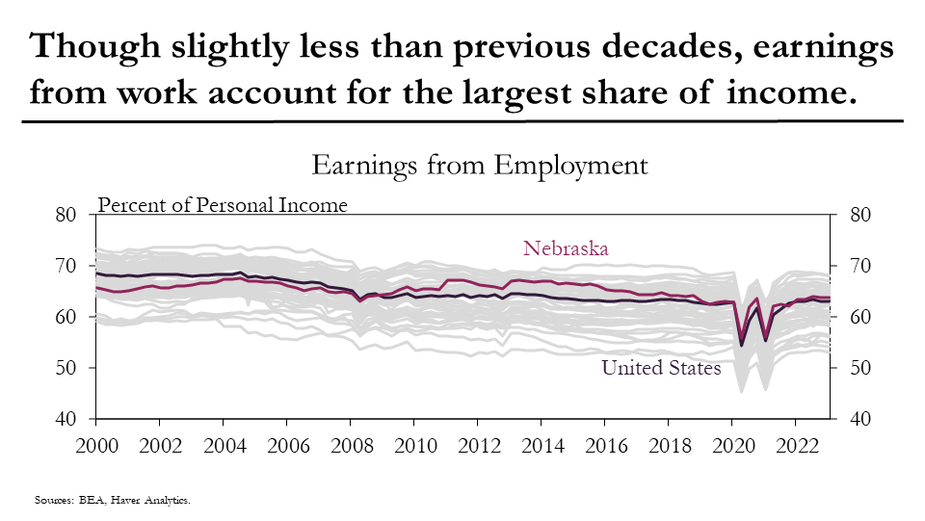

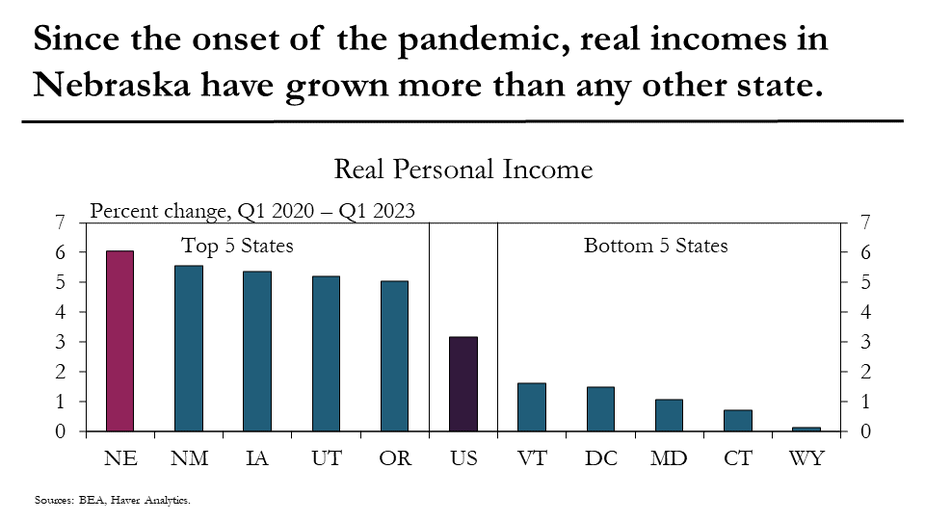

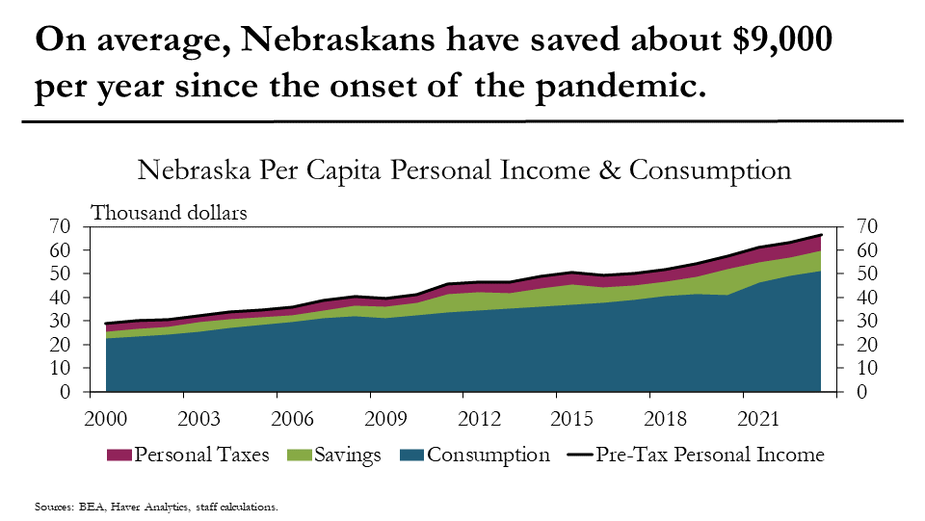

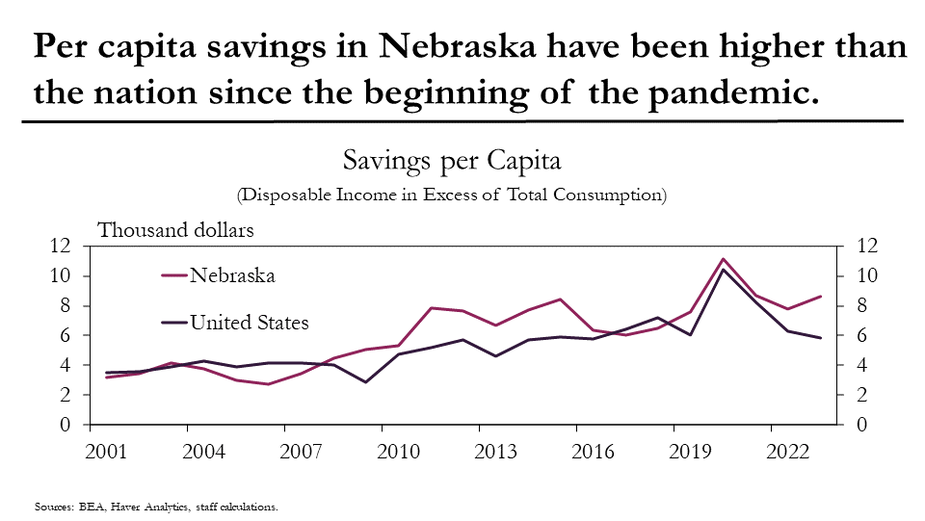

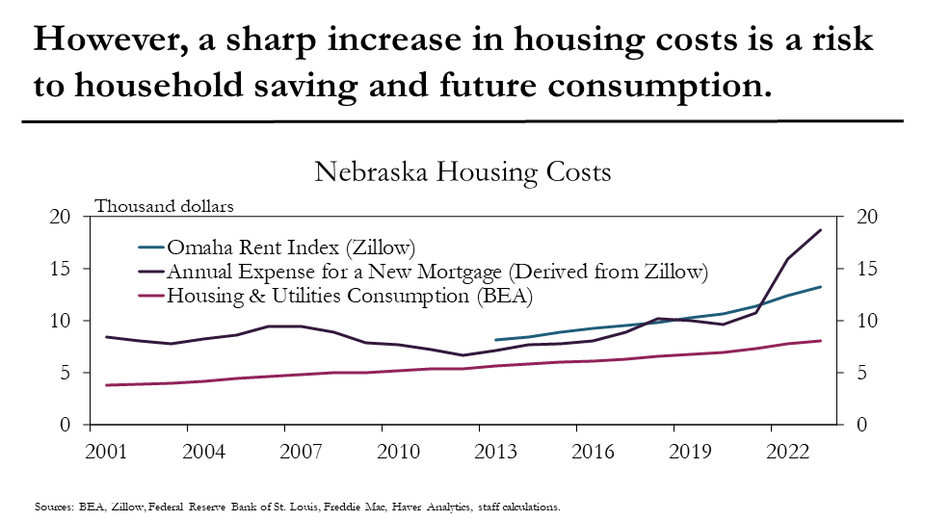

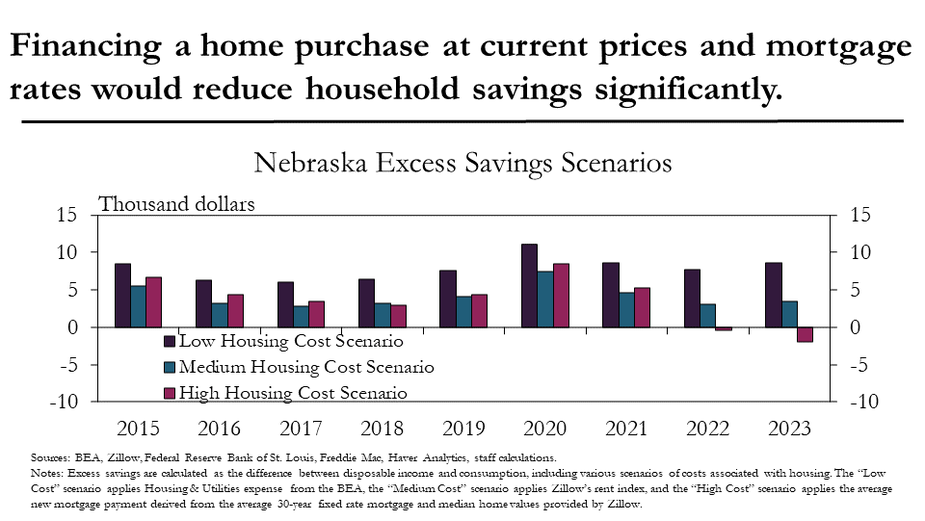

Nebraska households appear to be in a relatively solid financial position with strong job opportunities, increased wages, and robust levels of savings. Large increases in costs associated with housing, however, may significantly constrain the ability of some households to maintain current levels of saving and/or spending.

Key Takeaways

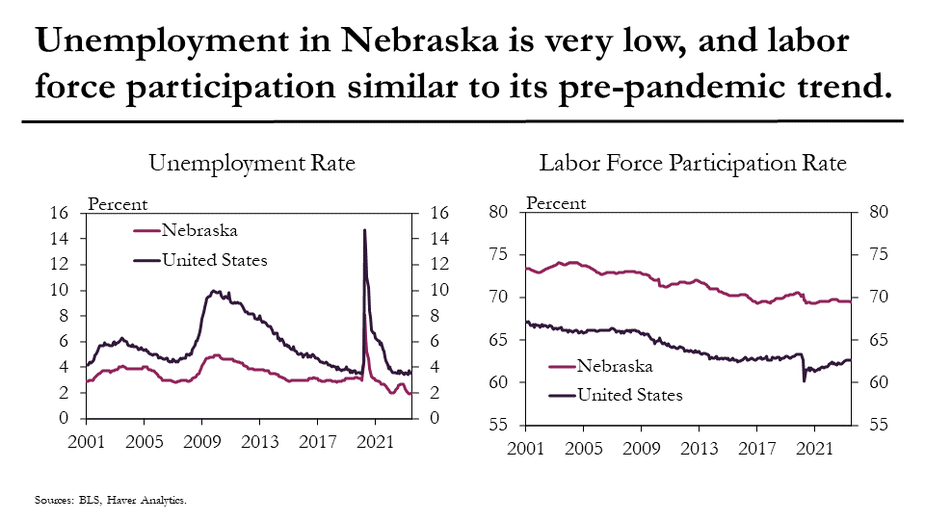

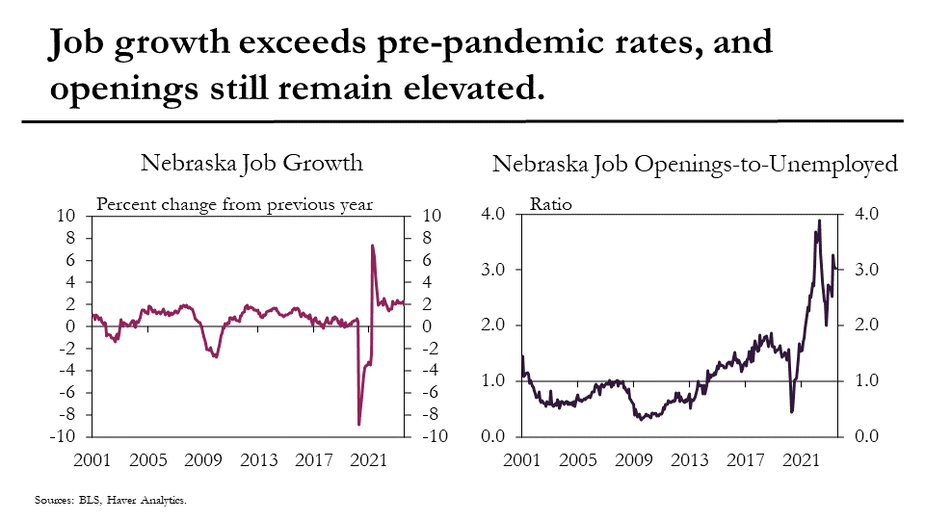

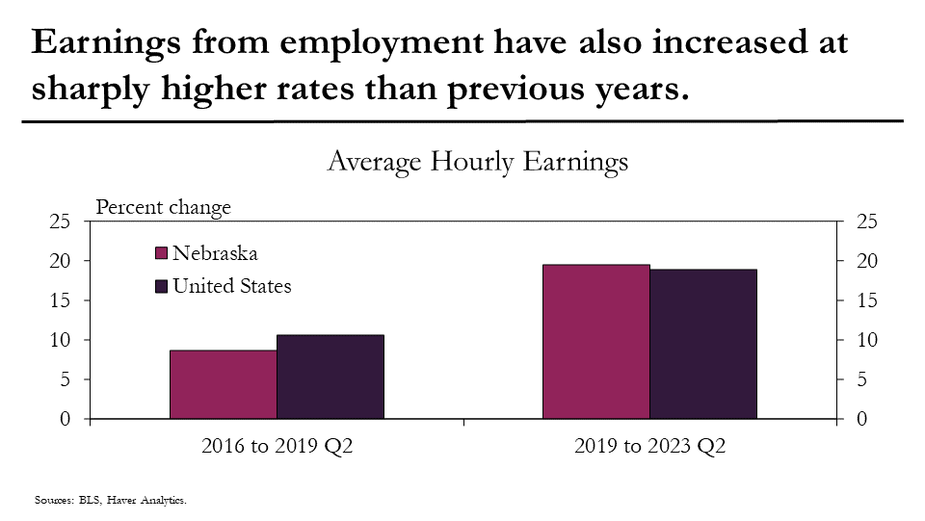

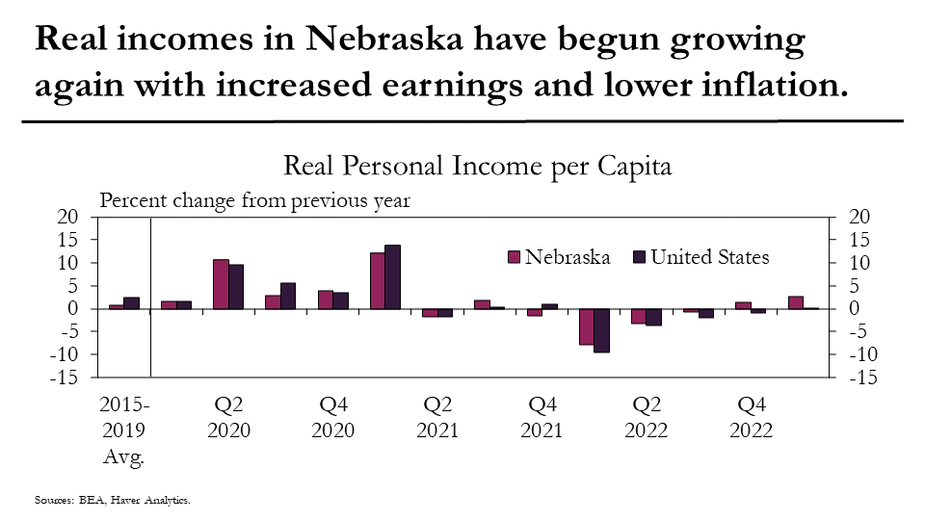

Strength in the labor market does not appear to be fading much in Nebraska, despite a small reduction in job openings. Real incomes continue to rise as wage gains have recently outpaced inflation, boosting household savings. Sharp increases in housing costs, however, may be an important indicator to monitor when considering the future strength of household finances.

Related article: How increasing prices in housing is affecting Nebraskans

Annual expenses for a new mortgage have increased sharply since the pandemic.