Nebraska’s economy remained strong in 2018 and early 2019 as tight conditions in the labor market continued to support increases in wages. Strength in the labor market has continued to provide support to other areas of Nebraska’s economy, including real estate and consumer spending. Nonetheless, additional weakness in agriculture and ongoing trade tensions contributed to weaker growth in 2018. Agriculture and trade may continue to be headwinds to economic growth in 2019 in addition to the potential for widespread effects associated with recent extreme flooding across the state.

Labor Market Strength

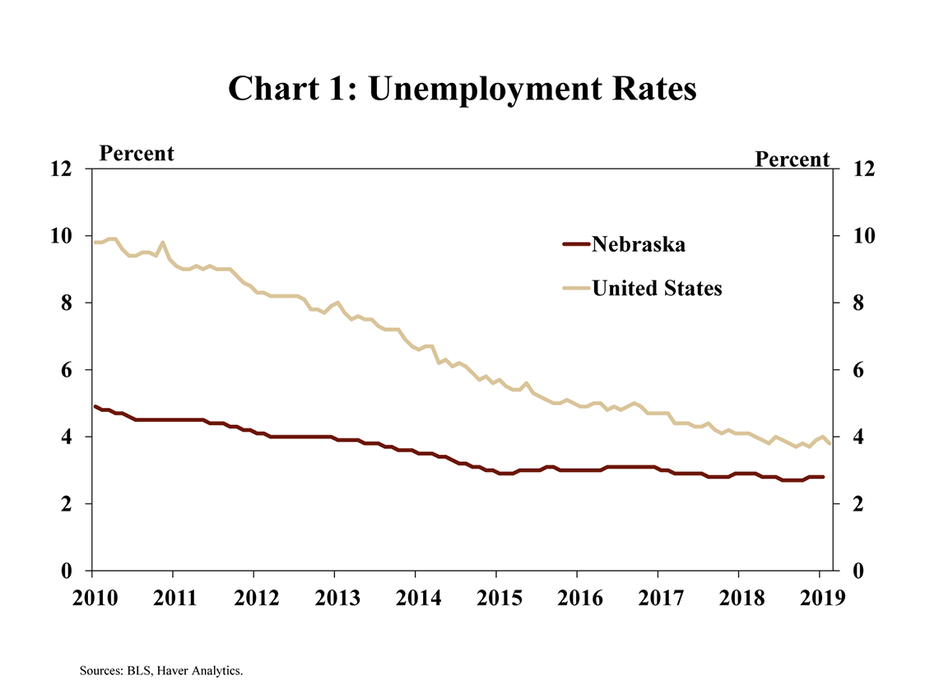

Unemployment in Nebraska remained historically low through 2018 and into 2019. The unemployment rate in Nebraska has not exceeded 3 percent since January 2017 and has been less than 4 percent for more than six years alongside historically low unemployment nationally (Chart 1). The last time Nebraska’s unemployment rate was less than 4 percent for this long was in the 1990s, when unemployment ranged between 2.3 and 2.9 percent for more than a decade.

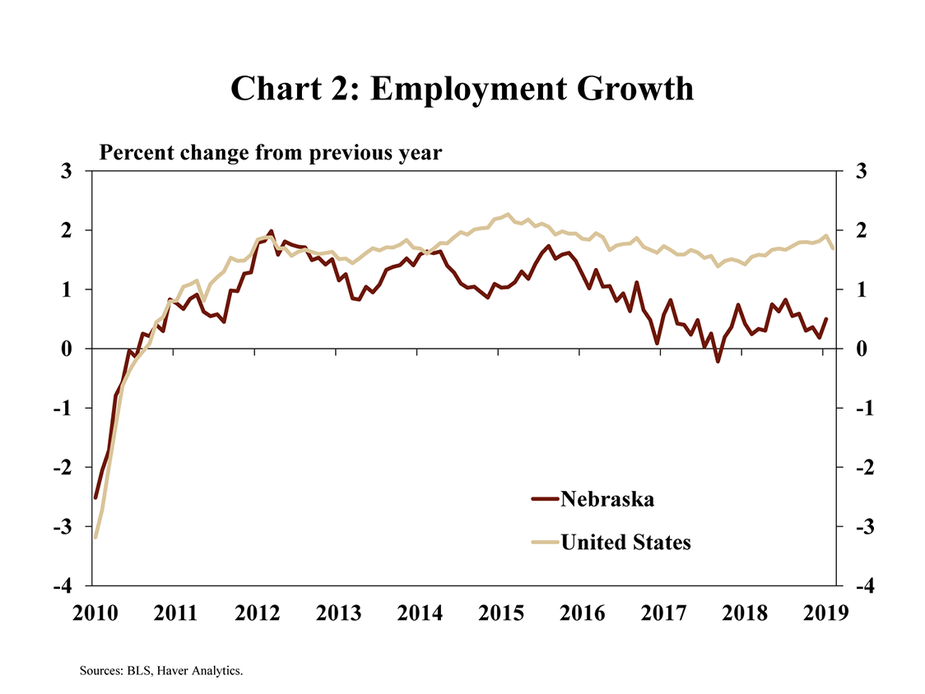

Job growth remained modest compared with nationwide growth. Employment growth in Nebraska has been slightly slower than the nation in recent years, possibly due to extremely low unemployment (Chart 2). From October to January, job growth in the state averaged 0.3 percent, in contrast with 1.8 percent nationally. Since the beginning of 2017, job growth in the state has averaged just 0.4 percent as labor markets across the region have remained tight.

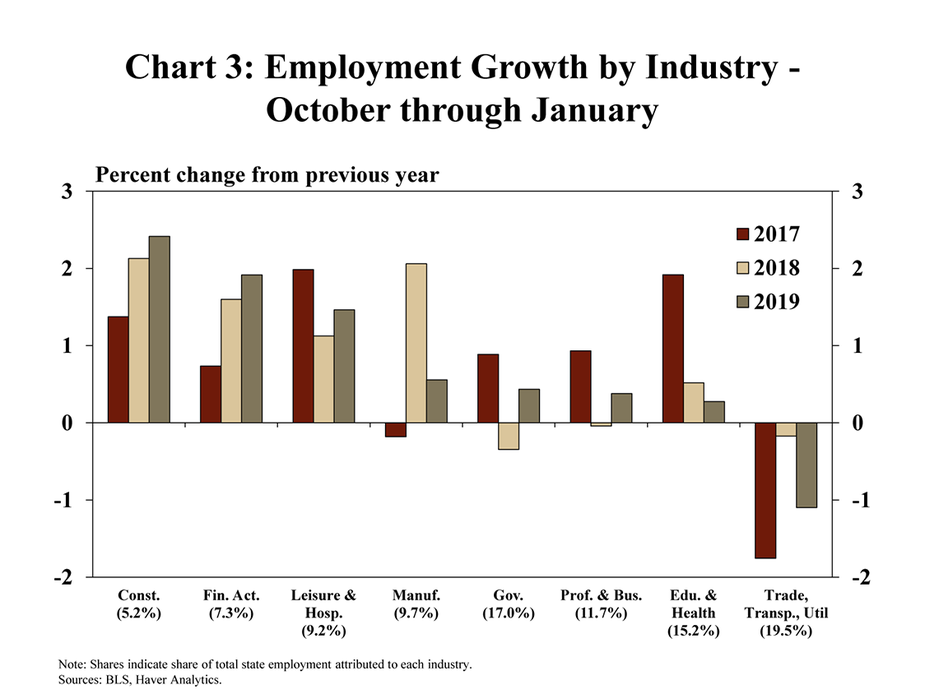

The pace of hiring, however, increased in most industries in recent months compared with a year earlier. From October through January, employment in most industries increased more than the statewide rate of 0.3 percent (Chart 3). Some industries, such as construction, financial activities, and leisure and hospitality, increased at least 1.5 percent from the previous year. Only the education and health services and trade, transportation and utilities industries expanded more slowly than the state average.

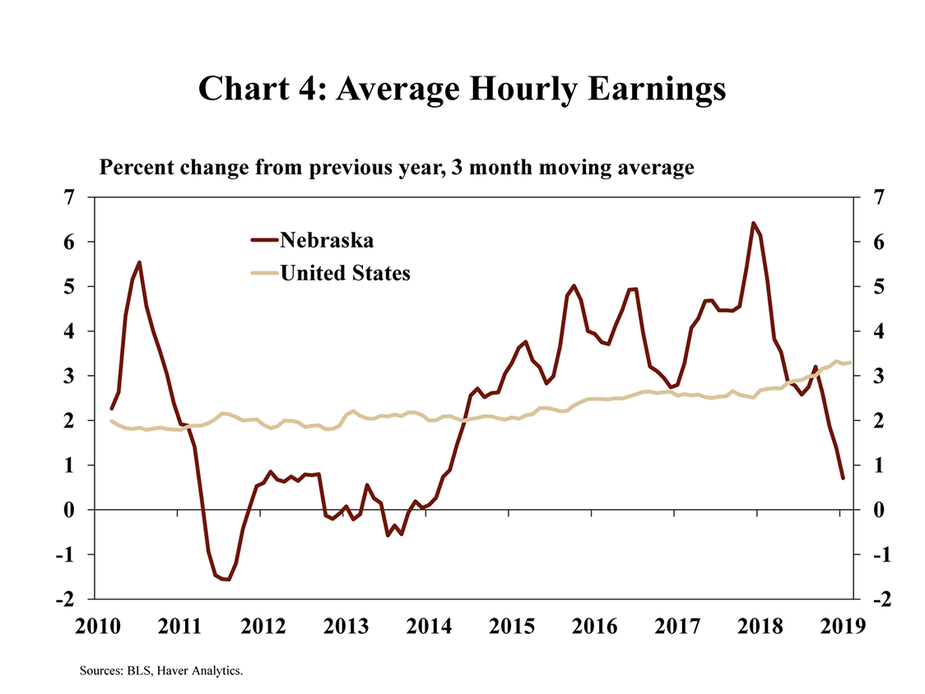

Wages continued to increase, but at a slower pace in the fourth quarter and into January. From October through January, average hourly earnings increased at an average rate of 0.8 percent (Chart 4). This increase was notably less than the averages through 2018 of 2.8 percent and 3.2 percent for Nebraska and the United States, respectively, but the slower growth may have been due to a significant increase in 2017. Wages in some industries, however, continued to rise significantly. In construction, for example, wages increased almost 7 percent from the previous year alongside robust job growth.

Other Indicators of Strength

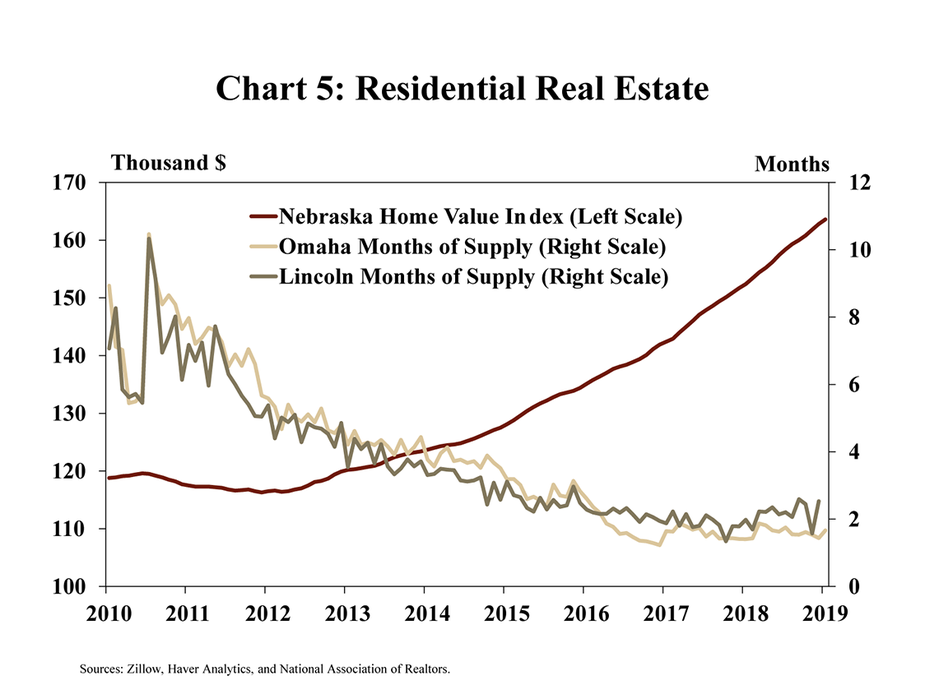

In addition to the ongoing strength in Nebraska’s labor markets, residential real estate markets also remained strong in the fourth quarter. As inventories in Omaha and Lincoln have remained very low, house prices have risen significantly over the past five years (Chart 5). Supplies of housing in the state’s two major metropolitan areas have remained less than the industry-defined neutral level of six months for several years.

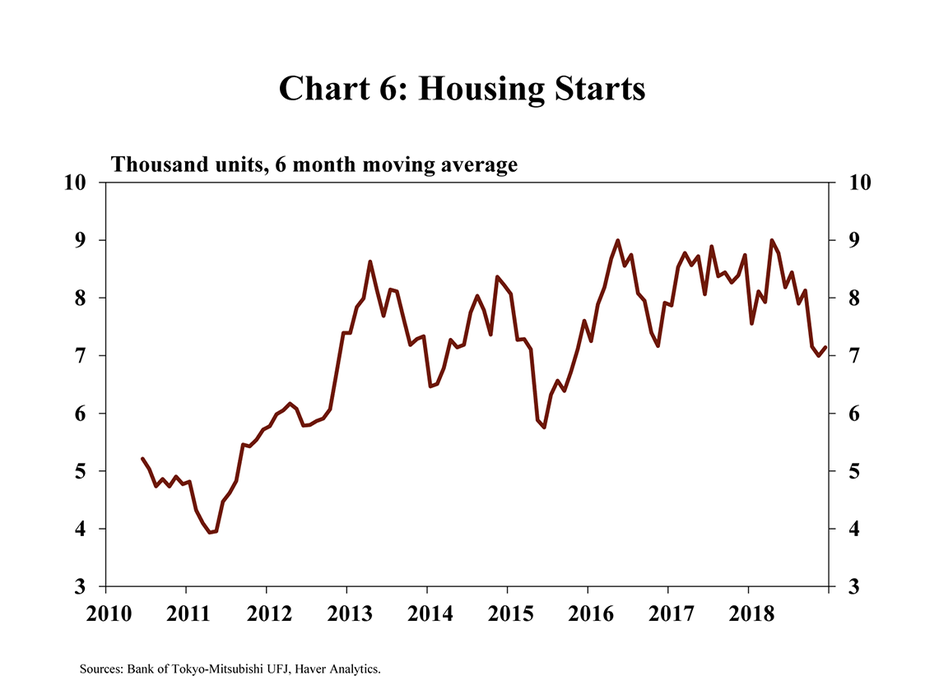

Despite limited inventories of homes available in Omaha and Lincoln, the pace of new home construction slowed in the last half of 2018. From 2011 through 2013, housing starts had increased sharply, as inventories declined and prices began to rise (Chart 6). Construction of new homes picked up again in 2015 and the pace had remained relatively high in the years since. In 2018, however, housing starts by year’s end had declined from a peak of about 9,000 units to nearly 7,000 units.

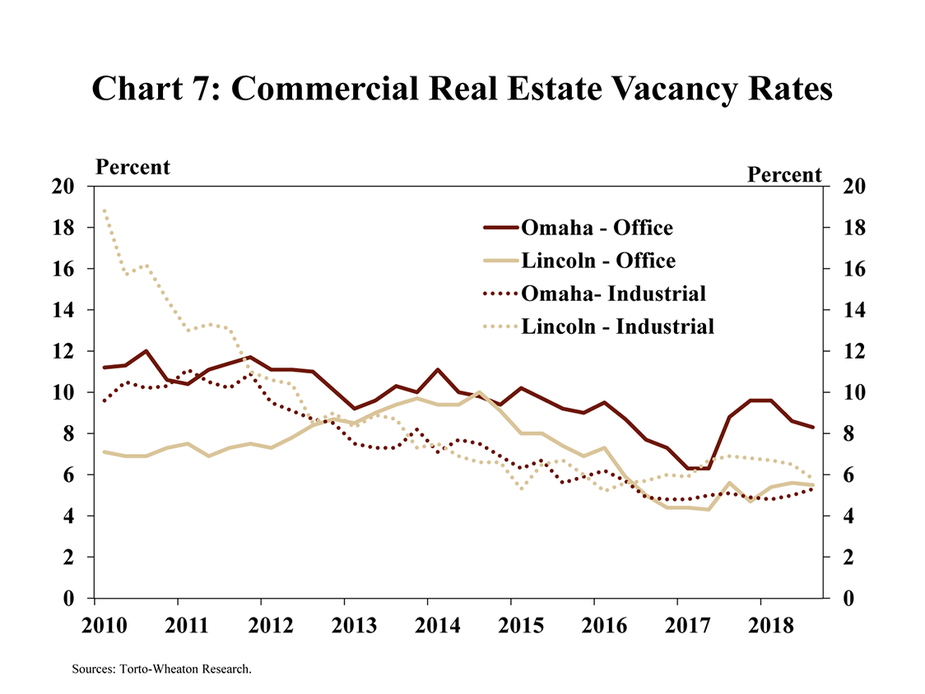

Commercial real estate markets were relatively steady in the fourth quarter despite a slight uptick in vacancy rates in some markets. In Omaha, vacancy rates for office space declined from the previous year, and at 8 percent, remained well below the average of previous years (Chart 7). Office vacancy rates in Lincoln edged higher, but also were notably lower than the average of the previous decade, evidence of ongoing strength in Lincoln’s commercial real estate market. Vacancy rates for industrial space, meanwhile, remained little changed from the prior year and continued to be considerably lower than recent years.

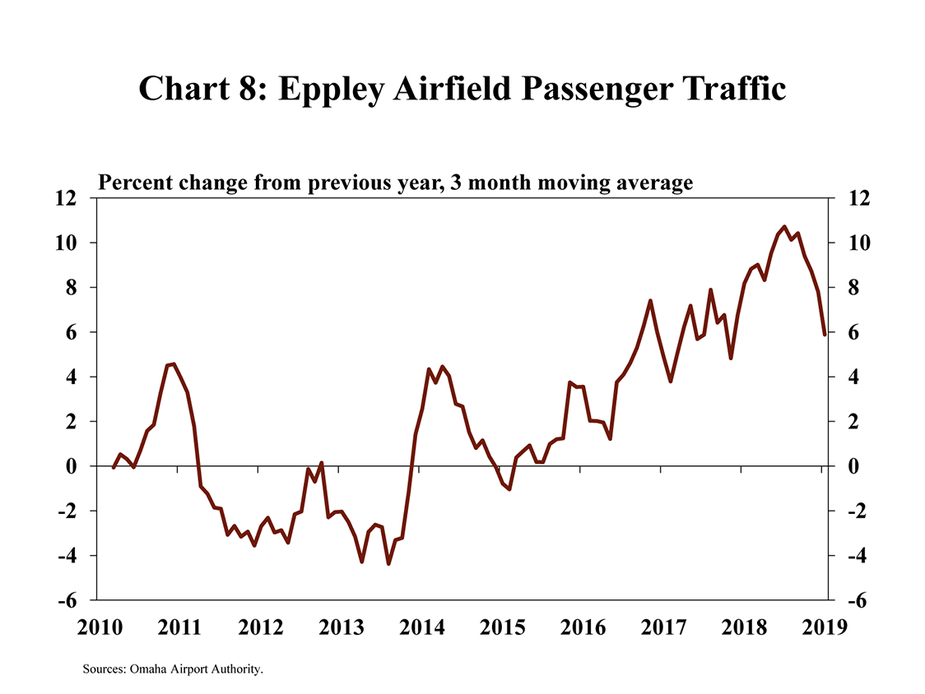

Another indicator of a strong economy, particularly in the state’s metropolitan areas, passenger traffic at Omaha’s Eppley Airfield continued to trend higher in 2018. Passenger traffic increased an average of 9.4 percent in 2018 (Chart 8). New flights in and out of Omaha, and the associated increases in passengers, have prompted additional renovations at the airport, in particular the construction of new parking and rental car facilities. However, passenger traffic began to taper in the first month of 2019, though a particularly harsh winter may have accounted for lower traffic.

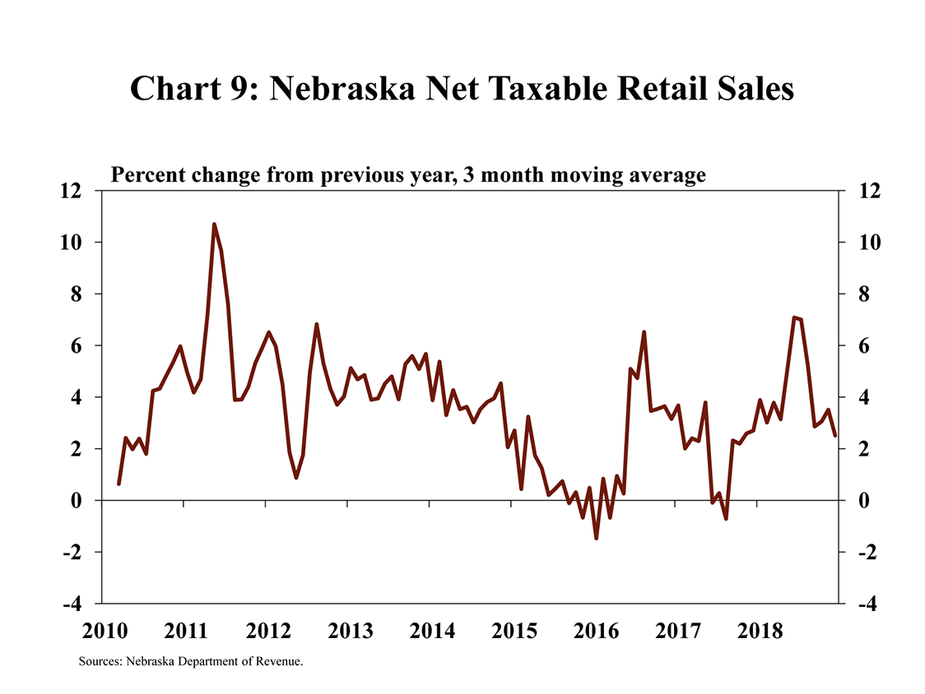

Consumer spending also increased modestly in 2018 alongside a strong labor market and additional increases in wages. Taxable retail sales increased an average of approximately 4.1 percent in 2018 (Chart 9). Despite weakness in retail employment, sales tax revenue rose in the second half of 2018 following slower growth in mid-2017.

Signs of Slower Growth

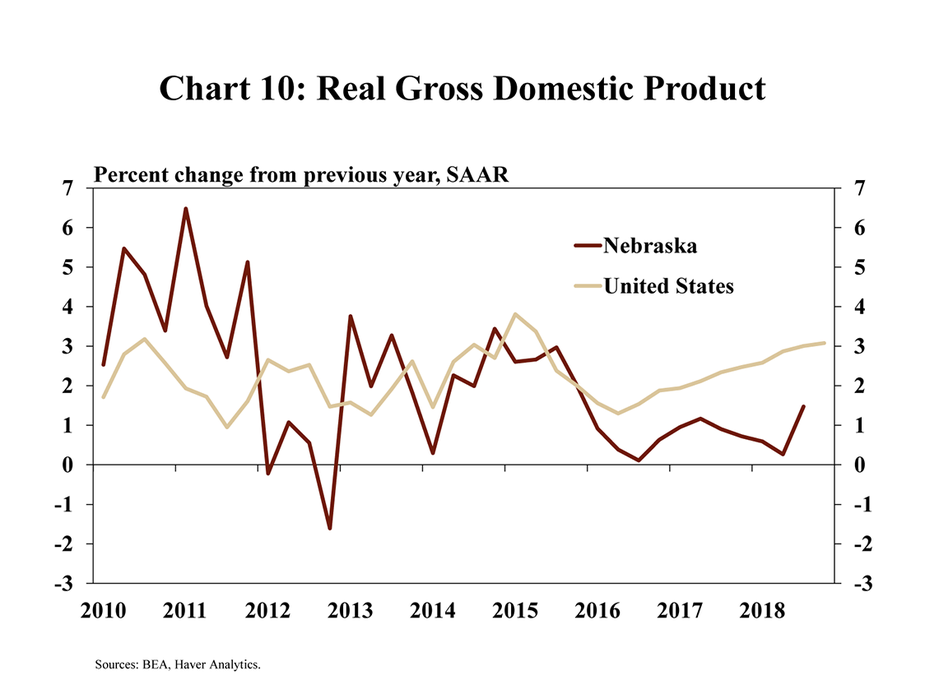

Despite the number of indicators pointing to ongoing strength, economic output in Nebraska was relatively sluggish in 2018. Real growth in gross domestic product (GDP) in Nebraska began to lag the nation in early 2016 alongside an environment of reduced profitability in the agricultural sector (Chart 10). The divergence between GDP at the state and national level became greater in mid-2017 and the gap continued to widen in 2018 despite a slight increase in growth in the third quarter.

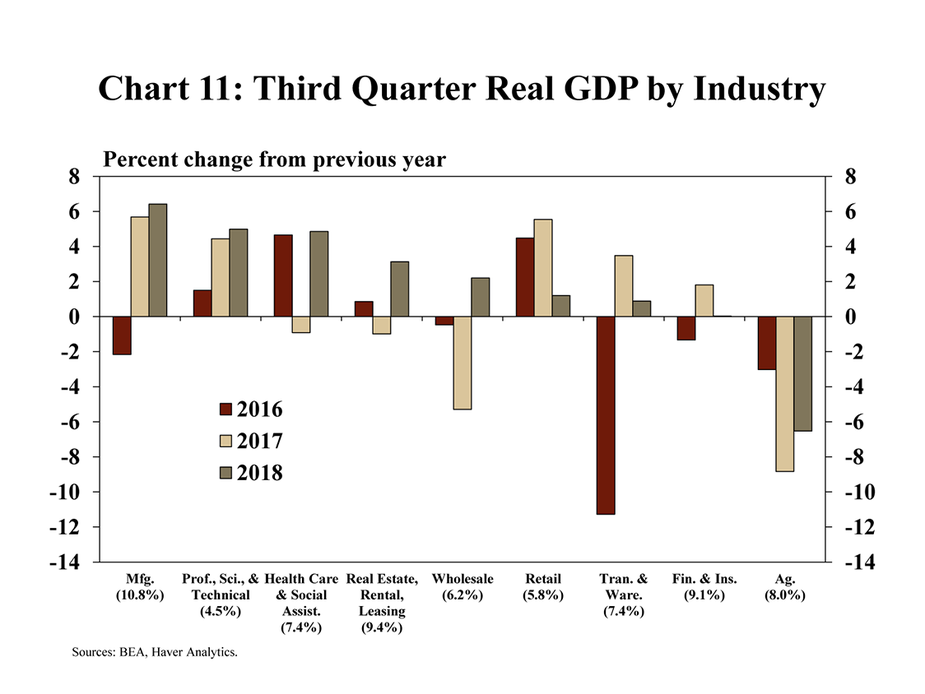

Ongoing challenges in the agricultural sector contributed significantly to slower economic growth in 2018. Agriculture, the fourth-largest industry in Nebraska in direct contribution to overall GDP, contracted about 6.5 percent in the third quarter (Chart 11). The drop in 2018 followed an even sharper decline in 2017, and weakness in agriculture appears likely to have continued throughout 2018.

Economic growth in most other industries, however, remained positive. Through the third quarter, the latest data available, output in the manufacturing sector continued to boost state GDP growth in addition to other major industries outside of agriculture.

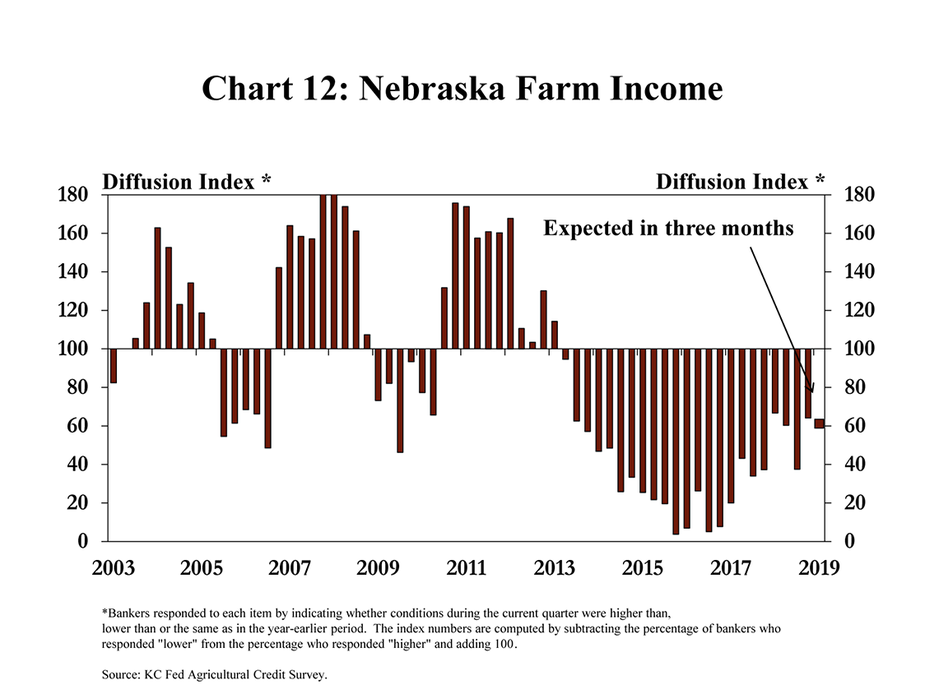

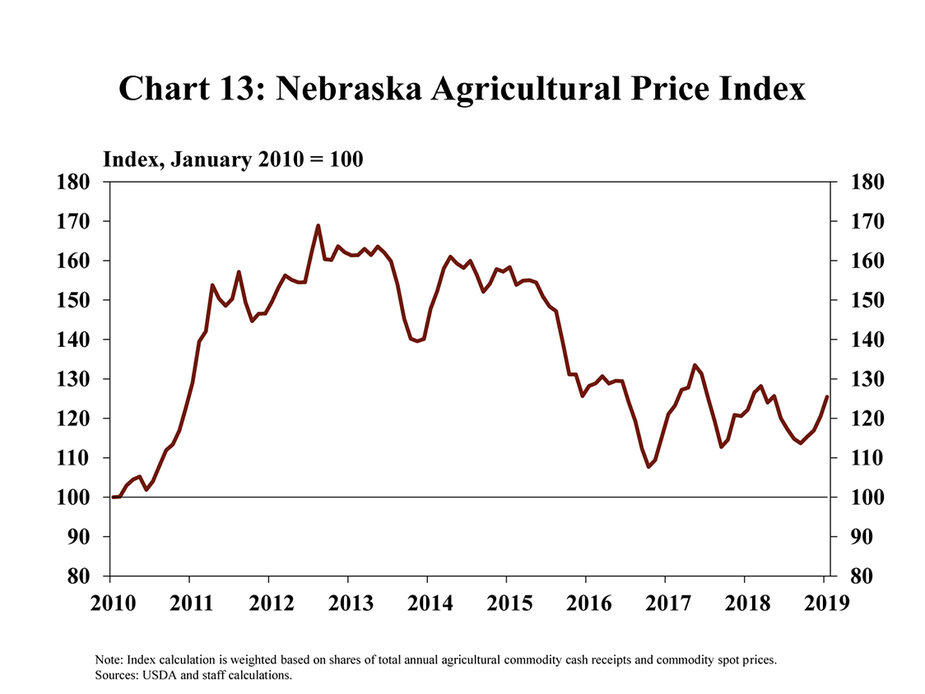

Income in the farm sector declined in 2018 alongside persistently low agricultural commodity prices. Farm income in Nebraska, as in the nation, began to decline in 2014 and continued to weaken in 2018 (Chart 12). Agricultural commodity prices also dropped in 2014 and have remained well below the highs reached earlier in the decade (Chart 13). Bankers in Nebraska expect farm income to continue to decrease through the first quarter of 2019, and sluggishness in the state’s farm economy appears likely to continue to weigh on broader economic activity and revenue in rural parts of the state.

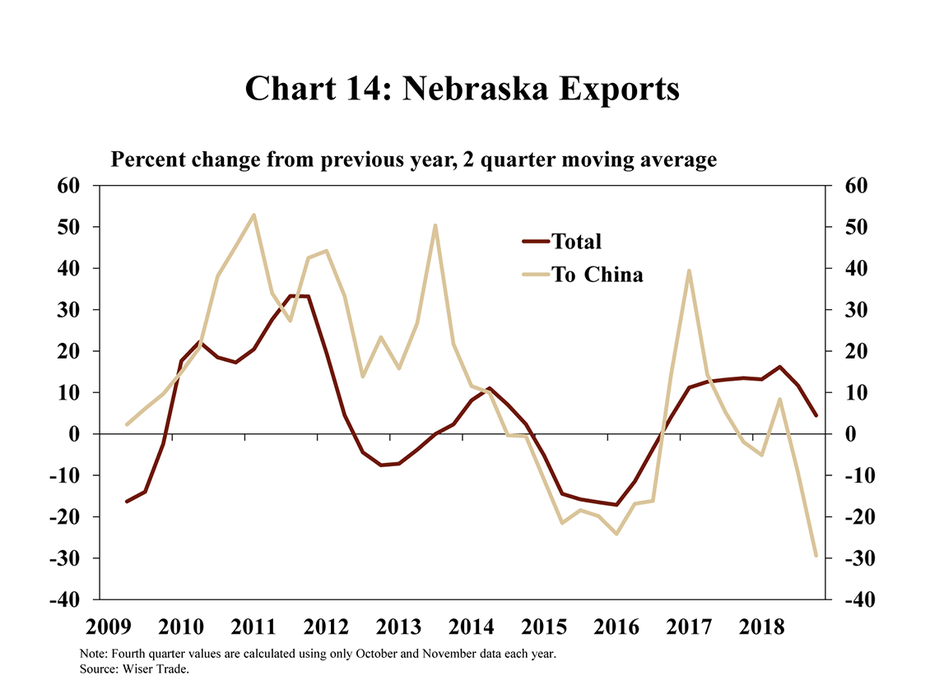

The pace of Nebraska’s exports, significantly connected to agriculture, remained positive but slowed toward the end of 2018 alongside ongoing trade disputes. In the fourth quarter, exports from Nebraska increased, but at a notably slower pace than previous quarters as trade tensions with China persisted (Chart 14).

Conclusion

The persistently low unemployment rate has remained a primary indicator of labor market strength in Nebraska, as in the nation. Strength in both residential and commercial real estate also have been significant contributors to overall strength in the state’s economy, but a recent slowdown in construction of new homes could have important implications for the real estate market as well as construction employment. Similar to the way 2018 ended, however, prospects for growth in agriculture and trade are likely to be significant determinants of the pace of economic activity throughout 2019.

The views expressed in this article are those of the authors and do not necessarily reflect the views of the Federal Reserve Bank of Kansas City or the Federal Reserve System.