The economies of Colorado, New Mexico and Wyoming have performed differently since the end of the Great Recession. Colorado has experienced some of the strongest and most consistent growth across the United States, while the recovery in New Mexico started slowly and has been sluggish. In contrast, Wyoming’s economy grew moderately in the early stages of the national recovery, but experienced a sharp downturn as oil prices started to fall in mid-2014. Despite different paths since the end of the recent recession, each state has been expanding in 2017. This issue of the Rocky Mountain Economist examines recent economic trends in the Rocky Mountain States.

Employment trends since December 2007

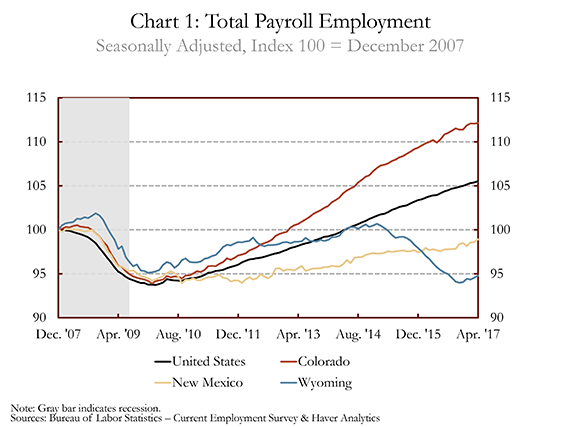

One of the most-cited economic indicators is employment, which helps assess not only the health of the labor market but also that of the overall economy. Employment fell sharply during the Great Recession but has increased over the past seven years at the national level (Chart 1). Among the Rocky Mountain States, employment growth has been mixed, with gains outpacing the nation in Colorado and much weaker employment conditions in New Mexico and Wyoming.

During the 2007-09 recession, employment in the United States, Colorado, New Mexico and Wyoming fell 7.6 percent, 8.1 percent, 8.0 percent and 9.3 percent, respectively, from their respective peaks to troughs. Employment has steadily recovered in the United States and Colorado since 2010. Chart 1 shows Colorado and the United States have surpassed their previous peak levels, and employment is now 12.1 percent above levels in December 2007 (the first month of recession) in Colorado and 5.5 percent higher in the United States.

Unlike Colorado, employment levels in New Mexico and Wyoming have not returned to their previous peaks and are still 1.1 percent and 5.2 percent, respectively, below December 2007 levels. Weakness in the Wyoming and New Mexico economies has been due at least in part to the industry mix in each state. In New Mexico, the recovery has lagged the national recovery and has been much weaker. A more significant decline in construction and a larger oversupply of homes in New Mexico has contributed to the lagged nature of the recovery; a greater reliance on government spending and the energy sector have limited employment gains in recent years.

Employment rebounded in Wyoming at about the same time as Colorado and the United States, but as oil prices declined in mid-2014 so did Wyoming employment. Weakness in the energy sector has weighed heavily on Wyoming’s economy over the past two years. More recently, it appears Wyoming’s employment reached its bottom in November 2016 and has increased since then as headwinds from the Great Recession and a weak energy sector subside. Employment conditions in the United States and Rocky Mountain States highlight the diverse paths of economic growth each economy has taken over the past 10 years.

Recent trends in the Colorado economy

Employment gains in Colorado have outpaced the nation over the past seven years, with employment growth averaging 2.1 percent annually since reaching its trough in January 2010. Some of the strongest employment growth over the past seven years has occurred in the health care and education services, leisure and hospitality, professional and business services and state government sectors. Employment in each of these sectors is more than 17 percent above December 2007 levels. However, employment in several sectors remains below pre-recession levels despite recent gains including the energy, information, construction and manufacturing sectors.

Accompanying strong employment growth has been a decline in unemployment. At 2.3 percent as of April 2017, the unemployment rate in Colorado is the lowest in the country as well as the lowest it has been since recording began in 1976.

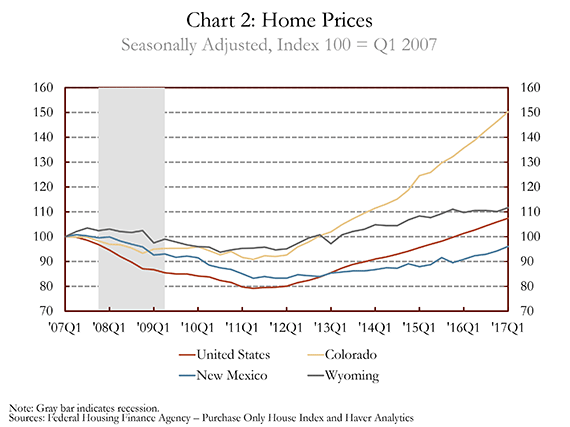

The residential real estate sector also bounced back quickly in Colorado. As inventories declined, home prices have increased sharply (Chart 2). Colorado home prices declined 9.2 percent between the first quarter of 2007 and their trough in the second quarter of 2011. Since then, home prices have increased 65.4 percent. As of the first quarter 2017, Colorado’s home prices had expanded the fastest in the nation at 10.7 percent over the same period in 2016.

As home prices increased, residential construction activity also picked up. Single-family and multifamily permits in Colorado through April 2017 are up 9.4 and 70.7 percent, respectively, compared to year-ago levels. The number of multifamily permits so far in 2017 is strongly above its pre-recession peak, although single-family permits remain below their pre-recession levels. The strength in multifamily building is a trend that can also be seen at the national level.

Tourism has been another strong sector in the Colorado economy, attracting both business and leisure travelers. Employment in the leisure and hospitality sector has increased solidly in 2017 and has been a leading industry during most of the recovery period. Average state hotel occupancy rates and room rates through April 2017 are at their highest levels over the past decade, and Colorado’s national park visits and airport passengers through Denver International Airport are at record highs.

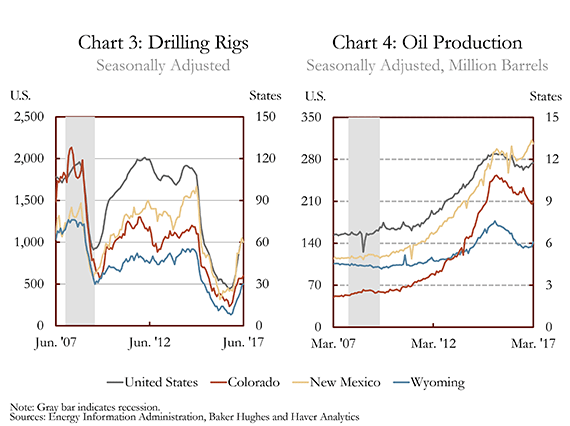

Despite overall strong growth in the Colorado economy, the agricultural and energy sectors have struggled in recent years. The energy sector started declining in mid-2014 as oil prices fell from over $107 per barrel to $28 in early 2016. More recently, however, oil prices have increased from their lows, and active drilling rigs (Chart 3) and employment in the energy sector have increased in 2017. Farm income remains sluggish in Colorado as crop and livestock profit margins remain tight.

Recent trends in the New Mexico economy

Employment in New Mexico has been slower to recover than the nation, but employment growth has picked up slightly in recent months (Chart 1). Employment growth has averaged 0.5 percent annually since reaching its trough in September 2010, but is up 0.8 percent compared to year-ago levels so far in 2017. Employment growth over the past year has been fairly broad-based, with 10 of 15 major employment categories experiencing positive growth. The construction and transportation and utilities sectors have grown the fastest over the past year, with increases of 8.3 percent and 3.7 percent, respectively. Despite recent gains, employment in most industries remains below pre-recession levels. Only the private education and health services and leisure and hospitality sectors have surpassed their pre-recession employment levels.

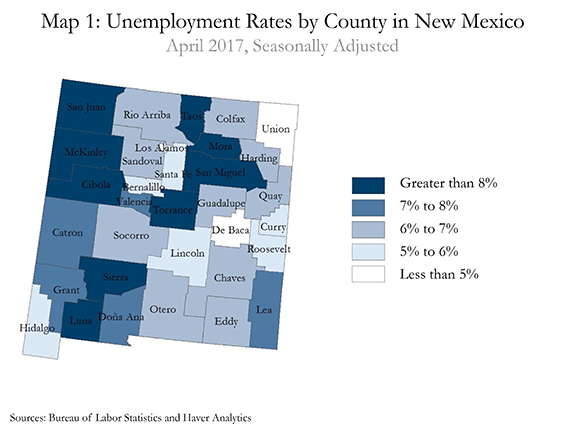

The unemployment rate in New Mexico at 6.7 percent in April 2017 remains elevated compared to the national rate, and many counties in New Mexico continue to struggle with high levels of unemployment (Map 1). Only two counties in New Mexico (Union and Los Alamos) have unemployment rates equal to or below the national unemployment rate of 4.3 percent. Luna County has the highest unemployment rate in New Mexico at 15.2 percent.

Similar to employment, New Mexico’s housing market has also expanded at a slower pace than the nation, but home prices have been increasing gradually over the past few years (Chart 2). As of the first quarter 2017, home prices have increased 5.7 percent across the state compared to the previous year but are still 4.7 percent below their previous peak levels in the second quarter of 2007.

The energy sector is important to the New Mexico and Wyoming economies, and declines in the energy sector since mid-2014 have weighed heavily on economic growth in both states. As oil prices fell, the number of active drilling rigs fell sharply in New Mexico (Chart 3) and employment dropped 31.9 percent between its peak of January 2015 and its low in December 2016. Employment in the energy sector has increased slightly in 2017 as oil prices appear to have stabilized. Despite some volatility in oil production during the recent downturn, oil production increased to its highest recorded level in New Mexico in February 2017 (Chart 4).

Recent trends in the Wyoming economy

Employment in Wyoming has followed a much different path than Colorado and New Mexico during the recent national recovery period. After falling sharply during the 2007 recession, employment levels expanded in Wyoming between 2010 and 2015. However, Wyoming’s employment recovery was cut short when the energy sector started to decline. About one of 10 workers were directly employed by the energy sector at its peak in late 2014, and many more ancillary industries are indirectly tied to the sector. Weakness in the energy sector led to significant employment losses in Wyoming. Total employment fell more than 6 percent between January 2015 and November 2016 in Wyoming, while energy employment dropped almost 34 percent. More recently, employment has started to increase as the energy sector stabilizes. Total employment has been expanding since November 2016, and employment in the energy sector is up almost 10 percent over the past seven months.

Wyoming’s large reliance on the energy sector and its weakness in recent years has greatly hindered economic growth in the state. Similar to New Mexico, the number of active drilling rigs in Wyoming fell sharply as oil prices declined in 2014. Drilling rigs have rebounded over the past eight months as prices have increased and remain well above year-ago levels. Wyoming oil production also dropped over the past couple of years from about eight million barrels per month in April 2015 to around six million barrels per month so far in 2017.

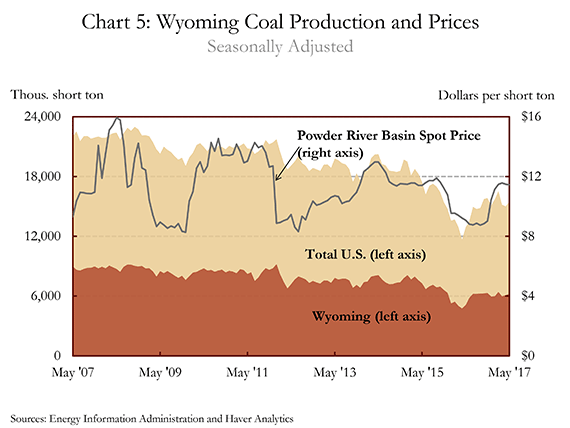

Wyoming is also the largest producer of coal in the United States and produces more than 40 percent of all U.S. coal. Coal production has declined over the past 10 years in Wyoming and at the national level (Chart 5). Wyoming’s year-to-date coal production through May 2017 is down almost 30 percent compared to the same period in 2007. Coal production is up almost 20 percent in 2017, but that is compared to a historically low year in 2016.

Conclusion

Economic growth across the Rocky Mountain States has varied during the Great Recession and subsequent recovery. Colorado’s recovery has been one of the strongest in the nation, and labor market conditions are tight. New Mexico and Wyoming’s heavier reliance upon the energy sector stalled their respective recoveries, but headwinds from the energy sector appear to be subsiding. So far in 2017, all of the Rocky Mountain States have been experiencing positive employment growth.