In the last 10 years, the economic landscapes in the United States and Rocky Mountain States have been reshaped by many forces. The recent recession’s effect on the housing market, specifically on affordability, has been significant. As home prices and interest rates declined across most of the nation, houses became more affordable early in the recession. However, as the recovery took hold, home prices started to rebound. In some areas, prices have surpassed previous peak levels, giving many people a feeling that housing is increasingly unaffordable. There are many ways to measure housing affordability, and this issue of the Rocky Mountain Economist analyzes three key determinants of affordability—household income, house prices and interest rates. Growth in income alone increases housing affordability, however, if home prices also increase, and at a faster rate, affordability decreases. Furthermore, interest rates affect monthly mortgage payments, which in turn affect affordability. Analysis of the evolution of these three components provides insight into the affordability of housing in the Rocky Mountain States.

Components of Housing Affordability

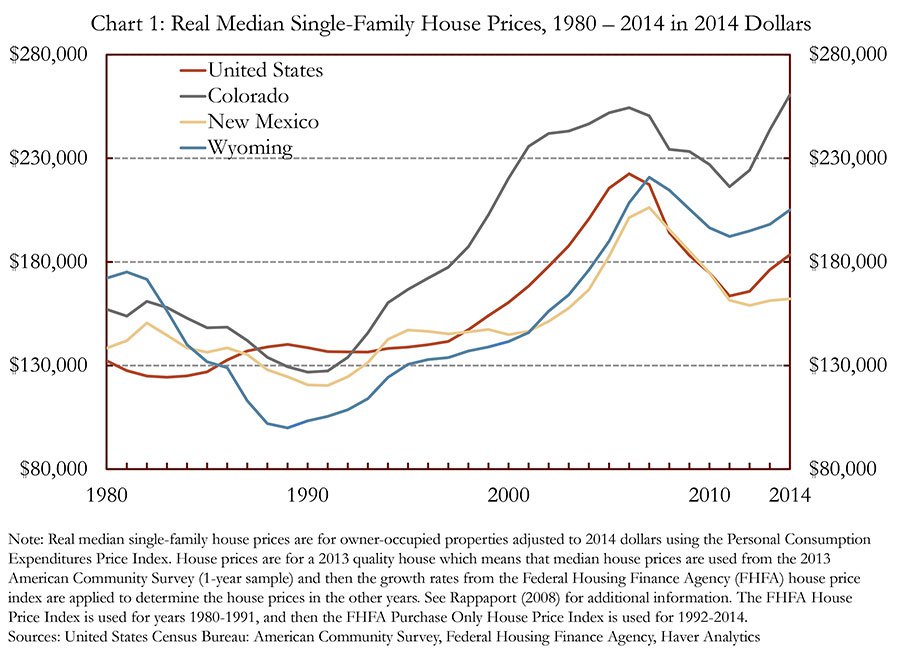

In the years prior to the recent recession, home prices grew significantly. At the national level, nominal home prices increased more than 125 percent from 1990 to 2006; prices increased at an even faster pace in the Rocky Mountain States (Chart 1). However, as the 2007 recession took hold, home prices declined across most of the nation, with nominal home prices in the United States, Colorado, New Mexico and Wyoming decreasing by 19.3 percent, 7.4 percent, 16.0 percent and 6.9 percent, respectively. Over the past few years, home prices have begun to rebound, although at varying rates across states.

Colorado real median home prices have increased sharply in recent years and have surpassed their pre-recession peak levels. However, home prices in New Mexico, Wyoming and the United States remain below their pre-recession peak levels. New Mexico real home prices have not yet experienced as strong of a recovery as the other Rocky Mountain States or the United States, but as of 2014, prices have stabilized and increased slightly from their 2012 trough.

As real median home prices increase housing affordability falls, which could push potential buyers out of the market or lead to households spending a higher fraction of their income on housing. All else equal, states with the strongest home price appreciation experience the largest decline in housing affordability. However, real median household income has also been increasing in recent years along with median home prices. An increase in income increases affordability, mitigating the effect of the increase in home prices.

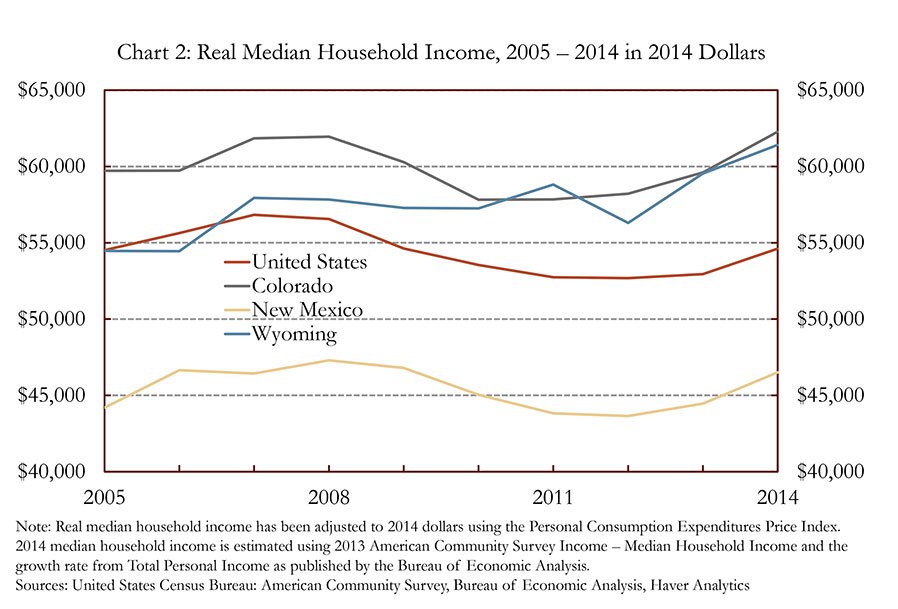

Real median household income peaked in 2008 in the United States, Colorado and New Mexico, and in 2009 for Wyoming, and then began to decline during the recession (Chart 2). In recent years, real median household income has been recovering and has surpassed pre-recession levels in Colorado and Wyoming. Holding all else constant, if income growth outpaces home price growth, housing affordability will increase. A higher level of income allows consumers to spend more money on housing and higher monthly mortgage payments will make up a smaller fraction of household income. However, interest rates are also an important component as they can greatly affect monthly mortgage payments, and thus affordability, even if home prices remain constant.

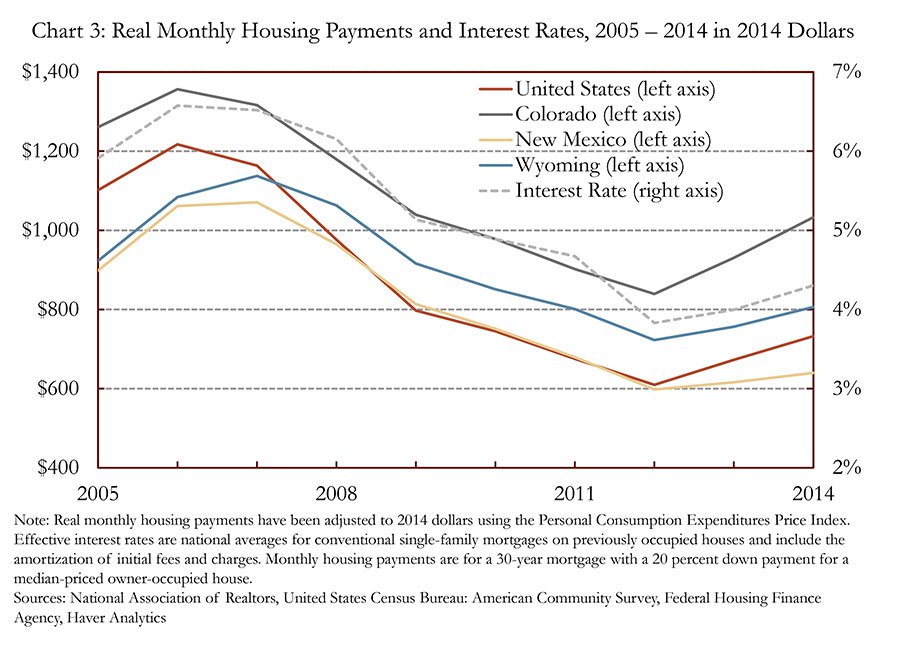

Typically, homeowners finance a home purchase through a mortgage, and this article focuses on housing affordability for this type of consumer. If a home is purchased without borrowing any money, interest rates will not have a direct effect on affordability. Chart 3 shows the effective average interest rate for single-family mortgages and the corresponding real monthly housing payments assuming a 30-year mortgage and a 20 percent down payment for a median-priced owner-occupied home.

After reaching peak levels for housing payments in 2006 and 2007, real monthly housing payments declined as a result of both falling home prices and interest rates. After reaching their trough in 2012, real monthly housing payments in the United States and Rocky Mountain States began to rise as interest rates rose slightly and home prices increased. Despite the recent growth in real monthly housing payments, payments remain below pre-recession peaks. This is primarily due to low interest rates as well as subdued home prices in many parts of the nation. In 2014, the effective interest rate was 4.3 percent, compared to its pre-recession high of 6.6 percent in 2006. However, interest rates are well below historical averages and sharply lower than the historical peak of 18 percent for a 30-year conventional mortgage in the early 1980s.

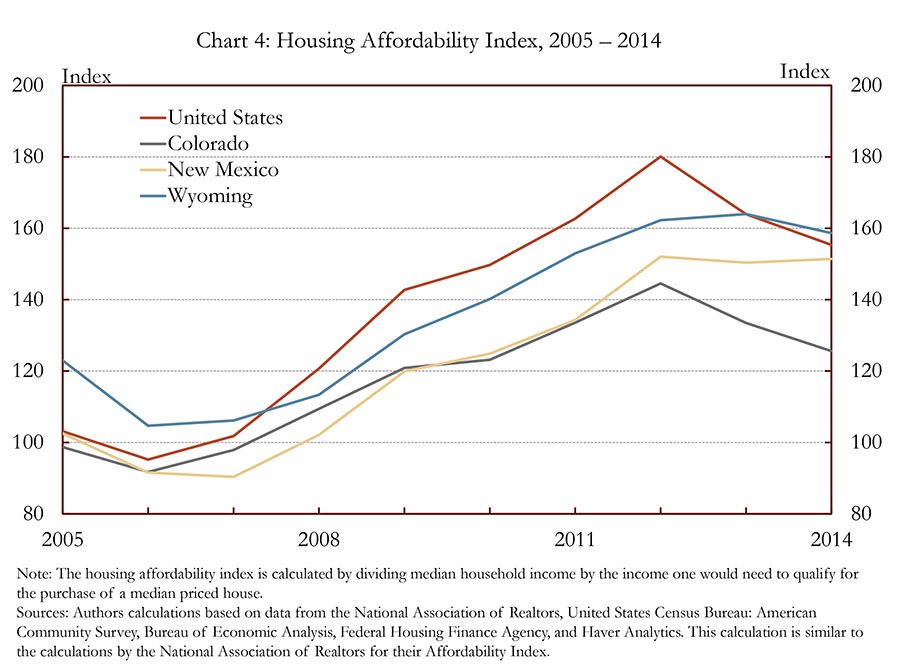

Although real monthly housing payments have been increasing in recent years, it is important to also consider the recent increase in real median household incomes when determining housing affordability. By combining the three determinants of housing affordability—household income, home prices and interest rates—into a single index, it is possible to compare affordability over time and across regions. The housing affordability index is calculated by taking the ratio of annual median household income to qualifying income, or the annual amount of income needed to make mortgage payments on a median-priced home at the current interest rate that do not exceed 25 percent of income.[i] This ratio of median household income to qualifying income provides a useful index of housing affordability and is shown in Chart 4 for the United States and Rocky Mountain States.

The housing affordability index shown in Chart 4 can be interpreted as median household income as a percentage of qualifying income. For example, a reading of 150 indicates that median household income is 1.5 times that of the qualifying income, and a reading of 50 indicates that median household income is 0.5 times that of the qualifying income needed for a median-priced home purchase. In other words, anything over 100 implies that the median household income should be enough to purchase a median-priced home, while levels below 100 indicate that a household with the median income could not afford to purchase a median-priced home.

The housing affordability index reached a trough, indicating that homes were least affordable, in 2006 in the United States, Colorado and Wyoming, and in 2007 in New Mexico. In 2006, the housing affordability index was below 100 in the United States, Colorado and New Mexico, indicating that the median household was not able to afford the purchase of a median-priced home. Despite reaching these recent lows in 2006 and 2007, the affordability indices in the United States and Rocky Mountain States were significantly lower in the 1980s due, in part, to historically high interest rates. As the 2007 recession took hold, home prices and interest rates decreased, more than offsetting the decline in real median household income, leading to an increase in housing affordability and a peak around 2012-13.

As of 2014, Colorado, which has experienced the fastest growth in median home prices in recent years, is the least affordable region shown in Chart 4, yet the affordability index remains above 100 and above pre-recession levels. From 2008 to 2011, homes in all three Rocky Mountain States were less affordable than the United States. As of 2014, only Wyoming had become slightly more affordable than the United States due to slower home price appreciation and stronger growth in median household income.

The affordability ratio used in this article gives one snapshot of housing affordability, but does not tell the whole story. For instance, median household income was used as the primary measure of income, however, income growth during the recent recession and recovery has not been uniform across the income distribution, and thus may not accurately represent the entire population. Similarly, income growth across different households such as married and single-parent homes has also varied during the recovery.[ii] These variations in income growth would cause housing affordability to move differently for some income classes.

Furthermore, it is important to note that it is possible for the housing affordability index to decrease even as residual income—income left over after paying the mortgage—increases. This occurs when the qualifying income needed for a mortgage increases at a faster percentage than the median household income, yet median household income still increases. In other words, monthly mortgage payments will make up a larger share of household income causing the housing affordability index to decrease but the residual income may still be higher, leaving households feeling better-off as they have more money left over to spend.

Conclusion

This issue examines how household income, home prices and interest rates affect housing affordability in the Rocky Mountain States and the United States. Overall, housing affordability increased significantly during the recent recession due to declining house prices and falling interest rates, and despite its recent decrease, housing affordability remains above pre-recession levels. However, sharp increases in house prices in some areas have increased concern about the affordability of homes in some markets. Variation in income growth across the income distribution and difficulties saving for larger down payments also factor into affordability concerns. Looking ahead, if house prices continue to increase at a faster pace than household income, and if interest rates increase from historically low levels, housing affordability will continue its recent decrease.

End notes

[i] First, annual mortgage payments are calculated by multiplying monthly mortgage payments, as shown in Chart 3, by 12. Next, that number is multiplied by four to represent mortgage payments not exceeding 25 percent. The final number is the qualifying income required to purchase an owner-occupied median-priced home with a 20 percent down payment at the current effective interest rate which leaves the owner paying 25 percent of their income towards a mortgage.

[ii] Rappaport, Jordan. 2008. “The Affordability of Homeownership to Middle-Income Americans.” Federal Reserve Bank of Kansas City, Economic Review (Fourth Quarter).