The U.S. economy is in its fifth-longest expansion ever, and most forecasters expect growth to continue in 2016. However, despite an improving domestic economy, concerns about global economic growth and a stronger U.S. dollar have increased attention on the importance of international exports from the United States and the Rocky Mountain States. This issue of The Rocky Mountain Economist examines the reliance of Rocky Mountain States on exports and looks at each state’s top exported goods and trading partners.

Global Outlook

To analyze exports from the United States, it first is useful to examine growth in the international economies to which we export. The health of the global economy affects demand for U.S. exports. The International Monetary Fund’s World Economic Outlook shows global economic growth slowed slightly in 2015, due primarily to slower growth in emerging and developing countries. Growth is expected to pick up slightly in 2016, with advanced economies projected to expand 2.1 percent in 2016, up from 1.9 percent in 2015. Emerging and developing economies, which typically experience higher rates of GDP growth than advanced economies, are expected to expand 4.3 percent in 2016, up from 4.0 percent in 2015. Growth in China, a large trading partner for the United States, slowed from double digits less than a decade ago to 6.9 percent in 2015, and is expected reach 6.3 percent in 2016. Similarly, GDP growth in Canada, the largest U.S. trading partner, fell from 2.5 percent in 2014 to 1.2 percent in 2015, but is expected to pick up to 1.7 percent this year.i

Slower economic growth across the world, especially in Canada and China, can be a significant headwind for U.S. exports as it may lead to decreased global demand for U.S. products. Another headwind for U.S. export growth is the appreciating exchange value of the dollar. Between January 2010 and February 2016, the dollar appreciated 11.3 percent, 22.2 percent and 32.2 percent against the British pound, the euro and the Canadian dollar, respectively. This puts pressure on U.S. companies that export internationally as the price in U.S. dollars of their goods or services relative to the currencies of countries to which they are exporting is now more expensive and thus may slow demand for these goods.

Reliance of States on Exports

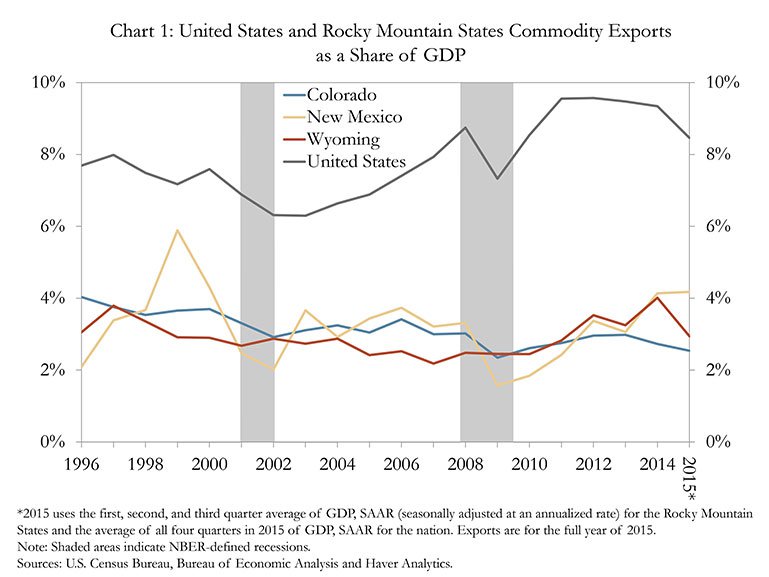

The economies of Colorado, New Mexico and Wyoming are much less reliant on commodity exports than the United States overall.ii In 2015, commodity exports were 2.5 percent of GDP in Colorado, 4.2 percent in New Mexico and 3.0 percent in Wyoming (Chart 1). In contrast, commodity exports were 8.5 percent of U.S. GDP. The real value of commodity exports in the United States and the Rocky Mountain States has increased in the last two decades. Between 1996 and 2015, the inflation-adjusted value of commodity exports increased 72.0 percent in the United States, 16.0 percent in Colorado, 189.0 percent in New Mexico and 74.0 percent in Wyoming.

However, over this same period, only the United States and New Mexico experienced a gain in the share of GDP from exports. The share of U.S. exports as a percentage of GDP increased from 7.7 percent in 1996 to 8.5 percent in 2015, while the share in New Mexico increased from 2.1 percent in 1996 to 4.2 percent in 2015. As other sectors of Colorado’s economy grew faster than the export sector, Colorado’s commodity exports declined from 4.0 percent in 1996 to 2.5 percent in 2015. Over the same period, the share of Wyoming’s GDP derived from commodity exports remained roughly flat.

Real commodity exports declined significantly in 2009 in the nation and the Rocky Mountain States as global economies slowed due to the recession. During the recovery, real commodity exports expanded in the nation from 2009 through 2014. Exports in the Rocky Mountain States also rebounded in that period. More recently, however, real commodity exports for the nation and Rocky Mountain States have decreased, partially due to a slowdown in the global economy and appreciation of the U.S. dollar. In 2015, real commodity exports fell 7.4 percent in the United States, 4.6 percent in Colorado, 1.0 percent in New Mexico and 33.4 percent in Wyoming. The large decrease in Wyoming was due primarily to its heavy dependence on the natural resources and mining sector, which slowed significantly in 2015 as energy prices remained low.iii

Top Importing Countries and Types of Commodities

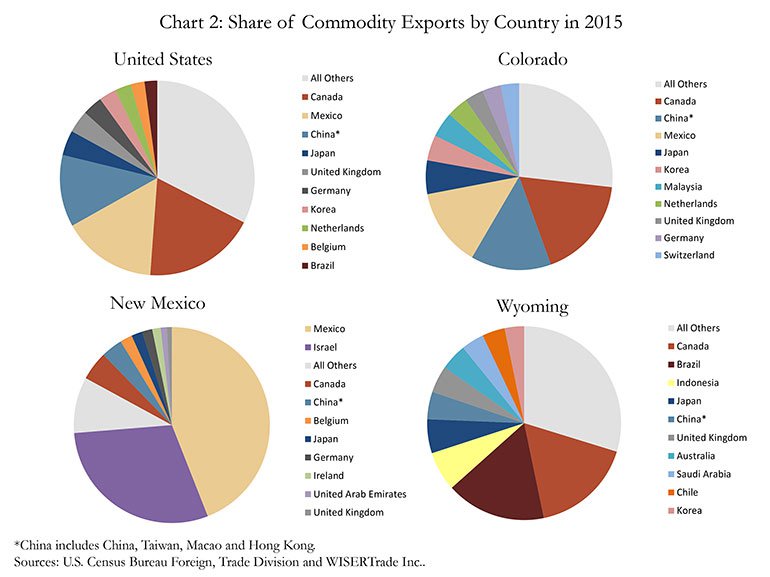

The Rocky Mountain States have distinct economies and diverse portfolios of countries to which they export (Chart 2). There are similarities, however, as Canada, China, Japan and the United Kingdom are among the top 10 largest export countries for the Rocky Mountain States and the nation. Belgium, Brazil and the Netherlands also are popular destinations for exports and are on three of the four top 10 lists for the Rocky Mountain States and the nation. New Mexico’s heavy reliance on Mexico as a trading partner is not surprising due to their close proximity. Also, Union Pacific Railroad’s hub in Santa Teresa, N.M., completed in mid-2014, is expected to further facilitate trade between New Mexico and Mexico. It’s worth noting that the “All Others” category, which includes all export destinations outside the top 10, is the biggest category for the United States, Colorado and Wyoming. This indicates the portfolio of countries to which exports are sent is large and diverse.

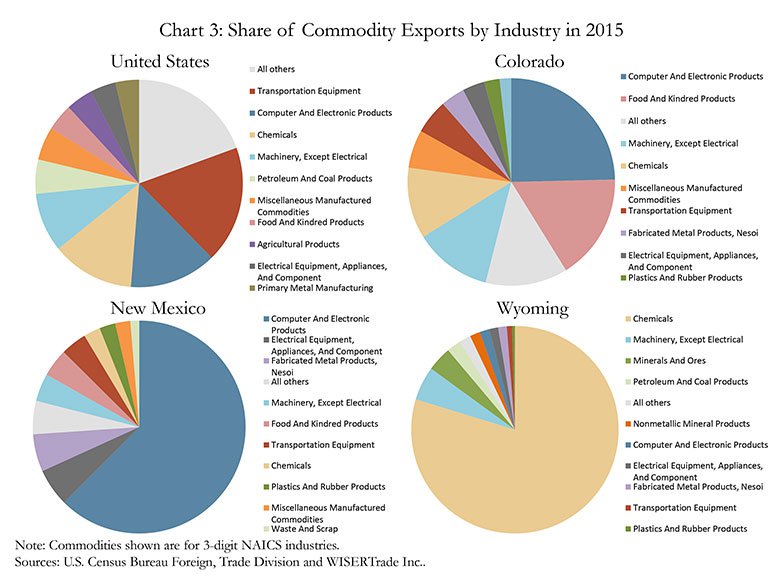

It is also important to understand what goods are exported from the Rocky Mountain States. Chart 3 shows the 10 largest export commodities for the Rocky Mountain States and the nation in 2015.iv There are a few similarities between export commodities for the Rocky Mountain States and the nation. Chemicals; computer and electronic equipment; electrical equipment, appliances and components; machinery (except electrical); and transportation equipment are among the 10 largest export commodities for each of the Rocky Mountain States and the nation. Furthermore, food and kindred products; miscellaneous manufactured commodities; fabricated metal products; and plastics and rubber products also are three common exports from the Rocky Mountain States and the nation.

For the United States, the largest export sector after “All Others” in 2015 was transportation equipment at 18.0 percent. This sector includes motor vehicles and parts, ships and boats, aerospace products and parts and railroad rolling stock. The importance of high-tech manufacturing is notable in both Colorado and New Mexico, where computer and electronic products is the largest sector for export commodities in each state. This category includes computer equipment, audio and video equipment, semiconductors and communications equipment, to name a few. Throughout the Rocky Mountain States, the importance of the agriculture and energy sectors on commodity exports is apparent. Food products are a sizable share of exports in Colorado and New Mexico, while chemicals are important in all three states. In particular, chemicals make up 80.0 percent of Wyoming’s exports due primarily to the export of trona-related products.

Conclusion

Real commodity exports from the Rocky Mountain States and the nation have decreased over the past year, partly because of a slowdown in the global economy and appreciation of the dollar. Export growth can be affected by many factors, including the economic performance of key trading partners and the types of goods exported. Canada, Japan, China and the United Kingdom are top export destinations for the United States and the Rocky Mountain States. In addition, New Mexico and Wyoming are more heavily reliant on single export sectors (computer and electronic products and chemicals, respectively) than Colorado. In general, however, the Rocky Mountain States are much less reliant on international commodity exports than the nation as a whole.

End notes

i Emerging and developing economies and advanced economies are classified by the International Monetary Fund (IMF) and depend on a countries per capita income level, export diversification and degree of integration into the global financial system. More information, including lists of countries in each category, is available at hExternal Linkttp://www.imf.org/external/ns/cs.aspx?id=29 . World Economic Outlook, January 2016 Update. International Monetary Fund, January 2016. Web. Jan. 28, 2016.

ii Throughout this article, exports refers to the export of commodities only and does not include the export of services.

iii There was a large increase of oil and gas exports in 2014 and a subsequent decline in 2015, which accounted for a large share of the decrease in total exports. However, total exports still would have declined in 2015 after excluding oil and gas exports.

iv NAICS, or North American Industry Classification System, was developed by federal agencies in the United States, Mexico and Canada to simplify how an establishment is classified into a specific industry in North America. The most recent NAICS list, which is used in this article, is from 2012. The NAICS codes in Chart 3 are classified by three digits.